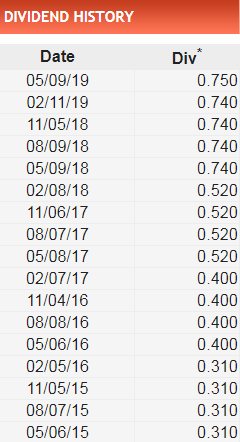

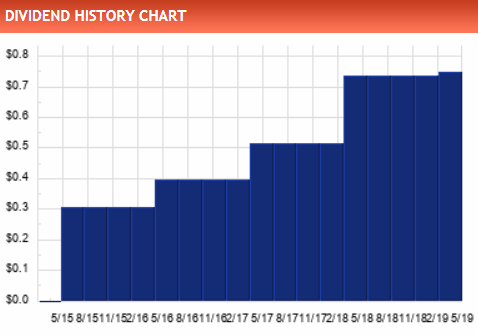

Como la mayoría de compañías, parón en el incremento de dividendos.

Se estarán curando en salud ante lo que esperan que venga si es que viene algo.

Se han endeudado un monton para comprar Canopy apostando a la marihuana en bebidas. Veremos si han asignado bien el capital. Ahora toca desapalancarse a costa de frenar el crecimiento del dividendo.

Constellation Brands Reports Second Quarter Fiscal 2020 Results (3/10/2019)

Outlook

The table below sets forth management’s current EPS expectations for fiscal 2020 compared to fiscal 2019 actual results, both on a reported basis, a comparable basis, and a comparable basis excluding Canopy equity losses and related activities.

Third Quarter 2020 Results (8/1/2020):

Morningstar eleva el moat de STZ a Wide, su fair value a 230$ y la considera barata.

After reassessing recent structural changes to Constellation Brands’ business, as well as the positioning of its largest brands, we believe it boasts a competitive position that belongs in the most august tier of our consumer-packaged goods coverage. Consequently, we’ve raised our moat rating to wide from narrow. Our fair value estimate increases to $230 from $212, driven by the valuation implications of our moat upgrade as well as a reduction in our systemic risk rating to align with our global beverage coverage. The stock has been beleaguered by uncertainty regarding the future of its wine/spirits business and noise surrounding no-moat cannabis supplier Canopy Growth, its largest venture investment. Still, from our vantage point, these developments have provided an opportunity for prospective investors to own a high-quality asset on the cheap, and we think Constellation’s shares represent compelling value.

“Constellation’s moat is primarily predicated on the intangible assets–and to a lesser degree cost advantage–emanating from its Mexican beer portfolio (80% of profits). These ultimately manifest in brewing margins that are unparalleled across North America (and, for the most part, globally) as well as other poignant indicators of brand prowess, such as a sustainably lower level of advertising spending. We view its intangibles story as multipronged and one of the more compelling across our broader coverage, as in addition to the brand notoriety and supply chain entrenchment that typically undergird consumer-packaged-goods moats, we see a clear nexus between the success of the firm’s largest trademarks (Modelo and Corona) and the U.S. Hispanic population.”

He recordado que Tim McAleenan Jr. publicó un artículo sobre ella en Septiembre del año pasado donde incidía en el tema de la elevada deuda (algo que también comentó en su día Vash). Junto a BF.B la colocaba en el altar de las empresas dentro del sector “large-cap alcohol and spirits” todavía capaz de hacer crecer su beneficios a doble dígito. A diferencia de M* no la considera barata y estima que en el rango de los 135$ sería una auténtica ganga

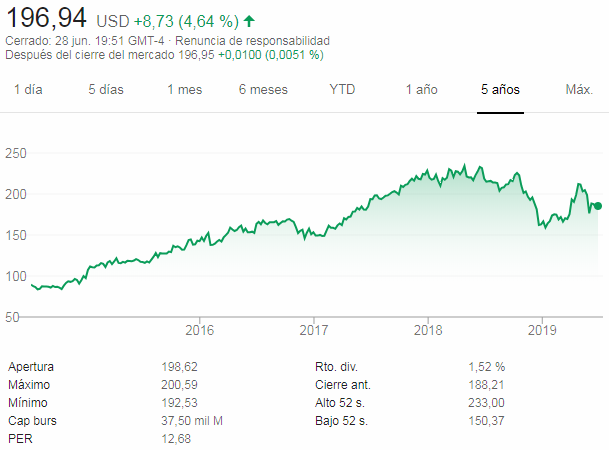

Está ahora en los 200$. 135$ viene a ser el 66%.

Casi cualquier empresa con más de un 30% de descuento es una ganga.

Yo confío en que los vicios no me defrauden.

En la anterior crisis cayó casi un 50% en el periodo de un año (abril 2008-2009). Nada es imposible

Me preocupa la calidad del management.

El acuerdo para comprar los derechos de importacion de las marcas mejicanas del Grupo Modelo les llovio del cielo porque ya tenian el 50% de la joint venture y practicamente eran los unicos candidatos que tenia AB InBev para venderles los derechos obligado por los reguladores. Y eso es el motivo por el que les ha ido tan bien estos años. Un acuerdo en el que le vendedor estaba obligado a vender y ellos eran practicamente el unico comprador.

El resto de decisiones de asignacion de capital han sido lamentables. Endeudarse para comprar Canopy y practicamente congelar el dividendo. Comprar Ballast Point por 1 billon y venderla cuatro años despues por mucho menos. Dudosas inversiones en la parte de vinos.

Me extraña que el stewardship no sea Poor en M*.

Ya la tenemos a 178$. Un par de meneos más por gentileza del Coronavirus y se nos pone en el “punto dulce”.

Un mes más tarde ya la tenemos a 125$. Hay que tener cuidado con lo que se desea porque se puede cumplir

Yo deseaba poder teletrabajar y la que he liado ![]()

Maldiciones chinas:

“Ojala se cumplan tus deseos”

“Ojala vivas tiempos interesantes”

Parece que con la famosa sopa de murcielago lo han logrado …

STZ has 1 vote per share and receives a dividend 10% greater than the dividend on STZ.B.

STZ.B has 10 votes per share and is largely owned by members of a family which has dominant voting power among shareholders

Pito, pito, gorgorito???

Algo similar ocurre con las BMW, sino recuerdo mal. Y, si de nuevo no recuerdo mal, creo haber leído a @alvaromusach argumentar los beneficios de comprar aquellas con derecho a voto porque serían las que subirían de cotización en caso de OPA/Merger.

Pim pom fuera

Has decidido algo? ![]()

Las Clase A. La cabra siempre tira al dividendo

La cerveza no es un bien de primera necesidad … en México!!!

Que beban cigarrillos !!