Además de las que mencionas: Coca Cola, Anheuser-Busch, Imperial Brands, Dunkin’ Brands, Wells Fargo y Franklin Resources.

A mí de esa lista hay alguna que me dan un poco de yuyu…

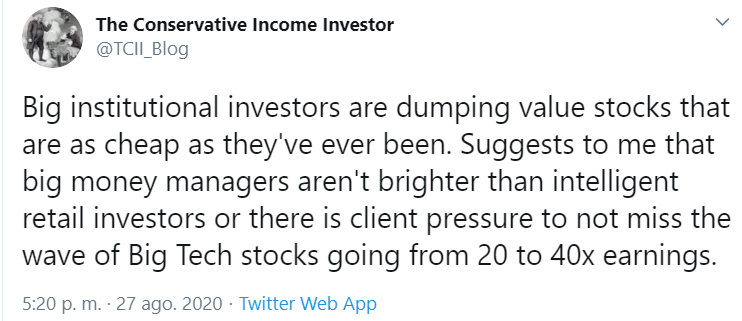

Right now, stocks like Tesla, Beyond Meat, and certain internet-based videoconferencing firms are having their “moments” where the valuations are north of 100x earnings. That just can’t be a siren call for you. It is hard to say when, but a moment will come when rationality returns.

With the sole exception of Amazon, the world is not kind to companies that trade at that type of P/E ratio with a market cap in the billions of dollars.

A rising stock price, for one reason or another, can feed its own momentum for a time as others buy it simply for the reason that it has been going up. But if you buy stocks that are not backed by earnings, you will often lose money. In contrast, if you buy stocks that are backed by earnings, you will rarely lose money.

Yo no puedo pensar más este tipo de empresas están tomadas por legiones de operadores técnicos (especuladores, dicho con respeto) que se suben a la ola y no se bajan mientras no le salten los stops, dejando correr las ganancias. Como tienen buenos beneficios pueden asumir colocar los stops en líneas de soporte de largo o muy largo plazo. Por lo que, paradojicamente estos “inversores” cortoplacistas se convierten en inversores estables que “nunca” venden. Los fundamentales, para estos “inversores estables” nunca son motivo para vender porque ese no es su juego. De hecho hay quien solo compra empresas que rompen máximos históricos (subida libre, que le dicen).

Todo esto, obviamente, no puede terminar más que en burbuja y tortazo al que lo pille con el paso cambiado cuando pinche.

Bueno, esto solo es una teoría mía de una tarde de mucha caló

Pero una teoria con mucha base y que mucha gente hace

Me atrevería a decir que es de lectura obligatoria para todos los que invierten en MSFT a día de hoy

Buying Microsoft Stock: From 2000 Through Today

https://theconservativeincomeinvestor.com/buying-microsoft-stock-from-2000-through-today/

Buying Stocks: Looking at Revenue Growth

https://theconservativeincomeinvestor.com/buying-stocks-looking-at-revenue-growth/

I found it startling how few companies in the S&P 500 are capable of achieving revenue growth that is necessary to be an adequate compounder (which I define as 10% returns or greater). In the S&P 500 today, there are probably only 50 components that are going to outperform the index itself over the next twenty years. At a bare minimum, I don’t think there will be a single component that grows revenues below 5% that will be one of those fifty.

In some sense, I think investors perform their due diligence backwards. Instead of looking at the cheapest stocks and determining which ones might have sufficient quality, I would argue it is better to compile a list of the fastest growing companies by revenue and then narrowing the list by identifying the ones with a defensible valuation level.

The Coffee Can Portfolio Approach To Investing

https://theconservativeincomeinvestor.com/the-coffee-can-portfolio-approach-to-investing/

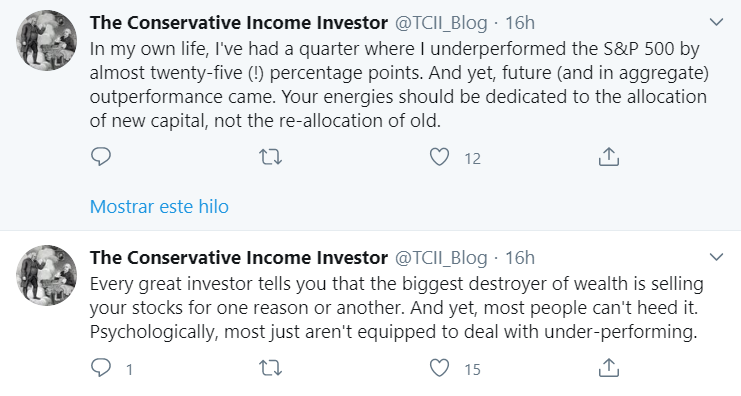

To benefit from compounding requires that you step back and allow compounding to occur. Remarkable careers are not made by selling stocks that gain 30-50% and then selling them and trying to repeat the process over and over.

The wealth gets made by identifying a few of the best businesses in the world, adding them to your portfolio one at a time based upon which ones trade at the most attractive valuation at a given time, and then getting out of the way to allow them to grow in value.

Parece que ha estado leyendo el foro últimamente y quiere aportar su granito de arena sobre como maximizar el total return y batir los índices. Sin desperdicio

https://theconservativeincomeinvestor.com/buying-dividend-aristocrats-patiently-making-more-money/

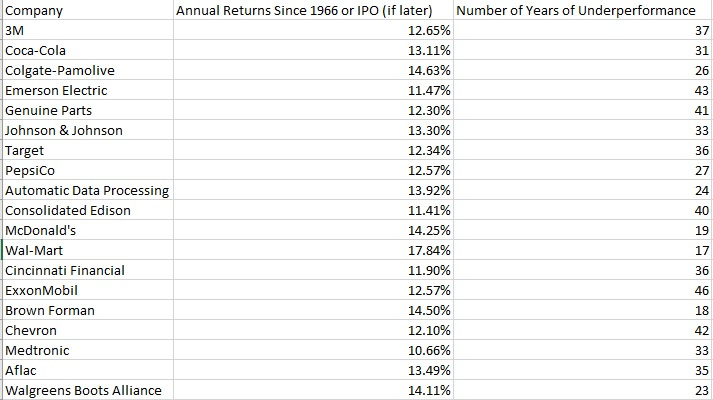

I reviewed the histories of over 20 companies that are considered Dividend Aristocrats to determine both their long-term total returns and the number of years in which these stocks underperformed the S&P 500.

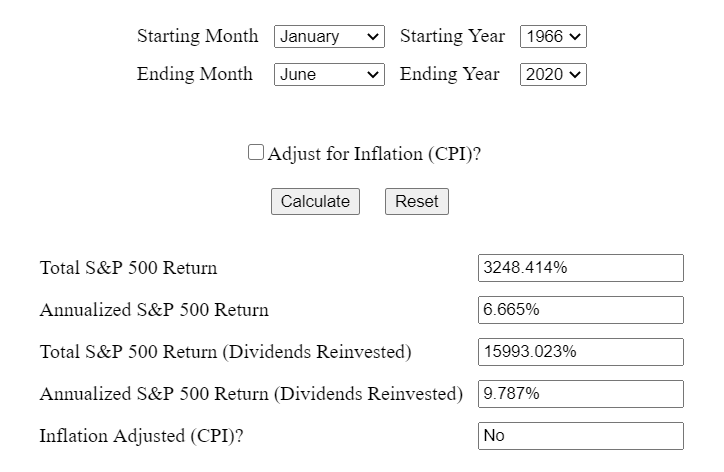

Aunque no lo aclara entiendo que en la tabla de arriba se refleja el “Average Annual Total Return” sin reinversión de dividendos

En el mismo periodo (1966-2020) el S&P500 ha tenido un retorno del 6.66%

If you are an individual investor, you might be owning great assets but turning on the TV and seeing Netflix or Tesla going up by a greater amount per month than you’ve made in the past year or two and decide to abandon ship. Then, you get to experience having an asset bought at 200x earnings return to 20x earnings while someone who bought your old stocks finally gets the capital appreciation that would have been yours if you did not sell out too soon.

To receive the historical compounding rates of approximately 10% or greater, your capital has to be committed for a decade or more. The absolute best wealth generators in the entire world underperform the market somewhere between a third and a half of the time that you own it. This fact must be acknowledged or you will find yourself perpetually shuffling between the latest fads.

https://theconservativeincomeinvestor.com/why-some-stocks-have-a-high-ask-price-right-now/

As a result of the present unusual circumstances, many stocks are now experiencing gaps in trading where the only ask price is sometime not seriously trying to sell the stock. Instead, they are motivated by a desire to counteract their brokerage’s ability to offer the stock to short sellers, or they might be the exploitative investors who have been their all along hoping that someone inadvertently pays too much, but the present market conditions are providing an opportunity for this opaque corner of market-making to reach the ordinary investor.

Ojito con el “fat-finger”

Muy interesante, el fat finger me abre una diminuta luz de esperanza para sacarme de encima algún muerto del armario jeje

URW ofrecidas a 200€. Se busca pardillo de dedos gordos.

URW ofrecidas a 200€. Se busca pardillo de dedos gordos.

Me pongo un aviso para 2034 (por no apurar).