[Posts de Simon Property Group movidos desde el hilo de compras de y ventas de empresas estadounidenses]

SPG, Value line:

M* (1/2)

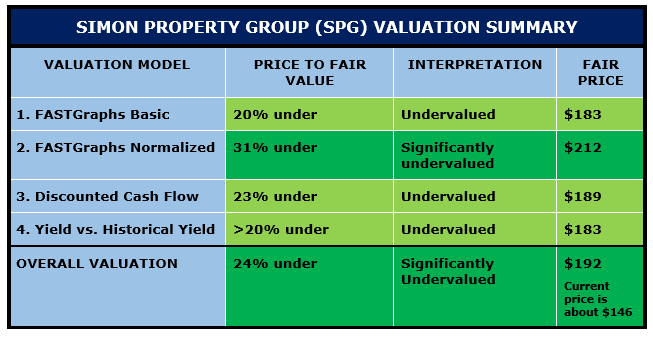

Third-quarter results for Simon Property Group were in line with our expectations. As a result, we are reaffirming our $189 fair value estimate and narrow-moat rating for the company. Occupancy was up 30 basis points sequentially but fell 80 basis points year over year to 94.7%, in line with our expectations. Tenant sales per square foot surprised by accelerating 4.5% to $680 per square foot, well ahead of our 2.2% growth assumption. Re-leasing spreads were up 22.2% as the company continues to benefit from releasing vacant anchor boxes to junior anchor tenants. Comparable property net operating income was up 1.6% in the third quarter, in line with our expectation. As a result, funds from operations also came in line with our estimate of $3.05 for the quarter. We continue to believe that the Class A malls will see solid growth and outperform lower quality retail locations.

Simon announced this week several partnerships that include an equity investment in an assortment of companies. Simon purchased a 5% stake in London-based hotel club chain Soho House for $100 million, which should help the company double its international exposure to 50 locations. Simon will partner with lifestyle brand Life Time, that plans to put resorts, sports facilities, and coworking space in at least 10 Simon malls. Simon invested in the modern bowling and dining company Pinstripes, which currently has plans for four Simon locations. Simon also made investments in e-gaming company Allied Esports, Sports Illustrated, and Major Food Group’s casual dining brand PARM, with plans to open locations for each of those brands across Simon’s portfolio. Finally, Simon partnered with Rue Gilt Group to expand the digit shopping experience in Simon malls. While these investments come with significant risk, we like that Simon is being proactive in finding the tenants it wants to populate its malls and believe that a partnership could lead to long-term success for both tenant and landlord.

Business Strategy and Outlook 09/30/2019

Simon Property Group, the largest mall real estate investment trust and second-largest U.S. REIT, manages one of the top retail portfolios in the country. It owns and operates Class A traditional regional malls and premium outlets in markets with dense populations and high incomes; these malls frequently have domestic or international tourist appeal. The high-quality properties will continue to provide consumers with unique shopping experiences that are hard to replicate elsewhere, and as a result, we think Simon’s portfolio will be sought after by retailers that are increasingly pursuing an omnichannel strategy.

E-commerce continues to pressure brick-and-mortar retail as consumers increasingly move their shopping habits online. When excluding categories of retail sales that are generally found neither in malls nor online, like autos, gasoline, groceries, and building materials, e-commerce now accounts for more than 20% of all retail sales. While we believe that online sales will continue to grow at a significant spread over brick and mortar, we also believe physical retail sales growth will still be positive over the next decade. Retailers will become more selective with their physical locations, opting to locate storefronts in the highest-quality assets that Simon owns while closing stores in lower-quality malls.

Additionally, many e-tailers are beginning to open stores in Class A malls to take advantage of the high foot traffic, as a physical presence provides additional marketing, a showroom for products they want to highlight from their online store, and another source of sales.

Occupancy remains in the mid-90s for Simon’s portfolio, and the company is still achieving double-digit re-leasing spreads. Additionally, Simon continues to redevelop its assets and replace struggling tenants and anchors with new tenants that drive higher foot traffic. While e-commerce presents a serious challenge to brick and mortar, we believe there will be continued bifurcation in the mall space between the highest- and lowest-quality malls, which should lead to continued earnings growth from Simon’s high-quality portfolio over the next decade.

Economic Moat 09/30/2019

We assign Simon a narrow moat due to the network effect and efficient scale benefits that are produced by the company’s portfolio of high-quality, well-located, and productive properties. While we recognize that the continued growth of e-commerce places pressure on traditional brick-and-mortar retail and that the U.S. is significantly overretailed, we believe there will always be demand for high-quality retail locations. Simon’s properties are located in many of the best markets with dense populations and high disposable incomes and can provide an experience for consumers that is hard for other retail to replicate. Simon’s high-quality properties attract desirable tenants, which in turn makes their properties more attractive to consumers and future tenants.

The continued growth of e-commerce is putting significant pressure on traditional brick-and-mortar retail. The U.S. currently has approximately 24 square feet of retail space per capita, a ratio that is 2-10 times greater than in other industrialized countries. As consumers change their habits from shopping in physical stores to shopping online, the demand for retail space will shrink, and many existing stores and malls will go away. There are approximately 1,100 traditional malls in the U.S., and many will not survive the shift of consumer buying habits to e-commerce. However, we expect the reduction in retail space will occur almost entirely at the lower end of the quality spectrum. The approximately 350 Class C and Class D malls are struggling and are either currently in or on the precipice of the mall death spiral, in which vacancies lead to lower sales for remaining tenants, which lead to more vacancies and so on. We do not expect any of these malls to exist as they currently stand 10 years from now. The approximately 400 Class B malls might survive the growth of e-commerce, but they will probably need to come up with very creative solutions and find nontraditional tenants to attract shoppers. Meanwhile, the 300 Class A malls should not only survive but thrive in the future retail landscape. Simon derives more than three fourths of its net operating income from Class A malls and almost 90% of its NOI from B+ or better malls while Class C+ or lower malls make up less than 1% of its NOI. Therefore, we do not assume Simon will follow the path of the average mall but rather the path of the Class A mall.

The likely winning strategy for retailers will be to pursue an omnichannel strategy where they have an online presence while maintaining a few stores in the top locations. An online presence is extremely important for most retailers in order to capture a share of the growing preference for e-commerce. However, brick-and-mortar stores will still play an integral role for most retailers. Not only does brick and mortar present the traditional way for people to shop, it will also benefit the online store. The physical store provides an important component of marketing the online business. The physical store provides a location to pick up goods purchased online when you don’t want to wait for them to be shipped to you. Shoppers may prefer to shop at online stores where they know they can easily return purchases to a physical store rather than ship them back to the e-retailer. The physical store can act as a showroom for large products before they are bought online or as a place to try on an item before the shopper explores the online store for a larger selection of colors. Most retailers do not need the number of physical stores that they currently have, but they will want to maintain a presence in all markets in order to enjoy the benefit of the physical store to the omnichannel strategy.

The locations in the worst trade markets that see the smallest foot traffic and generate the fewest sales are the stores most likely to be closed. Retailers will want to keep their stores located in the top malls, as they have strong demographic trends and high foot traffic and generate high sales. Additionally, many previously exclusive e-retailers are seeing the benefit of opening physical locations to enjoy the benefits of the omnichannel strategy. Amazon, Warby Parker, Bonobos, Boll & Branch, Athleta, and Casper are all examples of companies that got their start as online-only retailers that have opened select physical locations. These retailers are looking to put their new stores in the top retail locations, providing additional demand for space in the top malls in the U.S. Finally, Class A malls are being redeveloped to provide more food and recreation options in order to present themselves as destinations for entertainment rather than simply places that consumers shop. These trends should all lead to the Class A mall retaining a vital role for both the retailer and the consumer.

The primary moat source for a mall REIT like Simon is efficient scale, as the regional mall effectively and efficiently serves its own submarket. Retailers are becoming more strategic in placing their stores, but Simon is able to secure leases with many of the most desired tenants in its malls. Simon’s highest-quality assets, with their high foot traffic and favorable demographics, are sought-after locations for any retailer, and the company can leverage the overall size of its portfolio by insisting that retailers put stores in lesser-quality assets in order to gain access to the best-quality ones. Simon’s tenant base protects it from competitors as the development of a new mall in the trade area of a Simon mall is extremely unlikely, and a new property would have a hard time competing on preleasing tenants. Simon’s portfolio of Class A malls offers shopping and entertainment options that make the portfolio’s malls a destination for consumers, which differentiates the portfolio from other retail real estate types that offer more-routine shopping experiences. Even though e-commerce is negatively affecting the entire retail landscape, the Class A malls that Simon owns and operates stand out as an experience that can’t be had anywhere else in their trade area, and we believe that experience will continue to be sought out by consumers in any future of retail.

Simon also benefits from the network effect moat source in its mall portfolio. Consumers prefer to make their shopping trips efficient by being able to visit their favorite stores and possibly compare prices in a single trip, making sought-after retailers next to one another a desirable location for shoppers. High-quality anchors, in-line tenants, and entertainment options draw significant foot traffic to the mall, which makes placing a store in the mall attractive to other retailers, as it would benefit from the large number of people already heading to the mall. Therefore, having high-quality tenants improves the quality of the mall, which attracts more higher-quality tenants. While there is a limit to the number of shoppers and the amount of money they will spend in a given market, Simon’s malls are located in densely populated, high-income submarkets that support high foot traffic and high sales for tenants. Simon has regularly and successfully redeveloped its properties to provide the most attractive shopping experience for consumers, maintaining the attractive qualities of the properties to both consumers and retailers. As long as Simon continues to reposition its assets to match the needs of a changing retail landscape, its assets should benefit from its network effect moat.

We use an adjusted return on invested capital calculation to determine if a company historically has shown or is forecast to have the characteristics of an economic moat. After adjusting the ROIC calculation to use maintenance capital expenditures instead of accounting depreciation, we calculate that over the past few years, Simon has averaged an adjusted ROIC approximately 200 basis points above our 7.1% weighted average cost of capital. The adjusted ROIC remains above our WACC estimate for the company at this level through our forecast horizon, providing quantitative evidence of a moat for the company. This affirms our view that Simon Property Group should be assigned a narrow moat rating.

Fair Value and Profit Drivers 09/30/2019

We are decreasing our fair value estimate to $189 per share from $195 due to incorporating first-half 2019 results and updating our internal growth assumptions. Our fair value estimate implies a 5.5% cap rate on our forward four-quarter net operating income forecast, 15 times multiple on our forward four-quarter funds from operations estimate, and a 4.3% dividend yield, based on a $8.20 annualized payout. The occupancy, minimum rent growth, re-leasing spreads, and margin assumptions drive total company annual same-store NOI growth averaging 1.9% across our 10-year forecast. We believe Simon won’t have any acquisition opportunities, as most Class A malls are already owned by long-term investors, but also won’t make any major dispositions. Instead, the company will improve the quality of its assets and reposition them in its markets through continual redevelopment and also selectively invest in development projects. We project $1.2 billion of investments in the company’s pipeline of new development and redevelopment projects at an 7.5% average yield in 2019 that slowly declines over time to $1.0 billion at a 6.75% average yield as construction costs rise and accretive projects become harder to source. We estimate Simon’s net asset value to be approximately $189 per share based on a 5.5% cap rate assumption. We use NAV as an assessment of potential private market value, essentially viewing the firm as a portfolio of assets. To calculate NAV, we utilize recent asset transactions to assign a cap rate to each segment of the portfolio, apply the cap rates to arrive at gross asset value for the company’s real estate, put a multiple on the company’s non-real estate assets, add the non-income-producing tangible assets, then net out the company’s liabilities (excluding corporate overhead considerations). We find NAV to be a useful data point in gauging the underlying value of the firm, especially the likelihood of realizing this value through potential asset sales, recapitalization, or merger and acquisition activity.