Yo el único motivo que le veo para que la acción la hagan caer tanto, es su pequeña capitalización de 7,51 millones, frente a 157 de NEE o los 59 de D.

La primera según gurufocus tiene una deuda a ebitda de 4,47 frente a 7,71 de la segunda y 5,69 de la tercera y el payout también es razonable.

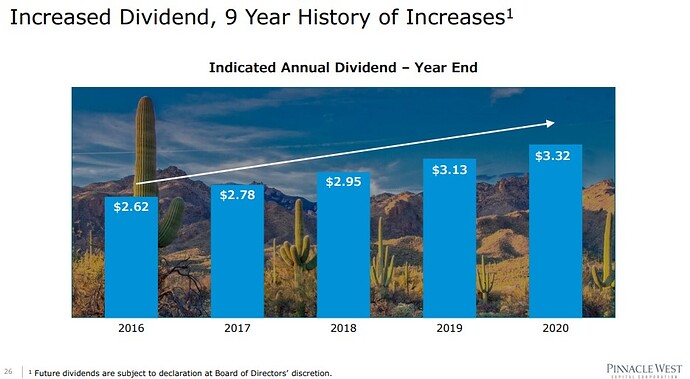

Pues ya tiene un yield superior al 5%, el dividendo anualizado es 3,32$, el 5% se alcanza con valor de 66,40$. Y veremos si lo suben para diciembre.

Voy a ampliar lo poco que puedo esta tarde.

On Thursday, Pinnacle West received bad news regarding its pending rate case with state regulators when the Arizona Corporation Commission (ACC) voted to reduce the potential profits of the state’s largest electric utility.

The ACC moved to decrease Pinnacle’s allowed return on equity (ROE) from 10% to 8.7%. This ruling is worse than what management considered its worst-case scenario and will likely have a more significant impact than what we wrote about last month.

Typically, relationships between state regulators and public utilities are even-keeled, allowing utilities to generate slow and steady returns over time. However, the relationship between Pinnacle and the ACC has deteriorated to a disruptive state.

At this point, despite some legal pathways for Pinnacle to fight this ruling, we don’t expect any major positive developments in the next year or so.

As such, Pinnacle will now need to rely more heavily on outside financing, including issuing more shares, to fund infrastructure improvements and new development.

We estimate a potential increasing share count coupled with a substantial reduction in earnings from a lower ROE could drive the dividend payout ratio to around 90%.

That payout ratio is far beyond the 60-70% range Pinnacle has historically maintained and above the 80%-plus figure we discussed as a possibility in our last note.

The details aren’t finalized yet, though. For example, the ACC is still considering a judgment that could allow Pinnacle to recoup expenses tied to improvements made to its Four Corners pollution reduction program.

This issue accounts for over one-third of the potential earnings hit. A ruling is expected in the next 6 to 12 months.

Pinnacle’s payout ratio will move higher, but how high depends on how this matter gets resolved, in addition to any levers management pulls to offset some of the expected decline in profits.

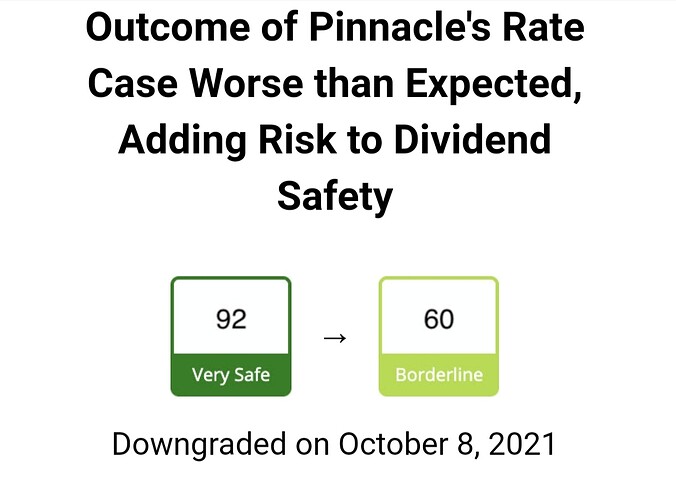

Regardless, given the deteriorating regulatory environment’s larger than expected impact on Pinnacle’s payout ratio and profitability, we are downgrading the firm’s Dividend Safety Score from Very Safe to Borderline Safe.

If the Four Corners issue receives an unfavorable ruling, making the 90%-plus payout ratio scenario almost a sure bet, we would consider another downgrade.

While Pinnacle should continue benefitting from favorable demographic tailwinds as Arizona’s population growth leads the nation, it would still take years for earnings to grow to a point where a payout ratio this high would return to the firm’s historical range.

In this scenario, we believe Pinnacle would instead strongly consider cutting its dividend by 30-35% to get its payout ratio back to historical norms and retain more cash flow for reinvestment.

Pinnacle is set to declare its next dividend later this month. We would be surprised if management cut the dividend at this stage since some key issues have yet to be resolved. Still, visibility is admittedly not great given the unique nature of this situation.

Much of the bad news is already reflected in Pinnacle’s stock price, so investors may feel inclined to ride this situation out until management provides more guidance.

For example, if Pinnacle ultimately cut its dividend by a third and traded at its 5-year average dividend yield of 3.5%, shares would be priced at about $63.50, or less than 4% below the current price.

If shares trade at a 4% yield instead, a discount that reflects some disappointment in the regulatory environment balanced by Arizona’s demographic tailwinds, Pinnacle would sit near $55 a share. This price would represent about 15% downside from today.

Overall, Pinnacle’s operating environment is far more unstable than you would expect for a regulated utility as expectations reset for its ongoing level of profitability.

We will continue monitoring Pinnacle and provide an update as soon as management comments on the ruling. Depending on the firm’s updated guidance and financing plans, we would consider another change to Pinnacle’s Dividend Safety Score.

No solo en España cuecen habas.

Por lo que se ve las utilities por su negocio regulado tienen ingresos muy predecibles, hasta que ya no los tienen, de un plumazo.

M*

Analyst Note | by Stephen Ellis Updated Oct 11, 2021

We are lowering our fair value estimate to $77 per share from $88 after the Arizona Corporation Commission voted 4-1 to include an amendment in Arizona Public Service’s rate proceeding that will cut APS’ allowed return on equity to 8.7% from 10% if commissioners later approve the full rate filing.

We are reaffirming our narrow moat and stable moat trend ratings, but will consider a downgrade depending on the final outcome. Pinnacle West has earned near its 10% allowed return and more than its cost of capital for many years, but that could be difficult if the regulatory environment turns hostile in Arizona. This would be one of the biggest allowed ROE cuts in the industry in many years.

The five ACC commissioners’ next opportunity to accept or reject the full amended rate filing will be at the next open meeting Oct. 26, but we are already incorporating the allowed ROE reduction for 2022-24 given that four of the five commissioners supported the amendment. We also lowered our long-term allowed ROE assumption by 50 basis points to reflect a more challenging regulatory environment.

Pinnacle West has produced strong earnings growth primarily due to rapid customer and usage growth in its service territory, helping it avoid the need for rate increases. We had forecast 2022 earnings per share near $5 per share, but reaching that threshold now likely won’t happen until 2025 or later. Pinnacle West management said they will wait until after the final ruling to provide earnings guidance.

The consumer advocate group in Arizona asked for the 8.7% allowed ROE, lower than the ACC administrative law judges’ 9.16% recommendation, 9.4% ACC staff recommendation, and APS’s 10% request.

Commissioners still must decide on rate treatment for APS’ Four Corners coal plant environmental upgrades. Ultimately, we believe regulators will reach a constructive outcome on this issue because the equipment is required to run the plant and it is critical for electric reliability in the region…

…

In 2012, the ACC approved a rate-case settlement that helped APS improve returns by providing automatic rate riders on solar energy investments and a decoupling mechanism that reduced the impact of customer-installed rooftop solar units and energy efficiency projects. The improved returns and earnings outlook allowed Pinnacle West to increase its common dividend almost 4% in 2012, the first increase since 2006.

This increase was followed by three years of approximately 5% increases, accelerating to 6% in 2017-20. The rate cut could lead to little or no dividend growth for several years as management works to bring down its payout ratio. Management had been targeting 6% annual dividend growth

Gracias por la información.

Le están dando duro:

- SSD lo pasa de 92 a 60 puntos

- M* le cambia el FV de 88 a 77$

- Value Line le rebaja la seguridad de 1 a 2 y el fortaleza financiera de A+ a A

Yo que soy un poco raro cada día me interesa más. Tampoco la llevo en cartera hasta ahora.

Por lo menos una buena noticia dentro del panico. También tuvieron reunión con los reguladores ayer, no sé qué habrán decidido.

Saludos

Yo ya la daba por sentenciada.

Obviamente desde la noticia regulatortia no volví a ampliar. (también porque se había convertido en mi mayor posición en cartera).

Así que no vamos a hacer mucho ruido por si acaso

Atentos que hoy presentan resultados. A ver que tal salen.

Yo tengo una pequeña parte y debería ampliar pero echaré un ojo a otras empresas mejor, de momento.

En la carta a los accionistas leemos

Buscaremos mejoras en el entorno regulatorio

✓ Presentar un nuevo caso de tarifas para reducir el retraso regulatorio y mejorar el ROE

✓ Trabajar con las partes interesadas en temas comunes, incluidos reduciendo el retraso regulatorio y mejorando el cliente experiencia

✓ Continuar para encontrar la alineación con los reguladores

✓ Centrarse en la asequibilidad del cliente

Quieren continuar con el crecimiento de dividendos pero ponen un asterisco, el tema estará sujeto al consejo de administración

Lo he ojeado por encima

Gracias por tanta información.

Este artículo es del 11 de julio, mucho antes de que el regulador de Arizona propusiera una rebaja de las tarifas eléctricas, que de llevarse acabo finalmente, afectará de forma notoria a los ingresos de PNW

Si perdón, cuando me he dado cuenta, he querido borrarlo y no me he aclarado😬

Pese a ello incrementaron dividendo

… No se como tomarme eso