Pernod Ricard es dueña de marcas de bebidas como Absolut, Chivas, Beefeater o Havana Club. En el primer semestre fiscal ha incrementado su beneficio en un 4%. Esta es la noticia:

Yo la tengo hace un año y muy contento para complementar a Diageo.

Resultados de los nueve primeros meses del ejercicio fiscal:

- Ingresos: 7.047 millones (+3%).

- Previsiones para el ejercicio 2016-2017: crecimiento en ingresos operativos y beneficios de entre el 2% y el 4%.

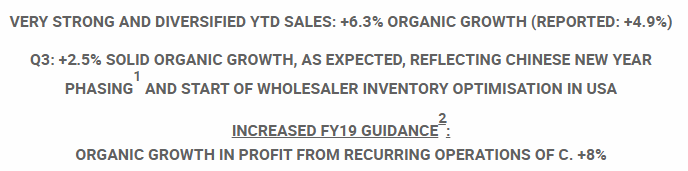

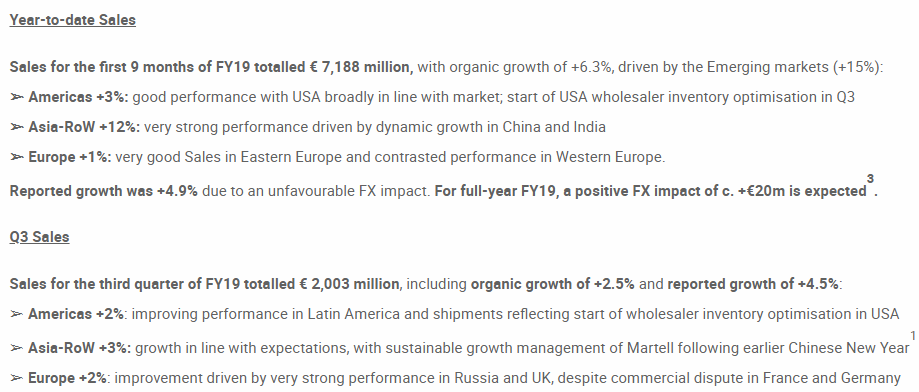

2018/2019 full-year Sales and Results (08/29/2019)

Excellent FY19, demonstrating clear business acceleration:

- +6.0% organic sales growth (+5.3%)

- +8.7% Organic growth in PRO (+9.5%)

- FY20 guidance: organich growth in PRO between +5% and +7% financial policy inflection.

- Dividend increased to €3.12/share (50% payout) from FY19 up to €1BN share buy-backprogramme across FY20 and FY21.

Q1 FY20 Sales (17/10/19)

Sales for the first quarter of FY20 totalled € 2,483 million, with organic growth of +1.3%:

- Good start in USA: +6%

- China: +6% and India: +3%

- Global Travel Retail: -6%

- Good growth in Europe: +3%

By category, growth was driven by:

- Strategic International Brands: +3%., with growth moderation due to high comparison basis

on Martell and Scotch but acceleration of Jameson, Beefeater, Malibu and Havana Club - Strategic Local Brands: +2%, with softer growth due to very high Q1 FY19 for Seagram’s

Indian whiskies - Specialty Brands: +15%, continued very dynamic performance, particularly for Lillet,

Monkey 47, Del Maguey and Altos - Strategic Wines: -2%, modest decline linked to continued implementation of value strategy

on Jacob’s Creek - Pricing: +2% on Strategic brands

Pernod Ricard will implement a first tranche of the share buy-back programme announced on 29/10/19

- Pernod Ricard will undertake to acquire its own shares for a maximum amount of €150m.

- The purchase period shall start on October 18, 2019 and end on December 18, 2019 latest.

- The price shall not exceed the maximum price as set by the 12th resolution of the Ordinary

Shareholders’ Meeting of November 21, 2018. - Repurchased shares will be cancelled.

FY20 Half-year Sales and Results (12/02/2020)

Solid H1 FY20

- +2.7% organic sales growth (+5.6% reported)

- +4.3% Organic growth in profit for recurring operations (+8.1% reported)

New FY20 guidance:

- Organic growth in profit for recurring operations between +2% and +4%

FY20 Q3 Sales (22/04/2020)

- Covid-19 leading to organic sales decline of -2.1% YTD and -14.5% in Q3.

- interim dividend of €1.18 per share to be paid on 10 July 2020.

- Remaining share buy-back of up to €0.5BN suspended.

- Confirmation of revised FY20 guidance : organic decline in profit from recurring operations of c. -20%.

Tengo ganas de entrar en esta empresa, ya que tienen la filosofía de una empresa familiar, como Brown & Forman $BF.B y no es USA, como Diageo $DGE.

Ahora solo falta que de una oportunidad, aunque el CEO ha comprado en los últimos meses.

Algunos se pensaban que el socialismo era una broma Xi Jinping se dedicaba solo a hundir las acciones chinas

Pues si los chinos no quieren beber ya lo haremos nosotros.

Total con el déficit que tienen del enzima degradador del alcohol, tampoco les sienta bien…

Hoy a FinX le toca comprar esta empresa por lo que veo