Para el caso haya recesión y en bolsa durante un tiempo vuelvan a haber cotizaciones que nos permitan comprar calidad a buenos precios. Se podrá volver a aplicar las reglas de Chowder.

Comentario de 2013 y complementado por un forero de Seeking Alpha.

“I notice that a lot of people are now referring to The Chowder Rule. I thought that as long as people are going to use it as a criteria in their stock selection, I would explain how and where it came from.

In order to understand the importance of The Chowder Rule, and how it relates to the stock selection process, one needs to understand the concept of dividend growth investing as I see it. One needs to understand what I was trying to accomplish and why. Once you understand this, you may be able to adjust the numbers to suite your needs, or accept it and apply it as it is.

When I discovered dividend growth investing I was surprised that there wasn’t a blue print to describe exactly what it was. I saw where people had various views or ideas of what dividend growth investing meant to them.

One concept I came across stated that any company whose expected long-term dividend growth rate exceeded its current yield, was a dividend growth stock. I can see that as workable, but it appears to have limitations. One would have to abandon owning high quality companies with high yields, yet low dividend growth rates. One might get caught up with owning mostly low yielding companies with high dividend growth rates that are unsustainable.

Keep in mind that there is usually a trade off between yield and dividend growth. My objective was to find a balance between the two.

I do prefer a long history of dividend growth over a short one. I do prefer more dividend growth over less. With the threat of higher interest rates affecting high yield companies, it is also plausible that high dividend growth will slow, and low dividend growth will freeze or decline. So again, I’m looking for balance between the two.

One of the problems with high dividend growth is that it eventually has to slow.

So in my opinion, I am better off trying to balance a high yield vs high dividend growth.

Another consideration about double digit dividend growth is the base from which it began. If a company started with a dividend of 2 cents, it wouldn’t be difficult to grow at double digits and it wouldn’t have much of an impact on the income stream either. Also, keep an eye on the payout ratio. Just make sure it isn’t astronomically high in order to provide dividend growth. A company can’t continue raising the payout ratio, so something has to give.

One thought that had an impact in applying The Chowder Rule was a stock that yields 1% has to raise its dividend 20% to generate the same dollar increase in annual income that another stock yielding 4% can achieve with a mere 5% hike.

Which growth rate is more realistically expected to be maintained over long time frames?

Most of the principles and concepts I apply have been taken from the book, “The Single Best Investment” by Lowell Miller.

According to Miller, the hidden key to the single best investment is dividend growth. The reason dividend growth is so important for long-term investors is because dividend growth is what drives the compounding machine in a way that is certain and inevitable. Dividend growth is an authoritative force that compels higher returns regardless of other factors affecting the stock market.

An important point is that an instrument that produces income is valued based on the amount of income it produces. The more income it produces, the more valuable the asset.

Keep in mind, you not only receive greater income as the years go by, you also get a rising stock price because the asset producing the income is worth more as the income it produces increases.

Stop and think about it for a minute. When you look at the long dividend growth history of companies like KO, PG and JNJ, if share price didn’t keep up with dividend growth, they would have yields of 10%, 15% or more – and the market isn’t going to allow that to happen.

(The following paragraph is the essence of The Chowder Rule!)

So in effect, you get a “double dip” when you invest in high yield stocks that have high rising dividends. You get the income that increases to meet or surpass inflation, and you get the effect of that rising income on the stock price, which is to force price higher.

Dividend growth investing to me means that I am creating a compounding machine, not playing the market. Dividend growth is the energy that drives that machine.

In the book, “What Works on Wall Street” by James O’Shaughnessey, he states … “It’s impossible to monkey with a dividend yield.” The author found that high yield was a much more effective factor in stock price performance when what he calls “large” stocks are studied. Among large stocks, he found that the highest-yielding stocks out-performed the overall universe 91% of the time over all rolling ten year periods.

Miller/Howard Investments revisited the issue of high yield and dividend growth with the help of Ford Investor Services, an institutional database and research organization based in San Diego. Using their data base going back to 1970, they found that high-yield stocks outperform the market over long periods on both an absolute and a risk-adjusted basis. The key is to own quality! … (I hope you got that.)

Once you understand the concept, the next step is to come up with a plan of action.

This leads to a formula I adopted. I call it "The Success Formula That Never Fails."

High Quality + High Current Yield + High Growth of Yield = High Total Return.

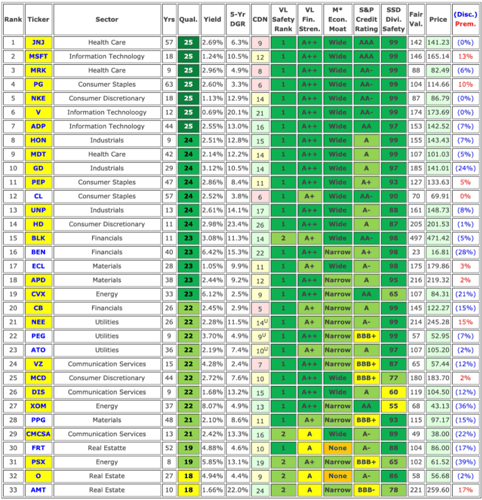

High Quality is defined as having superior financial strength. A company must have a 1 or 2 rating for Safety with Value Line, or a BBB+ rating or better with S&P. Both of these Financial Strength ratings indicate investment grade quality. … Anything that doesn’t meet the High Quality definition is considered speculation and managed differently within the portfolio.

High Current Yield is defined as a yield that is at least 50% above the yield offered by the S&P 500. Therefore, if the S&P 500 has a 2% yield, then 3% is the minimum number for purchase under the formula stated above.

High Growth of Yield is defined as companies that raise their dividend at a rate of 5% or more.

With the “Success Formula” in hand, I needed to come up with a way for it to support my long-term objectives.

My long-term objective is to grow the portfolio at an 8% compounded annual growth rate (OTCPK:CAGR). I decided I would try to take advantage of total dividend return, current yield plus a 5 year CAGR to help support my long-term 8% CAGR objective. This total dividend return concept was dubbed The Chowder Rule by a Contributor on Seeking Alpha by the name of J.D. Welch.

Since High Current Yield called for a 3% minimum yield, based on the 50% above the S&P 500 yield concept, Howard Miller’s 5% annual dividend growth minimum, when added to the yield came out to 8%. That was exactly what my long-term goals were and I established those goals before I read Miller’s book.

I then decided I would place a “moat” around that 8% number as a margin of safety because I knew as price rises, yields come down and the original Chowder Rule number will as well.

I thought I would go 50% higher and came up with a Chowder Rule number of 12% as a total return objective. .… If others want to adjust the number to meet their objectives, that’s fine. As long as it supports what it is you are trying to do, you’ll get no argument from me. … Ha!

Anyway, that 12% total dividend return number is now referred to as The Chowder Rule by many. So basically, if a stock has a 3% yield, I need a 5 year dividend growth rate of 9% to get my 12% number. If a stock has a 4% yield, I only need an 8% dividend growth rate.

For example:

CVX has a yield of 3.1% and a 5 year CAGR of 9.13%. When added together, I get a Chowder Rule number of 12.23%. … It qualifies for purchase as long as the fundamentals and valuations meet your standards.

As I delved deeper into the concept of dividend growth investing, I realized I needed to focus on the safety of the dividend first. As I researched, I found that a lot of companies with solid dividends weren’t able to grow their business like a lot of other companies, so their dividend growth may not be as robust. Utility companies are a good example of this.

Since my long-term goal is to achieve an 8% CAGR, I thought I would use that number for utility companies since it still supported my objective. I include telecom and MLP’s under the utility umbrella. So for example, D has a yield of 3.4% and a 5 year CAGR of 6.99%, giving me a Chowder Rule number of 10.39%. It qualifies for purchase as long as the fundamentals and valuations meet your standards.

I know there are those who wish to own companies with yields below 3%, yet have higher dividend growth. I’m not opposed to this, but keep in mind, the lower the yield, the more you must rely on capital appreciation to achieve High Total Return.

I decided that if I’m willing to accept a yield below 3%, I must require a higher dividend growth rate. I needed a higher Chowder Rule number to serve as a margin of safety. I decided to use 15% for companies yielding less than 3%.

So for example:

DE has a yield of 2.4% and a 5 year CAGR of 13.84% for a Chowder Rule number of 16.24%. It qualifies for purchase as long as the fundamentals and valuations meet your standards.

Again, these numbers were designed around my long-term objectives. If your goals are different, you can adjust the numbers any way you wish as long as they support your goal. Just keep in mind that the lower the yield, the more you must rely on price appreciation.

I applied The Chowder Rule as a way to take the pressure off of price appreciation. I was looking for the “double dip” balance. <<<”