Abro hilo con los resultados de ExxonMobil de 2016, que vio reducidos sus beneficios a la mitad por el ajuste en los precios del petróleo:

La interpretación de OCU es bastante halagüeña:

"Exxon Mobil ha publicado un resultado trimestral que cae un 40% respecto al de un año antes, debido principalmente a una depreciación del valor de sus actividades. Sin tenerla en cuenta, el beneficio superaría al de hace un año y mejoraría el dato del trimestre anterior. Además, Exxon ha recortado aún más sus costes. "

El director ejecutivo de Exxon Mobil anunció que invertirán 20.000 millones de dólares en la costa del Golfo de Estados Unidos en los próximos 10 años:

Está en mínimos de 52 semanas y me planteo comprar un primer paquete.

¿Qué opináis?

Exxon Mobil compra un 25% en un yacimiento de gas natural cerca de Mozambique por 2.800 millones de dólares

The Board of Directors of Exxon (NYSE:XOM) today declared a cash dividend of $0.87 cents per share on the Common Stock, payable on June 10, 2019 to shareholders of record of Common Stock at the close of business on May 13, 2019.

This second quarter dividend compares with $0.82 cents per share paid in the first quarter of 2019.

Through its dividends, the corporation has shared its success with its shareholders for more than 100 years and has increased its annual dividend payment to shareholders for 37 consecutive years.

https://news.exxonmobil.com/press-release/exxon-mobil-corporation-declares-second-quarter-dividend-9

Tengo una anotación en Degiro de un dividendo de Exxon y acto seguido otra anotación retirando el mismo importe del dividendo… sabéis si ha dado dividendo? Gracias

El próximo dividendo es el 10 de Junio (0.87$). Ex-dividend date: 10 de Mayo

Hola Inmodu.

Yo utilizo Degiro y tengo Exxon en mi cuenta Degiro, a mi no me aparece ningún movimiento raro de Exxon, el ultimo dividendo lo pago en Marzo y el próximo es en Junio, si cobraste el dividendo de Marzo no tienes porque preocuparte.

Saludos.

Sí, el de marzo lo tengo, así que debe haber sido un error de ellos que rápidamente rectificaron. Muchas gracias por la aclaración!

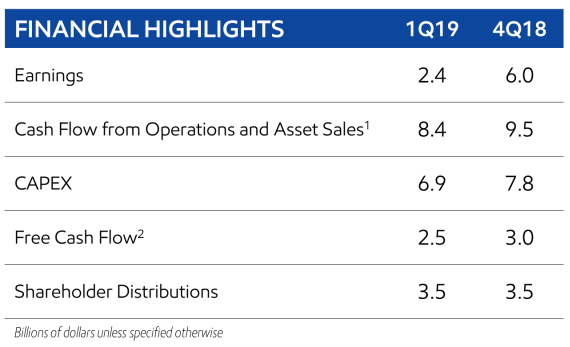

ExxonMobil Earns $3.1 Billion in Second Quarter 2019 (02/08/2019):

Exxon Mobil Corporation today announced estimated second quarter 2019 earnings of $3.1 billion, or $0.73 per share assuming dilution, compared with $4 billion a year earlier. Earnings included a favorable identified item of about $500 million, or $0.12 per share assuming dilution, reflecting the impact of a tax rate change in Alberta, Canada.

Capital and exploration expenditures were $8.1 billion, up 22 percent from the prior year, reflecting key investments in the Permian Basin.

B&H2012:

It’s a shame to allow ideas about climate change to get in the way of seeing what a wonderful investment Exxon Mobil is.

Since the stock market low on March 9, 2009, Exxon Mobil has paid out $26.90 per share in dividends.

Because I have held Exxon Mobil for 49 years, I now have 52,800 shares.

That means that since March 9, 2009, I have received $1,419,320 in dividends from Exxon Mobil.

And dividends are taxed at a favorable tax rate.

So I always know what’s in my wallet.

El share count que siempre menciona Chowder ![]()

OCU 04/10/2019:

El grupo petrolero norteamericano advierte de que sus resultados en el tercer trimestre de 2019 serán inferiores a los del mismo periodo de 2018.

Acción barata (US30231G1022) incluida en la cartera del Experto en acciones.

COMPRE.Nosotros ya esperábamos este retroceso, pero la amplitud de la caída podría ser más importante de lo previsto. Las dificultades del negocio químico y sobre todo la caída del precio del petróleo explican esta rebaja de previsiones. Habrá que esperar a la publicación de los resultados el 1 de noviembre para comprobar si la liquidez de Exxon alcanza para cubrir las inversiones.

If you are worried about beating the market, you are going to drive yourself nuts underperforming the stock market every three out of four years. But if you define yourself in terms of owning great businesses, and focusing on the income growth from those investments, it’s a much more enjoyable experience. If you were earning $1,000 in annual income from your Exxon stock in 1989, you would be earning over $18,000 annually (paid out as four $4,500 quarterly dividend checks) today.

When you are perpetually given dividend growth that exceeds the rate of inflation (which is truly the case as Exxon’s lowest dividend hike during this time period was 3.8% in 2015), you don’t have to be chasing the “investment rabbit” of your performance relative to the S&P 500. You can be satisfied that you own an asset that is sitting on half-a-trillion dollars in proven oil reserves and sharing part of the proceeds with the shareholders each other.

https://theconservativeincomeinvestor.com/collecting-exxonmobil-dividends-for-thirty-years/

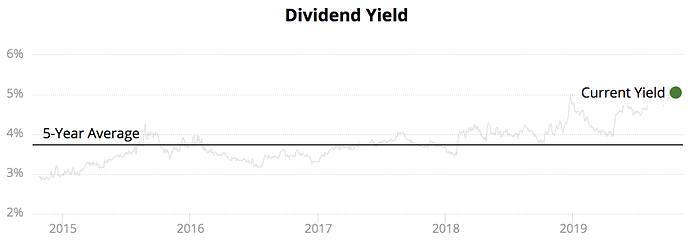

Simply Safe Dividends:

"Exxon Mobil’s (XOM) dividend yield sits just above 5%, its highest level in nearly 30 years. The energy giant’s dividend continues to look secure thanks to its strong balance sheet, but Exxon’s high spending on growth projects, coupled with today’s challenging energy market, will likely put more pressure on the firm’s cash flow in the short term

As a result, we are downgrading Exxon’s Dividend Safety Score from Very Safe (87) to Safe (70). I plan to continue holding our shares of Exxon in our Conservative Retirees portfolio and believe the company’s dividend remains attractive for income investors."

ExxonMobil, la mayor petrolera de Estados Unidos, ganó en los primeros nueves meses de este año 8.650 millones de dólares, un 42,8 % menos que en el mismo periodo de 2018, debido a una caída del precio del crudo que es reflejo de la desaceleración económica internacional.Por lo que respecta al tercer trimestre, al que más atención prestaban los mercados este viernes, los beneficios netos se redujeron en un 49,2 % hasta los 3.170 millones de dólares, comparado con los 6.240 millones en el mismo tramo del ejercicio previo.Las ganancias por acción han pasado de ser de 1,46 dólares la acción en el tercer trimestre de 2018 a sólo 0,75 dólares en el mismo periodo de este año, si bien esto representa dos centavos más que en el trimestre anterior.

O bien estaba descontado de la cotización o se esperaban peores porque abre en positivo

Me autocontesto, fueron mejores de los esperado, se contemplaban 0.67 centavos de EPS