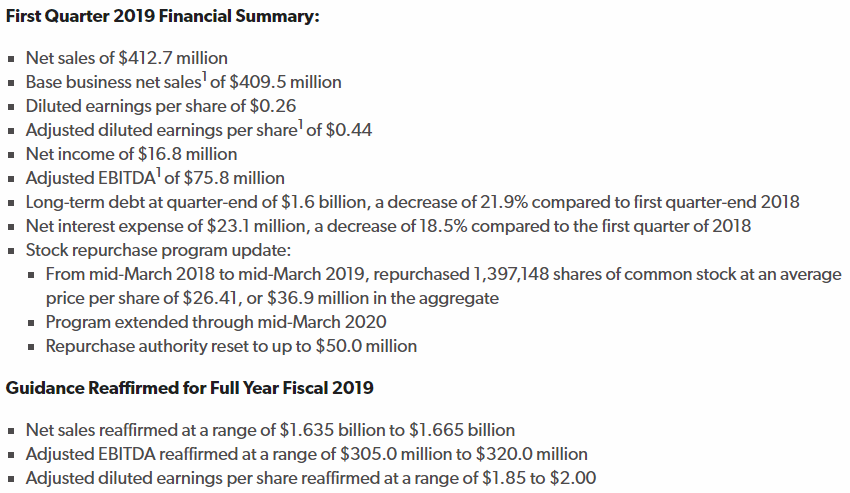

Es pequeña (1,5B) yo no la conozco.

USA/Canadá. Comida congelada, snickers, el gigante verde, MacDonald’s…

No encuentro presentaciones en su web

Deuda >2B!

At January 1, 2022, we had $1,450.0 million of fixed rate debt and $836.6 million

of variable rate debt. Based upon our principal amount of long-term debt outstanding at January 1, 2022, a hypothetical 1.0% increase or decrease in interest rates would have affected our annual interest expense by approximately $8.4 million

At July 2, 2022, we had $1,450.0 million of fixed rate debt and $859.1 million of

variable rate debt. Based upon our principal amount of long-term debt outstanding at July 2, 2022, a hypothetical 1.0% increase or decrease in interest rates would have affected our annual interest expense by approximately $8.6 million.

As of February 21, 2020, the registrant had 64,044,649 shares of common stock outstanding.

As of February 24, 2022, the registrant had 68,521,651 shares of common stock outstanding.

As of July 29, 2022, the registrant had 71,670,346 shares of common stock, par value $0.01 per share, issued and outstanding

Ingresos +4.5%, cada vez más acciones más… A ver cómo pasan la inflación que va a tener presión por ella y con esa deuda a priori pinta fea

MacDonald’s tú, qué fenómenos xD