¿Qué opináis de la teleco canadiense BCE? Está en mínimos de dos años y tiene una RPD del 5.65%.

Una buena opción para diversificar en telecos y paises, yo la llevo hace unos meses y bastante tranquila.

Aparte de la RDP del 5 y pico, crecimiento del dividendo este año de un 5 y pico también, vamos, más contento con BCE q con Telefonica y sus dividendos.

BCE reports second quarter 2019 results (01/08/2019)

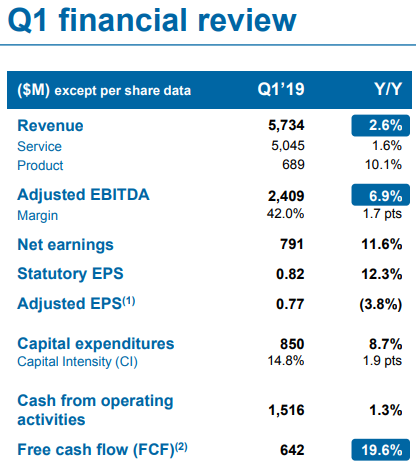

- 6.8% adjusted EBITDA growth and 1.8 percentage-point increase in margin to 43.8% driven by 2.5% higher total revenue and IFRS 16 impact

- 185,667 total wireless, retail Internet and IPTV net customer additions, up 25.5%

- Excellent wireless performance: best Q2 total postpaid and prepaid net customer additions since 2001 with 149,478, up 30.6%; 9.9% adjusted EBITDA growth with 2.7-point margin expansion to 44.8%

- Wireline adjusted EBITDA up 2.1%, driven by** **36,189 total retail Internet and IPTV net additions

- Strong media results with revenue up 6.4% and 23.9% higher adjusted EBITDA

- Net earnings grew 8.2% to $817 million; net earnings attributable to common shareholders increased 8.1% to $761 million, or $0.85 per common share, up 7.6%; adjusted net earnings increased 9.0% to $847 million, driving a 9.3% increase in adjusted EPS to $0.94

- Cash flows from operating activities up 1.8% to $2,093 million, free cash flow grew 10.0% to $1,093 million

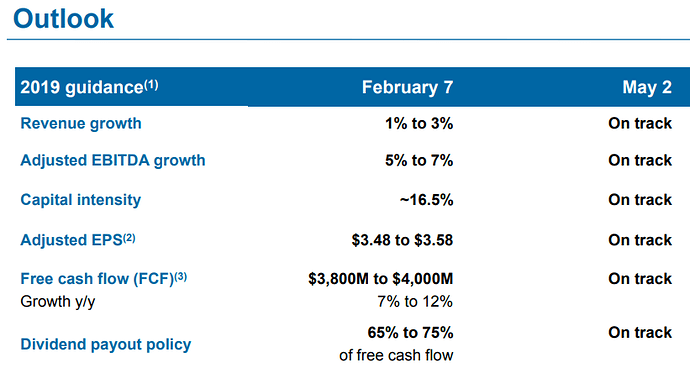

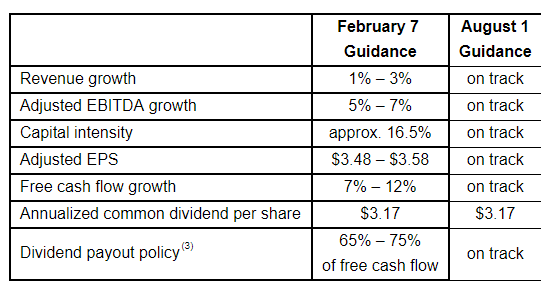

Outlook for 2019

1 me gusta

BCE reports third quarter 2019 results (31/10/2019)

- Record Q3 wireless net additions of 204,067, up 14.8%, combined with ABPU growth of approximately 1% and a reduction in postpaid churn to 1.12%, delivered stronger wireless revenue growth of 3.5% and 7.9% higher adjusted EBITDA

- 293,950 total wireless, retail Internet and IPTV net customer additions, up 8.4%

- 89,883 total retail Internet and IPTV net additions; 50 basis-point improvement in Bell’s leading wireline margin to 44.2%

- Continued strong Bell Media financial performance with revenue up 2.7% and 24.2% increase in adjusted EBITDA

- BCE adjusted EBITDA up 5.6% on strong year-over-year growth at all Bell operating segments, driven by 1.8% higher revenue and IFRS 16 impact

- Net earnings grew 6.3% to $922 million; net earnings attributable to common shareholders increased 6.5% to $867 million, or $0.96 per common share, up 6.7%; adjusted net earnings of $820 million generated adjusted EPS of $0.91, down 5.2%

- Cash flows from operating activities increased 10.5% to $2,258 million; free cash flow up 17.3% to $1,189 million