Al final parece que la multa de Estados Unidos al Deutsche Bank se queda en la mitad de lo que se decía: unos 7000 millones de dólares. Esta es la nota de prensa:

Multa de 425 millones de dólares al Deutsche Bank por blanqueo de dinero:

Ampliación de capital de 8.000 millones para poder mantener su filial Postbank. Con este movimiento habrá 687,5 millones de acciones más en circulación…

Mmmm… Un banco con siglos a sus espaldas necesita una ampliación de capital… huele mal. Parece que otra vez toca hablar de Deutsche Bank y su exposición a derivados, algo que se lleva repitiendo cíclicamente cada tres meses.

Deutsche Bank se plantea cerrar su negocio minorista en España, Portugal y Bélgica a corto plazo para evitar desprenderse de Postbank.

¿Qué oportunidades pueden crearse para los bancos españoles si DB deja su negocio en España? ¿Más ampliaciones de capital en camino?

Supongo que venderá sus oficinas y clientes como hizo Barclays a CaixaBank. En aquel caso creó que eran unas 200 oficinas. Supongo que DB serán bastantes más…

Esto parece los inmortales. Sólo puede quedar uno

Resultados de 2016:

- Pérdidas netas: 1.402 millones de euros (reducción de pérdidas desde los 6.794 millones del años anterior).

- Negocio neto: 30.014 millones (+10,5% ).

En su descargo, en sus cuentas destacan 4.300 millones relacionados, con litigios, reestructuración y el deterioro de activos.

Otra multa para Deutsche Bank en USA:

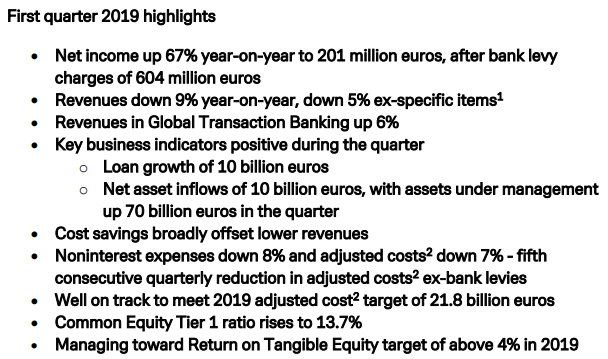

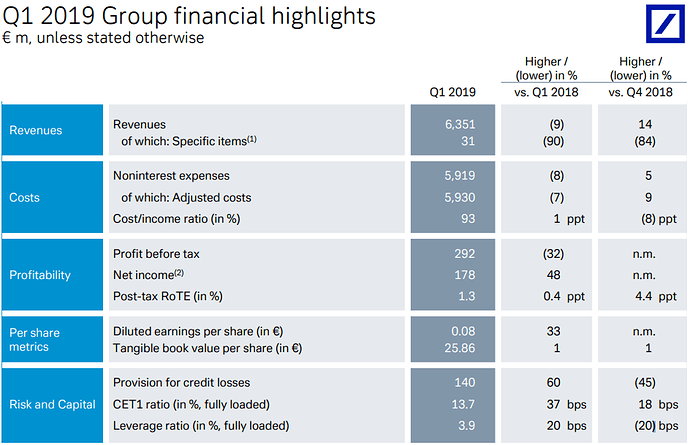

Resultados del 1erQ 2017:

- Beneficio neto atribuido: 571 millones (+167%).

- Cifra de negocio: 7.346 millones (-8,9).

Resultados del primer semestre de 2017:

- Beneficio neto atribuible: 1.018 millones (x 4)

- Cifra de negocio: 13.962 millones (-9,6%).

Caída del beneficio del 53% en la primera mitad de 2018

Pues ya lo han anunciado:

Era previsible algo asi, y a ver si esta medida es suficiente. Al final Alemania tambien tiene lo suyo con los bancos.

Deutsche Bank reports net loss driven by transformation charges in the second quarter of 2019

Second quarter and first half 2019 highlights:

- Second-quarter net loss of 3.1 billion euros after strategic transformation charges of 3.4 billion euros

- Substantial portion of expected transformation charges now taken

- Large majority of transformation charges have no impact on capital position

- Second-quarter net income would have been 231 million euros and pre-tax profit 441 million euros excluding transformation charges

- Revenues down 6% or 5% if adjusted for specific items1; revenues essentially flat or growing in more stable businesses (Global Transaction Banking, Private & Commercial Bank and Asset Management) if adjusted for specific items1

- Continued volume growth in the first half year

- Loan growth of 14 billion euros

- Net asset inflows of 20 billion euros

- Assets under management up 88 billion euros

- Noninterest expenses of 7.0 billion euros and adjusted costs2 of 5.7 billion euros. Excluding transformation charges, in the second quarter:

- Noninterest expenses down 3%

- Adjusted costs down 4%

- 6th consecutive quarter of year-on-year adjusted cost reduction ex-bank levies

- Capital position remains robust: Common Equity Tier 1 ratio of 13.4%

- Substantial progress on strategy execution

- Cash Equities positions exited/system shutdown initiated

- Negotiation of Prime Finance/Electronic Equities sale on track

- Over 900 employees given notice or informed their role will be eliminated

- As at 30 June 2019, businesses to be transferred into the Capital Release Unit accounted for (pro forma):

- Leverage exposures of 250 billion euros

- Risk weighted assets of 65 billion euros

3Q 2019 Results (30/10/2019)

Significant progress on transformation with regard to de-risking and costs

- As a result of strategic adjustments and in line with expectations, Group reports a net loss of 832 million euros and pre-tax loss of 687 million euros

- The Core Bank, which excludes the Capital Release Unit, made a pre-tax profit of 353 million euros after absorbing 315 million euros of specific revenue items1, restructuring and severance and transformation-related charges2

- All four core businesses profitable in the quarter

- Capital Release Unit pre-tax loss of 1.0 billion euros, driven by the exit of nonstrategic business and transformation costs3

- Common Equity Tier 1 ratio stable at 13.4%

- De-risking in Capital Release Unit offsetting negative impact on earnings from transformation

- On track to meet 2019 cost reduction targets after 7th consecutive quarter of yearon-year reduction in adjusted costs2 ex. transformation charges and bank levies

- Adjusted costs down by 1.8 billion euros annualised since 1st quarter 2018

- Noninterest expenses of 5.8 billion euros

- Core Bank business growth in key areas demonstrating franchise stability

- Loan growth of 12 billion euros

- Net inflows of 5 billion euros

- Assets under management of 1.24 trillion euros, up 125 billion euros in 2019, across Asset Management and the Private Bank

- Gained market share in core Debt Origination franchises; over 50 Equity Origination mandates completed, priced or won since July

- Group headcount below 90,000 for first time since Postbank acquisition

Deutsche Bank reports continued progress on strategic transformation (30/01/2020)

2019 net loss entirely driven by transformation-related effects

- Pre-tax loss of 2.6 billion euros includes 3.0 billion euros in transformation charges1, goodwill impairments and restructuring and severance expenses

- Net loss of 5.3 billion euros additionally includes transformation-related deferred tax asset valuation adjustments of 2.8 billion euros which do not significantly impact capital

- 70% percent of anticipated cumulative transformation-related effects2 already recognised

- Common Equity Tier 1 ratio of 13.6%, up from 13.4% in the third quarter of 2019, after ahead-of-target risk weighted asset reduction by the Capital Release Unit

Core Bank (ongoing core businesses): stabilising and gaining momentum in 2019

- Revenues down 2% on a reported basis, stable excluding specific revenue items3

- Reported pre-tax profit of 543 million euros; adjusted pre-tax profit4 of 2.8 billion euros, excluding specific revenue items, transformation charges, goodwill impairments and restructuring and severance expenses, up 7% vs. 2018

Fourth-quarter results underline further progress on transformation

- Pre-tax loss of 1.3 billion euros includes 1.1 billion euros in transformation charges and restructuring and severance expenses.

- 8th successive year-on-year reduction in quarterly adjusted costs excluding transformation charges and bank levies

- Core Bank: loss before tax of 437 million euros; profit of 465 million euros excluding specific revenue items, transformation charges as well as restructuring and severance expenses

- Capital Release Unit: risk weighted asset reduction from 56 billion euros to 46 billion euros during quarter, better than target by 6 billion euros; pre-tax loss of 856 million euros, in line with expectations

Mira que simpaticos