Domino’s Drops 9% After Weaker Than Expected Earnings

Yesterday, Domino’s (DPZ) reported financial results for the second quarter of 2019. The company’s performance – particularly its comparable store sales – was weaker than expected and shares fell by 9% in yesterday’s trading.

On the top line, global retail sales increased by 5.1% in the second quarter. Excluding the impact of foreign exchange fluctuations, global retail sales would have increased by 8.4%.

As mentioned, it was the company’s same store sales that disappointed investors. In the United States, Domino’s generated company-owned same store sales growth of 2.1%, compared to consensus estimates of 3.4%, while franchised stores generated same store sales growth of 3.1% compared to consensus estimates of 4.7%.

The story in Domino’s international locations was similar. International same store sales growth of 2.4% was lower than the 2.6% consensus estimate.

Still, Domino’s same store sales growth has been consistently positive – remarkably so, in fact. The second quarter of 2019 marked the 102nd consecutive quarter of international same store sales growth and the 33rd consecutive quarter of U.S. same store sales growth .

Domino’s also continues to aggressively open new stores. More specifically, Domino’s opened 200 net new stores in the second quarter, including 42 U.S. stores and 158 international locations.

On the bottom line, results were much, much stronger, as Domino’s generated GAAP diluted earnings-per-share growth of 23.0% and adjusted diluted earnings-per-share growth of 19.0%.

Overall, Domino’s second quarter was worse than expectations but it was not so bad that the company’s long-term thesis has changed. The company is one of the fastest-growing stocks outside of the technology sector. This trend continued in the second quarter as the company reported 20%+ earnings growth. Still, the company’s high valuation prevents it from earning a buy recommendation from Sure Dividend at current prices – instead, we rate Domino’s as a hold.

Cintas Rises ~6% in After-Hours Trading After Reporting Record Revenue and Earnings

Yesterday, Cintas (CTAS) reported financial results for the fourth quarter and fiscal year ending May 31st, 2019. The company’s results were better than expected, causing shares to rise by 6% in after hours trading.

In the quarter, revenue of $1.79 billion increased by 7.4% over last year’s quarter. Organic revenue growth – which adjusts for acquisitions and foreign currency exchange rate fluctuations – was 7.6%. The organic growth rate for the Uniform Rental and Facility Services segment was 6.8%, while First Aid and Safety Services generated organic revenue growth of 10.7%.

Further down the income statement, operating income increased by 18.4% year-on-year due to meaningful margin expansion and partially offset by small expenses related to the continued integration of G&K Services, Inc.

The company’s net income performance was arguably its strongest financial metric. Ne income increased by 19.5% year-on-year, while adjusted earnings-per-share (which excludes G&K integration expenses) increased by 16.9%.

Cintas’ full fiscal year performance was similarly strong. Revenue increased by 6.4% (including an organic revenue growth rate of 6.4%) while adjusted earnings-per-share increased by 27.9%.

Cintas also published some preliminary fiscal 2020 financial guidance with the publication of its fourth quarter earnings release. The company expects to generate revenue growth of 5.4% to 6.5% while earnings-per-share growth is expected to be between 9.2% and 11.2%.

Overall, Cintas’ fourth quarter financial results were very strong. However, the company’s stock is quite overvalued, so the company earns a sell recommendation from Sure Dividend at current prices…

Wells Fargo Beats Expectations Thanks To Smart Capital Allocation

Yesterday, Wells Fargo (WFC) reported results for the second quarter of fiscal 2019. The company beat expectations on both the top and bottom lines, yet the stock fell by about 3% in yesterday’s trading.

We’ll be examining the company’s results in this email to determine why this might be. Before we do, note that since February 2nd, 2018, Wells Fargo has operated under a Federal Reserve-imposed asset cap that prevents the company’s balance sheet than growing any larger than its total asset size at the end of 2017.

This amounts to a balance sheet no larger than $1.94 trillion. Keep this in mind as we discuss the company’s results.

At the top of the income statement, the company’s performance was nothing to celebrate. Wells Fargo generated revenue of $21.6 billion, which was the same as both the previous quarter (1Q2019) and last year’s comparable quarter (2Q2019).

In a sense, this is exactly what one would expect – since Wells Fargo’s business model is to earn a spread on deposits and loans, then its revenues will likely never grow meaningfully until the asset cap is removed.

With that said, other factors allowed the bank’s profitability metrics to perform much better. Wells Fargo generated net income of $6.2 billion, which increased by 19.2% over the $5.2 billion reported in the same period a year ago. Diluted earnings-per-share of $1.30 rose by 32.7% from last year’s $0.98.

Many investors will be wondering how the company’s earnings and earnings-per-share were able to increase so much without any actual revenue growth. Two main factors caused this.

The first was significantly improved asset efficiency, which for banks is typically measured using return on assets (net income divided by average total assets). In the second quarter, Wells Fargo’s return on assets increased to 1.31% from 1.10% last year.

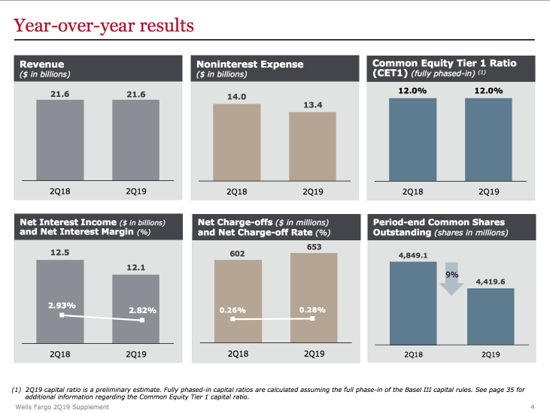

The second factor that contributed applies only to Wells Fargo’s earnings-per-share growth, and can be seen in the following image:

As the bottom right part of the image shows, Wells Fargo was able to lower its shares outstanding by 9% year-on-year. We are very encouraged by this as it shows that the company’s management team recognizes that it cannot invest in growing its balance sheet, so it is instead returning capital to shareholders.

Separately, Wells Fargo’s 2019 Capital Plan was approved by the Federal Reserve. Under the terms of the plan, the bank will increase its quarterly dividend to $0.51 (from $0.45 previously) and execute up to $23.1 billion of gross common stock repurchases in the period between 3Q2019 and 2Q2020.

This share repurchase authorization amounts to around 11% of the company’s current market capitalization and suggests that Wells Fargo’s impressive pace of share repurchases is likely to continue for the foreseeable future.

Overall, we were impressed with Wells Fargo’s ability to grow its profits despite an externally-imposed asset cap. The company also appears committed to returning capital to shareholders through dividend payments and share repurchases. We believe that Wells Fargo has low double-digit total return potential, so the bank earns a buy recommendation from Sure Dividend today.

United Airlines Announces Highest Second-Quarter Pre-Tax Income In Company History

Yesterday, United Airlines (UAL) announcedfinancial results for the second quarter of fiscal 2019. The company beat expectations and announced its highest second-quarter pre-tax income in company history.

On the top line, United generated total passenger revenue growth of 6.1%, which includes passenger revenue per available seat mile (PRASM) improvement of 2.5% year-on-year. Overall, United’ total operating revenue (which includes a negative impact from shrinking cargo revenues) increased by 5.8% in the second quarter.

Costs were also prudently management. Costs per available seat mile (CASM) decreased by 0.4% over the same period a year ago, resulting in nice margin expansion year-on-year. Indeed, the company’s adjusted pre-tax margin of 12.4% expanded by 2.0 points versus the second quarter of 2018.

On the bottom line, United generated net income of $1,052 million, which increased by a remarkable 54.0% year-on-year. Diluted earnings-per-share of $4.02 increased by 62.1% over the same period a year ago, helped by a 5.1% year-on-year decline in United’s weighted average shares outstanding.

United also updated its financial guidance for the full fiscal year with the publication of its second quarter earnings release. The company now expects adjusted diluted earnings-per-share between $10.50 and $12.00 in the twelve-month reporting period.

For context, United generated adjusted earnings-per-share of $9.13 in fiscal 2018. The midpoint of the airline’s new guidance range implies year-on-year earnings growth of 23.2%.

United Airline’s financial performance has been strong, but the stock is not sufficiently cheap enough to earn a buy recommendation from Sure Dividend today. Instead, the stock earns a hold rating.

Abbott Reports Second Quarter Results, Raises 2020 Financial Outlook

This morning, Abbott Laboratories (ABT) reported financial results for the second quarter of fiscal 2019. In the quarter, the company beat earnings expectations and raised its guidance for the full fiscal year.

Here are what the numbers look like. Abbott generated sales of $8.0 billion in the three-month reporting period, which increased by 2.7% on a reported basis and 7.5% on an organic basis. The stark difference between Abbott’s reported sales growth and its organic sales growth is because organic sales growth excludes both foreign exchange fluctuations and 2018 sales from a non-core business in U.S. Adult Nutrition, which was discontinued in 3Q2018.

Abbott’s sales growth was broad-based, but one segment in particular was responsible for its strong performance. Abbott’s organic sales growth by segment is listed below:

- Nutrition: 5.1%

- Diagnostics: 6.2%

- Established Pharmaceuticals: 6.1%

- Medical Devices: 10.5%

As you can see, Abbott’s Medical Devices unit was its best performer in the second quarter of fiscal 2019.

On the bottom line, Abbott’s adjusted diluted earnings-per-share of $0.82 increased by 12.3% and was above the company’s previously-announced financial guidance band.

Abbott’s strong financial results were due to broad-based strength across its various product categories. Certain products demonstrated particularly strong growth.

For example, Abbott’s FreeStyle Libre – a continuous glucose monitoring system for patients with diabetes – saw organic sales growth of 72.9% and is now reimbursed for approximately 75% of patients with private pharmacy benefit insurance.

Separately, sales of Abbott’s MitraClip, a mitral vale to treat mitral vale regurgitation for patients who should not have open heart surgery, increased by 30.6% on an organic basis. Abbott’s next-generation MitraClip was granted FDA approval earlier this week.

As mentioned, the company also increased its 2019 financial guidance with the publication of its second quarter earnings release. The company now expects to generate organic sales growth of 7.0% to 8.0%, while adjusted diluted earnings-per-share are expected to fall within the range of $3.21 to $3.27.

For context, Abbott generated adjusted earnings-per-share of $2.88 in fiscal 2018. The midpoint of the company’s new guidance band ($3.24) implies year-over-year earnings-per-share growth of 12.5%.

Abbott’s second quarter financial results were better than expected, but the company remains too overvalued for our liking. Because of this, the company continues to earn a sell recommendation from Sure Dividend today.