Tener los 2 sitios web mas visitados del mundo. Con mas de 100.000.000.000 de visitas mensuales, si te dedicas a la publicidad, es una clara ventaja competitiva.

“He visto sitios que vosotros no os creeríais…"

Recién salido del horno:

M* le reduce el fair value a $154 (desde $160) “as the firm’s fourth-quarter results displayed the impact of the macroeconomic environment on its ad business”.

@DivGro22 nos regala este magnífico vídeo.

Y es que el anuncio promocional que la multinacional publicó el lunes en Twitter, Bard respondía a una pregunta con información incorrecta. A la pregunta “¿Qué nuevos descubrimientos del telescopio espacial James Webb (JWST) puedo contarle a mi hijo de 9 años?”, el bot conversacional señalaba que ese telescopio se usó para tomar las primeras imágenes de un exoplaneta —un planeta fuera del sistema solar—, algo que es falso.

Parece ser que estas cosas no solo pasan en España ![]()

Jejejej vaya tela. Habrá que aprovechar y agenciarse alguna.

Break Google plis

https://twitter.com/Giuliano_Mana/status/1637482106472284160

¿Recuerdan el intento de sustituir los mapas de Apple por los de Google en los iPhone? Eso lo tendrán que aceptar los usuarios, y no las marcas…

Disculpa mi ignorancia…no. ¿Qué pasó exactamente? Porque no uso iPhone pero la mujer si y juraría que tiene lo smapas de Apple, ¿no?

Gracias!

Intentaron reemplazar forzosamente la app de Google.

Muchas gracias por la respuesta ![]()

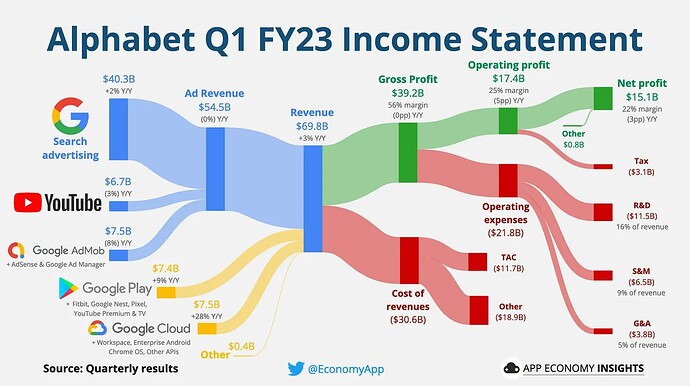

https://www.elconfidencial.com/amp/economia/2023-04-25/resultados-alphabet-millones-dolares_3618088/

A más de uno no le gustaron los resultados trimestrales

I’m curious how many of you actually listened to the entire earnings call and stayed on for the Q&A portion. I’m not short or long, and I recommend many of you who are excited about this quarter’s results go read the entire earnings call transcript… just feels like many commentators are missing some rather stark developments.

- Cloud is primarily profitable due to accounting changes and future redistribution of costs from one business segment to another.

- Cloud will NOT report continued sustained profitability based on CFO’s responses to an analyst; essentially, expect more volatility with negative / positive quarters, as the focus is on growth / investment and NOT on profitability.

- The EPS beat is partially because of shifting of share based compensation further OUT into 2023, without affecting the total amounts. They literally usually have it in Q1 and suddenly shifted into Q2 because they needed better numbers.

- The CEO PAUSED for 3-4 seconds when asked about how MSFT’s competition is impacting GOOGL’s long term strategy and if this is what is driving their CAPEX ‘modestly higher’ in FY2023 compared to FY2023. Not good. No sound strategy, a lot of words. Expenses heading up long term, margins are compressed.

- The company kept touting a focus on ‘growth’ instead of on profitability, which seems genuinely silly considering the growth rates GOOGL sports for revenues nowadays… it’s the wrong focus, especially now.

- The cost savings initiatives do not sound strategically feasible - the CFO basically contradicts herself. On the one hand, she articulates there’s an AI / automation possibility for cost savings, on the other she keeps reiterating how more investment is needed in this space and guides for MORE CAPEX in FY2023 as a result. Expecting savings from GOOGL’s third-party supplier base after supply-driven inflation pumped up COGS / BOMs for companies and components won’t be a ‘big win’ on the cost savings and cost avoidance side. It’s poor timing and negotiation with third-party suppliers right now for many large corporations isn’t super effective.

- Guidance is poor and confusing. Essentially, macro-economic weakness persists while CAPEX is increasingly moderately over FY2022. …so, lower FCF in FY2023, likely, compared to FY2022. This will be lower YoY FCF for the second year in a row.

- The call included a lot of fluff and show - who cares about combining two AI segments? Why in the world does GOOGL management think this is worthy of an announcement when they seemed 2 steps behind MSFT on everything?

- Obfuscation… a lot of accounting changes, confusing statements, misleading suggestions, all at once. This does not instill confidence in management. A lot of contradictory statements between what was announced and what was given in response to analyst Q&A.

- The risk of more negative headlines for FY2023 is high for negative momentum / surprises, while there is no likely positive catalyst from earnings until Q3 / Q4 2023, barring more layoff announcements - which may be viewed as a mixed bag. The reported figures, while better than what some expected… frankly suck. The revenue growth is stagnant, EPS shrank, FCF grew very moderately. Margins deteriorated and CFO responses to analyst questions indicates there’s no short-term fix, and in fact, further pressures are forthcoming.

There is not a thing to be impressed about with this call, unfortunately. On the bright side, I’m now in agreement with anyone that called for the CEO to go and complained about him… never heard a more apathetic, uninspiring, and downright confusing messaging from a CEO of a major company.

Me encanta este tipo de gráfico

Google celebra hoy su Google I/O 2023, el evento anual dónde presentan sus novedades en hardware, software y servicios y este año destacan los nuevos Pixel 7A y la competencia a ChatGPT.

https://www.elconfidencial.com/tecnologia/2023-05-10/google-io-2023-pixel-7a_3627003/

Y mientras se produce la presentación +4%

En directo aquí: