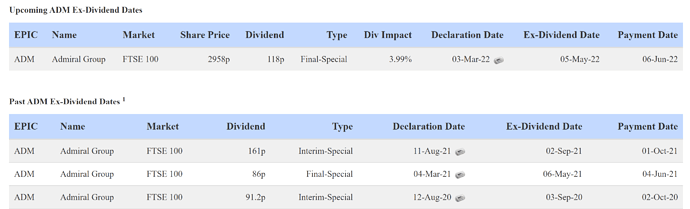

The Board has proposed a final dividend of 86.0 pence per share representing a normal dividend (65% of post-tax profits) of 63.6 pence per share and a special dividend of 22.4 pence per share. The dividend will be paid on 4 June 2021. The ex-dividend date is 6 May 2021 and the record date is 7 May 2021.

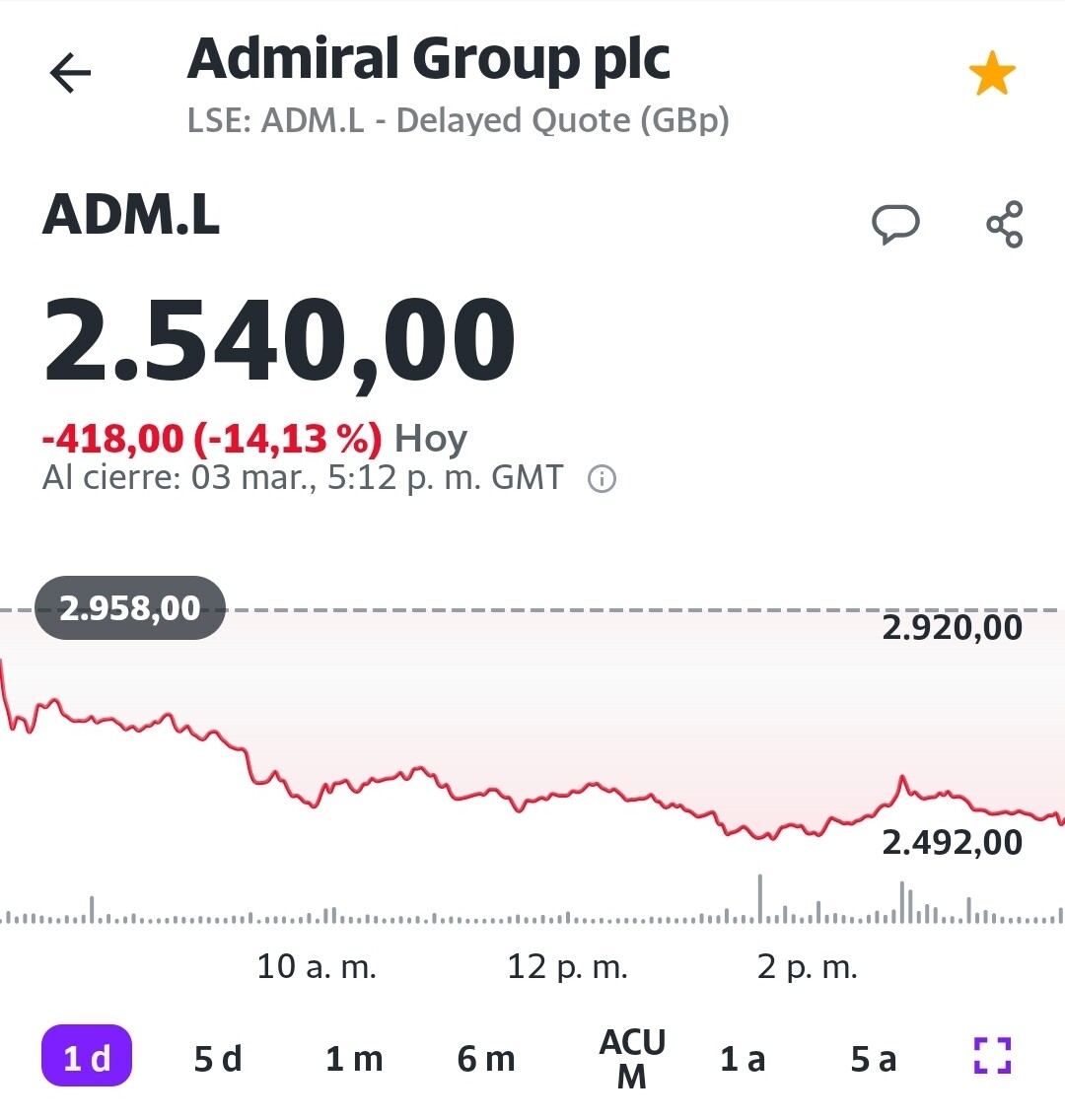

¿Alguien sabe por qué ha caído casi un 8% durante los dos últimos días?

¿Qué le pasa a la joya de la corona últimamente? ![]()

Ni p…idea @ruindog. pero tampoco sé la causa por la que había subido tanto a partir de Abril’20.

Yo he comprado unas cuantas a 2.900 pero sospecho que seguirá acercándose al M1000 de los 23.450.

Therefore, the Directors have recommended a final dividend of 118.0 pence per share for the year to 31 December 2021 representing a distribution of 91% of our second half earnings (72.0 pence per share) as well as 46.0 pence per share as the second of three payments related to the Penguin Portals disposal proceeds.

This will bring the total dividend for the year to 279.0 pence per share, an overall increase of 78%. This represents a pay-out ratio of 88% of full year earnings (187.0 pence per share) and 92.0 pence per share related to the Penguin Portals disposal. The Group has delivered a Total Shareholder Return (TSR) of 577% over the last 10 years.

Han dicho que para 2022 los beneficios seran menores que en 2020 y 2021

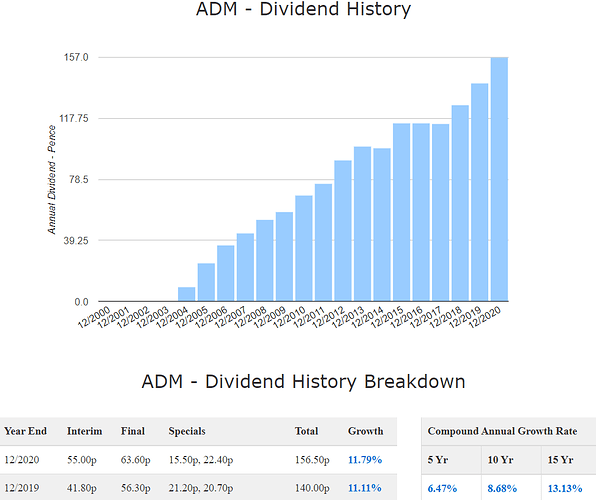

El dividendo normal final de 2021 (sin lo de los portales) ya ha sido muy bajo, solo 72p, menos que el de 2019 incluso que fueron 77p

Que no cunda el pánico. El dividendo normal provisional del 2021 fue 115p frente a los 63p del 2019

Porque liberaron un monton de reservas. Ya dijeron que fue algo puntual y extraordinario que no se repetiria en el segundo semestre (como asi ha sido).

Yo por ahora estimo 63p (interim 2019) + 72p (final 2021) para 2022 (los 2 dividendos mas bajos desde 2019 para cada periodo) + 45p de los portales. Mejor ser prudentes.

Y para 2023 que dios reparta suerte

Entonces amplio posición, ¿no?

Me quema el efectivo de la venta de VTRS

Parece que los resultados no han gustado mucho…oportunidad? No sé si hay algo más aparte de las pérdidas fuera de UK.

Ya he comentado que las previsiones de beneficio para 2022 son inferiores a 2020 y 2021 (años pandemicos) y la valoracion era exigente.

We think Admiral reported pretty decent numbers for full-year 2021 and note the market’s very negative reaction. We think the market is wrong on this name, and we reiterate our GBP 35 fair value estimate and no-moat rating.

Customer numbers are one of the keys to this business, and U.K. motor customers came in at 4.97 million, 2.7% below our estimate of 5.11 million. However, where U.K. motor missed our anticipated number, U.K. household substantially exceeded. Here, 1.32 million customers came in 5.85% above the 1.25 million that we forecast. U.K. travel customers were also substantially above our estimates at 0.15 million, more than double our 0.07 million forecast. Total U.K. customers are now 6.44 million, a smidge ahead of our 6.43 million full-year estimated number. While this year may have missed in terms of U.K. motor, we do anticipate that this market is going to enter flux in 2022, and during these periods, Admiral has historically proved itself to be very effective at picking up customers.

Admiral beat our estimates in the international business. Vehicles insured in Spain came in at 0.37 million versus our estimate of 0.36 million, and Italy and the United States hit the nose at 0.85 million and 0.23 million vehicles, respectively. The stellar performance was in France, where vehicle numbers outstripped our estimate by 12.9%, coming in at 0.36 million versus our 0.32 million. Admiral’s international vehicles now stand at 1.81 million; our numbers anticipated 1.76 million.

Profit after tax from continuing operations came in at GBP 583.3 million, substantially ahead of our expectations of GBP 491.4 million. The final dividend announced is GBX 118 per share, which includes a GBX 75.8 special in lieu of the sale of Penguin Portals. Admiral looks to be investing quite a lot back into the business.

Parece que por fin tiene algo de moat

Economic Moat 04/29/2022

We award Admiral a narrow economic moat.

We think Admiral has established a persistent competitive advantage based on intangible assets, driven by its proprietary technology. We believe Admiral’s investments in proprietary technology have enabled the business to select the most profitable risks for the company to underwrite. Admiral has delivered a persistent loss-ratio advantage over the United Kingdom motor insurance market of 7 percentage points over an eight-year period. A loss ratio is made up of two parts and those two parts are claims and pricing. A personal lines insurer can develop a loss-ratio advantage by underwriting risks that have lower claims costs to underwrite. An example of these lower claims cost risks would be older drivers and perhaps drivers based in the countryside. Alternatively, a personal lines insurer can develop a loss ratio advantage by underwriting risks that have higher claims costs to underwrite and disproportionately higher pricing. Examples of these higher price risks would be younger drivers, owners of exotic cars, those wishing to pay by credit card, and drivers based in London. The reality is not clear-cut because lower-risk policyholders will be charged a lower price and higher-priced policyholders will cost more in claims. However, the key for any insurer is to find the optimal place where they can maximise this price over claims margin. If that margin is higher in younger drivers then underwriting there will lead to the best underwriting standards and lowest loss ratios. If the margin is highest in older drivers then underwriting there will lead to the best underwriting standards and lowest loss ratios. We think Admiral has long found its sweet spot by insuring mainly younger higher-risk, higher-priced nonstandard risk policyholders. Over the years the business has grown its perimeter of nonstandard risks by also insuring drivers based in Northern Ireland and exotic and utility vehicle drivers. We think this was then taken further when Admiral also started selecting policyholders with no prior experience and drivers with no prior insurance. Both of these latter two data points seem to confirm Admiral’s preference for younger drivers.

We think Admiral has managed to optimally select and price these risks with its proprietary technology that includes systems, software and data. While Admiral may not be the lowest-cost U.K. motor insurance direct distributor, the business has always operated on a direct distribution model. We think where other personal lines insurers have turned to brokers and partners to acquire policyholders, Admiral’s focus on direct distribution has meant the business has maintained full control over its risk selection, data collection and pricing. In distributing direct to policyholders Admiral has been able to collect more data points on policyholders in the process of its risk selection and pricing. And Admiral has also likely been able to consistently collect the data points it wishes to accumulate and evaluate within this process. Other personal lines insurers that have also relied on third parties have diluted their ability to do this and have likely had to handle more missing values. Admiral is not the only U.K. motor insurer that distributes direct only and only lowest-cost operator. However, versus nearly all the others Admiral has maintained this direct distribution strategy for a lot longer, sticking to its knitting.

Direct distribution would probably not mean a lot if Admiral did not have the proprietary technology it needed to continually collect this data through the direct channel and then analyse this data to assess claims. The key premise for any insurance company is to accurately predict how often a claim will occur and how much that claim will cost the company in terms of magnitude. These two elements that form the total cost of claims are termed “frequency” and “severity.” If an insurer can more accurately assess the frequency and claim severity of claims, then the business is already ahead of the competition. If, on top of this, an insurer can more accurately assess how much they should charge versus how much they can charge, then this further advances its relative competitive position. In reality it is unlikely any insurer can predict with 100% accuracy the frequency of claims, or the magnitude of claims, or the price they should charge versus the price they can charge. However, any insurer that can do this better than the rest and has a proven and persistent method for doing this, has established a persistent competitive position.

We think the ability to assess the likely frequency of claims, the likely magnitude of claims, the price to charge and the price that can be charged by and large comes down to an insurer’s proprietary technology. And while many insurers will buy persistent off-the-shelf technology solutions, we don’t think this is how an insurer is going to win. Off-the-shelf solutions simply take the company/market average. While over the years Admiral has, of course, adopted off-the-shelf technology that has included telematics, Guidewire and Radar Live, we think Admiral’s competitive advantage lies in its personalised and crafted technology, its bespoke solutions. For example, generalised linear models are widely used in insurance for risk modelling. And while these techniques are flexible and rely on data and methods, Admiral only uses these traditional methods where relevant and has instead built out its own bespoke solutions. In 2009, we believe Admiral set up a specialised division called Inspop Technologies in New Delhi to support this. Of Admiral’s entire investments between 2002 and 2021 of close to GBP 1.1 billion, the business has invested close to 25% of this in new software solutions. The nearly GBP 250 million of investments in software over this period accounts for close to 30% of Admiral’s intangible asset investments. Within Admirals’ U.K. car insurance market alone, the business has generated more than 100% returns on new investments. This far outstrips Admiral’s peers who have generated returns of flat to negative.

We think Admiral’s investments in its proprietary technology have been augmented by two further inter-related intangible assets. As we’ve discussed, Admiral has always placed a strong emphasis on data collection, historically asking prospective policyholders 35% more questions. This has provided the company with more detailed data and an ability to perform better analysis, using its bespoke risk assessment and pricing models. We think increased data has been a key ingredient in the granular nature of the company’s risk selection. And we think it has also enhanced the company’s ability to build more underwriting rules than peers, incorporating better antifraud systems. We think the sheer size of the company’s data lake has become impressive and, as we have already touched on, the company’s direct distribution model has helped with the uniformity and cleanliness of this. With the largest share of the U.K. motor insurance market and highest U.K. motor insurance growth rates versus its peers, Admiral has naturally been able to collect more data points. Even if we restrict this to internal data points such as standard policyholder data and internal claims data collected by the business, with the largest market share and highest growth rates, Admiral is ahead of its competition. Going further, we know Admiral has historically asked policyholders more questions and therefore collected more data points from them in the risk assessment and pricing process. In addition to data points, Admiral has collected data internally about claims experiences and policyholders’ questions, and it has also augmented this data lake with external data as the company has become a strong user of external credit data, vehicle data, demographic data, and broader claims data that has been reported on the Claims and Underwriting Exchange. This is a central database for reported motor insurance, home insurance, personal injury, and industrial illness claims.

Admiral’s ability to collect more data has undoubtedly been amplified by its coinsurance and reinsurance relationships. While these relationships significantly improve Admiral’s profit profile and its capital position, we think they also help significantly enhance the business’ competitive position. Within insurance, claims tend to lead pricing. Expressed another way, price increases tend to lag a rise in claims. When prices rise, policyholders shop around and switching tends to increase. This is almost universal because as prices go up, consumers tend to look for a better deal. These moments of rising claims and then rising prices have been instrumental in Admiral’s growth in customers. As prices have gone up, Admiral has historically tended to undercut the rise in prices versus peers. Thus, in these moments Admiral has acquired more policyholders from its peers. Admiral’s coinsurance and reinsurance relationships allow the business to grow its customer numbers in these times to a greater degree than its competition. With Admiral’s coinsurance relationship, it has ceded between 65% and 20% of its gross written premium to its long-term partner Munich Re. Admiral has then taken a percentage of the underwriting profit. In its proportional reinsurance relationships Admiral has ceded between 5% and 50% of its gross written premium to a panel of reinsurance businesses. Admiral takes nearly all of the underwriting profit in these agreements. What is most important though is that by partnering with these reinsurers, in times of increasing pricing, rising customer shopping and higher customer switching, Admiral can take on more customers than almost any of its competitors. In total Admiral has on average ceded around 70% of its gross written premium to coinsurers and reinsurers and that stands head and shoulders above the average of 35% among its competition. Admiral’s proportional reinsurance relationships allow the company to convert ceded business back to itself if it so wishes. We think this furthers Admiral’s ability to fine-tune its preference for nonstandard risks, allowing Admiral ex-ante to analyse which policyholders are the most profitable risks. And by growing customer numbers at higher rates than peers, Admiral has significantly augmented its data lake that is used to assess and price risk.

Con esos ratios combinados y ese crecimiento, decir que admiral no tiene moat dice más de la desgana del analista que de admiral.

Lo que le falta al articulo es valorar si en la expansión fuera de uk van a conseguir replicar ventajas. En el caso de españa, rascarle cuota en seguro directo a línea directa y mutua sin palmar pasta, por ahora no lo ha conseguido nadie.