Enbridge Inc. Reports Strong Second Quarter 2019 Results (02/08/2019)

- GAAP earnings of $1,736 million or $0.86 per common share for the second quarter of 2019, compared to $1,071 million or $0.63 per common share in the second quarter of 2018, both including the impact of a number of unusual, non-recurring or non-operating factors

- Adjusted earnings of $1,349 million or $0.67 per common share for the second quarter of 2019, compared to $1,094 million or $0.65 per common share in the second quarter of 2018

- Adjusted earnings before interest, income tax and depreciation and amortization (EBITDA) of $3,208 million for the second quarter of 2019, compared to $3,165 million in the second quarter of 2018

- Cash Provided by Operating Activities of $2,494 million for the second quarter of 2019, compared to $3,344 million for the second quarter of 2018

- Distributable Cash Flow (DCF) of $2,310 million for the second quarter of 2019, compared to $1,858 million for the second quarter of 2018

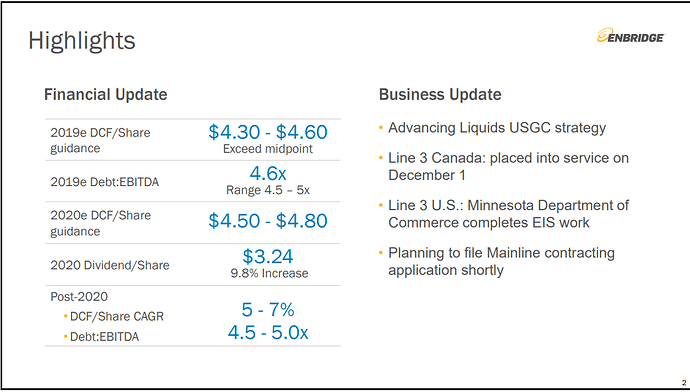

- Reaffirmed financial guidance range for 2019 DCF per Share of $4.30 to $4.60/share

Perdonad mi ignorancia al respecto pero soy nuevo operando en mercado americano y ademas esta acción es de una empresa canadiense y no se si influirá.

He recibido el pago del dividendo hoy y veo que me han retenido un 25% más luego el 19% correspondiente del resultado. ¿Es correcto? ¿En el resto de acciones americanas es igual?

Enbridge es una empresa canadiense por lo que, aunque la compraras en el mercado estadounidense, la retención en origen es del 25%. Luego, en la declaración podrás recuperar un 15%, el resto se pierde.

Salvo en IB que retienen un 15%. Ya lo hemos comentado muchas veces, pero por si acaso alguien se lo ha perdido…

Muchas gracias por vuestras respuestas. Aprendo mucho.

Third Quarter 2019 Results (08/11/2019)

- GAAP earnings of $949 million or $0.47 per common share for the third quarter of 2019, compared to GAAP loss of $90 million or $0.05 loss per common share in the third quarter of 2018, both including the impact of a number of unusual, non-recurring or non-operating factors

- Adjusted earnings of $1,124 million or $0.56 per common share for the third quarter of 2019, compared to $933 million or $0.55 per common share in the third quarter of 2018

- Adjusted earnings before interest, income tax and depreciation and amortization (EBITDA) of $3,108 million for the third quarter of 2019, compared to $2,958 million in the third quarter of 2018

- Cash Provided by Operating Activities of $2,735 million for the third quarter of 2019, compared to $1,461 million for the third quarter of 2018

- Distributable Cash Flow (DCF) of $2,105 million for the third quarter of 2019, compared to $1,585 million for the third quarter of 2018

- Reaffirmed financial guidance range for 2019 DCF per Share of $4.30 to $4.60/share; full year results expected to exceed the mid-point of the guidance range

Subida del 9,8%

Fue la misma subida que comento tambien A. Estebaranz en el video que colgaste @anbax?

Para mi es la primera subida de “casi” dos digitos en una accion con cierto peso en mi cartera… ya me han alegrado el dia

Yo también estoy encantado. Empiezo a ver esto del DGI.

Compré en mayo del año pasado y desde entonces hasta ahora han subido el dividendo en un 20%.

La cotización tambien ha seguido un camino similar. Algo más del 20% pero se mueve en un orden similar.

¿alguien sabe cómo interpretar que ENB tenga un payout de 282 % en 2018 y uno del 100% en 2019?

A mí no se me ocurre nada bueno de esto, pero M* le da 4 estrellas así que algo me estoy perdiendo.

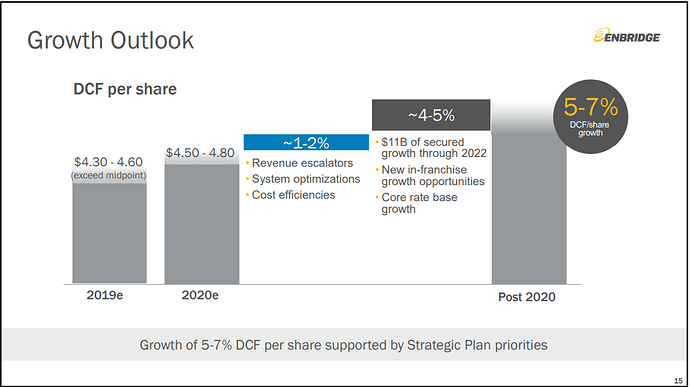

Hay que mirar el Distributable Cash Flow

2017: 3.68

2018: 4.42

Como te comenta @anbax, ENB mantenía estructura de MLP, por lo que lo suyo es seguir el DCF, que es el equivalente del FCF en una C Corp. Y a la hora de valorar la sostenibilidad del dividendo, lo que habría que mirar sería el distribution coverage ratio, DCR porsus siglas en inglés, que vendría a ser el equivalente del Pay Out ratio en una C Corp. No es mas que el índice que mide la proporción del DCF pagado sobre las distribuciones pagadas.

Te adjunto el guidance que han presentado ahora en Diciembre y cómo argumentan ese guidance para el DCF en años próximos.

Un saludo.

Poco a poco se va despejando el camino de obstáculos para la culminación de la sustitución de la línea 3 …

Un saludo.

Quería ampliar pero cada vez se escapa más

Fourth Quarter & Full Year 2019 Results (14/02/2020)

- Full year GAAP earnings of $5,322 million or $2.64 per common share compared with $2,515 million or $1.46 per common share for 2018

- Adjusted earnings of $5,341 million or $2.65 per common share in 2019 compared with $4,568 million or $2.65 per common share for 2018

- Adjusted earnings before interest, income tax and depreciation and amortization (EBITDA) of $13,271 million in 2019 compared with $12,849 million for 2018

- Cash Provided by Operating Activities of $9,398 million in 2019 compared with $10,502 million for 2018

- Distributable Cash Flow (DCF) of $9,224 million in 2019 compared with $7,618 million for 2018

- Achieved the top-end of full-year DCF per share guidance range of $4.30 to $4.60

- Reaffirmed 2020 DCF per share guidance range of $4.50 to $4.80, and longer term 5 to 7% DCF per share growth outlook, within an equity self-funding model

We See Opportunity in the Canadian Midstream Space

M* 12-Mar-2020

We are lowering our fair value estimates across the board for the Canadian midstream firms we cover: Enbridge, TC Energy, Inter Pipeline, Pembina Pipeline, and Keyera. Our updated forecast includes lower oil sands production over the next two years and deferrals of major growth projects. Our forecasts also include lower production levels from the rest of western Canada. We expect the lower supply to result in lower throughput volumes and higher commodity price exposure on certain pipelines. We still believe Enbridge is our Best Idea in the space, but we also see upside and attractive dividend yields from Pembina and Keyera.

After incorporating the impact of our lower near-term oil-price forecast into our model, we are slightly lowering our Enbridge fair value to $44 (CAD 60) from $47 (CAD 62). Our lower fair value is mainly driven by our outlook for lower near-term throughput on the Mainline coupled with temporary underutilization when the competing Trans Mountain Expansion and Keystone XL projects are built. Despite the lower fair value, we see the sell-off as an excellent entry point. However, we don’t expect the market’s concerns will be fully addressed for some time, which can lead to volatility. We advise investors to stay the course while getting paid a handsome 7.3% (and growing) dividend. In the end, we believe Enbridge’s long and winding road will lead to over 35% additional upside.

Un brote verde…