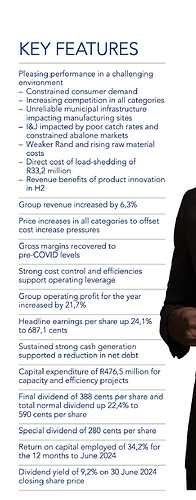

Hola, hoy dejo esta empresa que me llama la atencion por ser una especie de consumer staples de sudafrica. Vende de todo y paga dividendos. Esta a 6% o 7% FCF yield. Inflacion en sudafrica no supera el 4%, el ZAR rebota entre los 2 y los 15 euros.

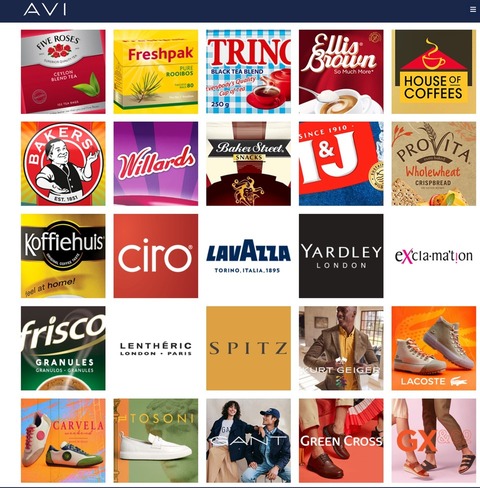

Me parece interesante pq el ZAR se puede apreciar con el oro y otras cosas que tiene sudafrica. Ademas de que la empresa parace una compounder. La unica marca que yo conozco es Lacoste y Lavazza.

AVI Limited is a South African consumer products company with a diverse portfolio of well-known brands. Here's a breakdown of the information you requested:

**History:**

* AVI was founded in 1944.

* It has a long history in South Africa and has grown through acquisitions and organic growth to become a major player in the FMCG (Fast-Moving Consumer Goods) market.

* AVI is listed on the Johannesburg Stock Exchange (JSE).

**Major Stakeholders:**

* AVI has a mix of institutional and retail shareholders.

* Some of the major institutional shareholders include:

* Old Westbury Large Cap Strategies Fund

* MFS International New Discovery Fund A

* Vanguard Total International Stock Index Fund Investor Shares

* iShares Core MSCI Emerging Markets ETF

* You can find more detailed information about shareholders on financial websites like Fintel or by looking at the company's annual reports.

**Industries and Countries of Operation:**

* AVI operates primarily in the **food, beverage, footwear, apparel, and cosmetics sectors.**

* Its brands cover a wide range of categories, including:

* **Food:** Biscuits, snacks, frozen foods, out-of-home ranges (e.g., Bakers, Pyotts, I&J)

* **Beverages:** Hot beverages (e.g., Five Roses, Freshpak, House of Coffees)

* **Personal Care:** Cosmetics, fragrances (e.g., Yardley, Lentheric, Coty)

* **Footwear and Apparel:** Shoes, accessories, fashion apparel (e.g., Spitz, Carvela, Kurt Geiger, Lacoste, Gant, Green Cross Shoes)

* **Countries:** AVI's primary market is **South Africa.** However, some of its brands have a presence in other African countries and internationally.

**Market Share:**

* AVI holds significant market share in many of the categories where it operates in South Africa.

* It has a strong portfolio of well-established and popular brands, giving it a competitive edge.

* Specific market share numbers can vary depending on the product category. You might find this information in market research reports or industry publications focused on the South African consumer market.

**Key Strengths:**

* **Strong Brands:** AVI owns a portfolio of well-known and trusted brands that resonate with South African consumers.

* **Diverse Portfolio:** Its presence across various consumer product categories helps to reduce risk.

* **Established Distribution Network:** AVI has a well-developed distribution network in South Africa, enabling it to reach consumers effectively.

**Where to find more information:**

* **AVI Limited Website:** The company's website is a good source for information about its brands, history, and investor relations.

* **Financial News Websites:** Websites like Fintel, the Financial Times, and Bloomberg provide data on AVI's stock, financials, and shareholders.

* **Market Research Reports:** Reports from market research firms can give you insights into AVI's market share and competitive landscape.

Deuda bien, cash lo justo y dando pasta al accionista a saco.