Abro hilo para un autor muy respetado por sus enseñanzas en DGI.

Pondré enlaces de varios de los textos que ha escrito.

Inicio de tutorial sobre CEF:

Total Return: Vainilla vs Chocolate ![]()

Diria que el

Total return chocolate includes the reinvestment of dividends.

Habria que calcularlo uno ya que las retenciones+impuestos no son la mismas no? Por eso ponen el TR a pelo.

" I propose that we solve the dilemma by clearly noting that there are two kinds of total return:

Total return vanilla is the same as Investopedia’s definition: Price change + dividends, without the dividends reinvested.

Total return chocolate includes the reinvestment of dividends.

Since dividends are always positive, we can state a fundamental rule about investing: Chocolate > Vanilla. That is, the total return you will get from an investment will always be more if you reinvest the dividends or interest than if you do not."

En el artículo ponen enlace a DRIP Returns Calculator | Dividend Channel

Donde te calcula Retorno total con/sin reinversión de dividendos. Sin impuestos, claro está.

Comentario sobre la recompra de acciones

“Buybacks seem to bring out emotions for some reason.

Mathematically, buybacks lower share count assuming that the shares are retired. That relieves pressure on the dividend and does improve per-share metrics. But if they are not retired, then those things don’t happen.

If the market’s valuation of the company remains the same or improves, then buybacks work their way through to increased price per share. But the fact that shares are bought back does not guarantee anything with respect to valuation. Valuation might decline even in the face of buybacks. Nobody knows for sure what the market will do short or long-term.

I don’t like the phrase “returning cash [money] to shareholders” when applied to buybacks. The money actually goes to former shareholders, namely the ones who sold their shares back to the company. I don’t like it when buybacks are lumped together with dividends as returning cash to shareholders. They are totally different animals”

Otro que le tira un dardito a Chowder…

Price is the result of auctions…that’s what the stock market is, an auction house.

So for me, evaluating quality is separate from price or valuation. In a highly efficient market, price does correlate with quality. But I don’t believe the stock market is always efficient, do you? Years ago, I read “The Myth of the Rational Market,” and I believe the reasoning there.

Because there are not that many CEFs, and because retail investors (aka dumb money) are most of the participants, it is widely thought that the CEF market is less efficient than the market for, say, large cap blue chip companies. That means that price disparities are more common.

Putting all that together, my approach is to find the most desirable investments first, then go looking for price deals on them. If I have two basically identical stocks, or CEFs, and one of them is on sale for some reason, that’s the one I’ll buy.

Some advisors say you should build up positions and not pay much attention to the price as you do so. I don’t agree. In the long term, I’ll build up my positions, but each purchase will be made at a bargain price, or at most a fair price. Bargains are always available somewhere, that’s been my experience.

Las lecciones de DVK sobre DGI en “Daily trade Alert”.

Me gusta lo que leo de este hombre. Gracias, no le conocía

"Across a whole portfolio, calculating DGR is easy. It’s just 12-months dividends (dollars) divided by prior 12-months dividends.

What that number means may not be apples to apples between two portfolios, however. If one investor is adding new outside money to their portfolio, they will have a different (higher) DGR compared to a portfolio where no new money is being added. If one investor is reinvesting dividends, they will have a higher DGR than someone else who is not, or who is only reinvesting part of their dividends.

Dave"

Traducción:

En todo un portafolio, calcular DGR es fácil. Son solo dividendos de 12 meses (dólares) divididos por dividendos anteriores de 12 meses.

Sin embargo, lo que ese número significa puede no ser manzanas con manzanas entre dos carteras. Si un inversionista agrega dinero externo nuevo a su cartera, tendrá un DGR diferente (más alto) en comparación con una cartera donde no se agrega dinero nuevo. Si un inversor está reinvirtiendo dividendos, tendrá una DGR más alta que otra persona que no lo está, o que solo está reinvirtiendo parte de sus dividendos.

Dave

Pregunta: Do you trim or sell your overvalued stocks or are you more of a buy and hold investor? If so, what guidelines do you use to trim?"

Respuesta:

When a position rises above my maximum position size, and is way overvalued, and stays that way for a couple months, I have trimmed positions. I cash out enough to bring the size down, and use the cash to purchase a high-quality stock that is better valued and usually has a higher yield.

Overvaluation is a price risk, so trimming reduces that risk. Being “too large” a position is a concentration risk, so trimming reduces that risk. Buying a better-yielding stock raises income flow immediately, and rising income is my main goal, so that goal is served. Buying a high-quality stock keeps the overall portfolio quality up, maybe even improves it a little (depending on the stocks involved)…

I don’t rebalance my portfolios on a set schedule, but this kind of targeted trimming does bring a portfolio into more balance. Having a balanced portfolio is not a goal of mine. I do not have “full positions” or “half positions” or things of that nature.

I should mention that my maximum position guideline is 10% of the portfolio, which is higher than most investors would tolerate, so these opportunities don’t arise all that often. I don’t trade much. My turnover is usually in the 0%-7% range each year.

Overall, I guess that makes me closer to buy-and-hold, although being such is not a goal of mine. My default decision in the absence of compelling evidence to “do something” is to hold.

Turnover is a byproduct of trying to improve the portfolio when my guidelines are “violated” by my stocks or maybe (very seldom) where I just decide that a stock isn’t cutting it and I let it go. I have no guideline that says I will hold everything forever, but in practice I have very little turnover.

Dave"

Este tío tiene mucho sentido cuando habla las veces q le he leído, es interesante cuando escribe. En este caso al leer me surge un escenario, y es q si la sobrevaloración se da en una posición madura de la cartera, en la q el tiempo ha hecho su trabajo y el yield inicial se ha convertido en un “high yield”, entonces el sustituir ese rendimiento por otro q te procure mayores ingresos por dividendo sin recurrir a valores “high yield high Risk” es complicado. Por lo demás, como siempre, interesante leerle.

Un saludo.

suele hablar con sentido común y a mí me parece muy didáctico en la forma de escribir que tiene.

en el siguiente enlace explica como decide recortar una posición que ha cogido demasiado volumen en la cartera:

Why I Sold Some Johnson & Johnson (JNJ) and Pepsi (PEP) | Daily Trade Alert

Ahora no lo encuentro en sus artículos pero me acuerdo leer que también redujo exposición a PG cuando este cogió un tamaño que no respetaba su “plan de negocio”. Explicaba como vendía cierta cantidad de acciones para bajar el peso de PG por debajo del 10%. Al mismo tiempo, comentaba como el “actual RPD” de PG era muy bajo (por debajo de la media de la cartera) y que con la rotación que estaba haciendo quería aprovechar para meter más RPD en la nueva adquisición.

A mí , me parecio una “master class” facil de entender de cómo gestionar la cartera y seguir poniendo el foco en el largo plazo.

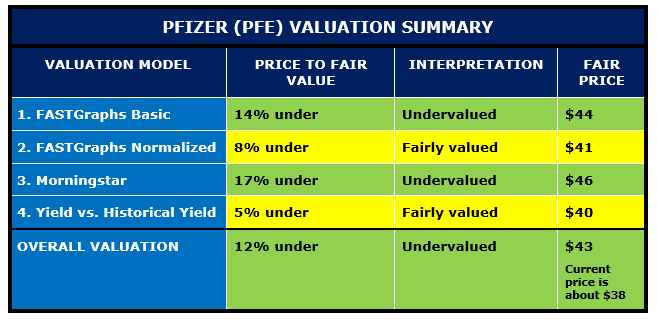

Muy interesante. Como siempre. Que opinión os merece la fusión con Mylan? Estaba pensando abrir posición para la cartera familiar, pero tengo mis dudas…

" Pfizer’s evolution took its biggest step forward this past weekend when management announced plans to combine its off-patent established medicines with generic drugmaker Mylan (MYL), creating a new global pharmaceutical company with nearly $20 billion in revenue. This deal has important implications for dividend investors."

"Pfizer also expects that following the closing of the transaction the combined dividend dollar amount received by Pfizer shareholders in the event the equity distribution is structured as a spinoff, based upon the combination of continued Pfizer ownership and an expected 0.12 shares of the new company granted for each Pfizer share, will equate to Pfizer’s dividend amount in effect immediately prior to closing

In other words, Pfizer’s current dividend will probably be reduced (we’d guess by 10% to 20%), but the new company formed with Mylan will pay a dividend that makes income investors whole"

Hmmm…pues la verdad, no se muy bien que pensar