Ya somos dos.

Vaya sangría lleva esta empresa… Es con diferencia la peor posición de mi cartera. ¿Alguien saber qué razón hay para la bajada de hoy?

No sé si deshacer posición y a otra cosa.

HM-B está en puesto 13 de 264 de mi lista con un 27% sobre precio objetivo.

Voy a ir buscando opciones con strike 110

Finalmente H&M no seguirá adelante con el DRIP y pagará un dividendo en efectivo de 9.75 coronas suecas.

Venta 2 opciones put strike 110 con prima total de 1800 SEK (177 €)

Si la cosa se pone fea entraré a 101 SEK con 200 acciones.

Saludos!

The H&M group’s sales development in the second quarter 2019

17 Jun, 2019 08:00 CEST

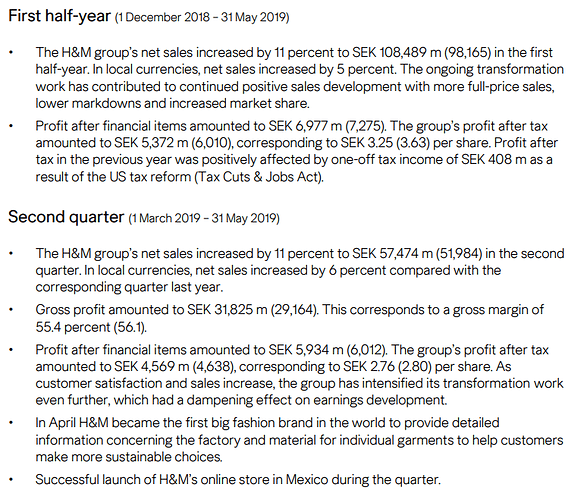

In the second quarter of 2019, i.e. during the period 1 March 2019 to 31 May 2019, the H&M group’s net sales increased by 11 percent and amounted to SEK 57,474 m (51,984). In local currencies, net sales increased by 6 percent.

The H&M group’s sales development in the third quarter 2019 (16/09/2019)

In the third quarter of 2019, i.e. during the period 1 June 2019 to 31 August 2019, the H&M group’s net sales increased by 12 percent and amounted to SEK 62,572 m (55,821). In local currencies, net sales increased by 8 percent.

H&M Hennes&Mauritz AB Nine-month report (03/10/2019)

Nine months (1 December 2018 – 31 August 2019)

- The H&M group’s net sales increased by 11 percent to SEK 171,061 m (153,986) during the first nine months of the financial year. In local currencies, net sales increased by 6 percent. The ongoing transformation work has contributed to continued positive sales development with more full-price sales, lower markdowns and increased market share.

- Profit after financial items increased by 6 percent to SEK 11,988 m (11,287). The group’s profit after tax increased to SEK 9,231 m (9,109), corresponding to SEK 5.58 (5.50) per share. Profit after tax in the previous year was positively affected by one-off tax income of SEK 418 m as a result of the US tax reform (Tax Cuts & Jobs Act).

Third quarter (1 June 2019 – 31 August 2019)

- With well-received summer collections, the H&M group’s net sales increased by 12 percent to SEK 62,572 m (55,821) in the third quarter. In local currencies, net sales increased by 8 percent compared with the corresponding quarter the previous year.

- Online sales in the third quarter increased by 30 percent in SEK and by 25 percent in local currencies.

- Gross profit increased by 13 percent to SEK 31,815 m (28,091). This corresponds to a gross margin of 50.8 percent (50.3).

- Profit after financial items increased by 25 percent to SEK 5,011 m (4,012). The group’s profit after tax increased to SEK 3,859 m (3,099), corresponding to SEK 2.33 (1.87) per share.

- The stock-in-trade continues to improve. As a proportion of sales, the book value of the stock-in-trade in SEK was lower than at the same point in time the previous year. Adjusted for currency effects the stock-in-trade decreased somewhat.

- H&M was successfully launched on India’s leading ecommerce platform Myntra in August. The reception has exceeded the company’s high expectations.

- Sales in local currencies in September 2019 increased by 8 percent compared to September the previous year.

- The H&M group is ranked as one of the world’s best retailers for sustainability in the Dow Jones Sustainability World Index.

- The integration of the online and physical stores continues at full speed.

- The H&M group continues to actively optimise the store portfolio through increased consolidation in established markets while continuing its expansion in growth markets. The net addition of new stores for full-year 2019 will be around 120, somewhat fewer than previously communicated.

Vendí la posición a 197. Le he sacado algo más de un 10%. Supongo que subirá más pero no es un sector que me guste demasiado. Prefiero salirme por si acaso visto los grandes meneos que ha llevado. Bastantes guerras llevo por otros lados.

Análisis puntual de OCU

Con unas 4.900 tiendas físicas en Alemania, EE. UU. Reino Unido y otros 70 países, y marcas como H&M, COS y Weekday, el gigante sueco textil nº2 mundial H&M (SE0000106270) cotizado en la Bolsa de Estocolmo tiene unas ventas anuales que rondan los 21.000 millones de euros. Sin embargo, la falta de reacción ante el empuje de competidores como Inditex o la tardanza en entrar en la batalla de ventas en la red provocó un deterioro de sus márgenes hasta rondar poco más del 7% frente p.ej. al 18% logrado en 2012. Y la cotización desde 2015 se hundió en 4 años cerca de un 60%.

La gerencia tomó cartas en el asunto, dejó de abrir tiendas sin ton ni son, centró su oferta en aquellos segmentos más prometedores y desarrolló el comercio electrónico… Así, y por primera vez desde hace dos años, en este, los resultados del tercer trimestre han experimentado una mejoría: sus ventas y margen operativo se han incrementado un 8% y un 24,6% su beneficio por acción.

Pese a todo ello el grupo sigue siendo frágil. Y muchos son los retos que tiene que afrontar de cara al futuro: cierre de tiendas, equilibrio entre tiendas físicas y online -con los consecuentes costes en logística-, fuerte inversión en marketing para poder ganarse a una joven clientela menos fiel a la marca. Factores que a nuestro juicio harán que la rentabilidad del grupo se resienta.

En suma, a los 184 SEK que ronda su cotización creemos que, a lo sumo, merece un consejo de conservar siempre que no le asuste su riesgo.

Group’s sales development for the full-year 2019 including the fourth quarter 2019 (16/12/2019)

- The H&M group’s net sales increased by 11 percent to SEK 232,764 m (210,400) in the financial year of 2019. In local currencies, net sales increased by 6 percent.

- In the fourth quarter of 2019, i.e. during the period 1 September 2019 to 30 November 2019, the H&M group’s net sales increased by 9 percent to SEK 61,704 m (56,414). In local currencies, net sales increased by 5 percent.

Full Year Report (30/01/2020)

Full-year (1 December 2018 – 30 November 2019)

- The H&M group continued to grow globally in 2019 in an ever-changing fashion industry. The group’s net sales increased by 11 percent to SEK 232,755 m (210,400) in the 2019 financial year. In local currencies, net sales increased by 6 percent. The ongoing transformation work has contributed to continued positive sales development with more full-price sales, lower markdowns and increased market share.

- Gross profit increased to SEK 122,453 m (110,887). This corresponds to a gross margin of 52.6 percent (52.7).

- Profit after financial items increased by 11 percent to SEK 17,391 m (15,639).

- The group’s profit after tax increased to SEK 13,443 m (12,652), corresponding to SEK 8.12 (7.64) per share. Profit after tax in the previous year was positively affected by one-off tax income of SEK 425 m as a result of the US tax reform (Tax Cuts & Jobs Act).

- The year’s increase in profit means that SEK 86 m has been allocated to the H&M Incentive Program (HIP), which is for all employees.

Fourth quarter (1 September 2019 – 30 November 2019)

- The H&M group’s net sales increased by 9 percent to SEK 61,694 m (56,414) in the fourth quarter. In local currencies, net sales increased by 5 percent compared with the corresponding quarter the previous year.

- Gross profit increased by 9 percent to SEK 33,287 m (30,592). This corresponds to a gross margin of 54.0 percent (54.2).

- Profit after financial items increased by 24 percent to SEK 5,403 m (4,352). Before the allocation to HIP, profit for the quarter increased by 26 percent.

- The group’s profit after tax increased to SEK 4,212 m (3,543), corresponding to SEK 2.54 (2.14) per share.

- The composition and level of the stock-in-trade continue to improve. Currency adjusted the stock-in-trade decreased by 6 percent. The book value of the stock-in-trade in SEK was 16.3 percent (17.9) of sales.

First quarter (1 December 2019 – 29 February 2020) (03/04/2020)

- The H&M group’s net sales increased by 8 percent to SEK 54,948 m (51,015) in the first quarter.

- Online sales increased by 48 percent in SEK.

- Gross profit increased by 10 percent to SEK 28,034 m (25,526). This corresponds to a gross margin of 51.0 percent (50.0).

- Profit after financial items more than doubled to SEK 2,504 m (1,043), which shows that the company’s transformation work has had a good effect.

- The group’s profit after tax increased to SEK 1,928 m (803), corresponding to SEK 1.16 (0.49) per share.

- As a result of the rapid global spread of the Covid-19 virus, sales have decreased significantly. As at 31 March, a total of 3,778 out of 5,065 stores were closed. Net sales in March 2020 decreased by 46 percent in local currencies compared with March 2019. Since mid-March all of the stores have been closed in several of the group’s largest markets.

- Online sales in March 2020 increased by 17 percent in local currencies.

- In China demand has gradually started to recover. More or less all of the group’s stores have now re-opened and sales have gradually increased.

Yo compré a finales del 2017 y nunca la he tenido en precios como los de ahora.