Yo he entrado en XOM también ha 81. También ha caido Nordstrom por 45. Precios redondos.

Yo entré esta semana en Target 40acc@37.5$

Entre ayer y hoy:

1/2 posición de SPG a $176.92

1/3 posición de NNN a $43.92

1/3 posición de GPC a $93.82

1/4 posición más de O a $59.32

En la parte “value”:

CALM a $36.9

DEPO a $15.56

Hola investing.saints,

A que te refieres con los de 1/2, 1/3 y un cuarto de posicion ¿?

Me desconcierta un poco…

Lo de 1/2 posicion o 1/3 de posicion es que si quieres invertir un total de 10.000 euros por ejemplo en una sola accion, cuando inviertes 5.000, has invertido 1/2 posicion, si inviertes 3.300 has invertido 1/3 de posicion

Es lo de espaciar temporalmente las compras para no comprar todo en el peor momento

Hola Raul Offshore, Gracias. Entonces algunos manejan mucha liquidez o sus posiciones son muy pequeñas.

Como yo lo tenia pensado:

Promedio del dividendo global en cartera = 4%

Dividendos brutos necesarios/ año = 20.000 €

Nº valores = 30

Valoracion cartera = 20.000/0.04 = 500.000 €

Posicion completa = 500.000/30 = 16.666 €

Y luego lo de dejar que el valor haga el ultimo empujon por su revalorizacion. Quiere decir, no invertir más de 12.000 € por valor o posición.

Por tanto, hay algo que se me escapa. Entiendo que la mayoria realiza compras parciales. No comprar 6.000 € de golpe.

A lo mejor es que yo juego en otra liga…

Saludos

Pedren, si tu plan es ese, y vas a invertir un total de 12.000 por valor, siguiendo con el simil, si inviertes 1000 euros, has comprado 1/12 de tu posicion, si inviertes 2000, 1/6 y asi … hasta completar el 100%.

ten en cuenta, que cuando tu cartera te de los 20.000 y valga 500.000, tu no has tenido que poner los 500.000, según tu ejemplo, habras invertido 30 empresas por 12.000 en cada una … unos 360.000

sabes que invertirás 360.000, pero igual tu cartera llega a valer 600.000 o mas… o menos.

Bueno es saber la cantidad que vas a destinar a tu inversion

Sin prisa, sin pausa… se llega

Es como te ha dicho Raúl, pero las posiciones completas crecen conforme lo hace tu cartera. Es decir, no se mira el objetivo final (pueden pasar muchas cosas) sino uno más cercano. En mi caso, miro las posiciones respecto a lo que espero tener a 3 años vista. También depende del número de posiciones. Yo espero tener al menos 65 posiciones en la cartera.

Tengo 3 niveles de posiciones. El primero con 3 empresas con un peso del 3,5%. El segundo con 20 al 2,5%. El tercero con unas 42 al 1%.

Ah vale, con lo de los 3 años y las 65 empresas, ya me empiezan a cuadrar los numeros. Es que no me salian por ningun sitio. En 2015 yo me metí en Repsol con mucho capital y luego me arrepentí, porque pensé que debería haber realizado entradas parciales (me pesa un 15% de la cartera y eso que no ha llegado a los 12k comentados). Por eso ahora procuro moverme en compras más pequeñas. Gracias por la aclaracion.

Veo que sigues fiel a las enseñanzas del mesías Chowder ![]()

Yo también le he dado un mordisco a O y a SPG

Food For Thought …

According to S&P Capital IQ data, the S&P 500 is trading at 18.4 times consensus estimates of next year’s earnings, which is about the highest that widely watched metric has been in more than 10 years.

Based on this number, “the market feels basically fully valued,” Nick Colas, chief market strategist at Convergex, said on CNBC the other day.

He went on to say, to be sure, valuations are famously not an indicator of short or even medium-term market moves. But richly valued markets generally are thought to have less potential long-term upside than cheap ones.

Another caveat is that there are different ways of building valuation models. Based on the low level of current interest rates, for instance, stocks may not be overvalued at all.

STOCKS MAY NOT BE OVERVALUED AT ALL.

This is what I have been saying. This is what Warren Buffett confirmed, that based on the current condition of the market, valuations may not be as stretched as some believe.

Now, there is no question in my mind that the annualized rate of return for the S&P 500 won’t be as strong over the next five years as it has been over the last five, but I have said many times, that capital gains and income growth aren’t always on the same page, and when they’re not, you must make a decision. What’s more important to you? Capital gain growth or income growth? You can’t have both for long periods of time and some of you are about to find that out.

I choose income growth, and it’s why you see me focusing on companies still selling at what is considered to be fair value by most analysts and I am focusing on yields of 3% or more at the moment. Why? Because if we don’t get the capital gain growth most would like to see the market create, whatever total return the market does have in a no growth or declining market will come from the dividend. … Think about it folks!

I’m snatching those companies up while valuations are reasonable for another reason as well. I might be wrong. The market might show 15% annualized returns over the next 5 years, I don’t think it will, but I really don’t know, so I try to create balance. If I’m right one way, and wrong the other, I am getting a 50% accuracy benefit one way or the other as opposed to all or nothing. 100% of nothing is still nothing as those who stopped buying in 2012 have found.

Earlier this week I said TROW yield 3.2% and WPC yield 6.3%, and both still selling at a discount to fair value, were on the clock. Both have been purchased.

My “go for income” over the past week or so, in addition to TROW and WPC has had me buying VZ yield 4.6%, SPG yield 3.9%, TD yield 3.4%, PFE yield 3.7% and VFC yield 3.1%, all selling at a discount to fair value (that means undervalued folks) except for TD which was selling at a 2% premium, and I was willing to pay that premium due to an earnings beat. All in an older folks portfolio.

I can’t control falling prices, but I can control establishing new income records and we invest to generate income.

Make a decision … growth or income … you ain’t gettin’ both for long.

Sí, soy un discípulo aplicado ;). Aunque SPG la descubrí mirando otra en Value Line (gracias a la biblioteca de Houston por la suscripción), no por Chowder y ya tenía marcado este precio aproximadamente. Me gustó que con O es de los REITs con mejor situación financiera. Las subidas de tipos no son buenas en principio, pero como vienen de buenos números en la economía, al final creo que deberían ser hasta positivos para el sector. Además de que como dice Chowder, estaba tan cantado que han tenido tiempo de prepararse para ello. NNN pillé unas pocas por si venía lo que parecía, y la tengo porque Chowder habla muy bien de ella, a mí no me hubiera llamado demasiado la atención.

Hoy he entrado en WPC casi una posición completa a $62.17 (precio de primera hora porque tenía la orden puesta antes de que dieran la noticia que anunciaba más que probables subidas) y en HP 1/2 posición a $66.45. WPC habla muy bien Brad Thomas y dice que está por debajo de su precio objetivo; sin embargo, SPG y O un 15% caras (lo que pasa es que para mí son más seguras y por eso no me importa pagar algo más. Además para Value Line por ejemplo SPG está debajo de su precio objetivo, le dan un rango de 200 a 270; O de 60 a 80; WPC de 75 a 110)…

https://seekingalpha.com/article/4052189-definitive-margin-safety-w-p-carey

Para hacernos una idea de lo que compraron otros inversores en el mercado americano durante el pasado mes de Febrero

During the month of February a total of 58 buys were found throughout the DGI community. Even with the DOW above the 20,000 threshold, and uncertainty of the impact from Trump administration policies, it appears that DGI investors continue to find the value buys. This is evident in the slight spike in buying activity in February compared to the month of January.

To summarize the past month, out of a total of 58 buys found around the DGI community (with a minimum total of $300), a total of 43 companies were purchased with a total of 11 companies that were bought more than once

VFC 5 - TGT 2 - AAPL 2 - VZ 2 - WMT 2 - GILD 2 - MMM 2 - KO 2 - PFE 2 - BBB.V 2 - CU.TO 2

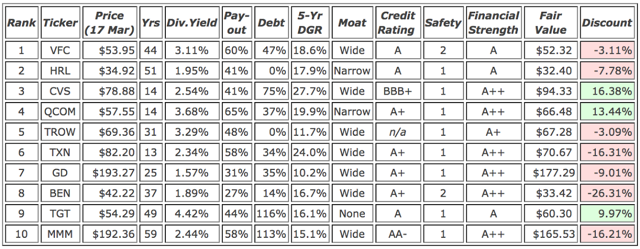

Interesante artículo de DivGro en SA donde muestra su Top 10 de acciones americanas candidatas a ser compradas en este mes de Marzo

The latest CCC list contains 813 stocks. Rating more than 800 stocks would be a daunting task, so I use several screens to trim the CCC list. This month, I applied the following screens favoring established dividend payers with positive earnings growth:

Number of Years of Consecutive Increases > 10 (removes 489 stocks)

10-year Dividend Growth Rate ≥ 7 (removes 110 stocks)

Ratio of Debt to Equity < 2.00 (removes 45 stocks)

Past 5-year Earnings Growth ≥ 0.00 (removes 44 stocks)

Dividend Yield ≥ 1.60 (removes 42 stocks)

No MLPs or stocks being acquired (removes 6 stocks)

These screens trim the CCC list to 77 candidates.

I ranked the 77 candidates using data from the CCC spreadsheet and additional sources like Morningstar, S&P Capital IQ, and F.A.S.T. Graphs. My ranking system favors established dividend paying stocks with strong fundamentals and stocks potentially trading at or below fair value. Dividend safety is another important factor.

Here are the top 10 ranked stocks for March 2017:

In the table, Yrs are the years of consecutive dividend increases, Payout is the EPS (earnings per share) payout ratio, and Debt is the ratio of debt to equity. The compound dividend growth rate over a 5-year period (5-Yr DGR) is provided, where available. Morningstar’s Moat and Standard and Poor’s Credit Rating, as well as Value Line’s Safety and Financial Strength ratings also are provided. Finally, I present my own estimate of Fair Value, along with a calculation of the current discount to fair value (Discount).

Compass Minerals 40 acc @ 67,15$

Cierro posición de SPG con 1/3 a $165.97

Mirando para añadir alguna de entre VZ, XOM, D, O, TGT, GIS, CMP, GPC o empezar en T, CF, SLB.

Compradas VZ a $48.82. Si no me acaba de convencer cómo evoluciona la empresa, posición completada.

Añadidas unas pocas más de TEVA a $32.27. Si no reduce dividendo no me preocupa lo que haga. Pero no me acaba de dar buena espina esta así que no creo que aumente más.

La próxima semana creo que ampliaré GIS.

Otro más que se sube al carro de TEVA con 1/2 posición a 32,3 $. La orden de entrada en Verizon la tengo más abajo todavía y en estudio de entrar en Chevron o Exxon?

Cuál véis mejor para entrar ?

Chowder en Seeking Alpha (01/04/2017)

Keep in mind that I use several sources for valuations and because I don’t know who is correct and who isn’t, and sometimes they are far apart, I take the average of them and use that as a guideline. If others disagree with the fair value numbers I use, then simply ignore them, it’s not something I wish to debate

DG … $72.50

HRL … $34.25

TGT … $60.00

ABT … $44.75

AMGN … $183.00

CAH … $88.00

CVS … $98.25

GILD … $94.33

MCK … $174.50

PFE … $35.25

CBRL … $160.00

DIS … $114.25

AXP … $81.00

TROW . $73.00

TD … $48.33

OHI … $42.00

PSA … $220.67

SPG … $200.33

WPC … $67.00

SEP … $50.00

XOM … $86.00

CSCO … $33.50

INTC …$36.25

QCOM . $63.75

I will list the company and then the discount to fair value.

Staples … DG - 3.8% … HRL - fair value … TGT - 8.4%

Utilities … VZ - 1.4% … DUK - actually selling at a 6.4% premium

Healthcare … ABT - fair value … AMGN - 10.3% … CAH - 7.3% … CVS … 19.8% … GILD - 28.0% (yeah, GILD) … MCK - 15.0% … PFE - 3.0%

Discretionary … CBRL - fair value … DIS - fair value

Financial … AXP - 2.3% … TROW - 6.8% … TD - 3.6%

REIT’s … OHI - 21.5% … PSA - fair value … SPG - 14.1% … WPC - 7.1%

Industrial’s … Nobody

Energy … SEP - 12.7% … XOM - 4.6%

Technology … CSCO - fair value … INTC - fair value … QCOM - 10.1%

Of the 21 consumer staples eligible for add on coverage, DG and TGT are selling at a discount to fair value.

HRL is selling at FV right now. I will be adding to all 3 this coming week.

In looking at utilities and healthcare in the Defensive sector, of which I have 22 eligible for potential add on, VZ, AMGN, CAH, CVS, GILD, MCK and PFE are selling at a discount to fair value. ABT is selling at FV right now.

I know I am going to add to VZ, AMGN, CAH, CVS, PFE and ABT this week. The health care demographics in this country are too compelling to worry about the short term uncertainty in the healthcare market. These companies will rebound in my opinion when that certainty shows up and I don’t want to miss out on the discount while waiting.

I was looking at adding to 7 utility companies yesterday in one portfolio I help manage because he has some cash to put to work. Here is how they broke down, all overvalued by the way. DUK had the best valuation, the premium is small enough for me to accept.

DUK … 6.4% premium to FV

SO … 8.5%

NEE … 9.9%

D … 11.2%

SRE … 12.5%

WEC … 13.3%

ED … 20.4%

Finished working with the Cyclical sector which includes Discretionary, Financial and REIT’s. Of the 23 companies I have eligible for add on coverage I have 6 selling at a discount to fair value. AXP, TROW, TD, OHI, SPG and WPC.

I won’t be adding to OHI. I still consider it speculative, but I know I’ll be adding to TD and I have work to do with the others.

CBRL, DIS and PSA are all at fair value and I have a high degree of certainty all 3 will be added this week.

I finished up with the companies in the Sensitive sector which include Industrial’s, Energy and Technology. I have 24 companies eligible for add on coverage but only 3 are selling at a discount to fair value. XOM, SEP and QCOM. I have 2 selling at FV right now. CSCO and INTC.

So those are the leading candidates this week for purchase. I need to read up a little on them first before deciding.

This week I’m looking for undervalued companies, those who are overvalued I will wait on earnings unless the premium is a small amount.

No veo nada que quiera aumentar en grandes dosis y prefiero este mes picotear varias.

Compras de 1/5 posición de CF a 28.27 y GPC a 89.72. Dejada orden en T y GIS. Me guardo para 1/2 posición entre DUK, TGT, QCOM, GE y XOM.

Y por ultimo las compras de americanas.

OHI a 32,15 $, XOM a 81,98 $ y PAYX a 59,07 $.

Con todas las compras mi cartera tiene ahora 59 empresas.