Candidata clara

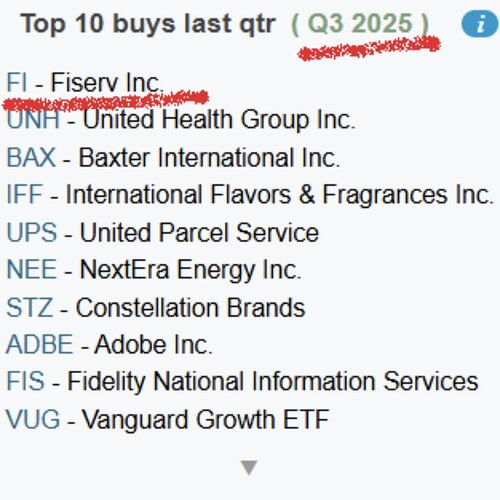

Entre las más compradas en Q3 de 25.

Ha pillado a muchos por delante.

Como dice @ruindog , puede ser buen momento de entrar.

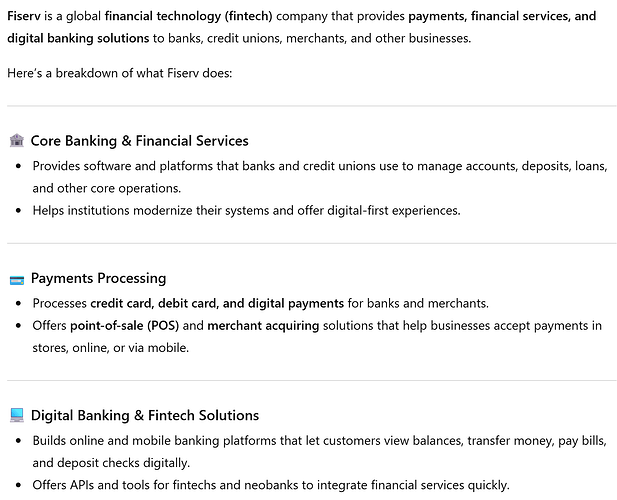

¿Fiserv? Últimamente la he escuchado/leído bastante cuando antes no sabía ni su nombre…

La caída desde máximos ha sido brutal desde luego. Vas a entrar? No sé bien ni a qué se dedica

Eso es MUCHO decir… aunque se quede en una pequeña parte de eso también..

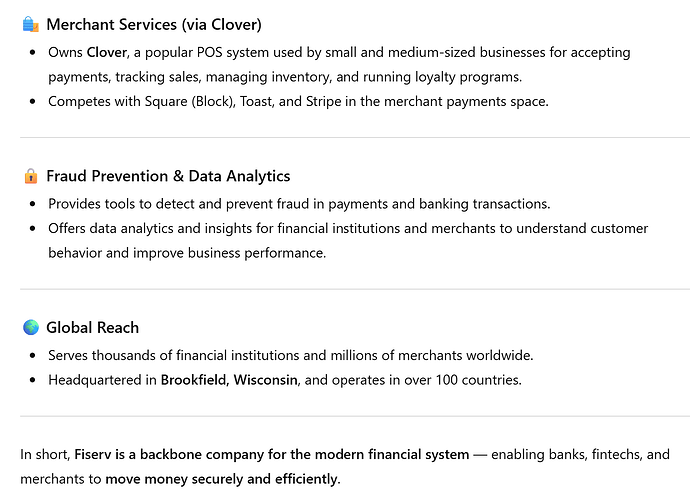

Y esto lo que nos cuenta M*

Fiserv’s third-quarter numbers were weak and management pointed to a much more difficult future, sending the shares into a spiral on Oct. 29.

Why it matters: The quarter itself was poor, with revenue growth fading and margins down. But management’s commentary about the future path of the company was the bigger surprise.

- Year-over-year organic growth was only 1%, with the merchant segment up 5% and the financial segment down 3%. Adjusted operating margin declined 320 basis points year over year.

- With a new CEO in place, management reviewed the company’s position and determined that Fiserv had been attempting to maximize near-term growth and margins in a way that could not be maintained. The company will now raise investment (which will lower margins) and expects growth to decline. Essentially, management pointed to more quarters like this one ahead, until Fiserv resets to a more stable base.

The bottom line: After revising our assumptions, we expect to reduce our $198 fair value estimate for the narrow-moat company by about 35%.

- The company lowered guidance for 2025, but we have limited insight into how aggressively it will increase investment. We plan to downgrade our Morningstar Uncertainty Rating to High from Medium as a result.

- While our previous projections were overly optimistic and there is significant uncertainty on where margins and growth will land as the company resets, the current market price is difficult to justify, in our view, representing a free cash flow yield of a little over 10% using the revised guidance for 2025.

Bulls Say

- The bank technology business is very stable, characterized by high amounts of recurring revenue and long-term contracts.

- The ongoing shift toward electronic payments has created and will continue to create room for acquirers to see solid growth without stealing share from each other.

- First Data’s growth had accelerated before the merger as it worked past its financial issues, and the business now has access to greater resources under Fiserv’s roof.

Bears Say

- Since it was built through acquisitions, Fiserv has to maintain multiple core processing platforms, which could limit margins and hamper the quality of its offerings.

- Fiserv’s bank technology operations are tied to a mature industry and almost entirely domestic, which limits its growth prospects.

- Due to the First Data merger, Fiserv is now more exposed to macroeconomic conditions.