Starbucks’ Comparable Store Sales Dazzle; Stock Rises 6.5%

Yesterday after the markets closed, Starbucks Corporation (SBUX) reported financial results for the third quarter of fiscal 2019. The company’s results – particularly its comparable store sales – were much better than the market anticipated, causing shares to rise 6.5% in after-hours trading.

To begin, let’s discuss Starbucks’ strong revenue number. The company generated consolidated net revenues of $6.8 billion, which grew 8% over the same period a year ago.

A number of factors contributed to Starbucks’ robust revenue growth. First and foremost, the company’s global comparable store sales – which measures sales growth at locations that have been open for longer than 12 months – increased by 6%, comprised of a 3% increase in average ticket and a 3% increase in comparable transactions.

Importantly, Starbucks’ domestic segment (which has historically had weaker comps growth) saw above-average comparable store sales growth in the quarter . More specifically, Americas comparable store sales increased by 7%, including a 4% increase in average ticket and a 3% increase in transactions.

Starbucks’ other most important segment also performed well. The China/Asia Pacific segment saw comparable store sales increase 5%, comprised of a 3% increase in average ticket and a 2% increase in average transactions.

To summarize, Starbucks’ comparable store sales performance was strong. Importantly, though, it was not the only contributor to the company’s revenue growth. Starbucks opened 442 net new stores in the third quarter, yielding a new store count of 30,626 at the end of the reporting period. Starbucks’ store count grew 7% year-on-year.

The geographic breakdown of Starbucks’ new store opening is important. Nearly one-third of net new stores openings were in China, and a full 48% of them were in international markets. In other words, Starbucks’ international expansion continues at a rapid rate.

Let’s now look at Starbucks’ performance further down the income statement. The company’s operating margin of 18.3% contracted by 20 basis points over the same period a year ago, driven entirely by a 70 basis point unfavorable impact from the company’s Streamline cost-cutting efforts. Excluding this impact, Starbucks’ operating margin would have expanded approximately 50 basis points over the last twelve months.

On the bottom line, Starbucks generated adjusted earnings-per-share of $0.78, which increased by 26% over the same period a year ago.

Starbucks also continued to allocate capital in an extraordinarily shareholder-friendly manner. The company returned $581 million to shareholders in Q3 through a combination of dividend payments and share repurchases.

Lastly, Starbucks’ loyalty program – called Starbucks Rewards – continues to grain traction at an impressive rate. The loyalty program grew to 17.2 million active members in the United States, up 14% year-on-year.

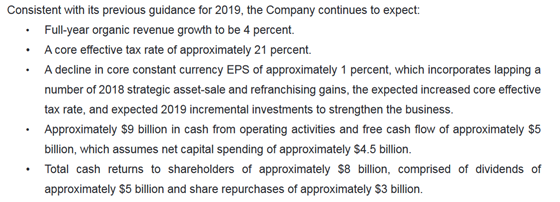

To round out an excellent earnings release, Starbucks also published an upwards revision to its 2019 financial guidance. The company now has the following expectations for the twelve-month reporting period:

-

Global comparable store sales growth of 4% (previously 3%-4%)

-

Revenue growth of 7% (previously 5%-7%)

-

Approximately 2,000 net new stores globally (previously 2,100 stores), comprised of Americas over 600, China and Asia Pacific ~1,100, and Europe, the Middle East, and Africa of ~300 (previously ~400). Note that the reduction of Starbucks’ net new store guidance comes entirely from the EMEA segment, which is arguably its least important division.

-

GAAP earnings-per-share between $2.86 and $2.88 (previously $2.40 to $2.44)

-

Adjusted earnings-per-share between $2.80 and $2.82 (previously $2.75 and $2.79)

Overall, it was an excellent quarter from Starbucks. Unfortunately, the company’s valuation is excessive today. The company is trading at a price-to-earnings ratio of 32.3 using the midpoint of its revised adjusted earnings-per-share guidance. Accordingly, the company earns a sell recommendation from Sure Dividend at current prices.

ABBV Beats Revenue & Earnings Expectations, Raises Guidance; Shares +2%

This morning before the markets opened, AbbVie reported financial results for the second quarter of fiscal 2019. The company’s performance beat analyst expectations on both revenue and earnings

On the top line, AbbVie generated net revenues of $8.255 billion, which decreased by 0.7% on a GAAP basis. Adjusted net revenues were flat on a reported basis and increased 1.5% operationally (which excludes the impact of foreign exchange fluctuations).

The most important revenue figure for AbbVie is the sales generated by its flagship drug Humira , which is responsible for more than half of the company’s revenue and is the highest-grossing drug in the world.

In the second quarter, U.S. Humira revenue increased by 7.7% to $3.793 billion while international Humira revenue decreased by 35.2% (or 31.0% operationally) due to enhanced biosimilar competition in international markets.

Importantly, Humira’s international weakness was broadly expected and was offset by strength in other parts of AbbVie’s portfolio. The company’s Hematologic Oncology portfolio generated $1.268 billion of revenue in the second quarter, which represents an increase of 38.7% on a reported basis and 39.1% on an operational basis.

The most important drug within the Hematologic Oncology portfolio is Imbruvica , which generated net revenues of $1.099 billion, an increase of 29.3%.

Moving down the income statement, AbbVie’s adjusted gross margin ratio was 82.7% while its adjusted operating margin was 48.2% - both well above many of its peers in the publicly-traded universe.

On the bottom line, AbbVie’s adjusted diluted earnings-per-share figure came in at $2.26, which represents an increase of 13% over the $2.00 generated last year. Much of this gain was due to the company’s actual business growth, but a tailwind from share repurchases also helped. AbbVie’s diluted shares outstanding decreased from 1,572 last year to 1,484 this year for a decline of 5.6%.

AbbVie’s Chairman and Chief Executive Officer, Richard A. Gonzalez, made the following statement about AbbVie’s performance in the quarter:

“We continue to see strong momentum in our business, as we delivered revenue and adjusted EPS ahead of our expectations for the quarter and announced plans to acquire Allergan, a transformative transaction that will provide scale and diversity to our business and position AbbVie for top-tier performance over the long term. Based on our strong performance year-to-date and our confidence in the outlook for the second half, we are raising our revenue and adjusted EPS guidance for 2019.”

As the above quote implies, AbbVie increased its financial guidance for fiscal 2019 with the publication of its second quarter earnings release. The company now expects to generate adjusted earnings-per-share between $8.82 and $8.92 (previous guidance was between $8.73 and $8.83). At the midpoint, the company’s new guidance band represents year-on-year growth of 12.1%.

Overall, it was an excellent quarter from AbbVie. The company continues to perform well, yet the market fails to reward it with a reasonable valuation. AbbVie is trading at $68.00 in this morning’s premarket trading right now, which implies a price-to-earnings ratio of 7.7 using the midpoint of its new guidance band. Fortunately, the company is aggressively repurchasing stock at these discounted valuations, which will boost its per-share intrinsic value over time.

Given all of this, AbbVie continues to earn a strong buy from Sure Dividend at current prices.

McDonald’s Beats Comparable Sales Estimates, Surges to New All-Time High

This morning before the markets opened, McDonald’s Corporation (MCD) reported financial results for the second quarter of fiscal 2019. The company met expectations for both revenue and earnings and surged to a new all-time high in premarket trading after announcing better-than-expected comparable store sales.

Let’s begin by discussing McDonald’s top line results. The company’s consolidated revenues were flat from the previous year (they increased by 3% in constant-currencies) due to a combination of strong comparable store sales and fully offset by the impact of McDonald’s continued refranchising efforts.

While McDonald’s consolidated revenue growth was not too impressive, the company’s operational results were better. The company generated global comparable store sales growth of 6.5% and systemwide sales growth of 8% in constant currencies. Remarkably, McDonald’s has now achieved 16 consecutive quarters of positive global comparable sales growth.

Further down the income statement, McDonald’s operating income increased by 1% (4% in constant currencies) while diluted earnings-per-share increased by 4% (or 7% in constant currencies).

Excluding one-time accounting charges – which primarily includes the strategic restructuring charge of $0.05 in the prior year – McDonald’s adjusted earnings-per-share increased by 3%, or 7% in constant currencies.

Overall, it was a solid quarter from McDonald’s, and the company’s fundamental financial results continue to impress us. However, McDonald’s is trading at a fairly unreasonable valuation – around 26.6 times earnings, to be precise. Because of its excessive earnings multiple, McDonald’s earns a sell recommendation from Sure Dividend at current prices.

Aflac Beats Earnings & Revenue Expectations; Reaffirms 2019 Financial Guidance

Yesterday after the markets closed, Aflac reported financial results for the second quarter of fiscal 2019. The company’s results beat expectations on both revenue and earnings, and Aflac reaffirmed its financial guidance for the remainder of the fiscal year.

Here are what the numbers look like. Aflac’s total revenues of $5.5 billion decreased slightly from the $5.6 billion in the same period a year ago. While Aflac’s sales contracted year-on-year, this was broadly expected – the consensus analyst estimate for the company’s Q2 sales was $5.46 billion.

Aflac’s bottom line results were stronger than its revenue trend would suggest. The company generated net earnings of $817 million, or $1.09 per common share, compared with $832 million, or $1.07 per common share, last year.

Aflac’s results through the first six months of the year were similar. Total revenues increased 1.0% to $11.2 billion, while net earnings of $1.7 billion ,or $2.32 per diluted share, increased over the $1.6 billion, or $1.98 per diluted share, generated through the first six months of fiscal 2018.

Aflac’s Chairman and Chief Executive Officer, Daniel P. Amos, also made the following comments related to Aflac’s financial guidance with the publication of its earnings release:

“I want to reiterate our 2019 earnings guidance. Our consistent, solid results in the first half of the year benefited from timing of expenses and a modestly favorable effective tax rate in the period, which puts us on track to produce adjusted earnings per diluted share toward the higher end of the range of $4.10 to $4.30, assuming the 2018 weighted-average exchange rate of 110.39 yen to the dollar. As always, we are working very hard to achieve our earnings-per-share objective while also ensuring we deliver on our promise to policyholders.”

Overall, it was an excellent quarter from Aflac. With that said, the security trades significantly above our fair value estimate, so its forward-looking return prospects are poor. Aflac earns a sell recommendation from Sure Dividend at current prices.

Alphabet Beats Earnings Expectations, Announces $25 Billion Share Repurchase Program; Shares +8%

Last night after the markets closed, Alphabet Inc. (GOOG) (GOOGL) – the parent company of Google – reported financial results for the second quarter of fiscal 2019. The company beat expectations on both the top and bottom lines while also announcing a significant $25 billion share repurchase program, causing shares to rise by more than 8% in this morning’s premarket trading.

Here are what the numbers look like. On the top line, Alphabet generated revenues of $38.9 billion, which increased by 19% versus the same period a year ago, or 22% on a constant-currency basis.

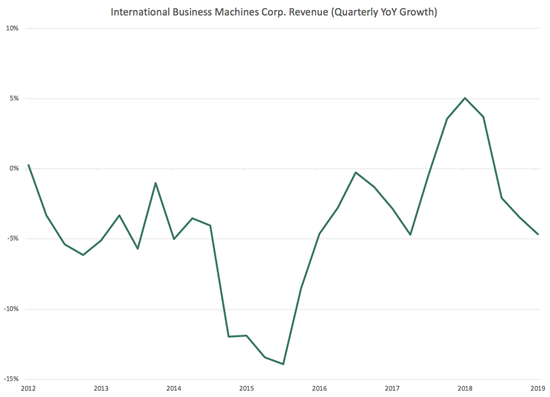

Importantly, this actually represents revenue growth acceleration for Alphabet, which has seen its revenue growth decline in recent years. You can see Alphabet’s year-on-year revenue growth broken down by quarter in the following image:

Further down the income statement, Alphabet generated operating income of $9.2 billion, which represents an operating margin of 24%, and operating income growth of 13.1% year-on-year.

The company’s bottom line results were even stronger. Alphabet generated adjusted net income of $9.9 billion, which grew 20.3%, while diluted earnings-per-share of $14.21 increased by 20.9% over the same period a year ago.

Google’s operational results announced in the quarterly press release were staggering. For one, the company’s headcount now sits at 107,646, which represents an immense 20.9% increase over last year’s 89,058.

The company’s Cloud and YouTube segments are its fastest-growing units at this time. With respect to Google Cloud, the company’s CEO Sundar Pichai said on the company’s earnings call that “ We continue to build our world-class cloud team to help support our customers and expand the business and are looking to triple our salesforce over the next few years. ”

Separately, the CEO also said:

“Q2 was another strong quarter for Google Cloud, which reached an annual revenue run rate of over $8 billion and continues to grow at a significant pace. Customers are choosing Google Cloud for a variety of reasons. Reliability and uptime are critical. Retailers like Lowe’s are leveraging the Cloud as one of the important tools to transform their customer experience and supply chain.”

The company also singled out YouTube as “ the second largest driver of revenue growth across Alphabet” in the second quarter.

Within its press release, Alphabet also announced that its Board of Directors has authorized the repurchase of up to an additional $25 billion of its Class C capital stock. This amounts to approximately 3% of Alphabet’s current market capitalization. The repurchase authorization has no expiration date.

Overall, it was an excellent quarter from Alphabet. The company has great growth prospects and is trading near our fair value estimate, so it earns a buy recommendation from Sure Dividend at current prices.

Colgate-Palmolive’s Adjusted EPS Decline 6% In Q2 2019 Earnings Release

Colgate-Palmolive (CL) reported underwhelming results for its second quarter of fiscal 2019 this morning.

Revenue declined 0.5% versus the same quarter a year ago. Excluding the effects of foreign exchange, organic sales increased 4.0%.

The bottom line showed worse performance. Adjusted earnings-per-share declined 6%. The company’s gross margin actually increased slightly versus the same quarter a year ago, but higher overhead and advertising expenses reduced operating margin. The company’s adjusted operating margin declined from 25.8% in Q2 2018 to 24.0% in Q2 2019.

The company’s CEO Noel Wallace had the following to say about the company’s results:

“We have achieved another quarter of sequential improvement in organic sales growth with the strong 4.0% increase driven by both positive volume and higher pricing. In particular, it was terrific to see positive pricing across every operating division…

Excluding charges resulting from the Global Growth and Efficiency Program in both 2018 and 2019, the charge related to U.S. tax reform in 2018 and the benefit from a foreign tax matter in 2018, based on current spot rates, we continue to plan for a year of gross margin expansion, increased advertising investment and a mid-single-digit decline in earnings per share.”

While Colgate-Palmolive’s Q2 2019 results were very close to in line with analyst estimates, we do not believe these results are driving shareholder value growth.

The company was able to grow constant-currency adjusted sales, but actual sales declined slightly despite 3.0% higher advertising expenses . This shows that the company is having to spend more to retain its current sales volume. Said another way, Colgate-Palmolive is less efficient today than it was a year ago.

For an established company like Colgate-Palmolive, bottom line results (earnings-per-share) are of critical importance. The company’s focus on growing the top line has resulted in a decline in earnings-per-share. This means investors can expect the dividend payout ratio to rise and the company’s dividend to increase only modestly. As a Dividend King, we do expect continued dividend growth at Colgate-Palmolive.

We see Colgate-Palmolive as significantly overvalued today. The company trades with a valuation that would be more suitable for a quickly growing stock – and that’s not Colgate-Palmolive today. Due to the company’s weak growth prospects and high valuation, we rate Colgate-Palmolive as a sell at current prices.

Illinois Tool Works Sees EPS & Revenue Decline In Q2 2019 Earnings Release; Shares Down 5.5%

Illinois Tool Works (ITW) released its second quarter 2019 results this morning.

The company generated earnings-per-share of $1.91 in the quarter versus $1.97 in the same quarter a year ago for a 3.0% decline.

The top line showed even worse performance. Illinois Tool Works’ revenue declined 5.8% versus the same quarter a year ago. On a constant-currency basis, the revenue decline was 2.8%.

The company’s CEO said the following about recent results:

“In this more challenging demand environment, the ITW team executed well on the elements within our own control and delivered solid financial results. Operating margin improved year-over-year to 24.4 percent, excluding higher restructuring impact of 30 basis points, as enterprise initiatives contributed 110 basis points. The combination of unfavorable foreign currency translation, higher restructuring expenses and a small loss on two divestitures reduced EPS by $0.09 year-over-year. Excluding these three items, EPS would have increased two percent to $2.00. Free cash flow increased 14 percent year-on-year.”

Adjusted EPS was $2.00, a 1.5% improvement versus EPS in the same quarter a year ago. And strong free cash flow growth is certainly a positive for investors.

Illinois Tool Works’ guidance calls for the following for full fiscal 2019:

- Revenue decline of between 1% and 3%

- EPS of between $7.55 and $7.85

- Free cash flow greater than 100% of net income

- Share repurchases of ~$1.5 billion

The company’s updated guidance shows a reduction in expected EPS for fiscal 2019. The previous guidance was $8.05 at the midpoint, versus the new guidance of $7.70 at the midpoint, for a decline of 4.3%.

The company’s free cash flow generation being more than 100% of net income is impressive. This shows that Illinois Tool Works’ earnings are translating into real cash that can be used on dividends and share repurchases. The company’s expected $1.5 billion in share repurchases in fiscal 2019 is equivalent to 2.9% of the company’s market cap at current prices.

With a reduced guidance and negative EPS growth on a GAAP basis, this was a poor quarter for Illinois Tool Works. Despite today’s price decline, we view Illinois Tool Works as somewhat overvalued. The company’s long-term growth prospects and long dividend history partially make up for its valuation. We rate Illinois Tool Works as a hold

Other Dividend News