Probablemente las cuentas omnibús jueguen algún papel en este tema

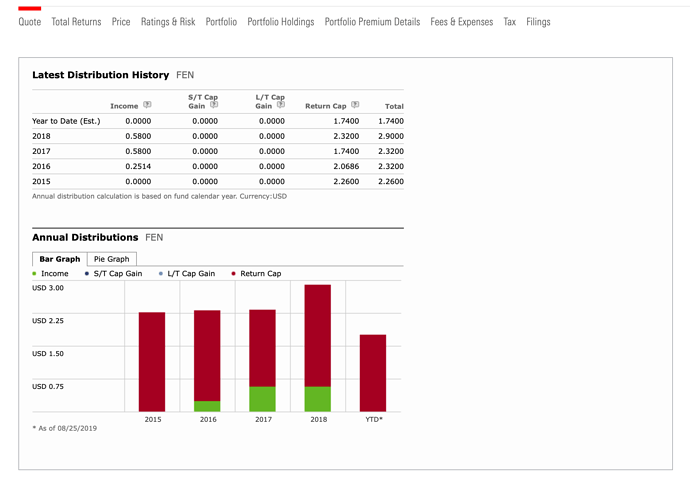

https://www.ftportfolios.com/Retail/Cef/CefDividHistory.aspx?Ticker=FEN

Ordinary distributions may include realized short-term capital gains and/or returns of capital. Final determination of the source and tax status of all distributions paid in the current year are to be made after year-end. The Fund will send you a Form 1099-DIV for the current year that will tell you how to report these distributions for federal income tax purposes. Additional information regarding Fund distributions can also be obtained from the Fund’s 19a-1 notices, or the year-end tax letters, however, these additional documents are not, and should not be used as a substitute for your Form 1099-DIV.

Puedes encontrar info de los dividendos en

Parece que una parte muy significativa de los dividendos son “return of capital”. Las gallinas que entran por las que salen. Me deja un poco frío, la verdad.

Solo por dar una estimación de uno de mis CEFs favoritos (UTG). En lo que llevamos de año ha pagado el 60% en long-term capital gains y el 40% en dividendos ordinarios. Nada de return of capital

Estamos hablando de una retención final sobre el total de la distribución de únicamente el 6%.

Luego ya podríamos entrar a debatir sobre la forma correcta de declarar los distintos conceptos en nuestra declaración de IRPF.

Mi duda con ENB era si por ser un MLP es diferente. Pero he recordado que en el hilo de midstream se decía que no es tal, luego efectivamente es 25/15. Las canadienses en general son 15% en IB (llevo RY y CDUAF y lo confirmo). Como dice ruindog, al ser cuentas ómnibus no distinguen nacionalidad y supongo que asumen que somos todos americanos.

Edito todo,

Cuanto más leo mas sé que no sé, pero seguiremos formándonos…

un saludo

Tendremos que esperar a próximas entregas de Mr. Van Knapp para desvelar el misterio

"CEFs use different techniques to generate income above and beyond the income they would receive from simple ownership of the basket of stocks.

Not all CEFs use leverage to generate those “extra” distributions. In a future article, I’ll try to break down the various techniques. As of now, to make things less mysterious, I’m treating the topic in my mind as if I were looking at manufacturing companies who employ different manufacturing methods to create their products"

"Some CEFs, by their own policy, don’t use leverage. They do other things, like buy and write options, to increase distributable funds. I think CEF Connect has a decent summary.

I’ll break the methods down in an article.

The point is, CEFs do SOMETHING to increase distributable money. If they didn’t, they’d be just like other funds…you’d get just what the companies or assets provided."

Efectivamente. En cualquier otro bróker te van a cobrar el 25%. Todo viene derivado del tema de las cuentas ómnibus. En este caso es favorable, en el caso de Francia que tendría que ser del 12,8% no es favorable. Que algún día cambie todo esto pues a saber, pero por ahora es lo que hay.

Exacto, ENB no es un MLP, es una C-Corp normal con sede en Canadá, por tanto las mismas retenciones que cualquier otra empresa canadiense, se compre en el NYSE o en el TSE.

En IB es el 15%.

Se puede poner enlaces a otros foros? Entiendo que sí:

https://foro.masdividendos.com/t/fondo-etf-que-invierta-en-india/1613/88

Aquí han hablado hoy de un CEF que se dedica a invertir en India, con unos gastos del 1.32% y una RPD algo superior al 12%; aunque algo errático. Estaba pensando en meter algo de dinero a la India y hasta hoy me planteaba un etf a su índice o la empresa canadiense Fairfax India (que viene a ser un holding tipo BRK que invierte en India y no reparte dividendos) pero este CEF me ha llamado la atención ya que el cobro de dividendos cuando vengan curvas siempre amortigua el tortazo. ¿Lo tenéis/seguís alguno?

Nueva entrega de DVK sobre CEF.

Acerca de UTG.

" >>>To determine the safety score of UTG, you could look at the safety scores of the top 10 holdings in UTG and take the average of it. That would one way to determine a safety score.<<<OK, I had a little time and a bit more interest in this myself.

I went to the Reaves Investment site for UTG to get the information there. The top 10 holdings (as a percent of total assets) (SSD score)

DTE (5.50% of assets) (SSD = 85)

SRE (5.29%) (79)

VZ (4.84%) (87)

UNP (4.66%) (88)

NEE (4.36%) (99)

BCE (3.97%) (42)

RDS/A (3.79%) (64)

OKE (3.57%) (54)

CHTR (3.57%) (no SSD score) [2]

WEC (3.44%) (87)If we do a simple average of the nine with SSD scores, we get an overall average safety of 76.1

Since they do not all make up an equal amount of the total assets, I also tried to do a weighted average [3]. I get a weighted average safety of 77.3In either method, the scores are a little below what SSD considers to be very safe. I will have to sit and think a bit if the calculation results make sense or not. I open the calculations up for discussion and improvement.

UP[1] www.utilityincomefund.com/…

Top 10 holdings as of 7/31/19

[2] CHTR does not have an SSD safety score, so I am going to exclude that from the calculations.

[3] In this case, the top 9 make up 39.42% of the entire fund. I used that value as the normalizing value for the partial SSD scores. The calculation then looks like

SSD(partial) = SSD(stock) * (stock% / 39.42%)

Then sum all the partial SSD scores

for DTE it would be 11.86 = 85 * (5.50% / 39.42%)"

# 3 Utility Closed-End Funds: Choosing Among DNP, UTF, UTG

Until recently, I have been adding to my UTF position. It would be my recommendation among these three funds.

This leads me to my final point: Is an investment in a utility sector CEF even advisable at this time? The sector has experienced a strong run up in 2019 (see charts at the top of the article) as investors seek safer havens in these volatile times. Is it realistic to see this momentum continuing?

I can’t say. But If I were to add to my own utility sector holdings, which I am not, I would either continue adding to my position in UTF or consider waiting for UTG’s rights offering and add to my position in that fund following the inevitable negative toll on the share price from the offering. The most opportune time should be soon after the rights offering closes. I would definitely shy away from DNP as nothing I see there justifies the 20% premium that is the fund’s cost of entry

Nueva entrega.

Puede ser información redundante ya que no he ceñido los artículos de DVK, pero me ha parecido interesante para quien se plantee entrar en estos vehículos de inversión.

Sacado del hilo de @Snowball en invertirenbolsa.info.

" Existe una página de internet donde se puede mirar fácilmente el descuento o prima sobre NAV de los CEFs, así como la media de los últimos años: