Gallifante para IBKR.

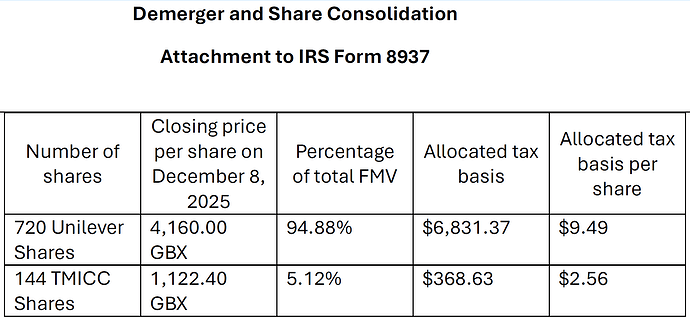

Pursuant to Section 6045B of the U.S. Internal Revenue Code of 1986, as amended, issuers (whether US or non-US) of corporate stock must report certain specified information on IRS Form 8937 if it takes an organisational action that affects the tax basis of US tax resident shareholders in their shares. Unilever’s completed IRS Form 8937 with respect to the Demerger and the Share Consolidation can be found here (PDF 229.29 KB), along with the supplemental attachment (PDF 96.5 KB).

The information above, including that contained in IRS Form 8937 and any attachment referred to above, is provided for informational purposes only and is not intended to be, and should not be construed to be, legal or tax advice to any particular shareholder. Unilever accepts no responsibility for the use that may be made of this information.

Shareholders should determine their own tax position taking into account their own particular circumstances. If you are in any doubt as to your tax position regarding the Demerger and the Share Consolidation you are urged to consult an appropriate professional adviser.