Warren Buffet compró a unos 86$. Si vuelve a esos precios hay que volver a cargar.

Creo que Buffet las llevaba compradas a una media de 149$ según un artículo que leí el otro día.

Yo entro hoy a 143$.

Creo que empezó a comprar a unos 86 dólares y que las lleva a una media de 144 aprox. Ahora mismo irá palmando unos 3500 millones de dólares con ella en la caída, jaja. ¡Yo ya me hubiese suicidado!, y él hasta puede que se haya puesto contento porque puede comprar más a mejor precio…

Ojo, porque si Apple no reacciona rápido en la nueva “guerra” por los dispositivos móviles plegables, podría quedarse atrás con respecto a otros competidores como Samsung o Huawei que ya han presentado el suyo al mercado…

¿Alguien sabe quién fabrica estas pantallas plegables? ¿Corning?

Me contesto a mí mismo:

- Samsung -> pantalla Samsung

- LG -> pantalla LG

- Huawei -> pantalla BOE

- Xiaomi -> pantalla Visionox

Incremento de dividendo de Apple

Nota de Apple para la presentación de resultados y nota del incremento del dividendo:

“Reflecting the approved increase, Apple’s board of directors has declared a cash dividend of $0.77 per share of the Company’s common stock, an increase of 5 percent. The dividend is payable on May 16, 2019 to shareholders of record as of the close of business on May 13, 2019.”

En cuanto a los resultados:

Cupertino, California — April 30, 2019 — Apple today announced financial results for its fiscal 2019 second quarter ended March 30, 2019. The Company posted quarterly revenue of $58 billion, a decline of 5 percent from the year-ago quarter, and quarterly earnings per diluted share of $2.46, down 10 percent. International sales accounted for 61 percent of the quarter’s revenue.

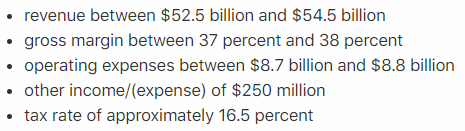

Y esta es la guidance para el 3erQ fiscal:

<<< Supreme Court rules against Apple in App Store case; shares -5.6%

May 13, 2019 10:10 AM ET|About: Apple Inc. (AAPL)|By: Jason Aycock, SA News Editor

Apple (NASDAQ:AAPL) is off 5.6% in short order as the Supreme Court has ruled against the company in its App Store antitrust case.

Hundred of millions of dollars in penalties are at stake in the issue.>>>

Sacado el enlace de Seeking Alpha.

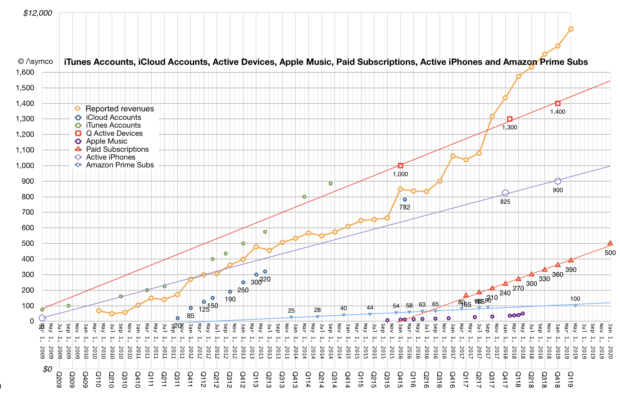

“Horace Dediu is one of the best Apple analysts. Everyone who is invested or interested in Apple should read the article at this link.”

http://www.asymco.com/2019/05/16/the-pivot/

The iPhone is the most successful product of all time.

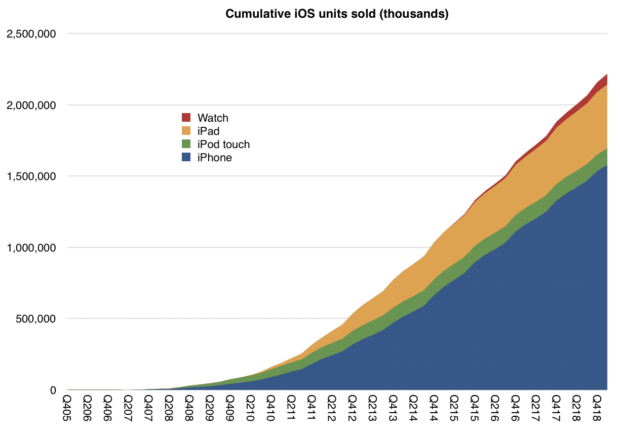

Over 1.6 billion have been sold. Including the iOS products it spun off, the total is over 2.2 billion. Of those 2.2 billion sold, 1.5 billion are still in use.

There are about 1 billion iPhone users.

Economically speaking, iPhone sales have reached one trillion dollars.1

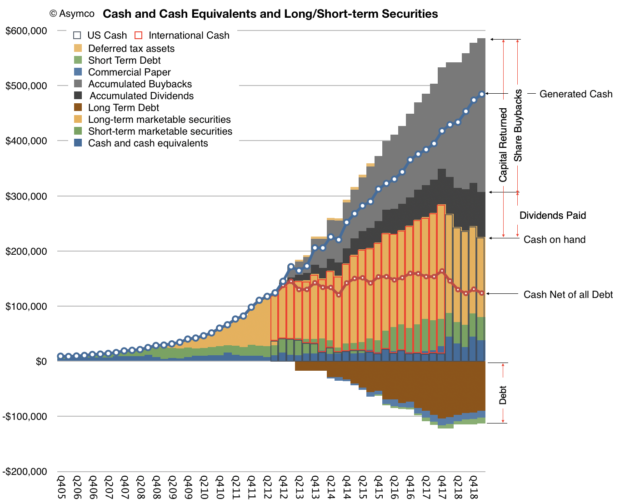

Since the iPhone launched, Apple’s sales have totaled $1.918 trillion. Of those trillions about one half a trillion was accumulated in the form of income.

Of that half trillion in income, $360 billion was paid out to shareholders2. and $131 billion was paid in taxes.

This sounds like a good business, but no business is good if it is static. What makes a business great is dynamism. The idea is to constantly maneuver for a new or enhanced way of doing business as technologies enable entrepreneurs to fundamentally change how value is captured or allocated.

The iPhone story isn’t static, the “pivots” or change in direction are several:

- The App Store, a platform for collaborative innovation where millions of developers are offered the chance to improve the product.

- Accessories, a licensing model for third-party hardware that works with the iPhone

- Distribution through multiple channels

- Integration with other Apple Products

- The marketing of older products alongside new ones at reduced prices

- An expanded product portfolio with a broader range of prices

- Trade-in and financing options

Each of these initiatives contributed to the iPhone growth story but the biggest change in business model was the addition of services. Apple Services grew out of the iTunes business that pre-dates the iPhone and was established to provide content for the iPod.

In 2006, the year before the iPhone launched, Apple customers spent $3.3 billion on iTunes, Software and Services. By 2018 the spending rate was $80.5 billion/yr. It’s very possible that this year’s spending rate will reach $100 billion/yr. This new division is simply called Services today and consists mainly of third-party apps and third-party content sales as well as licensing.

Recently Apple launched a set of new services that it will offer itself. This includes television, films, financial services and news. Apple already has a music service of its own and file storage (iCloud) both of which are offered as subscriptions.

Apps are also allowed to offer paid subscriptions, and that total has reached 390 million, growing at 30 million a quarter with an expected total of 500 million by 2020. That amounts to one subscription for every other iPhone in use.

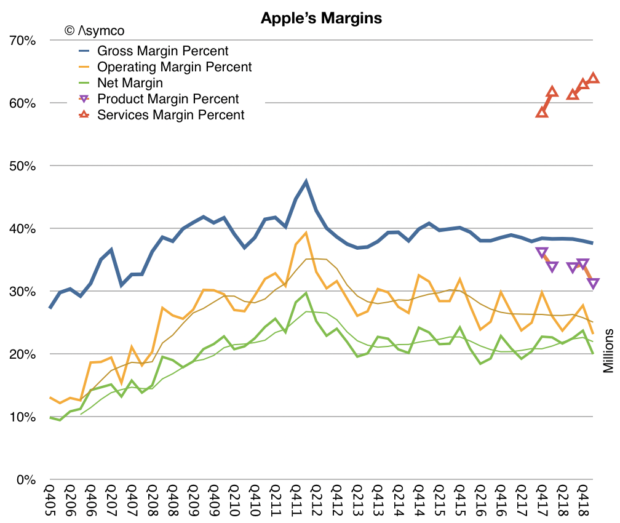

Some would argue that even with a $43 billion revenue rate, ($80 billion billing rate)3 Apple’s business is still a hardware business and that comes with low margins, potential for disruption, non-recurring revenues and cyclicality.

This is not the case. Apples’s business has high margins (64% gross margin for services, 34% for products), has been resilient over 12 years while attracting hundreds of imitators at lower price points, and has loyalty and satisfaction which results in more than 90% re-purchase rates. Cyclicality is driven by seasonality and product lifespans, not competition.

This common misconception of Apple is why it continues to be valued at a deep discount to not only peer companies who are services oriented (Google, Facebook, Microsoft and Amazon) but also at a discount to the overall market (the S&P 500).

Apple, since its inception, has always been oriented around its customers, not its products. The questions asked by management are “what can the company do to deliver experiences and satisfaction” rather than “what products can the company build”.

Every company is bound by its capabilities but the best companies re-shape these bounds because they are defined by priorities.

A priorities-driven company habitually re-designs its processes and its resources. A resources- or process-driven company re-designs its priorities as its capabilities change.

Moving as it does between computers, devices, software, services, retail, logistics and manufacturing means that it’s not classifiable as an “x” company where “x” is an industry sector. Rather, the company should be classified by the set of problems it seeks to solve (e.g. communications, community, productivity, creativity, wellbeing).

This disconnect between what people think Apple sells and what Apple builds is as perplexing as the cognitive disconnect between what companies sell and what customers buy.

Companies sell objects or activities that they can make or engage in but customers buy solutions to problems. It’s easy to be fooled that these are interchangeable.4

Conversely Apple offers solutions to problems that are viewed, classified, weighed and measured as objects or activities by external observers. Again, it’s easy to be fooled that these are the same.

This analysis is, of course, applicable to any company. Here I’m using Apple as a lens. This is because it’s just so much easier to tell this story with the narratives and anti-narratives that are so widely disseminated.

- The milestone of $1 trillion iPhone revenues was reached in the fourth quarter 2018 during which time the stock price of Apple fell by 40%.

- As a result, the number of outstanding shares has decreased by 29%

- The difference is in the way Apple accounts for App Store revenues: declaring only the 30% portion of sales that it keeps as revenues, and not including the 70% that is paid out to developers. The “billing rate” is what consumers spend, the “revenue rate” is what Apple reports.

- They are only correlated. Purchase decisions are not caused by a product’s existence. The real cause is a combination of need and supply and time and circumstance of purchase.

Apple Reports Third Quarter Results (30/07/2019)

- Quarterly revenue of $53.8 billion, an increase of 1 percent from the year-ago quarter.

- Quarterly earnings per diluted share of $2.18, down 7 percent.

- International sales accounted for 59 percent of the quarter’s revenue.

Guidance for the fiscal 2019 fourth quarter:

- Revenue between $61 billion and $64 billion

- Gross margin between 37.5 percent and 38.5 percent

- Operating expenses between $8.7 billion and $8.8 billion

- Other income/(expense) of $200 million

- Tax rate of approximately 16.5 percent

Las FAANG tomando posiciones en el negocio bancario. Que viene el coco… ![]()

Los bancos van a tener que ponerse las pilas, se les acaba el chollo de ser los niños mimados de los gobiernos. Más de uno va a tener verdaderos problemas.

Eso está por ver. No digo que no pueda ocurrir, pero los bancos tienen aún muchos mangoneos con los partidos políticos y eso les acaba haciendo poderosos.

¿Alguien se imagina a Apple o Google regando con dinero a los políticos de turno como hicieron las Cajas? Si lo hacen, acabarán siendo como un banco más.

Así es @born-to-run. Esto se soluciona aplicando una de las máximas de una economía de mercado y que los bancos no la cumplen, la libre competencia.

Fourth Quarter 2019 Results (30/10/2019)

Apple today announced financial results for its fiscal 2019 fourth quarter ended September 28, 2019. The Company posted quarterly revenue of $64 billion, an increase of 2 percent from the year-ago quarter, and quarterly earnings per diluted share of $3.03, up 4 percent. International sales accounted for 60 percent of the quarter’s revenue.

Guidance for its fiscal 2020 first quarter

- Revenue between $85.5 billion and $89.5 billion

- Gross margin between 37.5 percent and 38.5 percent

- Operating expenses between $9.6 billion and $9.8 billion

- Other income/(expense) of $200 million

- Tax rate of approximately 16.5 percent