Al final sucumbiréis todos

![]()

![]()

![]()

![]()

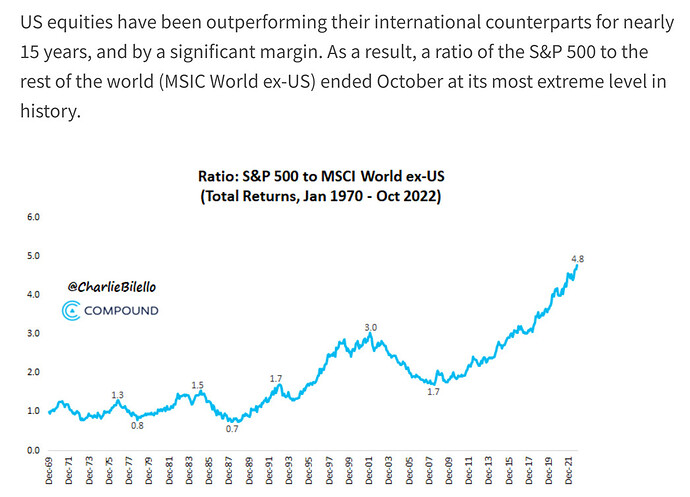

Pero al MSCI World si que lo ha batido ![]()

A summary of some of the layoffs this year…

- Twitter: cutting 50% of its workforce (estimated 3,700 jobs).

- Facebook ($META): cutting 13% of its staff (11,000 jobs), its largest round of layoffs ever.

- Snap ($SNAP): cutting 20% of its workforce (1,200 jobs).

- Shopify ($SHOP): cutting 10% of its workforce (1,000 jobs).

- Netflix ($NFLX): cut 450 jobs in two rounds of layoffs.

- Microsoft ($MSFT): cutting <1% of workforce (1,000 jobs).

- Salesforce ($CRM): cutting 1,000 jobs.

- Robinhood ($HOOD): cutting 31% of its workforce.

- Tesla ($TSLA): cutting 10% of its salaried workforce.

- Lyft ($LYFT): cutting 13% of its workforce (700 jobs).

- Redfin ($RDFN): cutting 13% of its workforce.

- Coinbase ($COIN): cutting 18% of its workforce (1,100 jobs).

- Stripe: cutting 14% of its workforce (1,000 jobs).

An addition to these cuts, Amazon ($AMZN) has announced a hiring freeze, Apple ($AAPL) has paused almost all hiring, and Google ($GOOGL) is reducing new hiring by 50%.

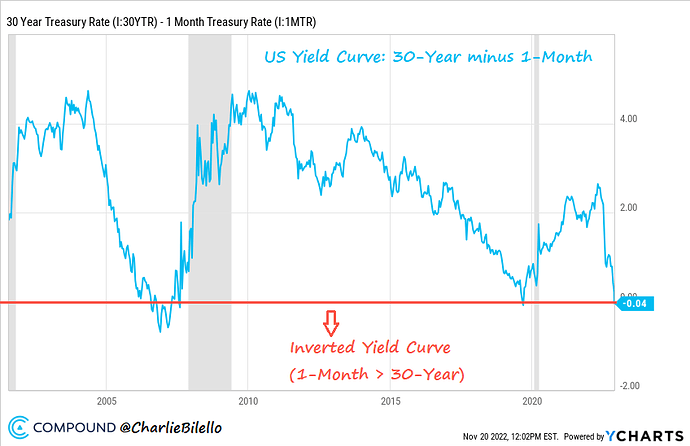

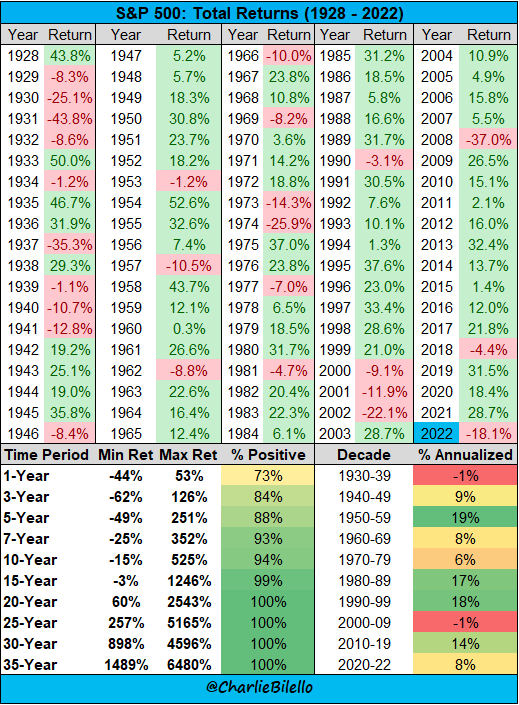

On the top of the list of leading indicators pointing to future economic weakness is the yield curve, which is now fully inverted.

The shortest maturity 1-month Treasury bill yield (3.93%) rose above the longest maturity 30-Year Treasury bond yield (3.89%) last week, a relatively rare occurrence.

The last 2 times that happened?

-August – September 2019 (recession started in March 2020)

-August 2006 – August 2007 (recession started in January 2008).

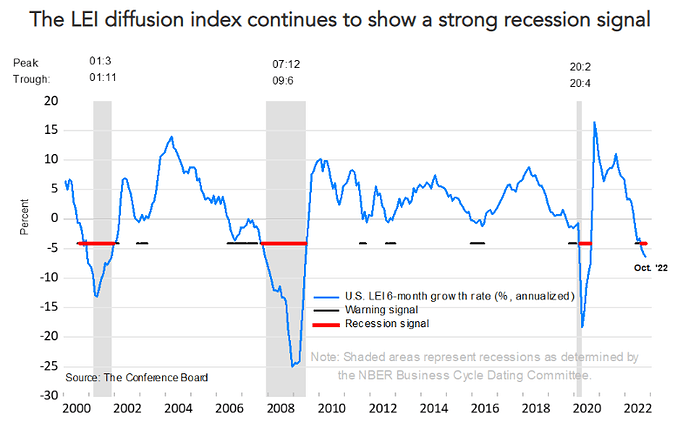

In addition to the yield curve, many other leading indicators (housing, ISM new orders, stocks, etc.) are pointing to a weaker economy.

As a result, the 6-month growth rate in the Leading Economic Index fell further into negative territory in October and is at levels that have signaled a high probability of recession in the past (2020, 2008, and 2001).

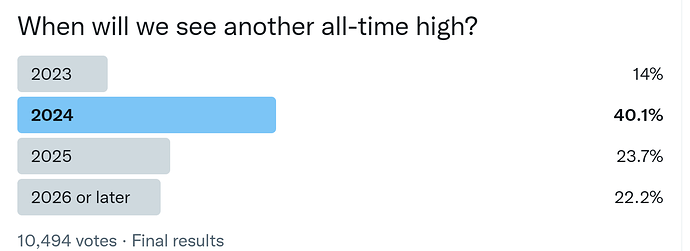

- Where will the S&P 500 end 2023?

- How about the 10-Year Yield?

- Where is Crude Oil headed?

- Is Gold or Bitcoin a better investment today?

- How many more times will the Fed hike rates?

- Will inflation move back down to its historical average?

- When will the economy fall into an official recession?

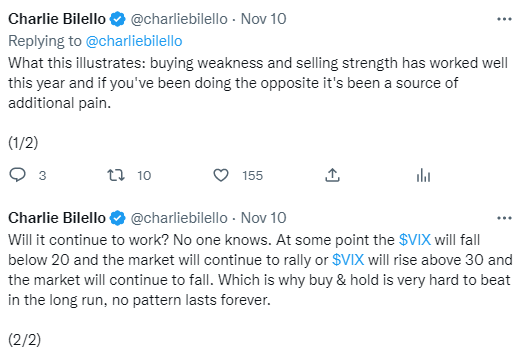

I don’t know the answer to any of these questions.

As Lao Tzu said, “those who have knowledge don’t predict. Those who do predict don’t have knowledge.”

In 2023, I predict one thing and one thing only: you will see many more surprises. That is the nature of markets.

¿Sigue funcionando la inversión de curvas al salir de una época ZIRP?

Y más que habrá que esperar