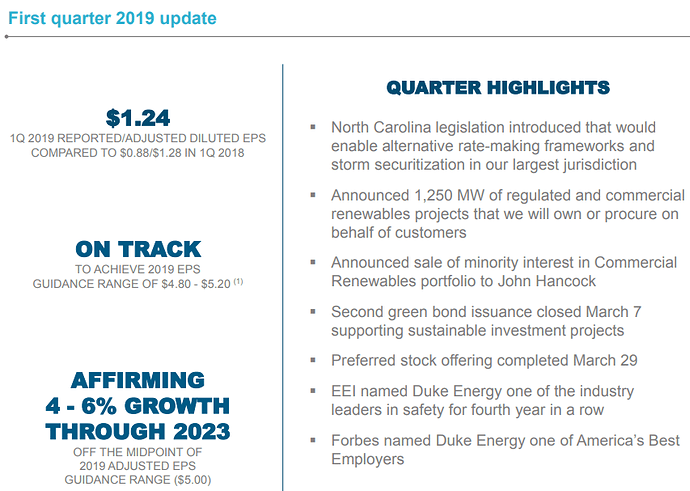

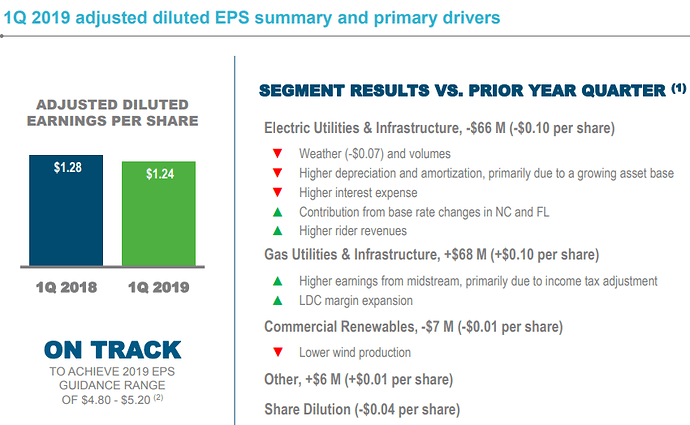

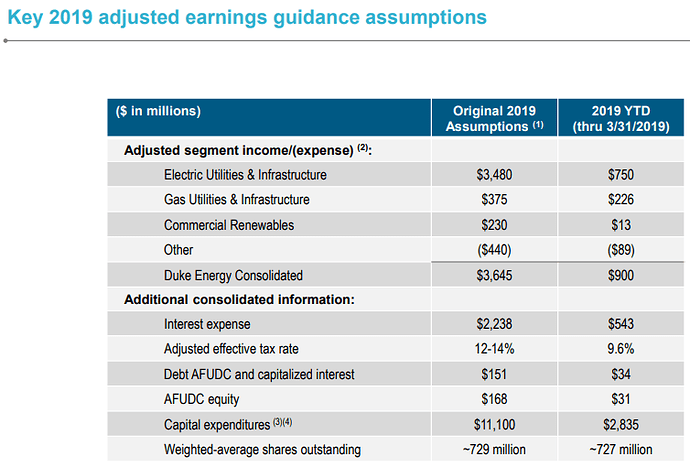

Resultados del 1Q 2019:

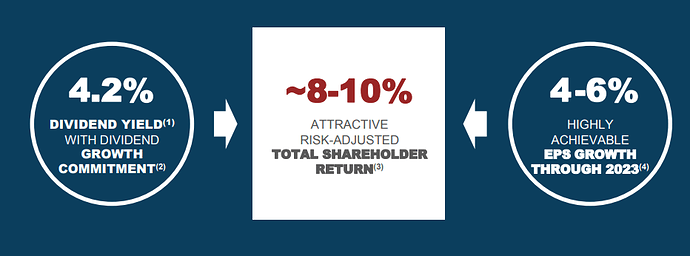

Duke Energy today declared a quarterly cash dividend on its common stock of $0.945 per share, an increase of $0.0175 per share. This dividend is payable on Sept. 16, 2019, to shareholders of record at the close of business Aug. 16, 2019.

Duke Energy has paid a cash dividend on its common stock for 93 consecutive

Third-quarter 2019 financial results (08/11/2019)

- Third quarter 2019 reported EPS of $1.82 and adjusted EPS of $1.79 with strong

results across all segments - Adjusted EPS growth of 7% year to date

- Company raises midpoint of 2019 adjusted EPS guidance; new range of $4.95 to

$5.15 - Company reaffirms long-term earnings growth target of 4% to 6%

Me parece una empresa interesante. De las que no deberían dar muchos dolores de cabeza, más allá de cobrar los dividendos periódicamente

Fourth-quarter and year-end 2019 financial results (13/02/2020)

- Delivered full-year 2019 GAAP and adjusted EPS of $5.06, representing adjusted

EPS growth of 7% - Achieved strong results above the midpoint of original and revised 2019 guidance

range - Established 2020 adjusted EPS target of $5.25 and guidance range of $5.05 to

$5.45 - Extending long-term earnings growth expectation of 4% to 6% through 2024

Inicio posición en DUK con la apertura hoy del mercado americano. 15 años de incremento de dividendo.

M*: Narrow moat, fair value 95 USD, stewardship standard.

Me sigue tentando, pero no me decido

Me pasa como a ti.

Hace dos semanas entre en D pero estaba entre SO, DUK, ED y D, y al final me decidi por estas dos ultimas.

Y no descarto SO y DUK. SO esta mas cerca, relativamente, de minimos que DUK.

A duke le dan un 80 los de suredividend, bastante mejor puntuación que D y So…

(M*)

We are lowering our Duke Energy fair value estimate to $92 per share from $95 after it and Dominion Energy announced they are abandoning the $8 billion Atlantic Coast Pipeline, or ACP. Our narrow moat and stable moat trend ratings remain unchanged.

Removing the contribution of ACP earnings from our forecast, partially offset by the absence of the remaining capital expenditure, reduced our fair value estimate. The lack of earnings contribution reduced our five-year earnings growth estimate 100 basis points to 4.2%, now one of the lower growth rates among its peers. We had always expected lower dividend growth for Duke relative to its peers. Our expectation for 3% annual dividend growth represents a 70% payout based on our revised 2024 earnings estimate.

The move came as a surprise to us after the U.S. Supreme Court recently upheld a prior Forest Service ruling allowing the pipeline to cross under the Appalachian Trail. While we thought the remaining regulatory obstacles were manageable, management noted the recent ruling by a federal judge in Montana on Nationwide Permit 12, a permit relied on heavily to build pipelines, and a subsequent federal ruling making an appeal unlikely, created too much regulatory and financial uncertainty for a pipeline that was already double its initial projected $4.5 billion to $5.0 billion cost. Duke will take a $2.0 billion to $2.5 billion charge against earnings for its investment in the pipeline to date.

Management reaffirmed its $56 billion five-year investment program, which previously included ACP. We expect more information from management during its earnings call in early August before deciding whether to include the additional $2 billion in our estimate.

ACP had been an overhang for Duke. Even after our fair value reduction, Duke remains one of the cheaper regulated utilities in our coverage, trading at 14.8 times our 2021 earnings estimate with an attractive 4.7% dividend yield.

Duke Energy rebuffed NextEra takeover approach

-

NextEra Energy recently made a takeover approach to Duke Energy, which ultimately rejected the bid, WSJ reports, which adds that NextEra may still have interest in pursuing a deal.

-

Duke has a $61B market cap following a 14% YTD decline in its share price, and an acquisition of the company could be the largest utility deal ever and the biggest merger so far this year.

-

NextEra is the largest public utility in the U.S. based on market value of $139B after its stock rose 22% YTD.

-

Any deal would need to pass muster with several government officials in a highly regulated industry.