En ClickTrader el ticker es

ENB:xtse

Muchísimas gracias, Vash

CALGARY, ALBERTA–(Marketwired - Nov 29, 2017) - Enbridge Inc. (Enbridge or the Company) (TSX:ENB)(NYSE:ENB) today announced the finalization of its strategic plan and outlook (the Plan) following the merger with Spectra Energy, which closed on February 27, 2017. The Plan includes a three-year financial outlook covering 2018 - 2020. The following summarizes the key elements of the Plan, which will be further discussed at the Company’s investor conferences on December 12th and 13th, in New York and Toronto, respectively.

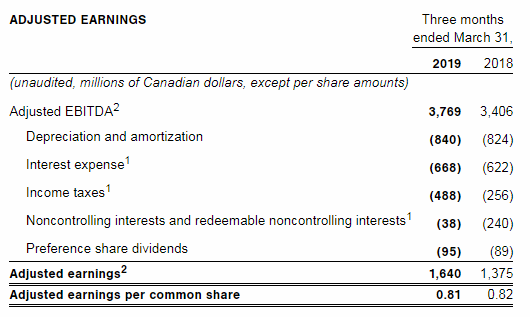

Highlights

Strong business outlook through the three-year planning horizon; resulting in a three-year compound annual ACFFO/share and dividend growth of 10% through 2020; dividend increase of 10% for 2018

Plan based on a remaining capital program of $22 billion through 2020

Rationalizing the asset mix to a pure regulated pipeline and utility business model emphasizing low risk and strong growth in three core businesses: Liquids Pipelines and Terminals, Gas Transmission and Storage and Gas Utilities

Identified $10 billion of non-core assets and intend to sell or monetize a minimum of $3 billion in 2018

Accelerating deleveraging to further strengthen the balance sheet; Debt to EBITDA of 5.0x expected by the end of 2018

Enbridge today announced a $1.5 billion privately placed common equity issuance and intends to issue an additional $4 billion of hybrid securities through the end of 2018

Enbridge Income Fund Holdings Inc. today announced a $0.5 billion public common equity issuance

Enbridge’s target credit metrics through the Plan horizon can be satisfied with additional asset sales, sponsored vehicle equity and the dividend reinvestment program; no additional follow-on common equity required for the Plan

Strong three-year outlooks provided for Enbridge Income Fund, Enbridge Energy Partners and Spectra Energy Partners (SEP)

To enhance Spectra Energy Partners’ cost of capital, Enbridge has provided SEP a formal proposal to exchange its incentive distribution rights and General Partner economic interests for newly issued limited partner units of SEP

Strategic Priorities

Enbridge is now the largest energy infrastructure company in North America with consolidated assets totaling over C$160 billion as at September 30, 2017, covering the most important and growing energy demand markets and supply basins. Enbridge’s key strategic priorities are as follows:

Focus on the safety and operational reliability of our systems and ensure cost effective and efficient transportation for our customers;

Ensure strong execution of our secured capital program that will drive ACFFO growth through 2020;

Concentrate on growth of core businesses through extensions and expansions of our premium liquids pipeline, natural gas transmission and gas utility franchises;

Further strengthen our financial position and optimize our cost of capital through diversified access to capital markets;

Position Enbridge for long term growth beyond 2020 through disciplined capital allocation.

Commenting on the strategic plan and outlook, Al Monaco, President and CEO of Enbridge noted; “2017 has been an important transition year for Enbridge. The acquisition of Spectra Energy has significantly diversified our asset base and opportunity set, and repositioned Enbridge for the future, particularly with respect to natural gas which we see as having excellent fundamentals and opportunities going forward. Integration is going well and synergy capture is on target. We have continued to successfully execute on our secured capital program, with roughly $12 billion of new projects expected to be put into service in 2017.”

Mr. Monaco continued, “With the Spectra Energy assets now in the fold, we will focus our attention on what we do best and the value proposition that has served shareholders well over the years. We will rationalize our asset mix to a pure regulated pipeline and utility business model, which emphasizes low risk businesses and strong growth in our three crown jewel businesses: liquids pipelines and terminals, natural gas transmission and storage and natural gas utilities. These franchises represent critical energy infrastructure with un-paralleled competitive positions, highly predictable cash flows and embedded growth. Through this review, we’ve identified a total of $10 billion of assets that are non-core to Enbridge. In 2018, at least $3 billion of certain unregulated gas midstream and onshore renewables businesses will be sold or monetized.”

Balance Sheet Strengthening Actions

The Company’s financing plan has been designed to fund its industry leading secured growth program while deleveraging the balance sheet. The plan achieves strong, investment grade credit metrics throughout the three-year period, with its Debt to EBITDA metric expected to reach 5x by the end of 2018, and trending to approximately 4.5x by 2020.

Total spending on secured growth and maintenance capital is expected to be approximately $22 billion through the end of 2020. This capital funding requirement, together with targeted debt reduction of approximately $4 billion, will be satisfied with the following sources:

$14B - Internally generated cash flow, net of dividends/distributions

$1.5B - Enbridge Inc. common equity (announced today)

$0.5B - Enbridge Income Fund Holdings Inc. common equity (announced today)

$4.0B - Hybrid securities (planned through the end of 2018)

$3.0B - Non-core asset sales (planned through the end of 2018)

A combination of DRIP and sponsored vehicle equity will satisfy the remaining requirement. As such, no further follow-on Enbridge Inc. common equity is required to support the current financing plan. In addition, the Company can create significant further financing flexibility through incremental non-core asset sales or monetizations, issuance of hybrid securities and sponsored vehicle financing actions.

Mr. Monaco commented, “With on-going execution of our secured capital investment program, it’s important that we maintain a strong financial position and financing flexibility, which this plan achieves. Over the last two years, excluding the common equity issued today, we’ve raised approximately $7.5 billion in equity or equity equivalent funding, financed the Spectra acquisition with 100% equity and sold or monetized $2.6 billion in non-core assets, which demonstrates our commitment to pro-active management of the balance sheet during this period of growth. The asset sales and further actions we’re announcing today, along with our three-year financing plan, will provide the capital required to fund our secured growth program and provide the financial flexibility going forward to support the execution of our strategy.”

2018 Guidance and Three-Year Financial Outlook

Enbridge expects 2018 ACFFO/share from its existing operation and secured-only capital program in the range of $4.15 to $4.45/share, inclusive of the dilutive effect of the $1.5 billion common equity issuance announced today and the other planned funding and asset sale actions noted above. The secured-only financial outlook implies a three-year compound annual growth rate in ACFFO/share of approximately 10% off of the midpoint 2017 guidance range of $3.60 - $3.90/share, ending with a midpoint of approximately $5/share of ACFFO in 2020.

Dividend Increase and Dividend Growth Outlook

The Board of Directors approved an increase in the annual Dividend of 10% for 2018. The new quarterly dividend of $0.671/share will be payable on March 1, 2018, to shareholders of record on February 15, 2018. Enbridge expects to continue to deliver annual dividend growth of 10% through 2020, which is expected to result in a dividend payout through the planning horizon of below 65% of ACFFO/share.

Commenting on the dividend increase, Mr. Monaco noted: “Over the decades, Enbridge has delivered superior shareholder value. Our low risk business model has resulted in strong and consistent growth in the dividend which we are continuing to deliver though this Plan period.”

Sponsored Vehicles

Three-year financial plans for the sponsored vehicles were also approved by Enbridge, as well as the Boards of Directors of Spectra Energy Partners, Enbridge Energy Partners and Enbridge Income Fund. Each of the Sponsored vehicles is expected to maintain solid distribution growth, strong distribution coverage, and solid investment grade credit ratings:

Enbridge Income Fund Holdings (ENF:TSX) announced today that it will increase its monthly dividend by 10% effective with the dividend payable on February 15, 2018. In addition, the robust long term outlook for distribution growth at Enbridge Income Fund (the Fund) will now support extension of annual dividend increases of 10% to ENF shareholders through 2020. ENF also announced a $0.5 billion common equity bought deal issuance, which along with a $0.1 billion common equity issuance to Enbridge to maintain Enbridge’s 19.9% common equity interest in ENF, will be used to increase its ownership in the Fund. The Fund is expected to realize strong EBITDA growth over the planning horizon while maintaining distribution coverage of 1.2x to 1.3x. The Fund Group credit metrics are expected to strengthen over the forecast horizon as a result of growing EBITDA from strong business performance and its secured capital program, and bolstered by the common equity investment by ENF which satisfies the Fund Group’s equity requirements through 2020. Debt to EBITDA levels are forecast to be below 5.0x by the end of 2018 and remain below this level for the remainder of the outlook period.

Enbridge Energy Partners, L.P. (EEP) (NYSE:EEP) is now comprised of highly predictable, stable cash generating assets, including the U.S. portion of the Enbridge’s crude oil mainline system. EEP is expected to generate distributable cash flow per unit growth of approximately 3% through 2020. Management expects distribution growth to approximately follow distributable cash flow growth. Distribution coverage of approximately 1.2x is targeted throughout the planning period. The Partnership expects consolidated Debt to EBITDA to be approximately 4.0x by 2020, once its liquids pipeline growth projects are placed into service and its call options in joint funding arrangements have been exercised.

Spectra Energy Partners L.P. (SEP) (NYSE:SEP) is expected to deliver on its targeted $0.0125/unit quarterly distribution increase through 2018, which equates to ~7% distribution growth next year, with distribution coverage of 1.1x-1.2x. After 2018, the execution of the current secured organic growth plan alone supports distribution growth of 4% - 6% annually in 2019 and 2020, while maintaining distribution coverage of 1.1x to 1.2x. This outlook could be further enhanced with additional organic growth and future drop down transactions. The Debt to EBITDA metric is expected to remain below 4.0x through 2020.

In addition, today Enbridge made a formal offer to Spectra Energy Partners, LP (NYSE:SEP) (SEP) to convert all of Enbridge’s incentive distribution rights (IDRs) and general partner (GP) economic interests in SEP into a fixed number of additional common units in SEP and a non-economic GP interest in SEP. Through this proposal, Enbridge seeks to highlight the value of its IDRs and GP economic interest in SEP, and reduce SEP’s cost of capital to support the sustainable long-term growth of the partnership. Enbridge would continue to act as SEP’s general partner. Enbridge expects the proposed transaction to be appropriately reviewed by SEP’s Board of Directors, including by a conflicts committee comprised of independent members of the SEP board. No assurance can be given that Enbridge and SEP will reach agreement on the proposed transaction.

Hasta el rabo todo es toro … pero parece que se va aclarando algo el panorama de la Linea 3 para ENB. A ver si finalmente sale adelante el proyecto de sustitución de la linea 3, saca adelante las propuestas para simplificar su estructura absorbiendo los MLP’s y las filiales y a ver si con ello le otorgan el favor dándole más credibilidad y visibilidad a su propuesta y compromiso de crecimiento en el dividendo de su plan estratégico. Si eso ocurre debería recogerlo tb en el precio, tan solo con los rumores de hoy le han hecho un 4% arriba …

Un saludo.

Enbridge’s Line 3 Replacement Project Approved by Minnesota Public Utilities Commission

Jaja, lo vi un poco mas tarde, despúes de haber enviado el anterior msj, pero ya había cerrado el pc y desde el móvil, salvo que sea inevitable, no me gusta escribir. Pero no se por qué, sabía que ibas a ser tú el que lo subiera jaja. de vez en cuando, aunque sea por casualidad, acierto con las predicciones jaja.

Y lo dicho, hasta el rabo todo es toro, pero a ver si poco a poco se le aclara un poco todo el rollo y espabila. Aunque no se por qué, pero me temo que los rollos tribales no se acabarán nunca. Porque ahora son por la construcción y el paso, luego serán por los mantenimientos, después porque no querrán renovar las concesiones y así eternamente. Con el fondo de siempre, que sí que es muy importante defender la tradición y los terrenos de sus ancestros pero que al final todo dependerá de cuanto terminen rascando con el tema.

Un saludo.

Muy buenas!

Tengo Enbridge en estudio pero, antes de nada, me gustaría saber si algún usuario tiene esta empresa y ha recibido dividendos (con algún broker español tipo ING o Selfbank), para asegurarme del tipo de retención que se practica en origen.

Intuyo que será el 25%, pero con eso de que tiene sede en USA, no está demás preguntar para cerciorarme antes de descartarla.

Muchas gracias y un saludo.

25% en brokers nacionales, 15% en Interactive Brokers

Siguiendo el guión … aumento del 10% en el dividendo.

Vash comentaba que de la presentación para inversores se quedaba con esta parte:

“ENB forecasts the midpoint of its projected DCF range at $4.45/share in 2019, unchanged from 2018, and $5.00/share in 2020; beyond 2020, the company targets annual DCF per share growth of 5%-7%.”

Lo cual venía a decir que le quedaba un año más creciendo al 10% y posteriormente se prevé crecer al 6%.

Un saludo.

Para mí lo más importante en la presentación es el incremento del 10% hasta el 2020 y luego entre un 5-7%. No se le puede perdir más teniendo en cuenta que el dividendo actual es bastante alto. Una acción para no preocuparse en una buena temporada, de las que me gustan.

Un saludo

Comentario de M* tras la presentacion de resultados:

During the quarter, Enbridge announced CAD 1.8 billion in capital growth projects, including the Gray Oak crude pipeline in the Permian basin. Subsequent to the quarter-end, the company announced another CAD 0.3 billion of secured growth projects. With these new projects, we are increasing our dividend growth outlook for 2021 and beyond to 3% annual growth from 2% annual growth.

Interesante. De la presentación de ENB del 15 de febrero me da la sensación de que la compañía aspira a algo más que ese 3 %, aunque es verdad que omiten la palabra dividendo y se limitan a señalar como objetivo un crecimiento del DCF del 5-7% anual a partir de 2020, a diferencia del objetivo hasta 2020, 10% de crecimiento del DCF y del dividendo. Última slide.

https://seekingalpha.com/article/4241392-enbridge-inc-2018-q4-results-earnings-call-slides

Saludos

Leyendo ahora el análisis de M* veo que el crecimiento del dividendo en rangos del 5-7% más allá del 2020 les parece agresivo a no ser que la directiva tenga en mente nuevos proyectos.

“With these new projects, we are increasing our dividend growth outlook for 2021 and beyond to 3% annual growth from 2% annual growth. Despite the increase, we still (see) management’s target of 5%-7% as aggressive unless major growth projects are added to the portfolio.”

El paréntesis (see) es mío.

saludos

Si dentro de 2-3 años, habiendo incrementado un 20% comparado con el de hoy, aún nos lo suben cada año un 3% creo que no nos podemos quejar. Además se ha podido comprar más barata no hace mucho así que es posible que todos la tengamos a precios más bajos.

Enbridge’s Line 3 pipeline replacement is being pushed back a year, the company announced Friday.

The project, which was initially expected to be in service before the end of 2019, now won’t be ready until the second half of 2020.

Permits from the state of Minnesota were expected to be finalized by the second quarter of 2019, but now they won’t be provided until November, with U.S. federal permits expected to be finalized one to two months later.

El que quiera aumentar posición hoy tiene un buen descuento. Ahora está bajando más de un 6% con un precio por debajo de 35USD

Even in a worst-case scenario, it seems likely that Enbridge’s dividend would merely grow slower than expected but wouldn’t be at high risk of a cut.

Lo pongo en esta pero valdría para cualquiera del sector gas/oil energy en general y midstream en particular … sobre todo aquellas que tengan alguna nueva línea en construcción paralizada por diferentes motivos burocráticos o en proyecto.

Will Trump’s Orders Revamp the U.S. Pipeline Industry?

In a bid to boost the U.S. oil and energy sector, President Trump is set to sign a couple of executive orders to fast-track oil and gas pipeline projects. Making good on his campaign promises, Trump is likely to overhaul some environmental permits to mitigate the roadblocks on energy infrastructural development and aid the energy companies to avoid unnecessary red tape.

Well, this is not the first time that Trump will be intervening by signing new orders to expedite the pipeline projects in the United States. He did sign executive orders in 2017, just a few days after he took upon his new administration, for smoothing the track for Keystone XL and Energy Transfer’s ET Dakota Access Pipeline.

Clean Water Act Reform in the Cards?

Environmental protests and state authorities’ attempts to block energy infrastructure projects have induced intervention by Trump, who is planning to roll out orders to trim regulations and speed up interstate pipeline construction.

It is most likely that Trump will direct Environmental Protection Agency to reform the Clean Water Act, under which energy companies are supposed to obtain state approvals for the construction of pipeline projects that are green lit by the federal government. Trump’s orders will be aimed at streamlining sanctioning procedures and limiting the state’s involvement in Clean Water Act permits.

*Notably, the long-stalled Constitution Pipeline project—which is jointly owned by Williams Companies WMB, Cabot Oil and Gas COG, Duke Energy Corporation DUK and Atlas Gas —has been denied a water permit by the New York state regulators, crushing the hopes of the companies to bring the pipeline online by 2019. *

The New York State Department has denied water quality certification to Millennium Pipeline’s Valley Lateral project. New York’s DEC had also refused a Clean Water Act certification for National Fuel Gas Company’s Northern Access Project in April 2017, which was finally rescinded by the FERC last October. The state’s ruling was overturned as it took longer than the stipulated time for the review of the pipeline.

Trump is poised to issue orders that will promote such projects reeling under water permit hurdles. While Trump’s orders can’t quash states’ authority in assessing the pipeline projects under the Clean Water Act, these can surely prohibit the state regulators from delaying the review process and curbing their powers to some extent.

Will Cross-Border Pipeline Projects Get a Boost?

The President is set to issue an order to stimulate the cross-border energy infrastructure by curbing the environmental reviews of the pipeline projects whose construction are delayed, as was the case with TransCanada Corporation’s TRP Keystone XL pipeline. The order is likely to limit the State Department’s power to review the environmental impacts of cross-border infrastructure projects. While the permit decisions of the project are expected to rest with the President only, the State Department will just be responsible for advising the government on the pipeline projects within a specified timeframe.

Final Thoughts

Well, Trump’s broader goal is to reduce energy prices by revitalizing the infrastructural projects in a country, which is witnessing high production of oil and gas even amid takeaway constraints. We know that Trump gets enraged over rising oil prices and has resorted to twitter many times, criticizing OPEC actions and blaming it on high prices. The President believes that regulatory barriers on pipeline development stifle the nation’s progress toward energy independence.

Even if the orders will not be able to jump-start widespread development of infrastructural projects, these will represent a formal push by the President to curb the State Department’s intervention, which has been apparently becoming a major threat to the construction of pipelines.

Un saludo.

Minnesota court rules Enbridge Line 3 environmental review inadequate

Enbridge (ENB) tumbles after the Minnesota Court of Appeals reverses a ruling by the state’s Public Utilities Commission on the environmental impact statement for the Line 3 oil pipeline.

The court says the project’s EIS, which was approved last year by the PUC, is “inadequate because it didn’t address the potential impact of an oil spill into the Lake Superior watershed.”

ENB’s Line 3 project calls for the construction of a new pipeline to carry Canadian oil across Minnesota to Superior, Wis., doubling capacity to 760K bbl/day.