en 40 años?. Acuérdate de ponerme el excel con el shield en la tumba para que no lo olvide

Reckitt incrementa el dividendo un 4,98%

https://www.reckitt.com/investors/results-and-presentations/

Anheuser ab-inbev sube dividendo de 50c a 75c

La “otra” Merck aumenta el dividendo un 19% (de 1.85€ a 2.20€)

Más dinerito para Altria

Europa está “on fire” en este 2023. A ver cuanto dura la alegría en casa del pobre

Calla, calla, para una vez que arrancan, no me los distraigas ![]()

Y España más

Te sube más el dividendo el Banco Santander que el 99% de aristócratas USA

Vivimos tiempos salvajes

Tratándose del Santander, tampoco hay que descartar aún que no se trate del viejo “arrancada de caballo, parada de burro” ![]()

O tiempos nuevos.

Habra que preguntarle a Jorgito el broncas.

S2

También puede ser.

Si a la reestructuración bestia de los últimos diez/quince años, se les une un entorno normal donde desaparecen barbaridades como los tipos de interés negativos, igual tienen un nuevo ciclo positivo por delante.

![]()

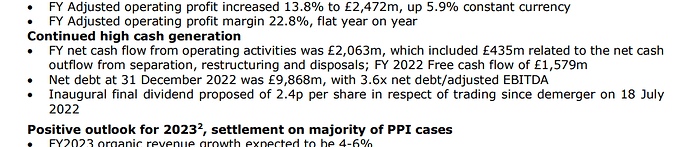

Haleon. Subida de dividendo de un infinito por ciento

Dividend

Consistent with our previous guidance, the Board is declaring a FY 2022 dividend of 2.4 pence which

represents approx. 30% of adjusted earnings for the period since listing.

Subject to shareholder approval, this dividend will be paid on 27 April 2023 to holders of ordinary shares

and US American Depositary Shares (ADS) on the register as of 17 March 2023 (the record date). The exdividend date is 16 March 2023. For ordinary shareholders wishing to participate in the Dividend

Reinvestment Programme (DRIP), the election deadline for the DRIP is 4 April 2023.

Reflecting our stated priorities to invest into the business for growth and reduce leverage our current

intention is, subject to Board approval, to maintain our pay-out ratio around the current level.

Subject to Board approval, future ordinary dividends are expected to be paid half-yearly with

approximately one third of the dividend paid as an interim dividend, following the Company’s half-year

results and paid in October, and the balance paid as a final dividend, subject to shareholder approval,

following the Company’s Annual General Meeting.

Tezanos se ha registrado en el foro

![]()

![]()

Ahora que me han pillado, comparto la información sin editar: “2,4 pences paga Haleon, de ellos, 2’3 son gracias a Pedro S. :corazonrojo :rosa :triangulitorojo”

Lo que no consigo ver por ningún lado es cuál va a ser la tónica a partir de ahora. Si solo va a ser un único dividendo anual o se plantean varios. Porque si solo va a ser uno, y de ese calibre…

Me rectifico yo solo:

Subject to Board approval, future ordinary dividends are expected to be paid half-yearly with approximately one third of the dividend paid as an interim dividend, following the Company’s half-year results and paid in October, and the balance paid as a final dividend, subject to shareholder approval, following the Company’s Annual General Meeting

Aún así, un poco rácana la cosa, no?

Lo principal es controlar todo lo que les empaquetaron de deuda, desconozco si el dividendo propuesto está ajustado pero no me hubiera sorprendido incluso que no hubieran propuesto nada.

The first dividend has been proposed at 2.4p per share, representing roughly 30% of adjusted earnings for the period since listing, with the board saying it intends to maintain the pay-out ratio around that level.

Haleon chief executive Brian McNamara said free cash flow of £1.6bn in the calendar year enabled the first dividend as the company was able to reduce net debt to £9.9bn from £10.7bn at the time of the demerger and “provides increased confidence in reducing debt faster than originally expected”.