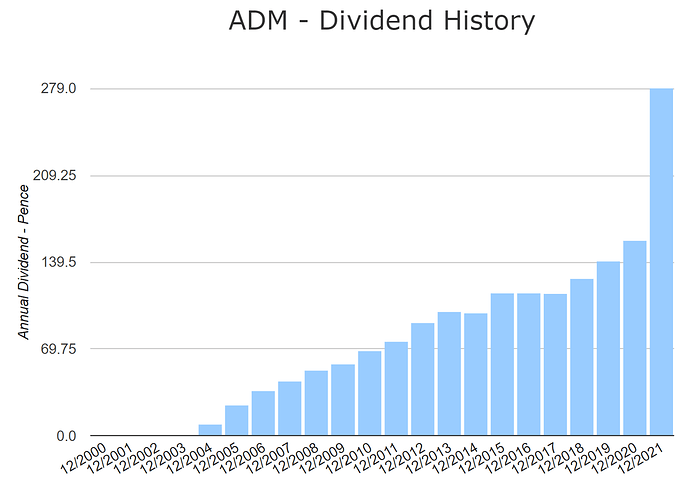

O quizás el dividendo pagado en el 2021 no fue “normal”. Salvo esa anomalía yo veo una gráfica bastante DGI.

A mí también me sorprendía porque como muchos os declaráis DGI no me encajaba mucho. Aunque esta en el medio y largo plazo tiene unos crecimientos de resultados y dividendos muy buenos, que al fin y al cabo es de lo que se trata.

@Marcos_Torcal_Garcia Mi pregunta era otra, pero muy de acuerdo con esto otro que comentas. Las etiquetas limitan y te hacen perder el foco de lo realmente importante.

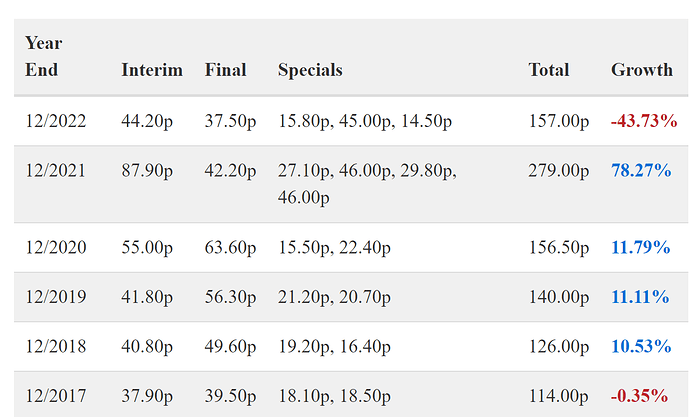

Tienes que seguir la evolución dividendos ordinarios, @ruindog , o en este caso particular incluso puedes añadirle los “special habituales”, todo es debatible. Pero no se pueden mezclar con la distribución de dividendos por la venta de Penguin.

En este 2022H1 el ordinario y suma de ordinario más special habitual ha caído respecto a 2021.

Si se quiere ser DGI estricto ya se sabe, a por los aristócratas “usanos” y nos dejamos de milongas. Sota, caballo y rey.

Analyst Note 08/10/2022

Admiral delivered a near 20% rise in operating profit to GBP 257.2 million in the first half versus the prepandemic comparable period of 2019. This was driven by a combination of business growth, pricing, and underwriting. While Admiral estimates around 11% claims inflation in the U.K. motor market, it raised prices by 16% for the back end of the second half. Yet, management expanded the business with a 3.4% rise in vehicles insured. Admiral looks to be well ahead of the market in terms of pricing and growth. The drivers of claims inflation have not changed, with a normalisation of U.K. driving patterns and a rise in the prices of used cars. Labour shortages and wage inflation are also adding pressure to the cost of claims and repairs. However, Admiral has outlined a policy of margin over growth for the second half and said there are signs that secondhand-car prices may start to decline in the second half. The broader U.K. business showed 10.6% growth in households insured, as we believe it continues to take share from others.

In the international business, while the profit result was negative, we are encouraged by the growth in the first half. Vehicles insured developed by mid-single-digit percentages across the board, with particularly strong delivery in Italy and Spain. Used-vehicle prices have not seen anywhere near the rise that they have in the United Kingdom and the United States, and that came through in the positive European result. However, with loss ratios rising by 14% in the U.S. at large, Admiral posted a negative $25.7 million net result. Most of the U.S. motor market is on a six-month renewal cycle, which should help with the speed of Admiral’s 23% price rise.

We maintain our GBP 35 fair value estimate while we update our model and do not anticipate we will change it by more than 10%. We also maintain our narrow economic moat rating, which is predicated on proprietary technology-driven intangible assets.

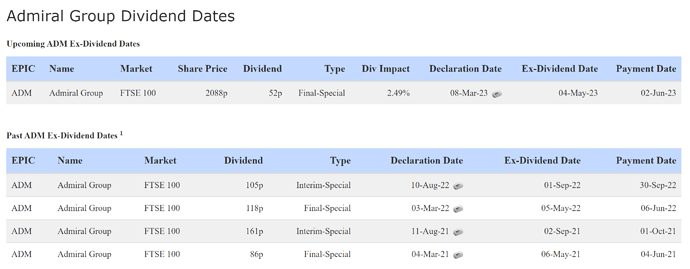

En este artículo explican que se debe tomar como referencia el dividendo pagado en el 2019 (140p). Esperan que en este 2022 se paguen 147.40p (dividendo especial por la venta de portales aparte) y 156.60p en el el 2023. Hablando en plata, no hay recorte ![]()

2019 financials are more representative, as 2020 and 2021 benefited from lower claims frequency due to COVID-19; 2021 also included cash proceeds from the Price Comparison Website (“PCW”) disposal.

Admiral’s Dividend Yield is somewhat subjective because of the one-off component in recent dividends. The dividend was 140p in 2019 and 279p in 2021, but the latter included 92p funded by the PCW disposal. For H1 2022, the total interim dividend is 105p, or 60p excluding the final 45.0p funded by the PCW disposal; the 60p figure represents a small decline from the 63p declared in H1 2019

Admiral targets paying out 65% of its EPS as regular dividends and has been paying special dividends every year. Including special dividends but excluding the PCW disposal proceeds, the Payout Ratio has been near 90%. If we apply this ratio to our forecasts, we arrive at dividends of 192.4p for 2022 (including 45p from PCW) and 156.6p for 2023.

On balance, we believe the 2023 forecasted dividend of 156.6p is the most representative. This implies a Dividend Yield of 7.0%.

Yo no digo que con esta no se vaya a ganar pasta, ni que no vaya a continuar con una decente política de retribución al accionista, para ser sincero, aunque la tengo en la excel no la sigo apenas, así que no tengo una opinión fundada sobre si está cara o barata, pero la sensación que tengo, solamente con lo que os he ido leyendo en el hilo, es que a día de hoy a esta se llega tarde, muy tarde.

Esta ya ha soltado lo más grande que es el especial de la venta de los portales. Eso para los que estaban dentro con mucho invertido habrá sido como si les hubiese tocado la lotería, pero creo que para los que se puedan arrimar ahora a ella igual no tanto.

No sé, me tendría que parar a leer el hilo de nuevo, luego buscar a ver qué van diciendo por ahí de ella, después actualizar los cuadros y ver cómo sale en la foto y tal, y tal … pero infundadamente o no, ya digo, la sensación que me provoca es la de que ahora se llega tarde. Y para compensar eso sugiere pedirle mucho descuento.

Un saludo.

No sé si acertaré, pero la estoy esperando a 1500

De momento tengo unas cuantas a 2444.

Pudiera ser que en octubre/noviembre venga la tremenda. Dios te oiga y llegue a 15 pounds ![]()

Lo que también puede tener sentido es que este rebote, ya más del 33% en unas pocas semanas, sea temporal y pronto vuelva a girar al sur hacia los mínimos de 17 libras.

¿Algún astrólogo que la destripe? ![]()

¿Y a esta qué le pasa hoy para abrir con un -15%? ![]()

Que DLG ha dicho que suspende el dividendo

![]()

![]()

![]()

Pues espero que esta y LGEN no sigan sus pasos… que son las que llevo yo.

Si mas pronto hablamos…

He comprado algo de cada y a esperar que escampe o que nos pille el chaparron.

S2

En ambas estoy yo también… junto con ADM. Veremos.

En el ejercicio fiscal 2022 pagaron 45p de la venta de los portales Penguin. Excluyendo ese tema han venido a pagar los 112p que comenta @faemino, bastante menos que en el 2020.

Con esta empresa y el jaleo de sus dividendos hace que sea difícil saber cuánto pagará con tantos especiales. No sé si ya habrán acabado con los especiales por venta de portales y demás.

En la noticia hablan de un dividendo total para el año 2022 de 112 peniques.