GEA confirms guidance for 2019 and introduces measures to improve earnings in Business Area Solutions

“GEA made a solid start to 2019. The Business Area Equipment managed to increase earnings in the first quarter, thanks largely to higher revenues and a disproportionate increase in service business. As announced in March, we have now drawn up further measures to counter the decline in earnings in the Business Area Solutions in the short term, this following the personnel changes already introduced there,” said Stefan Klebert, CEO of GEA Group Aktiengesellschaf

La cotización sube casi un 10% tras la publicación de los resultados del trimestre

2 Me gusta

M* la recomendó por el mes de Febrero. La meten en Industrials/Diversified Industrials como 3M, AOS, DOV, HON…

Wide-moat GEA Group, is an expert in food processing. It manufactures equipment for separation, fluid handling, dairy processing, and dairy farming, and designs and constructs process lines or entire plants for customers.

Based in Germany, GEA Group is a global market leader, with number one or -two positions in its markets. Its separators are used in hundreds of different, tailored applications. Every fourth liter of milk, third instant coffee line, third chicken nugget, and second liter of beer globally is processed with GEA’s specialized equipment.

Similar to British American Tobacco, we are highlighting GEA because it trades at just over a 30% discount to analyst Denise Molina’s EUR 45 fair value Molina thinks there are near-term headwinds as the firm’s restructuring efforts take effect, but her medium-term revenue growth forecast at 4.4%, including acquisitions (around 40 basis points of growth), remains intact. Molina believes GEA’s business and market positions reflect a wide moat. New entrants face a high barrier to entry trying to establish themselves in an industry where established firms are trusted to ensure that branded products are differentiated and consistent, and that they do not carry the risk of causing foodborne illnesses.

Existing market shares are stable for a similar reason: Food processing companies have a significant risk aversion to changing trusted suppliers. The sources of GEA’s moat are its intangible assets and high switching costs. GEA’s intangible assets come from its leading patent-protected technologies and reliability as a partner. In dairy farming and processing, it has been supplying to the market for more than a century. Its high switching costs come from barriers to entry created by regulatory requirements and the sensitivity of its customers to safety concerns and food scandals.

2 Me gusta

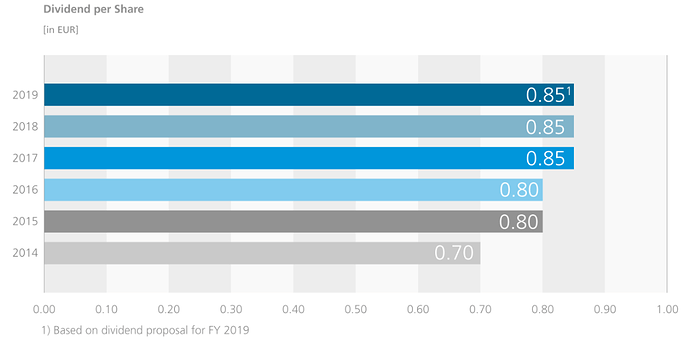

Mantienen el dividendo (0.85€) pero en Mayo solo pagarán la mitad (0.42€) como ROC

Owing to the COVID-19 virus, the technology company GEA is postponing its Annual General Meeting originally planned for April 30, 2020, in Düsseldorf and will reschedule it for the end of the year.

The company is upholding the proposal on the appropriation of profits formulated in its 2019 Annual Report, and thus still plans to pay a dividend for fiscal year 2019 of a total of EUR 0.85 per share. In advance, GEA will make the maximum possible advance payment of EUR 0.42 per share permitted by law based on the last two annual financial statements. This advance payment is set for May 6, 2020, when payment of the dividend was originally planned.