La cotización de Telstra (ASX:TLS) se había desplomado durante las dos últimos meses por la acumulación de malas noticias. El yield está entorno al 7% e incluso se especula con un posible recorte del dividendo. Hoy por fin hay buenas noticias y el valor ha recuperado un 4% en una sola jornada. Me planteo una posible entrada, es la mayor telco del país y lleva 17 años seguidos incrementando el dividendo (aunque como buena telco el crecimiento es más bien raquítico).

¿Alguién sabe si los dividendos no tienen retención en el origen (“fully franked”) a semejanza de otros valores australianos descritos en este artículo de CZD?

May 5 Australia’s competition watchdog said on Friday it will not regulate the nation’s mobile roaming market, in a favourable draft ruling for the country’s biggest telco, Telstra Corp Ltd, which can keep rivals from using its infrastructure.

There was “insufficient evidence” that regulating the market would improve competition, the Australian Competition and Consumer Commission chairman Rod Sims said in a statement, adding that a final decision is due mid-year.

Telstra, a former government-owned monopoly, operates Australia’s most extensive mobile network, and has argued against having to share its regional network with rivals such as Singapore Telecommunications’ Optus and and Vodafone Group at commercial rates.

The company had been lobbying strongly against government regulation of the mobile market, as it would hurt earnings and erode the benefits of a A$3 billion ($2.2 billion) mobile network upgrade Telstra announced last year.

The draft decision comes three weeks after Telstra stock was roiled by competitor TPG Telecom announcing it would build its own mobile network to rival Telstra’s.

The ACCC has previously twice decided against regulating the mobile roaming market

- Telstra welcomes ACCC draft decision on mobile roaming

- “if this decision is confirmed we will immediately move to expand our 4g coverage to reach 99% of population by later this year”

- about 600 base stations will be upgraded from 3g to 4g giving australian population access to a world leading 4g network

- “expect to see up to $1 billion of investment flow to small towns and regional centres across country over next five years”

Me respondo a mí mismo. En este link pone que los dividendos de Telstra son “100% franked” y eso me pone mucho ![]()

Inicio posición en Telstra (ASX:TLS) a 4.35AUD. Ha tocado madrugar un poco porque la bolsa australiana cerraba a las 08:00

Telstra Corporation Ltd (ASX:TLS) Takes a Beating (-10.62%)

Revenue from continuing operations rose 0.4% to $28,205 million

Profit from continuing operations grew 1.1% to $3,874 million

Telstra’s profit fell 33%, but this is due to profits from the sale of Autohome in 2016 that were not repeated this year.

Telstra maintained its dividend at 31 cents per share.

Dividends in 2018 are expected to be up to 30% lower, at 22 cents per share.

Como veis a Telstra? Con sus ultimas caidas su rpd se ha situado en el 9%. aun con una reduccion hasta los 22 cents en 2018, su rpd seguiria estando por encima del 6% a estos niveles.

Bear case

Telstra shares have slumped for a few reasons. Most of them are <i>perceived </i>threats to its status as the number-one telecommunications business in Australia.

The first is the NBN, or National Broadband Network. It is taking away Telstra’s ability to charge other telcos for access to its copper network. That means Telstra’s profit margins in fixed services like voice and broadband will fall.

Next up, Foxtel is…well… being <i>Netflixed </i>.

In mobiles, Telstra’s leading business, <b>TPG Telecom Ltd</b> (ASX: TPM), Optus and Vodafone are pushing harder than ever for a bigger slice of the pie. TPG, for example, is rolling out a high-speed mobile network in densely populated areas only, presumably for a cheap price.

While these threats are starting to play out, Telstra is forecasting a $3 billion reduction in its operating profits over coming years.

Bull case

Investors often underestimate how much easier it is to buy a good business than build one from scratch. But here’s a brief bull case for Telstra shares…

Telstra is being paid by the Government to give up its 100-year-old copper cable network, which was only becoming less valuable if you ask me.

Foxtel is a smallish part of its business, so it won’t be a game-changer if Netflix wins that fight.

And currently, most people <i>know </i>Telstra is the most expensive mobile phone provider — but they still pay up for the right to access its network. In other words, bulls might say Optus and Vodafone will be hurt more by TPG’s push into mobiles.

Finally, Telstra, using current analyst estimates, is tipped to pay a 6.1% fully franked dividend.

Conclusion

That’s why it is important to weigh up the pros and cons for yourself. If you think Telstra’s mobiles business is here to stay, with Foxtel and broadband producing decent cash flow — Telstra shares might be a good buy at these levels.

Hola, segun Degiro Telstra abona Dividendo + Reserva del rendimiento del capital … ¿? Esto es nuevo para mi

En mi caso, 42,75 AUD + 19,95 AUD. ¿Alguien sabe si eso es correcto?

En la nota que os adjunte arriba se especifica que 0.075 AUD son “ordinary dividend” y 0.035 AUD son “special dividend”. Ambos tienen el mismo tratamiento fiscal

"In a presentation to shareholders on 17 October, the company revealed it is set to forge ahead with its plan to hand out a certain percentage of the payments it expects to get from the company behind the National Broad Network (NBN), nbn, in relation to the transition of the telco’s customers across to the NBN.

Now, the company has said it will return in the order of 75 per cent of net one-off NBN receipts to shareholders over time through fully franked special dividends"

Mira que llevo tiempo detrás de esta empresa, pero parece que cuanto mas tiempo la dejas mas va cayendo.

Desde luego que su deuda como todas las telecos asusta, a ver si investigo un poco mas sus números pero $17,284,000 de total debt con unos beneficios netos de 3,891(M)… paga 729.000 de intereses.

Me gustaría Telstra nada mas que por tener un poco de diversificación en Australia pero hoy por hoy me da miedo.

Un saludo y suerte.

Telstra shares slump (-5.00%) as telco warns of lower profits amid ‘challenging conditions’

Telstra has warned investors to brace for a profit at the lower end of its guidance range, but remains committed to a 22-cent total dividend payment.

Financial results for the full year ended 30 June 2019 (15/08/2019)

- Strong progress on T22 strategy in first year

- reduced the number of Consumer & Small Business plans in market from 1800 to 20

- introduced no lock-in plans across fixed and mobile and removed excess data charges

in Australia - launched commercial 5G service

- 7.7 million (22 per cent) drop in calls to call centres

- Total Income, EBITDA and NPAT in line with expectations

- $456 million (6 per cent) reduction in underlying fixed costs

- Continued customer growth, with 378,000 net retail postpaid mobile services added including

181,000 from Belong - Final dividend of 8 cents per share, total dividend of 16 cents per share for FY19

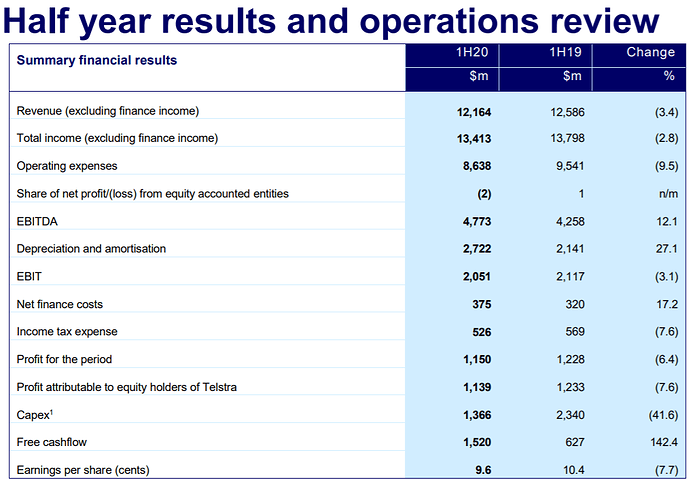

Financial results for the half year ended 31 December 2019 (PDF) (13/02/2020)