RPD a cotización actual del 4,56%

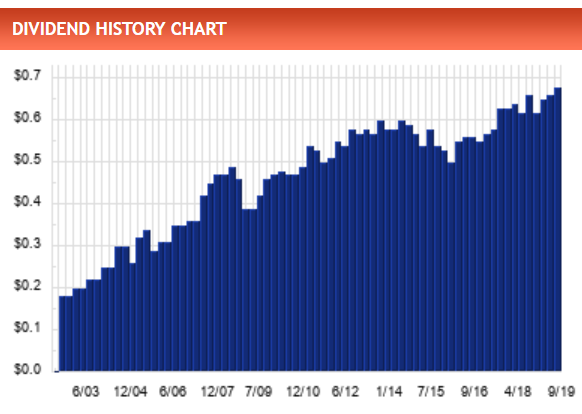

8 años incrementando dividendo con DGR1=7,54%, DGR3=6,44%, DGR5=6,54% y DGR10=5,50%.

Histórico de cotizaciones.

RPD a cotización actual del 4,56%

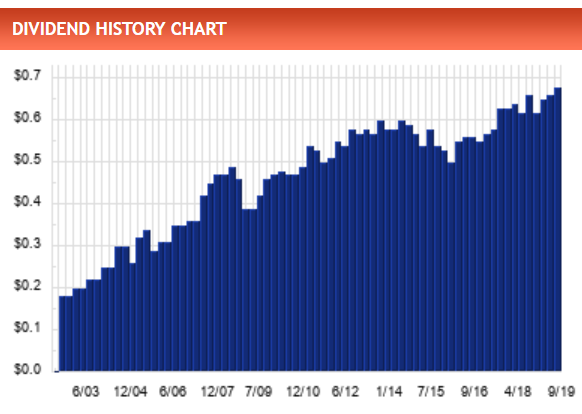

8 años incrementando dividendo con DGR1=7,54%, DGR3=6,44%, DGR5=6,54% y DGR10=5,50%.

Histórico de cotizaciones.

Fourth quarter and 2019 results (26/11/2019)

Fiscal 2019 Highlights on a Reported basis (versus Fiscal 2018)

Fourth Quarter 2019 Highlights on a Reported basis (versus Q4, 2018)

First Quarter 2020 Earnings Release (25/02/2020)

First Quarter Highlights on a Reported basis (versus Q1, 2019)

First Quarter Highlights on an Adjusted basis(1) (versus Q1, 2019)

Second quarter 2020 results (26/05/2020)

Second Quarter Highlights on a Reported basis (versus Q2, 2019)

Second Quarter Highlights on an Adjusted basis (versus Q2, 2019)

Dividend History:

Hola. Me podriais decir por favor que tipo de retencion tiene la accion de este banco compradas en la bolsa de Nueva York?? gracias.

Lo mismo que cualquier otra empresa canadiense (25%).

Si tu broker gestiona el formulario NR301 entonces se reduce al 15%

Muchas gracias por tu pronta respuesta @ruindog.

Scotiabank anunció el nombramiento de Jean-François Courville para el nuevo cargo de Presidente de Quebec, que reportará directamente a Aris Bogdaneris, Director de Banca Canadiense. Este importante cargo está diseñado para respaldar la estrategia Grow Quebec del Banco, que incluye oportunidades que abarcan todos los negocios de Banca Canadiense, Gestión Patrimonial Global y Banca y Mercados Globales. JF se incorpora a Scotiabank procedente de Purpose Unlimited, una empresa canadiense de servicios financieros y tecnología, donde se ha desempeñado como Presidente y Director de Clientes.

Anteriormente, ocupó altos cargos ejecutivos en Wealthsimple y RBC Wealth Management, y dirigió Manulife Asset Management a nivel mundial, así como el negocio canadiense de State Street Corporation. Originario de Montreal, Quebec, JF se graduó de la Universidad McGill y comenzó su carrera en operaciones financieras y ventas en el Banco Nacional de Canadá.

25 de septiembre

Los accionistas elegibles deben haber comprado las acciones antes del 2 de octubre de 2024.

Los accionistas elegibles deben haber comprado las acciones antes del 7 de enero de 2025.

Banco Davivienda SA (BVC:PFDAVVNDA) acordó adquirir las operaciones bancarias en Colombia, Costa Rica y Panamá de The Bank of Nova Scotia (TSX:BNS) el 6 de enero de 2025. Scotiabank recibirá una combinación de acciones ordinarias y preferentes recién emitidas que reflejan una participación accionaria aproximada del 20% en la entidad recién fusionada. Como parte de la transacción, Mercantil Colpatria venderá su participación en Scotiabank Colpatria en Colombia.

Como parte del acuerdo, Scotiabank tendrá el derecho de designar a una o más personas para que formen parte del Directorio de las operaciones combinadas de Davivienda en proporción a su participación accionaria. Las operaciones de Scotiabank que forman parte de esta transacción ahora se considerarán mantenidas para la venta a efectos contables, y se reconocerá una pérdida por deterioro después de impuestos de aproximadamente CAD 1.4 mil millones en el primer trimestre de 2025. Se espera que esto reduzca el índice de capital ordinario de nivel 1 (“CET1”) de Scotiabank en aproximadamente 10-15 puntos básicos. Además, puede haber cambios en la pérdida hasta el cierre debido a los cambios en el valor de las acciones recibidas y el valor contable de los activos que se venden.

Estimamos que se registrarán pérdidas adicionales de aproximadamente 0.300 millones de dólares canadienses al cierre, principalmente relacionadas con pérdidas acumuladas por conversión de moneda extranjera. Sujeto a la recepción de las aprobaciones regulatorias en las jurisdicciones pertinentes, se espera que la finalización de la transacción ocurra aproximadamente en 12 meses a partir de la firma.

Resultados del primer trimestre de 2025:

Los ingresos superaron las estimaciones de los analistas en un 5,7 %. Las ganancias por acción (EPS) no alcanzaron las estimaciones de los analistas en un 38 %.

Se prevé que los ingresos crezcan un 12% anual en promedio durante los próximos 3 años, en comparación con un crecimiento previsto del 7,3% para la industria bancaria en Canadá.

En los últimos 3 años, en promedio, las ganancias por acción han caído un 16% por año, pero el precio de las acciones de la compañía solo ha caído un 8% por año, lo que significa que no ha disminuido tan severamente como las ganancias.

27 de febrero

El dividendo de CA$1,06 es el mismo que el año pasado.

Sostenibilidad y crecimiento