Las drogas 2.0

Republic Services, $RSG, incrementa el dividendo un 8,08%

Mondelez, $MDLZ, sube el dividendo un 10,39%

Otra de las pertenecientes a la “banda del céntimo” acude a su cita. Swk pasa dividendo trimestral de 0,8 a 0,81

Otra que ya lleva 2 años en esa misma banda, Principal Financial Group, $PFG, lo sube de 0,64$ a 0,65$, un 1,56%

(Edito: en 2022 no lo subió; llevaba 7 trimestres pagando 0,64$)

Mejor eso que pertenecer a la banda del “recorte del dividendo” ![]()

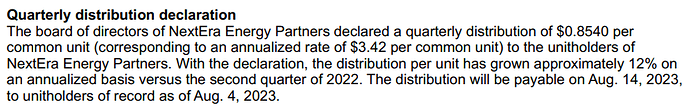

NextEra Energy Partners, $NEP, sube el dividendo un 1,36% respecto al trimestre anterior, y un 12% respecto al que pagó en agosto de 2022.

Diageo aumenta el dividendo hasta los 80p desde los 77p.

Un 4% de aumento.

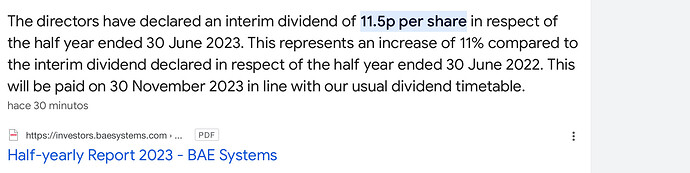

Bae System sube su interim dividend de noviembre casi un 11% respecto al del año pasado (pasado noviembre 10,4p).

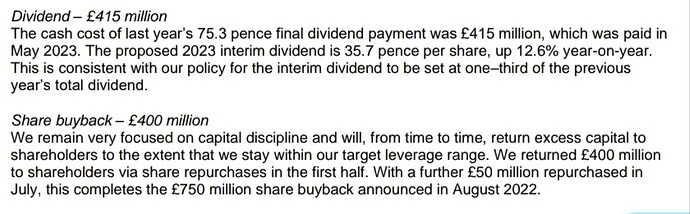

LSEG ha propuesto un dividendo a cuenta de 35.7p. El anterior fue de 31.7p (+12,6%).

La fecha de pago es el 20 de Septiembre.

Otra que nunca falla. ![]()

![]()

Y sin IA ni Metaverso