Pero hay liquidacion diaria no ?

S2

Una opinion más sobre 3M

¿Y que viene a decir ±?Es un tocho y mi guiri no es muy bueno que digamos…

Tranquilo. Con el exceso de información, el autor no sabe si comprar o vender, como todos.

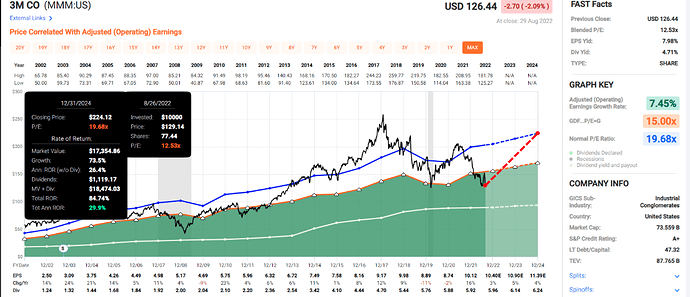

Me hace gracia uno de los últimos gráficos que pone de Fast:

Al final dice que 3M es un magnífica compañía, pero que ahora compraría ALIZY, ENB y VFC

Estaba actualizándome con el hilo y esto que he leído me parece a mí harina de otro costal.

Una cosa es que se le prohíba a la compañía la declaración de bancarrota sobre la división que llevó a cabo todo el negocio de los tapones con el fin de aislar al resto de la compañía de las posibles consecuencias judiciales que se puedan derivar de las demandas interpuestas hasta el momento, y de las que seguramente le seguirán cayendo, y otra muy distinta es que aquellos que promueven esas demandas quieran jugar a gobernar la gestión de la compañía.

El tema de que un tribunal haya impedido que la compañía aplique el chapter 11 sobre su filial Aearo en mi opinión sí tiene base porque lo que intentaba con ello la compañía 3M era impedir que se siguieran presentando demandas sobre su filial por el tema de los tapones auditivos defectuosos que sirvió al ejercito USA, y con ello estaría limitando el derecho a reclamar un daño a aquellos que creen pudieron haber sufrido daños por esos dispositivos defectuosos. Leyendo en foros USA y artículos le daban pocas posibilidades de éxito a esa estrategia por lo que digo, porque lo de impedir que alguien que cree ha podido sufrir un daño no pueda reclamar por ello en su cultura es algo que no se concibe, y mas si los afectados son veteranos y militares en servicio. Allí ese colectivo es una plegaria andante, con ellos se le toca el tuétano a la mayoría de la población.

Pero otra cosa muy distinta es que sin saber aun si esas demandas van a tener éxito o no, ni cuantas de ellas lograrán una sentencia favorable, sin saber seguro si la empresa tendrá que hacer frente a indemnizaciones y la cuantía de estas (se supone por lo expuesto hasta ahora que así será y las apuestas van en ese sentido, pero no hay sentencia firme que así lo diga para todo ese colectivo afectado), sin saber nada de eso, los demandantes (mejor dicho, aquellos que promueven esas demandas que son los bufetes buitre que viven de estas grandes demandas de grupos de afectados) pretendan limitar los poderes de una compañía para seguir gestionando su estructura y actividad como mejor y mas convenientemente estime su órgano de dirección.

Eso no creo que vaya a prosperar, igual que no se puede limitar el derecho de alguien a reclamar por un daño sufrido sobre el que supuestamente ha podido causar ese daño, tampoco creo se pueda limitar el derecho de un gobierno corporativo simplemente apoyándose en el argumento del “por si acaso” refiriéndose a la posibilidad de que tenga que hacer frente a indemnizaciones.

No obstante USA es USA, pero yo no veo que eso vaya a salir adelante sin una sentencia previa que pueda indicar las demandas estimadas y un rango de cuantías para las posibles indemnizaciones y no creo que eso vaya a ser antes que todo el rollo del split off y spin off que se han montado.

Un saludo.

Continuando con la puesta al día, gracias @jefedelforo por recoger el guante y plantear la encuesta. Realmente lograda al plantearla con todas las opciones comentadas ![]()

![]()

Por otro lado, sin que sean unos resultados sorprendentes, sí que me esperaba un mayor porcentaje de votantes, que aprovechando la “nocturnidad” y habiendo hecho voto de contrición, confesaran el pecado. Pero igual es que soy yo muy mal pensado y no hay tanto pecador suelto por ahí … (lo sigo pensando ![]()

![]()

![]() ).

).

Lo dicho, gracias por la encuesta, reveladora.

Un saludo.

https://seekingalpha.com/article/4540955-3m-investors-should-steer-clear

Given 3M’s rising legal risks, bloated balance sheet, and deteriorating outlook, we think investors should steer clear of the company.

During 3M’s second quarter earnings update, the firm cut its full-year guidance for 2022.

3M had a large net debt load on the books at the end of June 2022.

Its legal risks are mounting after a US federal judge ruled in August 2022 that lawsuits over defective earplugs a subsidiary of 3M sold to the military can proceed.

There are better opportunities out there than 3M.

La cara b de la subida del dólar para las empresas con muchas ventas fuera de EEUU

![]()

![]()

![]()

estoy pensando en surfear esta ola alcista para darle puerta a esta, quitarme de spin offs, demandas judiciales y crecimientos paupérrimos del dividendo de los úlitmos años.

Estoy un poco sobreponderado en industriales e infra en REITs. La idea es rotar a un REIT, y estaba pensando en DLR o NNN. Lo que, además, aumentaría mi PADI.

Como no lo tengo claro del todo, admito sugerencias, opiniones, y si alguien está/estuvo en la misma tesitura, preguntarle que ha hecho.

Me vi igual hace unos meses:

La liquidez obtenida la deposité a partes iguales en O y WPC, justo un mes después de la venta. Fue a coincidir que cuando iba tocando la compra mensual se dio una “““““corrección””””” Que al tipo de cambio €/$ acabé comprando a precio medio, pero se va compensando poco a poco con cada cobro.

En cuanto a los reits del comentario, veo que tienen 4-5% de yield, en la media con el sector. Dejando a un lado el PADI, que psicológicamente ayuda y mucho, personalmente priorizo la comodidad/tranquilidad frente a la rentabilidad en una cartera. Que no se malinterprete esto último, busco el yield como el que más, pero prefiero cobros sólidos aunque sean menores que no otros más elevados pero volátiles.

Hagas lo que hagas, el tiempo dirá si la decisión fue la acertada o no, en mi caso, y por el momento, lo fue.

Gregorio cree que entre 100-120 dólares es una buena compra suponiendo que el tema de los tapones no le salga en más de 4 billions.

Ultima compra del año 3M 58 títulos a 124,99$,bajo precio medio.

Pues una de las que tengo en mente tambien para acabar el año. MMM, WBA y TROW son las candidatas para las 3 ultimas compras del año

3M dejará de fabricar y descontinuará el uso de ‘Forever Chemicals’

La compañía dice que ya ha reducido su uso de PFAS, que se acumulan y tardan mucho en descomponerse

3M MMM dijo que dejaría de fabricar los llamados productos químicos para siempre y dejaría de usarlos para fines de 2025, a medida que aumentan las críticas y los litigios sobre el supuesto impacto ambiental y de salud de los productos químicos…

3M dejó de producir algunos tipos de productos químicos PFAS a principios de la década de 2000, pero continuó fabricando otros tipos, que según la compañía se pueden producir y usar de manera segura. 3M dijo el martes que dejaría de fabricar todos los fluoropolímeros, fluidos fluorados y productos aditivos a base de PFAS para fines de 2025.

La compañía también dijo que dejaría de usar PFAS en sus productos para fines de 2025, y dijo que ya ha reducido el uso de las sustancias en los últimos tres años…

Estos no levantan cabeza ![]()