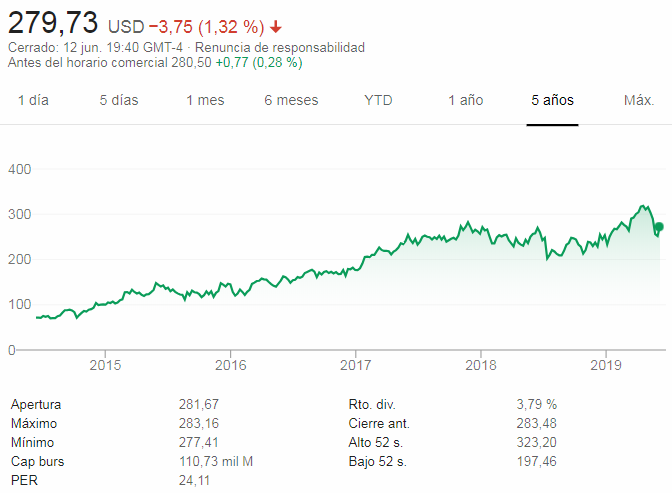

Abro hilo para Broadcom, aprovechando que hoy publicará resultados

La RPD está en torno al 3.5% y lleva 9 añ, pero lo más atractivo es que en los últimos años lo ha incrementado de manera espectacular. Según la lista CCC:

Abro hilo para Broadcom, aprovechando que hoy publicará resultados

La RPD está en torno al 3.5% y lleva 9 añ, pero lo más atractivo es que en los últimos años lo ha incrementado de manera espectacular. Según la lista CCC:

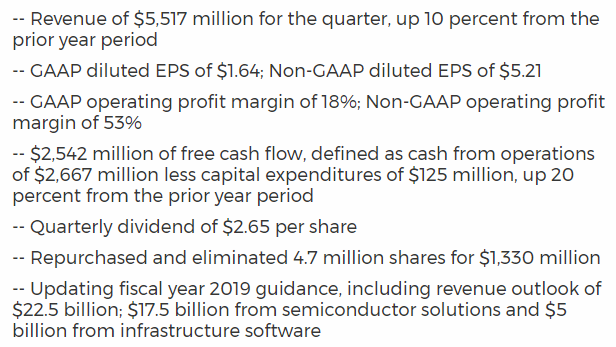

Los resultados del 2Q 2019, que se publicaron ayer

¿Qué empresas serían sus competidores? Lo digo por contrastar esos números con sus comparables

Yesterday after the markets closed, semiconductor manufacturer Broadcom (AVGO) reported financial results for the second quarter of fiscal 2019. While the company’s quarterly financial performance was solid and earnings actually beat expectations, the stock fell significantly in after-hours trading after it issued disappointing guidance to investors.

First, let’s discuss the company’s actual financial performance. Broadcom generated revenue of $5.5 billion, which represents growth of 10% from the same period a year ago.

Adjusted operating margin came in at 53% while free cash flow of $2.5 billion increased by 20% from the same period a year ago.

On the bottom line, adjusted diluted earnings-per-share totaled $5.21, which increased by 6.8% over the same period a year ago.

Here’s what Broadcom’s President and Chief Executive Officer, Hock Tan, had to say about the company’s performance in the quarter:

"We executed according to plan in the second quarter with tailwinds from networking offsetting the anticipated headwinds from wireless. We currently see a broad-based slowdown in the demand environment, which we believe is driven by continued geopolitical uncertainties, as well as the effects of export restrictions on one of our largest customers. As a result, our customers are actively reducing their inventory levels, and we are taking a conservative stance for the rest of the year. We remain well-positioned across our various semiconductor and software businesses and are confident this portfolio of franchises will continue to drive sustained long-term revenue growth and increasing free cash flow.”

This ‘conservative stance’ is impacting Broadcom’s projected financial performance. The company significantly reduced its full-year financial guidance with the publication of its second-quarter earnings release.

Broadcom now expects the following for fiscal 2019:

The sales forecast is the most surprising, with the $22.5 billion figure coming in a full $2 billion below the company’s prior guidance figure.

Looking ahead, we believe that Broadcom’s long-term growth outlook is bright despite short-term headwinds. With strong growth potential, an above-average dividend yield, and a stock price that trades below our fair value estimate, Broadcom earns a buy recommendation from Sure Dividend today

Key competitors include Intel, NXP, Marvell, and Mediatek. In wireless communications, competitors include Qualcomm, Skyworks Solutions , and Qorvo. In enterprise storage, Texas Instruments, Cisco, Marvell, and Microsemi all compete against Broadcom

Third Quarter Fiscal Year 2019 Financial Results

Sube el divi un 23% hasta 13 $ por accion

El otro día Enbridge un 10,8%, hoy Avgo un 22,6%…, gran semana de subidas de dividendo.

Esto se completa cuando le pregunte a mi jefe que cuanto me sube el sueldo al año que viene ![]()

Y hoy se va para abajo un 3-4%?

que se esperaba el mercado, una subida de divi del 50%?

oportunidad

Fourth Quarter and Fiscal Year 2019 Financial Results (12/12/2019)

M* 13-Dec-2019

Broadcom reported fiscal fourth-quarter results that were slightly ahead of management’s guidance, as the firm was able to navigate a challenging macroeconomic climate. Although nearly every major product line was down year over year (with the exception being networking), the firm is on track to recover in 2020 thanks to the improving health of key end markets such as the cloud and wireless. Additionally, the firm completed its acquisition of Symantec’s enterprise security business on Nov. 4, which was immediately after the completion of Broadcom’s fiscal calendar. For fiscal 2020, management expects revenue to be $25 billion. When excluding Symantec, the firm’s estimate top-line growth is about 3%. We are raising our fair value estimate to $310 per share from $300, as we update our valuation model. With shares near $320, up about 62% from July 2018 lows (when the firm announced its CA Technologies acquisition), we recommend prospective investors wait for a wider margin of safety.

Interestingly, CEO Hock Tan delineated the semiconductor business between core and noncore assets. Core semi assets include networking, broadband, and storage connectivity that address the needs of enterprise, service providers, and cloud infrastructure. Noncore areas included the firm’s wireless and industrial businesses. When asked if Broadcom may look to divest the latter units, Tan noted simply the firm may reduce investment in certain areas within the broader unit. As the firm’s current debt level (including the recent debt taken on for the Symantec deal that is not part of the end of fiscal 2019 balance sheet) has now ballooned north of $40 billion, we wouldn’t be surprised if the firm explores further divestitures. That said, we don’t expect the firm to exit the RF or Wi-Fi chip areas for its key smartphone customers (Apple and Samsung), particularly as 5G and Wi-Fi 6 are around the corner.

Al final Hattrick??? ![]()

Hola! Estoy mirando Broadcom para hacer una primera entrada (estoy en fase de construccion de cartera), se le ve un crecimiento espectacular tanto de beneficios como de dividendo, pero parece que tiene bastante deuda. Alguno de los que la llevais o la teneis estudiada algun consejo? Mirando en investing me da una rentabilidad por dividendo del 4,06% y en seeking alpha del 3,51% la verdad que es una buena diferencia.

En esta zona de los 310$ es zona de compra (no es un chollo)

3 Exciting Buys I Just Made In My Retirement Portfolio https://seekingalpha.com/article/4313982?source=ansh $AVGO, $IIPR, $SPG

Hoy ya en 301, mas compra todavia.

A este precio la RPD supera el 4%

Estoy dudando si darle un primer bocado pequeño, que luego se escapan jeje.