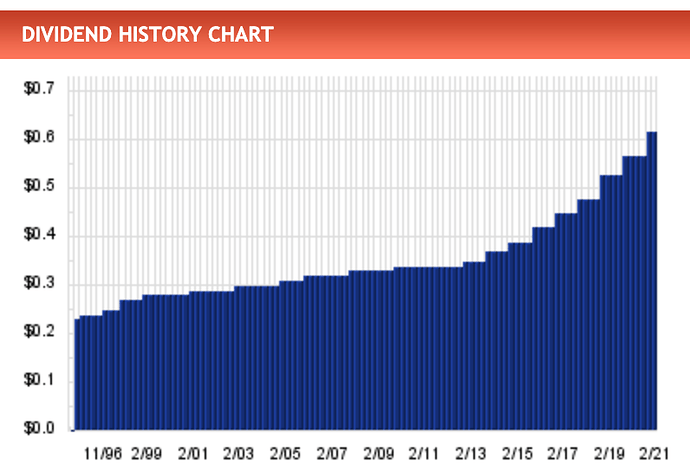

Dividend history:

Hola @anbax, como conocedor del tema utility en USA, ¿qué opinión tienes de Atmos Energy (ATO) o no le has echado nunca un vistazo?

Estoy buscando una utility tranquila y con gran historial de incrementos de dividendo, deuda no desbocada, etc., lo típico vamos, y me gustan varios ratios de esta empresa.

![]()

![]()

![]()

Jaja no conozco nada del tema utility en USA pero ATMOS esta entre las mejor consideradas por M* (Low uncertainty y Exemplary stewardship)

Te pego el ultimo analisis

Atmos Energy Capital Investment Plan on Track Providing Growing and Secure Dividend

Analyst Note 02/03/2021

We are reaffirming our $108 per share fair value estimate after Atmos Energy reported 2021 first-quarter earnings and reaffirmed full-year guidance. Reported EPS were $1.71 in the recently ended quarter versus $1.47 in the same period last year. The strong results were driven by rate increases from infrastructure investment, solid customer growth, and lower O&M expenses.

The lower O&M expense appears to be the timing of maintenance projects due in large part to the impact of COVID-19. We still expect full-year maintenance expense to be $675 million, 7.2% higher than last year and at the midpoint of guidance.

We are reaffirming our 2021 EPS estimate of $5.10, at the top end of the unchanged guidance range of $4.90-$5.10. Although capital expenditures in the first quarter were almost 15% less than the same period last year, this was also a pandemic-related timing issue and our $2.1 billion full-year estimate is unchanged.

We are also reaffirming our five-year capital expenditure estimate of $12.3 billion, slightly higher than the top end of management’s $11 billion-$12 billion target. Our estimated capital expenditures are 68% higher than the amount Atmos invested in the previous five years. We expect over 85% of this investment to be for pipeline replacement and other safety-related projects, which we have a high level of confidence will receive the support of regulators. We expect our above-guidance estimate of infrastructure investment to result in 8% average annual EPS growth over the next five years, the top end of management’s 6%-8% target.

Investors’ concern over the future of natural gas for building space and water heating has pressured valuations of natural gas utilities. However, we believe electrification of building space and water heating has significant technical and economic obstacles, and the market’s misperception of the future of natural gas results in an attractive price for the largest pure-play natural gas utility in the country.

Bueno, igual me lié entre utility y midstream, que esto último ya lo tocas más

Llevo unos días echando un ojo a las cuentas, web, proyecciones y me parece buena empresa para “gente aburrida como yo”.

Gracias por responder.

Análisis de Dividend Growth Investor

Lo que me chirría un poco es el aumento del número de acciones. Pero mirando otras utilities veo que tampoco es algo que sea exclusivo de ATO. Tampoco es que entienda yo mucho de esto…

dejo algunos datos sobre Atmos, que cada uno conforme su opinión:

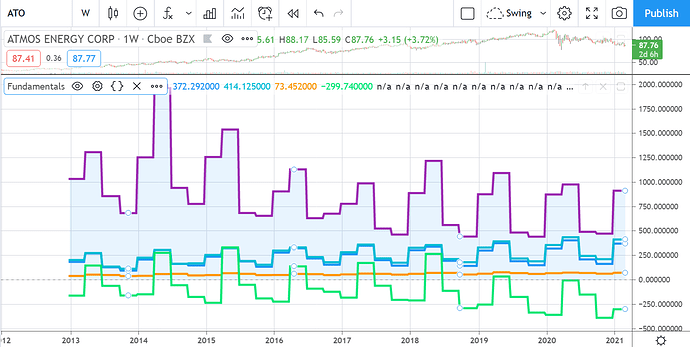

revenue decreciente y free cash flow negativo:

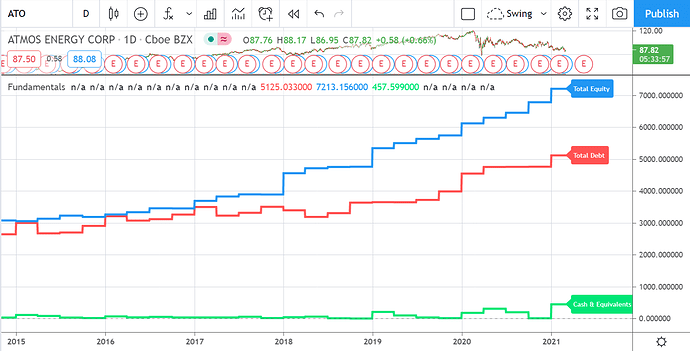

sobre deuda y equity:

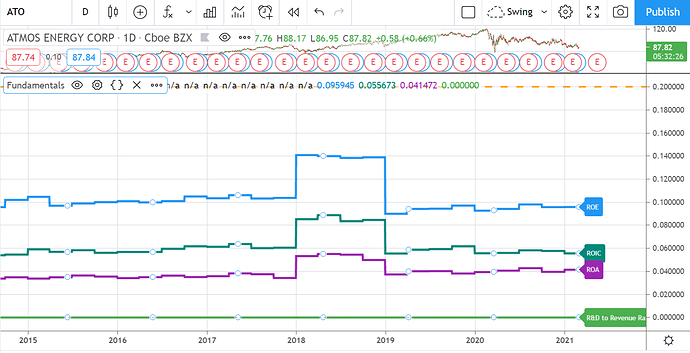

retornos:

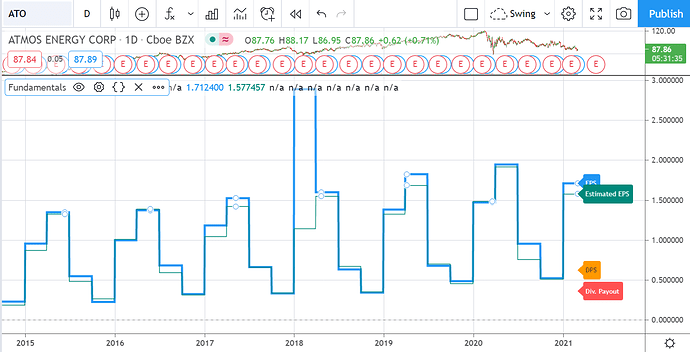

el EPS es una escalera estacional, lo cual cuadra:

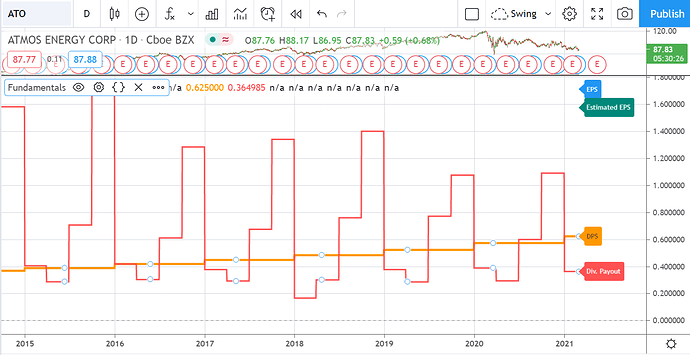

dividendo por acción y payout: