Hilo para Archer Daniels Midland aprovechando los resultados los resultados del último trimestre de 2016, con un BPA de 0.73$ (del cuatrimestre) que trae un incremento del dividendo del 6.6% (de 30 centavos a 32).

Buenas noticias, el incremento no es demasiado pero en todo caso supera la inflacion. Esto unido a su evolucion en bolsa la hacen una buena inversion. Me gustaria coger un nuevo paquete pero ha subido mucho respecto al precio q la compre, 33 $.

Cayendo el 9,18%, a pesar de hacer un beat in earnings y profits respecto año pasado ![]()

![]()

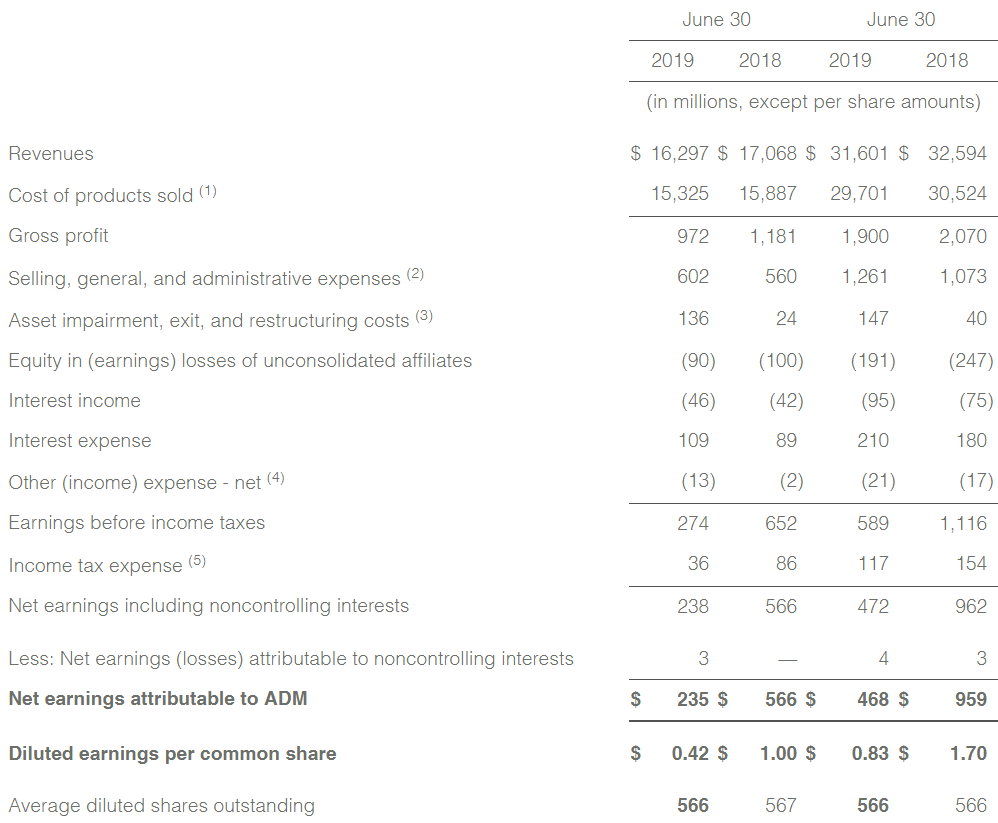

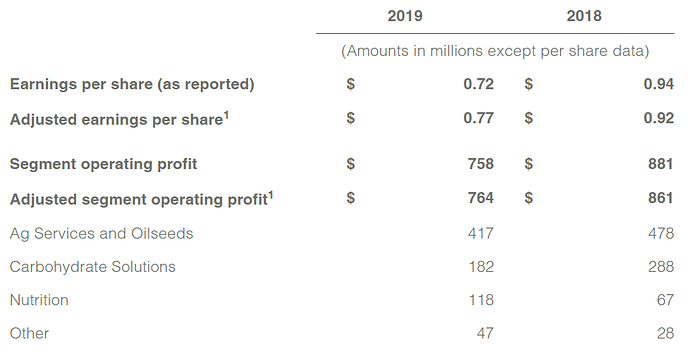

Second Quarter 2019 Earnings (01/08/2019)

A 37.70 USD está interesante en estos momentos.

En cada página que busco encuentro cifras distintas, pero me sale que el FCF de ADM es negativo. Hasta ahora no he invertido en ninguna empresa con este problema. Entiendo que esto significa que no genera el suficiente dinero como para compensar pérdidas, ¿no es así? ¿No es esto un grandísimo inconveniente, o es más normal de lo que parece?

Los datos los saco principalmente de Morningstar, donde en el informe anual de 2018 me sale un FCF de -5,626 millones. Los cojo anuales porque el FCF trimestral no lo encuentro por ningún sitio, pero los Operating Cash Flows de los dos últimos trimestres me salen negativos (Q1: -2,04 y Q2: -0.68)

Un poco pobre el incremento este año ¿no?

pues espero que vuelva a bajar de 40 para poder entrar

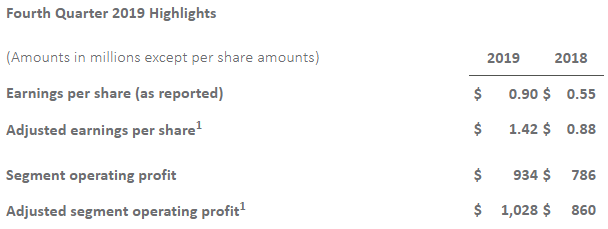

ADM Reports Fourth Quarter Earnings of $0.90 per Share, $1.42 per Share on an Adjusted Basis (29/01/2020)

Aunque ya lo ponían más arriba, pongo el enlace a la nota de la empresa del incremento de dividendo (30/01/2020):

- Board of Directors has declared a cash dividend of 36.0 cents per share on the company’s common stock, a 2.85% increase from last quarter’s dividend of 35.0 cents per share. The dividend is payable on March 5, 2020, to shareholders of record on Feb. 13, 2020.

- This is ADM’s 353rd consecutive quarterly payment, a record of 88 years of uninterrupted dividends. As of Dec. 31, 2019, there were 557,307,980 shares of ADM common stock outstanding.

Tenia pensado añadir ADM hasta que mirando rapido las cuentas he visto algo raro, a ver si alguien que la tenga mas estudiada puede aclararmelo:

Como es posible que los ultimos años venga teniendo Beneficios netos positivos mientras que su cash flow de operaciones es negativo (y por varias veces ademas).

Me echa para atras tambien el hecho de que no genera cash suficiente para pagar capex y dividendos.

Me estoy perdiendo algo o es un fallo de novato al mirar la contabilidad?

Yo también tengo esas dudas, estaba pensando en iniciar posición.

Buenas noches AngelRR

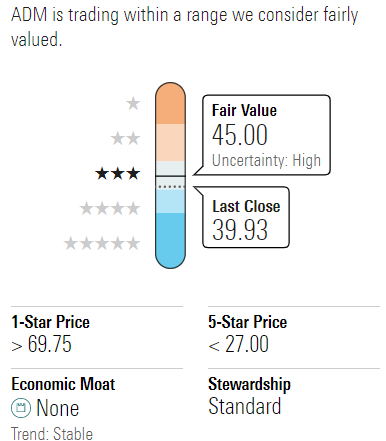

¿ Qué hiciste finalmente ?. Veo que el 19 de Febrero cerró a 43,97 $ y que luego ha tenido bastante volatilidad ( ahora mismo la veo a 39,93 $). Durante este tiempo yo he realizado 3 compras y están a 36,52 $ siendo una de las pocas que tengo en verde.

En “mis ratios” me salía como bastante aceptable como para formar parte de mi cartera de consumo defensivo. Bien es cierto que su incremento de FCF en los últimos 5 años es la mitad que su incremento en los dividendos, pero tampoco su P-O es demasiado alto así que…

Bueno, aquí me tienes si consideras interesante que comentemos.

Gracias y salu2

Buenas noches, finalmente no compré, hablo de memoria pero revisé que tenia un margen neto bajísimo, como del 2 y algo % y un ROE tambien bajo.

Mi idea es comprar para mantener siempre y aunque no dudo de que es una buena empresa y da una RPD alta esos dos datos me terminaron de echar atras. En la caida de marzo-abril estuvo rondando semanas los 38 y tampoco me decidí.

De consumo defensivo me decanté por PG (sigo esperando a que caiga a los 110) y empecé a mirar otras tipo Automatic Data Processing y Waste Management, mas calidad pero a unos precios prohibitivos…

Un saludo.

Si, yo eso lo tuve en cuenta, pero tambien tuve en cuenta que en su sector son 3-4 jugadores a nivel mundial y ADM es uno de los principales

Cuando hay dudas, el precio marca mucho, yo las pille a 35,7 y para mi es un buen precio.

ADP está cara, pero para una primera entrada, tampoco me parece el precio actual una auténtica locura. Lleva un buen recorte desde máximos.

Estaba como tú y al final me animé a entrar a 112€, harto de esperar. Si cae más, ya iré ampliando

Yo las he ido comprando poco a poco y ya tengo completada la posición en un promedio de 36,62 $ . No quiero que represente + del 1% de la cartera.

Efectivamente, tanto su ROA como su ROE son bastante flojuchos para el sector consumo defensivo.

A cambio, los precios que hay que pagar por su FCF y por su DPA son bastante razonables para este sector.

¡ Y que Dios reparta suerte !.