Professional managers generally feel compelled to come up with esoteric ideas in a belief that such investments justify high investment fees to clients. This is why the latest pharmaceutical drug, tech start-up, or AI-adjacent business tends to populate the portfolios of professional managers. If a portfolio is stuffed with Hershey, Johnson & Johnson, and Microsoft stock, the clients might think they can figure it out themselves and fire the advisors. Keeping clients is more important than maximizing their wealth and so you get more complicated behavior.

@luisg, ha sido leerlo y pensar en ti ![]()

If you have been a reader for a while, you may recall that I purchased a small stake in Sprouts Farmers (SFM) stock about nine years ago. At the time, I liked the company because it had a small niche in the natural/organic grocer industry and had a strong following in California. It also had net profit margins of around 3% and was planning on large expansion throughout California. The stock was trading around 30x earnings, which I found attractive because the company was so small that future store rollouts and any uptick in the profit margins would cause the earnings to increase substantially so even P/E compression would not be an issue for the stock.

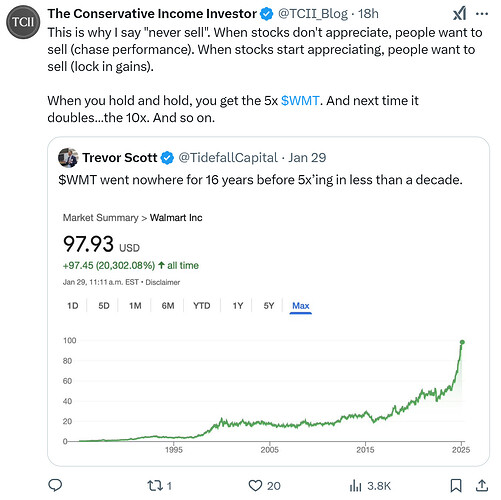

Well, if you looked at the scoreboard, i.e. the stock’s price, during the initial holding years, it would have appeared abysmal. The stock traded in the $30s in 2015, the $20s in 2016, 2017, 2018, 2019, before peaking back up into the low $30s in 2021 and 2022. The stock did not pay a dividend, so there was essentially a seven year period of no gains. Meanwhile, the S&P 500 increased approximately 85% inclusive of dividends.

Behaviorally, there could have been a temptation for an investor to see the dramatic underperformance, the stagnant stock price, and sell it and give up. Focusing on the stock price, however, understated the reality of what was occurring at the business performance level. Sprout was in the process of increasing its store count from 217 stores in 2015 to 386 stores by 2022 as it was expanding into Texas, Arizona, Florida, and Colorado, and was growing net profit margins to the 4% level as it rolled out distribution centers to keep costs in check. Profits per share increased from $.83 in 2015 to $2.39, for a 187% gain in the seven years. The stock price languished, as investors were valuing it at 12x earnings instead of 30x earnings, but the business was growing at a fine rate of 16.3% annually during this time frame.

Between 2022 and today, the investor community has decided to increase its assessment of Sprout and the stock now trades at $147. As the stock has climbed from approximately $30 to $147 over the past nine years, the compounding rate is now around 19% annually whereas the S&P 500 returned 14% annually. Cumulatively, that is 390% with Sprout versus 228% with the S&P 500. The catch, though, is that I made absolutely no capital gains on this holding from 2015-2022 and then all of the compounding occurred in the past two years.

Experiencing this phenomenon is part of the reason why I am in the “never sell” camp, but even without having these anecdotal experiences along the way, I came to the decision philosophically because the overwhelming academic literature demonstrates that investors “sell” decisions cause dramatic underperformance.

Habría que contar también con los casos de las que definitivamente terminan yéndose al guano, o en el mejor de los casos terminan engullidas por otra por cuatro perras de lo que en su día valieron.

No obstante es bien cierto que los ciclos ciclos son y que, por regla general, mas tarde o más temprano termina llegando el día en el que ya sea por acierto corporativo o simplemente porque la corriente de fondo en los mercados es asquerosamente alcista la mayoría terminan dejando atrás el polvo del desierto y volviendo a mejores valoraciones.

Dicho lo cual, lo que es impepinable es que las travesías por el desierto, como la aquí descrita por el amigo Tim, son mucho mas llevaderas cuando le pillan al sujeto con la cartera llena que cuando se anda todo el día haciendo números a ver de donde rascar.

La necesidad es poco amiga de la paciencia, y ojo, que no me estoy refiriendo al amigo @luisg, hablo en general de que todo se lleva con mas calma cuando se va más sobrado que necesitado.

Un saludo.

El post de la composición de cartera no lo recuerdo.

El que pones aquí es de las últimas cartas.

Desde luego, tiene más paciencia que yo ![]()

![]() .

.

En cualquier caso, a pesar de contar muy claro lo que hace, si algo de he achacarle es que no cuenta las cagadas o las maquilla. Lógico si vendes tu newsletter.

- Meta cargó a saco en los 80$ pero no lo dijo hasta que iba por 400$. Lo último que le leí de compras fue en los 175$.

- Under Umbrella nunca se supo.

- Para no ha habido más updates.

Algo ha dejado caer…

In particular, my Disney and Paramount Global positions are down substantially. In the fall of 2022, I made very large allocations into Paramount as the stock was crumbling towards $20 per share. To date, that has been by far my most underperforming investment of my lifetime and nothing else comes close. The S&P 500 is up around 50% since the fall of 2022, and even counting the dividends, the Paramount Global investment has lost almost half its value during this nearly two-year time period. My large investment in Disney is also a paper loss at this point of around 20%.

In the case of the communications sector in particular, I understand that sometimes “value” gives way to “deep value” and that means significant paper losses in the interim. In the case of both Disney and Paramount, the streaming subscriber counts are growing as subscription costs are increasing and budgets for content production are becoming tightened. Plus, it is a presidential election year and the next few months will have significant political advertising dollars flow their way. If stocks did not have daily quotations, most business operations would be thrilled to have the growth of a core business like Paramount+ that has grown from 17 million subscribers in early 2021 to 71 million subscribers today. I suspect the 2022-2024 period will be regarded in hindsight as the low point in the transition - when costs of content production far exceeded subscription revenue - and the economics of the business will improve as subscribers grow (particularly once Paramount Global hits 100-115 million subscribers in which case it could probably report $2 billion in profits in comparison to the August 2024 stock market valuation of $8 billion).

The important part of portfolio construction has always been that individual stocks or even multiple sectors does not derail the overall portfolio compounding.

As a result, my general philosophy with Visa, Mastercard, Microsoft, Amazon, Alphabet, Apple, etc. is something to the effect of, “These companies are great deals at 20x earnings. I intend to buy them even when the P/E ratio is in the mid-20s. But it is not open-ended. Around 30x earnings, or maybe slightly before reaching that level, the buy spigot should be turned off as earnings begin to suffer.”

In short, my learning lesson over the past ten years or so has been, “When you find a great high-growth company, and ‘great’ and ‘high-growth’ are both requirements, you loosen the valuation parameters by 25%. But trouble comes if you loosen them by 50%.”