A ver en que acaba esta noticia, ¿alguien puede verla entera?

SEC probes Exxon over Permian Basin asset valuation - WSJ

- Exxon Mobil (NYSE:XOM) -2.5% pre-market following a WSJ report that the SEC has launched an investigation after an employee filed a whistleblower complaint last fall alleging the company overvalued its Permian Basin properties.

- According to the report, several people involved in valuing a key asset in the Permian Basin complained during an internal assessment in 2019 that employees were being forced to use unrealistic assumptions about how quickly the company could drill wells there to arrive at a higher value, and at least one of the employees who complained was fired.

- Some Exxon managers in 2018 initially pegged the net present value of the company’s assets in the Delaware Basin - considered the most promising area of the Permian - at ~$60B, but some employees involved in Exxon’s annual development planning reportedly estimated during summer 2019 that the area’s net present value was closer to $40B.

- In November, Exxon pulled back from an ambitious plan by CEO Darren Woods to boost its overall oil and gas production by 1M bbl/day by 2025, but has maintained that the Permian Basin is essential to its plans.

muchas gracias!!

Creo que este hilo de twitter es muy interesante:

https://twitter.com/ViscosityRedux/status/1322393417024876545

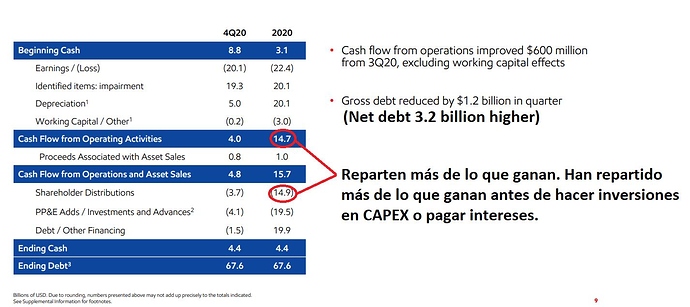

Ya tiene unos meses, pero me parece que tiene unos cuantos puntos muy perturbadores. El principal de ellos que Exxon desde 2008 ha añadido 88.000 millones de deuda neta. , más o menos un 40% de su market cap actual.

La presentación de Exxon es para llorar. Rezad los que estéis dentro, porque o cancelan dividendo o los precios del petróleo multiplican por 2, o la empresa dentro de un tiempo dejará de ser solvente. Eso si no la acaban de despiezar.

Me hace gracia en especial lo de poner “gross debt reduced” xD. Campeones.

Bueno, eso y que todos los “earnings” han sido por impairments y depreciaciones aceleradas de activos.

(M*)

Exxon Keeps Dividend Safe Through 2025

Exxon XOM announced a fourth-quarter $20.1 billion loss compared with earnings of $5.7 billion the year before. Included in the announced loss is a $19.3 billion impairment charge related primarily to dry gas assets in the U.S. but also western Canada and Argentina. Excluding those impairments, adjusted fourth-quarter earnings were $110 million, compared with $1.8 billion the year before, as downstream losses offset upstream earnings. Our fair value estimate and narrow moat rating are unchanged.

With the impairment expected after a filing in December, perhaps more important for investors were the other announcements made during the report. Most notable is the forward capital guidance typically reserved for the annual update in March. Exxon already announced capital spending guidance of $16 billion-$19 billion for 2021 last quarter, which was lower than the $21 billion it spent in 2020 which was $10 billion lower than 2019. It also announced updated spending guidance for 2022-25 of $20 billion-$25 billion per year well below the $30 billion-$35 billion it announced last March. It expects to be at the lower end of the range in 2021, which, along with the dividend, should be covered with operating cash flow at about $45/bbl, assuming continued poor downstream and chemical margins.

Beyond this year, it expects to cover the dividend and capital spending at oil prices as low as $35/bbl or with capital expenditures at the upper end of the range at around $50/bbl, both assuming historical average downstream and chemical margins. These breakeven levels also include the $3 billion of structural cost advantages it achieved this year and the additional $3 billion it plans to generate by 2023. Any excess cash flow would go toward debt reduction and shareholder returns.

This guidance should calm investors who became increasingly worried about Exxon’s heady capital spending plans and safety of the dividend given the pandemic fallout and sustainability of future oil demand and prices.

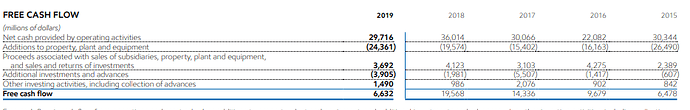

Enlos últimos 6 años su máximo ha sido de 36 billions de operating cash flow. Si llegan a ese máximo y “solo” gastan 16 billions en dividendos y 20 billions en CAPEX, pues si, se cubre.

Pero eso es si vuelven a beneficios record y si no tienes en cuenta los intereses de la deuda que se acumulan, ni recompras de acciones para paliar la dilución por las stock options a los directivos.

Llamadme loco, pero que una empresa este pagando dividendos con más que su Free Cash Flow de forma continua… no me genera confianza.

Exxon ha subido mas de un 100% desde que Joe Biden fue elegido presidente

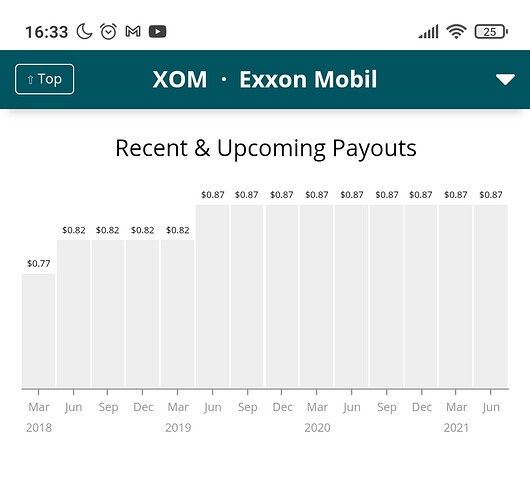

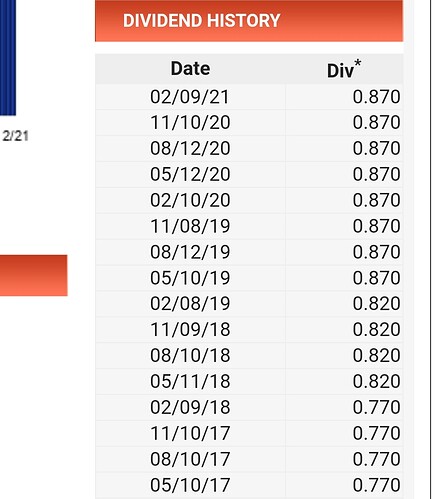

¿ No tendría ys que haber subido algo el dividendo para seguir manteniendo su status dgi? Es que ya lleva encadenados 8 pagos trimestrales iguales y no acabo de ver que le quede margen. Suele ser incremento casa 4 o si hiciese un att… ( Mantener y a ver si sube en los últimos para compensar)

Tendría tiempo hasta el último dividendo de este año. Con que suba 1 cent. el último dividendo, eso ya provoca que el dividendo anual sea mayor y por tanto no perdería el status.

2019 - 0.82+0.87×3

2020 - 0.87×4

2021 - 0.87×3+0.88

Gracias por la aclaración  me confundí y me daba ls impresión de que ya había perdido esa oportunidad

me confundí y me daba ls impresión de que ya había perdido esa oportunidad

![]()

![]()

![]()

Exxon saldrá de Rusia, dejando $ 4 mil millones en activos, proyecto Sakhalin LNG en duda

Exxon Mobil dijo el martes que abandonaría las operaciones de petróleo y gas de Rusia que ha valorado en más de 4.000 millones de dólares y detendría nuevas inversiones como resultado de la invasión de Ucrania por parte de Moscú.

https://twitter.com/TCII_Blog/status/1540802125235716101

https://twitter.com/TCII_Blog/status/1540818521134964736

https://twitter.com/TCII_Blog/status/1540887937142980608