GPC comprará Alliance Automotive; de momento parece que el mercado lo acoge bastante bien, subida del 7%

Había visto la subida pero no sabía el por qué de la misma. Una pena porque justo esta semana tenía intención de añadir más visto que la cotización no se movía de mi precio de compra. En fin, nunca sabes.

Saludos.

Bueno, ya habra otras ocasiones…

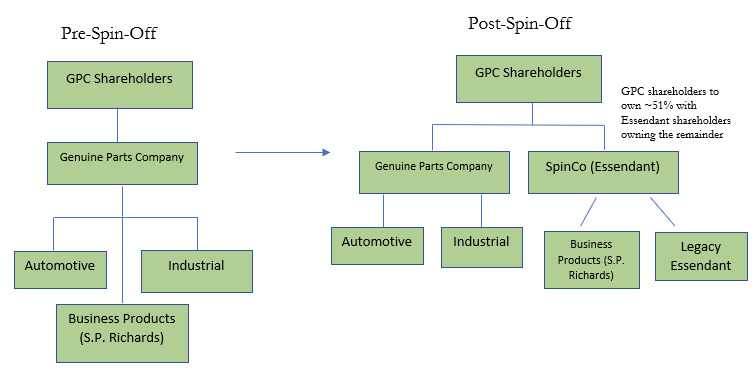

Genuine Parts Company has been a good long-term holding for dividend investors. Management’s determination to separate off the S.P. Richards segment will ultimately free the company of its lowest quality business and allow it to focus on growing its higher quality Automotive and Industrial divisions.

Simply put, the remaining GPC will have a higher growth rate, a superior margin profile, and better prospects for growing the dividend going forward.

On the other hand, Essendant appears to be a risky investment for legacy GPC investors if the spin-off and merger still end up going through despite Staple’s interest in Essendant. The company is facing intense competition, undergoing restructuring, and has significant debt on the balance sheet.

As a result, the spin-off’s dividend could be in jeopardy if the merger goes poorly and does not generate management’s expected synergies.

Morningstar reduce su fair value de 103$ a 101$.

Joer con Morningstar, vaya pedazo de rebaja

Llevo tiempo con una orden puesta a 93,xx$ y no hay manera. A ver si con esta rebaja entra.

Saludos.

¿Alguien sabe en que quedó este spinoff anunciado en Abril del año pasado?

Nunca oí nada más al respecto

Genuine Parts Company Reports Sales And Earnings For The Second Quarter Ended June 30, 2019

Sales for the second quarter ended June 30, 2019 were a record $4.9 billion, a 2.3% increase compared to $4.8 billion for the same period in 2018. Total sales for the second quarter included the contribution of 1.6% comparable growth and 2.7% from acquisitions, offset by the negative impact of 1.5% from foreign currency translation along with 0.5% due to the sale of Grupo Auto Todo in the first quarter of 2019. Net income for the second quarter was $224.4 million and earnings per share on a diluted basis were $1.53. Before the impact of certain transaction and other costs primarily related to the acquisition of PartsPoint Group (PartsPoint), adjusted net income was $230.3 million, or $1.57 per diluted share.

Second quarter sales for the Automotive Parts Group were up 1.4%, including a 1.3% comparable sales increase, a 3.5% benefit from acquisitions and an unfavorable foreign currency translation of 2.5%. In addition, automotive sales were impacted by 0.9% due to the sale of Grupo Auto Todo. Sales for the Industrial Parts Group were up 4.9%, including a 3.1% comparable sales increase, 2.1% from acquisitions and a slightly unfavorable foreign currency translation of 0.3%. Sales for the Business Products Group were down 1.1%, consisting primarily of the change in comparable sales growth.

2019 Outlook

In consideration of our results thus far in 2019, the continued softness we expect in Europe for the balance of the year, as well as the impact of the PartsPoint and Inenco acquisitions, the Company is updating its full year 2019 sales and earnings guidance. The Company expects sales to increase 4.5% to 5.5%, inclusive of an approximate 2% sales contribution from the PartsPoint and Inenco acquisitions. This updated sales outlook represents a change from the Company’s previous guidance for a 3% to 4% sales increase.

The Company expects diluted earnings per share to range from $5.42 to $5.52 and is updating its outlook for adjusted diluted earnings per share, which excludes any first half and future transaction and other costs, to $5.65 to $5.75. This is a change from the Company’s prior guidance of $5.75 to $5.90. This updated earnings outlook accounts for an approximate $0.05 contribution from PartsPoint and the additional 65% investment in Inenco. Additionally, the Company continues to expect a tax rate of approximately 25% in 2019.

Genuine Parts Company Reports Sales And Earnings For The Third Quarter Ended September 30, 2019 (17/10/2019)

- Record Sales of $5.0 billion, Up 6.2%

- Diluted EPS $1.56, Up 4.7%

- Adjusted EPS $1.50 Excluding Transaction Related Costs and Income

- Updates 2019 Revenue and Earnings Outlook

2019 Outlook

- The Company now expects sales to increase approximately 3.5%. This updated sales outlook represents a change from the Company’s previous guidance for a 4.5% to 5.5% sales increase.

- The Company expects diluted earnings per share to range from $5.44 to $5.52 and is updating its outlook for adjusted diluted earnings per share, which excludes any nine month and future transaction and other costs and income, to $5.60 to $5.68. This is a change from the Company’s prior guidance of $5.65 to $5.75 and is primarily due to the sale of EIS.

- The Company continues to expect a tax rate of approximately 25% in 2019.

Results For The Fourth Quarter And Full Year 2019 (19/02/2020)

- Fourth Quarter Sales $4.7 billion, Up 2.2%, and Record Full Year Sales $19.4 billion, Up 3.5%

- Fourth Quarter Diluted EPS $0.06 and Full Year Diluted EPS $4.24

- Adjusted Diluted EPS $1.35 and Full Year Adjusted Diluted EPS $5.69

2020 Outlook

- Full year 2020 sales guidance at Flat to up 1.0%, or up an adjusted 3.0% to 4.0%.

- Guidance for diluted earnings per share is $5.80 to $5.90, an increase of 2% to 4% or an adjusted 5% to 7%.

$GPC just announced their 66th consecutive year of increased dividends. This recent one was a generous increase of 10%.

Bonito - 18,5% se está pegando