BUY

Resumido en solo 3 letras ![]()

BUY

Resumido en solo 3 letras ![]()

While there was little in wide-moat rated T. Rowe Price’s fourth-quarter results that would alter our long-term view of the firm, we are lowering our fair value estimate to $195 per share from $212 to account for adjustments to our near-term forecast (primarily related to organic AUM growth and expenses) based on commentary from management about near-term flows and an expected rise in costs following the closure of the Oak Hill Advisors deal.

T. Rowe Price closed out 2021 with a record $1.688 trillion in managed assets, up 4.7% sequentially and 14.8% on a year-over-year basis. Absent the OHA acquisition, which closed at the end of December, the firm’s AUM was up 1.8% sequentially and 11.6% year over year. Net outflows of $22.7 billion ($2.5 billion of which came from T. Rowe Price redeeming investments in its own mutual funds during the quarter to finance the cash portion of the OHA deal) were the worst we can ever remember seeing from the company.

While average AUM was up 18.6% year over year during the fourth quarter, T. Rowe Price reported a 13.0% increase in net revenue when compared with the prior year’s period due to product mix shift and target date fund fee reductions that took effect in the back half of the year. Full-year top-line growth of 23.6% was in line with our forecast calling for 23.4% revenue growth during 2021.

As for profitability, full-year adjusted operating margins of 50.0% were 370 basis points higher than the year-ago period and in line with our projections. Management tried to get out in front of its expense issues this year (with expenses like marketing and distribution likely returning to more normal levels as the operating environment moves toward a post-COVID-19 world) by noting that the firm is likely to see expenses grow 12%-16% this year, which is inclusive of a full-years’ worth of OHA’s operating expenses. This led to a lower profitability contribution from OHA than we had forecast previously, impacting our valuation.

We’ve lowered our fair value estimate for T. Rowe Price to $195 per share from $212 to account for adjustments to our near-term forecast (primarily related to organic AUM growth and expenses) based on commentary from management about near-term flows and an expected rise in costs following the closure of the Oak Hill Advisors deal. Our new fair value estimate implies a price/earnings multiple of 15.0 times our 2022 earnings estimate and 14.0 times our 2023 earnings estimate. For some perspective, during the past five (10) years, the company’s shares have traded at an average of 15.5 (17.1) times trailing earnings. We assume a 21% U.S. statutory corporate tax rate and a 9% cost of equity in our valuation. T. Rowe Price closed out 2021 with a record $1.688 trillion in managed assets, up 14.8% year over year. Absent the OHA acquisition, which closed at the end of December, the firm’s AUM was up 11.6% during 2021. Net outflows of $28.5 billion ($2.5 billion of which came from T. Rowe Price redeeming investments in its own mutual funds during the quarter to finance the cash portion of the OHA deal) last year were the worst we can ever remember seeing from the company.

Management noted that net flows during 2022 are likely to fall below their long-term guidance for 1%-3% organic AUM growth. As such, we have revised our near-term forecast to include flat to slightly negative organic AUM growth in 2022, followed by flat to slightly positive organic AUM growth next year. Our five-year forecast for organic AUM growth now stands at 0%-1% on average annually during 2022-26 (compared with 0%-2% previously). Flows should pick up more after 2025 when fewer baby boomers retiring and millennials starting to hit their peak earnings years, with net redemptions from retirement plans putting less of a drag on annual flows. Despite management fees continuing to be pressured by industry dynamics, we expect T. Rowe Price, which is somewhat insulated due to its channel mix and already low-cost offerings, to generate a 2.7% CAGR for revenue during 2022-26, aided somewhat by the addition of Oak Hill Advisors to the mix.

As for profitability, we expect to see adjusted operating margins for the firm in a 44%-46% range (down from 47%-49% previously as OHA looks to be less profitable to the firm than we had been imagining given management’s current guidance on costs). We also expect to see T. Rowe Price invest more heavily in key regions and channels to drive additional organic growth.

Net outflows of $22.7 billion were the worst we can ever remember seeing from the company.

We expect T. Rowe Price to generate a 2.7% CAGR for revenue during 2022-26

Poco crecimiento la verdad. De todas las que estoy valorando por ahora la que menos  Tambien es la que mas barata esta

Tambien es la que mas barata esta

Pues no sé qué quieres decir ![]()

![]()

Básicamente que bajo los múltiplos pasados (ha cotizado históricamente a 20x PE) y los futuros (estimaciones) la acción parece undervalued con un margen de seguridad aceptable para mi. En los próximos años se espera que el crecimiento sea menor (5% y 7% para los próximos 2) como ya han comentado por eso el forecast lo hago sobre un 15x de PE y no sobre un 20xPE ya que no creo que se vuelva a ver a ese múltiplo si no vuelve a crecer a 10-20%.

Decir que las estimaciones de los analistas para esta compañía parecen bastante acertadas a 1 y 2 años vista como se ve en la última imagen y si acaso pecan de algo es de conservadoras

Y cual es el motivo por el que piensan que va a volver a cotizar a múltiplos históricos?

Y si se te ponen 2 buenas empresas a tiro ¿que haces? ¿Dejas una?

Yo hoy he puesto 8 órdenes de compra y ya te digo que si hubieran entrado todas estaría encantado. ![]()

Esperar al día siguiente

T. Rowe Price Group, Inc. (NASDAQ-GS: TROW), announced today that its Board of Directors has declared a quarterly dividend of $1.20 per share payable March 30, 2022, to stockholders of record as of the close of business on March 15, 2022. The quarterly dividend rate represents an 11.1% increase over the previous quarterly dividend rate of $1.08 per share. This will mark the 36th consecutive year since the firm’s initial public offering that the company will have increased its regular annual dividend.

Alto influjo el que creo ejerce esa SMA 200 sobre el precio como para no pensar en la posibilidad de que vaya a tocarla… y además coincide con la referencia de lo que en su día fue un máximo relevante desde el que se giró.

Un saludo.

Yo tengo vendida una Put 140 que me vence hoy

Hombre, ya tenía que ser casualidad que le dieran hoy el meneo como para dejártela hecha… pero que imagino que estos días andarás con el músculo tenso, como cuando se pide la hora en un partido al final de la prorroga.

Suerte.

Un saludo.

No cuento con que me la ejerzan.

No creo que la cotización llegue a caer por debajo de los 140 hoy; pero tampoco es problema, vendo otra put y a esperar y mientras tanto me embolso la prima.

¿ Eso indica 130,36 $ como posible ?..

…Yo la tenía en el radar a

…Yo la tenía en el radar a  120 $ …¿ Me estaré pasando ?

120 $ …¿ Me estaré pasando ?

Yo la empezaba a tener con una ponderacion que consideraba suficiente pero si llega a esos precios no descarto una compra mas

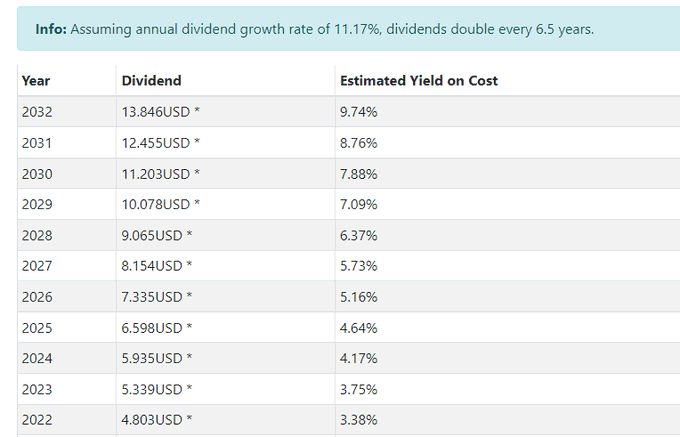

Cortesía de iDividendo

Assuming annual dividend growth rate of 11.17%

Mucho asumir es eso.

El papel lo soporta todo

Bueno @Rubifen , ya te han dado silla en el consejo de TROW? O se esperan al anuncio de los siguientes resultados?

Me han invitado a Baltimore pero he tenido que declinar el plan porque estoy de examenes.

A ver si hay suerte y con la ampliación marcada en 130$ que tengo me ponen ya el jet privado.