Junto con Exxon (XOM), las dos grades del sector energía.

Me ha sorprendido que no tenga hilo propio.

Anoto información del hilo de Chowder en relación a una adquisición reciente y sus opiniones. Precio actual 119,76$ (ROD 3,8%).

"“CVX is down 4.29% in premarket action. They are making an acquisition of APC. I haven’t followed APC in a number of years but if I recall correctly, they were one of the leaders in the oil service sector. They weren’t what I would have classified as a company for a dividend growth portfolio, but if the merger goes through, and they become a part of CVX, I think I like this move. I haven’t read any reports yet, but if the price remains down 4% or more after the open, I’m gonna git some.

I don’t need a beat and raise for this scenario. I like how CVX is trying to grow their business even though they are pretty large as it is.”

[…]

“It would appear to me that Morningstar likes this acquisition of APC by CVX. I used to follow the oil service sector closely, in fact I had 100% of my assets in oil service at one time. APC was one of the better upstream companies but upstream companies are not suited for dividend growth portfolios.

I do like the idea of merging an upstream company with an integrated oil company the quality of CVX. I used to own COP and sold them when they spun off PSX a refinery type business. I liked the idea of them combined, but not separate.

Anyway, the more diversity an integrated oil company gets, the more I like it. So, I did add to CVX today in this portfolio.

I’m looking forward to Christine’s take on the move, just to get another perspective, but I’m all in here, I’m satisfied with the move.”

[…]

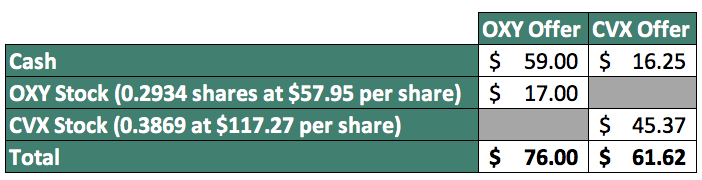

“Chowder, like you, I’m highly in favor of Chevron’s purchase of Anadarko.

Worth noting, for those who haven’t read the details, it’s for a combination of cash and Chevron common shares (and assumption of Andarko’s existing debt). Here’s a quote from Chevron’s web site:

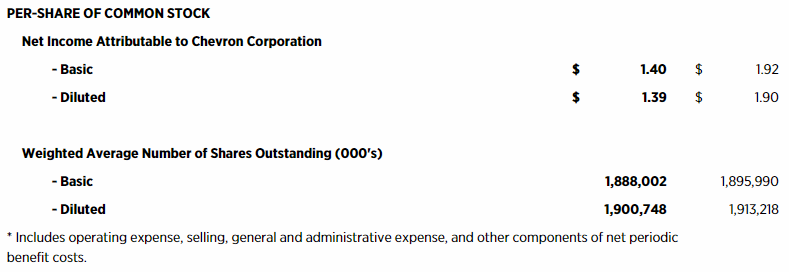

“Based on Chevron’s closing price on April 11th, 2019 and under the terms of the agreement, Anadarko shareholders will receive 0.3869 shares of Chevron and $16.25 in cash for each Anadarko share. The total enterprise value of the transaction is $50 billion.”

Since a share of Chevron is about $120 right now, that means this is primarily an acquisition using company stock. It’s about 75% stock and 25% cash.

For those who want Chevron’s take on the deal, go to their web site (chevron.com, naturally), and click on the very large link on their home page to go to their announcement.

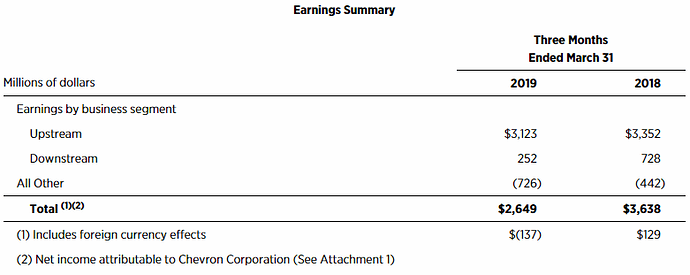

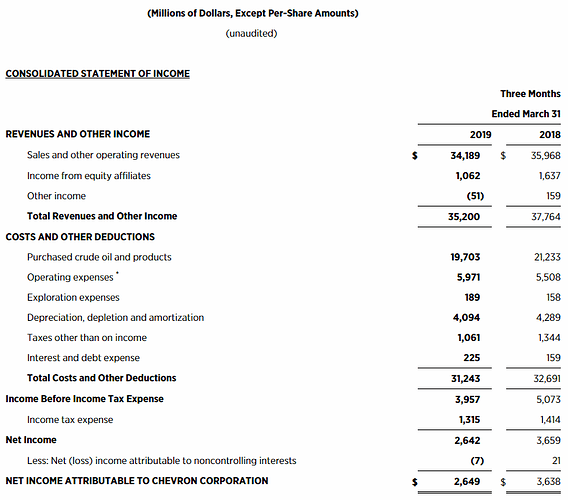

We tend to think of Chevron (and several others) as being fully integrated oil companies. But they’re more of an upstream company than a downstream company. (That’s also true of ExxonMobil.)

Chevron’s numbers from their 2017 annual report:

– Total upstream earnings $8.1 billion

– Total downstream earnings $5.2 billion

And that was during the calendar year 2017, when crude oil prices were significantly lower than they are now. The difference between their upstream earnings and their downstream earnings is undoubtedly much larger at the present time.

The difference in size between these sectors will increase with their acquisition of Anadarko, which is a pure play in the upstream space. For an idea of the difference in size of these two companies: The market capitalization of them (before the announcement) shows Chevron to be approximately 10x larger than Anadarko.

From a microscopic (boots on the ground view) all of the Chevron facilities I’ve been in (at least 7 different locations) have been quality places. I’ve seen a number of their facilities multiple times, including 7 continuous months in a refinery of theirs in southern California and four separate visits to a large oil field site in the Republic of Kazakhstan.

Christine”

[…]

“Mike,

“You aren’t concerned about the debt?”

Since you asked, I decided to go look at their financial statements, on their web site. The 2017 report (the most recent one on line) of course has the Dec. 31, 2017, balance sheet.

Looking at it, I concluded that they’re conservatively financed, which is exactly what I expected to find.

Based on current oil market conditions, Chevron has the ability to take on the additional debt that Anadarko has with no problem.

For grins, I looked at ExxonMobil’s as well. Their 2018 annual report is now up on their web site. I looked at the same financial ratio, namely how much of the company is debt vs. how much is equity. The two companies are very close in that regard. Surprisingly close, actually.

While we’re talking financials, I want to double back to how much of the company is upstream vs. downstream. I commented recently on what that looks like for Chevron. Here’s ExxonMobil’s breakdown on their company (for calendar year 2018).

ExxonMobil

Earnings after taxes, by sector

Upstream $14,079 million

Downstream $6,010 million

Chemical $3,351 million

Corporate and financing ($2,600 million)

Total $20,840 million

In my opinion, I’d describe Chemical as “even further downstream.” With the recent increases in crude oil prices, the difference in size between upstream and downstream is going to increase for 2019.

One significant difference between Chevron and ExxonMobil is that ExxonMobil’s chemical business is 100% company owned. In Chevron’s case, they own 50% of Chevron Phillips Chemical Company LLC. (As you might guess, Phillips 66 owns the other 50%.)

Christine”