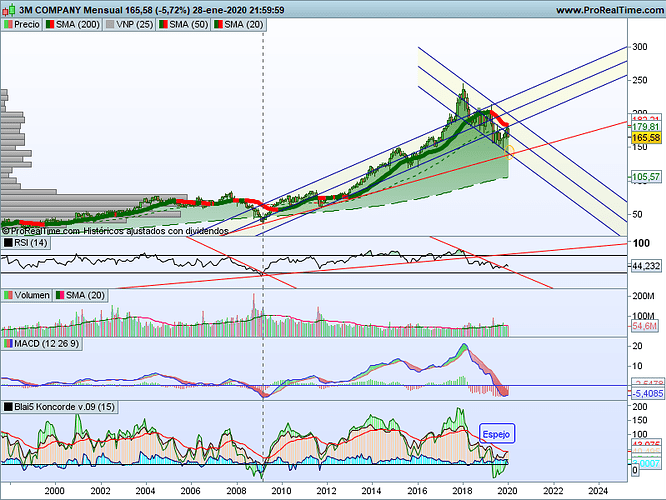

A esto le llamo yo perforar el canal.

Pues si, lo bueno de estos movimientos es que te dejan unos niveles clave a vigilar.

Sí se da otro paseo por los 150$ volveré a cargar

Mucho me parece después de lo que ya lleva de caída pero yo también la espero por ahí, a ver si me da una segunda oportunidad que si me han dado otras.

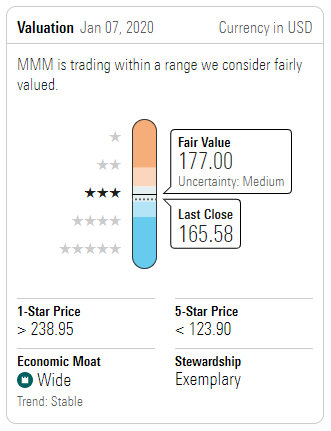

Os pongo la evaluación de M* de la compañía (con el analisis recien salido del horno), quien no es tan positivo con la compañía como lo somos nosotros a estos precios:

Analyst Note | by Joshua Aguilar Updated Jan 29, 2020

Wide-moat-rated 3M’s fourth-quarter and full-year 2019 were relatively in line with our expectations for revenue and adjusted EPS, and exceeded our expectations for free cash flow (cash flow from operations less reported capital expenditures), albeit from a far reduced prior outlook relative to the start of 2019. That said, its 2020 outlook continues to disappoint, although we’re not surprised by these dynamics given continually weak auto build data we surveyed at the close of 2019 (which, per our last review, is expected to remain flat).

Looking at the quarter, segment revenue growth was mostly in line with our expectations. 3M’s health care segment remained solid, with fourth-quarter revenue up 25.4% year over year (roughly flat on an organic basis). Revenue growth in the segment was largely driven by the acquisitions of Acelity and M*Modal. However, the balance of 3M’s segments continued to experience end-market weakness in autos, electronics, and in China. Given its auto and consumer electronics exposure, transportation & electronics was unsurprisingly the weakest among all the segments, declining 5.9% year over year on an organic basis. Safety & industrial declined by 2.8%, and the consumer segment stayed roughly flat year over year.

While auto build data looks like it will remain stagnant for the year, we believe consumer electronics data that we’ve surveyed from Gartner indicates this market will have some rebound in 2020. Despite near-term weakness, we continue to be optimistic in our long-term forecast. Therefore, we don’t expect to materially change our $177 fair value estimate. However, we will reassess all assumptions after we roll our model for the 10-K filing.

Business Strategy and Outlook | by Joshua Aguilar Updated Jan 07, 2020

Market sentiment has turned against 3M stock for three reasons: 1) slowing organic growth as the company matures; 2) recent weakness in the auto, semiconductor, and Chinese markets; and 3) litigation risks related to PFAS. As a result, bears now maintain 3M’s model is irretrievably broken. We disagree.

In our view, 3M is a GDP-plus business. We attribute 3M’s ability to remain ahead of GDP based on its suite of innovative products that are a byproduct of its R&D efforts. At its core, 3M is a materials science company. The firm’s legion of engineers improves everyday products down to their basic chemistry. For instance, 3M’s microreplication technology, which has been around since the 1960s, was originally used in overhead projectors. That technology has now been adapted into multiple use cases, including making signs brighter, reducing friction in aerospace applications, and more recently, is being developed for vaccine delivery as an alternative to hypodermic needles.

The firm’s proprietary secrets are closely held as 3M rarely grants licenses, yet its technology is difficult to imitate. As a result, 3M typically charges a 10% to 30% price premium relative to the market. 3M’s ability to adapt its technology into multiple use cases gives it additional economies of scope which reduce overall unit costs, as evident in its superior gross margins.

While we expect near-term headwinds will continue in 2019, we believe the company can grow its top line over 2% organically over the next five years, with another point from acquisitions. With the recent acquisitions of workflow solutions provider MModal and negative wound care solutions provider Acelity, we believe the firm can capitalize on the stable and ever-growing healthcare market. Healthcare benefits from multiple positive secular trends, including an aging population, greater access to care, as well as rising incidence of chronic disease and surgical procedures. We believe the rest of the portfolio will also benefit from rising industrialization and urbanization trends. Finally, we’ve surveyed prior environmental and product liability cases and believe the stock price bakes in overly pessimistic litigation risks.

Economic Moat | by Joshua Aguilar Updated Jan 07, 2020

We believe 3M has a wide economic moat based on intangible assets and cost advantage. In the diversified industrials space, we believe having a central, leveragable core competence can be pivotal to building an enduring competitive advantage. 3M is an innovative powerhouse that leverages its R&D platform across multiple product categories, with byproducts that include patents, brands, and proprietary technology.

The firm spends about 6% of its net sales on R&D compared with the median 5.5% in the Global Innovation 1000 and the median 2% to 3% for diversified industrial firms. While many firms say they innovate, 3M’s yield on these investments is quantifiably superior. 3M’s returns on research capital in 2018 outpaced each name on 2018’s top 10 Most Innovative Companies as named by Boston Consulting Group. For every dollar spent on R&D in 2017, 3M yielded $8.60 in 2018 gross profit versus about a $5.50 average for the top 10. This is the case even as every name on that list is in the technology sector, and in aggregate, according to Statista, the technology sector accounts for nearly 38% of global R&D spending compared with just over 10% for the entire industrials sector. Over a three-year cycle, returns on research capital for 3M outpaced each firm in the top 10, except for BCG’s number-one ranked firm, Apple. We think this is a testament to 3M’s business model, which emphasizes effective commercialization through two processes: 1) customer-inspired innovation (which focuses on customer spec-ins, at 70% of revenue) or 2) insights 2 innovation (which is a traditional market-driven approach, at about 30% of revenue). The firm receives about 120,000 customer interactions annually. These customer relationships are difficult-to-replicate intangible assets cultivated by over a century’s worth of operations. They have the additional benefit of more efficiently eliminating R&D programs that bear little probability of commercialization, or in the alternative, accelerating those that are potentially high impact and have a high probability of success. Also, 15% of the firm’s senior engineers’ time is unbudgeted to work on any new ideas and projects independent of their normal responsibilities.

3M has strong brands with high share of mind, including household names like Scotch tape, Scotchgard, Post-it, Scotch-Brite, and ACE bandages. Many of the brands command premium pricing. For example, a 12-pack of standard yellow Post-it notes typically sells at a 33% price premium over a comparable generic counterpart. We believe consumers are willing to pay the extra premium associated with 3M’s products given their reputation for quality, as well as superior efficacy. The overall firm has steadily risen in brand value in recent years, climbing from 90th in Interbrand’s Top 100 Best Global Brands to 60th in 2018 and ahead of well-known brands like Nestle and Colgate. With over 55,000 products that touch and concern nearly every industry, the firm’s portfolio is not overly dependent on any single product or category, which increases our confidence in its long-run returns on invested capital.

Additionally, throughout its history, the firm has benefited from over 118,000 global patents awarded to it. According to a search of the U.S. Patent and Trademark Office, 3M has been awarded 9,000-plus U.S. patents since 2001. We believe 3M’s current patent portfolio exceeds the carrying amount of $542 million listed on its 2019 balance sheet. While GAAP accounting does not permit the writing up of an intangible asset, our belief is anchored in the firm’s proven and consistent ability to use these assets to generate excess returns. We further think that the majority (between 80%) of its more recent U.S. patent portfolio is from utility patents based on data from the Intellectual Property Owners Association. To qualify for this designation, these inventions must be novel, new, and non-obvious. Given the comparably higher hurdle to obtain them, utility patents offer advantages over design patents given the intellectual property protection around an invention’s function. They can also protect many different variations of a product with a single approved filing. We think the complexity of 3M’s disruptive technology reflects the strength of its intangible asset moat source, as is the case with microreplication technology used in road signs, grinders, and overhead projectors.

3M’s 46 technology platforms and its manufacturing scale allow it to achieve the lowest unit cost in most of the categories in which 3M competes. As a result, 3M enjoys gross margins between 49% to 50% of sales versus about 37% median for comparable peers. The firm’s shared resources provide for economies of scope, such as in abrasive technology, which affects industrials, construction, and home improvement retail, as well as automotive aftermarket collision repair. The firm’s adhesives can also be used in a wide range of applications, from Scotch tape and Post-it notes to Tegaderm medical dressings.

3M’s emphasis on regionalizing its supply chain reduces complexity in the manufacturing process and allows for shorter supply chains, fewer stock-keeping units, and common processes. This ultimately translates to diminished demand for working capital and greater capital efficiency, drives down unit costs, and improves customer experience with fewer back orders. These cost and customer service benefits are amplified with a common enterprise resource planning platform, which further integrates various functions across the supply chain, from procurement to production.

In addition to the benefits 3M gets from being geographically proximate to its customers, the firm also derives economies of scale from managing a supply chain across a broader geography that is vertically integrated. The firm manufactures many of its own raw materials at a lower cost than competitors. Moreover, 3M has 200 plants around the world, and these are anchored to sites that are 4-5 times larger than a typical plant. These larger plants are on average 40%-45% more productive than smaller plants and tend to drive inventory turns that are on average 15% faster. This same phenomenon holds true for the firm’s distribution centers, which are 20%-25% faster than smaller local distribution centers.

By our calculations, during the 10-year period from 2009-18, 3M achieved incremental returns on tangible assets of about 31%. For at least the past 25 years, its returns on capital (including goodwill) have more than doubled our estimated cost of capital, even during years when the company endured negative sales growth. Even during the worst of its past 10 years, 3M still managed to earn returns including goodwill that cleared its weighted average cost of capital hurdle by more than 2.5 times. As a result, we have a high degree of confidence that 3M will continue to produce excess returns for at least the next 20 years.

Fair Value and Profit Drivers | by Joshua Aguilar Updated Jan 08, 2020

After making tweaks to our 2020 assumptions and pushing out the timing of certain cash flows, we raise our 3M fair value estimate to $177 per share (the $1 raise due only to time value of money). We value the stock at just over 18 times our 2020 EPS assumptions. We note that historically the stock trades at a premium relative to other diversified industrials (which typically trade between 15 times and 20 times forward earnings).

Some of the most influential growth drivers we observe from 2021 to 2023 include the personal protection equipment market (at 6%-plus growth), global medical dressings and medical software markets (at 4%-plus and 6%-plus respectively), as well as traffic safety (5%-plus) and adhesives (5%). With 3M’s current lineup, we forecast the firm will increasingly direct its R&D and capital expenditure spending toward these divisions, which we conclude are higher-growing portions of GDP. The PPE market, for instance, is driven by growing concerns surrounding employee health and safety in tandem with new regulations. We believe the firm is well-positioned in this space given its material science core competency. The PPE market demands innovative products that balance comfort, aesthetics, and lighter fabric, as well as premium quality in protective materials. Rising manufacturing and construction production in developing economies in the APAC region should further propel growth.

In medical solutions, we project rising incidence of wound infections around the world. Diabetes and chronic disease are on the rise. Aside from 3M’s legacy strength, the acquisition of Acelity should also provide 3M with a much stronger footing in the negative wound care market. A rising geriatric population is another industry tailwind. Other portions of 3M’s Health Care segment benefit from the trend toward value-based care, such as work flow solutions for doctors that improves documentation of patient care.

Risk and Uncertainty | by Joshua Aguilar Updated Jan 07, 2020

3M is exposed to several risks, including slowing organic growth as the company matures, end market weakness in short-cycle businesses, a slowdown in industrial production, execution risk related to its recent acquisitions of MModal and Acelity in 2019, as well as market rejection of new product introductions, which is crucial given the company’s emphasis on innovation, and more recently, litigation over some of its products.

Of these risks, we think the most critical risk is related to PFAS, which are a class of organic fluoride-based compounds created by 3M in the 1940s. These compounds aren’t easily broken down in nature, but are found in the water supply in portions of the United States and Europe. 3M originally manufactured them in everyday products like non-stick pans and fire-retardant materials, but were voluntarily phased out by the company; this process began in the early 2000s.

Nevertheless, the firm has had to settlement environmental suits, including against its home state of Minnesota in the amount of $850 million versus a suit that originally sought a payout of $5 billion from the office of the state attorney general. The firm recently reserved $235 million for five manufacturing sites, including three in the United States and two in Europe. However, we point out that this reserve does not account for product liability risks, which are significant given an association with higher cholesterol among exposed populations, with a limited association of low birth weights and immunological effects.

That said, we think the market is over-aggressively baking in a litigation liability that exceeds likely outcomes (we guess the market is assessing about a midteen billion dollar penalty). However, our survey of prior environmental and product liability cases leads us to assume a low- to mid-single digit billion-dollar liability is far more likely.

Le ha faltado fuerza para volver a meterse en su canal alcista de largo plazo. Y la bajada de un 16% en el beneficio del 2019 fue la disculpa perfecta para la bajada. Yo la voy a esperar entre los 140$-150$

Yo pensaba en los 150 pero es verdad que en situaciones asi se pasan de frenada, a ver si hay suerte y llega a los 140, seria un gran precio

A 150 estuvo hace pocos meses, según el gráfico, así que no tendría por qué ser raro que una vez que se ha puesto en modo bajar vuelva a llegar ahí. Lo de los 140$ lo digo porque coincide aprox con la línea roja que he dibujado. Entre esos niveles de precio estaríamos hablando de una rentabilidad por dividendo de entre 3,84% y 4,11%.

He hecho cosas en la vida peores que pegarle un tirito a MMM con una rentabilidad del 4%.

Sobre los 140 la espero yo tambien.

Jajaja, qué bueno!

Si baja a 140-150$ no tendré que pensarme mucho dónde meto mis próximas compras, la verdad.

Pues nada, a ver si le dan un bajoncillo y con lo que compremos nosotros se va hacia arriba

Los resultados no han gustado demasiado al mercado. Se prevee que el crecimiento orgánico sea plano y solo crezcan a base de compras durante unos años.

Si el mercado le coge manía muy posiblemente se vaya más abajo y cotice durante un tiempo a unos múltiplos de PER más acordes a la media de su sector, más cercano a 15.

“We value the stock at just over 18 times our 2020 EPS assumptions. We note that historically the stock trades at a premium relative to other diversified industrials (which typically trade between 15 times and 20 times forward earnings).”

Según datos de M*

Normalized Diluted EPS (TTM) 8.47$

Para un PER de 15 sale un precio de 127$

Quizás sea exigente pero puede marcar un límite de la cotización.

Para asegurar habría que ver el dato que han reportado ellos de EPS en sus cuentas.

Esta situacion es la que hemos comentado otras veces, en valores de calidad hay que aprovechar los momentos de debilidad, dudas, si estamos convencidos que es solo un problema temporal, lo cual es otra historia.

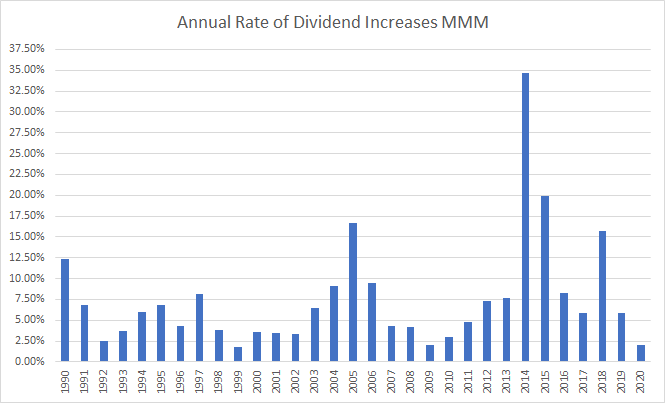

62 años y contando, impresionante!

Cuanto hacia que solo subia un 2%?

Según la lista CCC desde 2009.

Veamos el lado bueno. Están viendo el fin de ciclo y son conservadores. Por eso la elegimos casi todos.

Mirándolo por el lado bueno, ha caído un 20% el último año y aún y así sube el dividendo. Si se está formando cartera es perfecto.

Las 2 ultimas veces que el dividendo crecio tan poco hubo 2 crash bursatiles

Esta vez es diferente

Bueno, pero dos veces tampoco parece un muestreo demasiado exhaustivo no? O seré yo que me pone nervioso sacar conclusiones de correlación y causalidad con un par de observaciones…

aunque bien es cierto que en este caso no afirmas que haya causalidad.

aunque bien es cierto que en este caso no afirmas que haya causalidad.