Publica resultados y declara dividendo. Sigue fuerte.

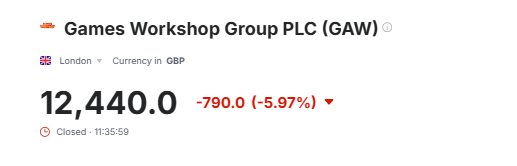

pues no parece que hayan gustado los resultados

La verdad es que la reacción no es buena, no. ![]()

No me queda claro esta bajada ni si eleva el dividendo.

“The Board has today declared a dividend of 85 pence per share taking dividends declared so far in 2024/25 to £1.85 per share (2023/24: £1.95 per share). This is in line with the Company’s policy to distribute truly surplus cash. This will be paid on 29 November 2024 for shareholders on the register on 25 October 2024, with an ex-dividend date of 24 October 2024. The last date for elections for the dividend re-investment plan is 8 November 2024.”

Dividend – Company Announcement - FT.com

A ver si se me ha colado algo o que, pero aquí menciona que eleva pero realmente baja de 1,95 a 1,85

![]()

The Board has today declared a dividend of £1.55 per share taking dividends declared so far in 2024/25 to £4.20 per share (2023/24: £3.15 per share, as at January 2024). This is in line with the Company’s policy to distribute truly surplus cash. This will be paid on 28 February 2025 for shareholders on the register on 24 January 2025, with an ex-dividend date of 23 January 2025. The last date for elections for the dividend re-investment plan is 7 February 2025.

El año pasado pagaron en enero 1,20 pounds y este año van a pagar 1,55 pounds. Eso es un 29,2% de subida. Pero en 2023 fue de 1,30 pounds. La política de dividendos es clara:

Pay regular dividends to our shareholders - we return any ‘truly surplus’ cash as dividends, as and when we have excess cash.

Así que no esperes pagos regulares, además como buena empresa birtánica es un lio saber si el dividendo va a cuenta de este año o del pasado.

Games Workshop prevé crecimiento en ingresos y beneficios Por Investing.com

Investing.com — Games Workshop Group PLC (LSE:GAW), fabricante de los juegos de mesa Warhammer, anunció el viernes sus estimaciones financieras para el año fiscal que finaliza el 1 de junio de 2025, proyectando un crecimiento significativo en ingresos y beneficios.

La compañía espera que los ingresos principales alcancen al menos 560 millones de libras, frente a los 494,7 millones del año anterior, lo que representa un aumento interanual de aproximadamente 13,2%.

Se prevé que los ingresos por licencias alcancen un récord de 50 millones de libras, en comparación con los 31 millones en 2023/24, marcando un sustancial aumento interanual del 61,3%.

Games Workshop anticipa un beneficio operativo principal de no menos de 210 millones de libras, superior a los 174,8 millones del año anterior. El beneficio operativo por licencias se proyecta en aproximadamente 45 millones de libras, un aumento significativo desde los 27 millones en 2023/24.

La empresa estima que el beneficio antes de impuestos (PBT) será de al menos 255 millones de libras, en comparación con los 203 millones del año fiscal anterior.

La compañía señaló que no se espera que los excepcionales ingresos por licencias se repitan en el año fiscal 2025/26. Sin embargo, las licencias siguen siendo un área donde se centra la atención del negocio.

Games Workshop planea distribuir aproximadamente 20 millones de libras en pagos de participación en beneficios al personal, frente a los 18 millones del año anterior.

La empresa también ha declarado y pagado dividendos por un total de 171,4 millones de libras, o 520 peniques por acción, durante el año fiscal, un aumento respecto a los 138,3 millones de libras, o 420 peniques por acción, en 2023/24.

-3.53% abajo en estos momentos

CHAIR’S STATEMENT

The last year has been a whirlwind at Games Workshop. We delighted our fans, launching terrific new products across our main brands. We opened new stores and now operate in 24 countries, enlisting hobbyists from all over the world. We saw record sales in our core business and a bumper year of licensing income, delivering the best financial results in our company’s history. And all this against a backdrop of major geopolitical uncertainty. We have had to adapt, innovate, and stay true to ourselves.

We’ve been in the news a lot this year. I note our promotion to the FTSE 100, but want to stress that it changes nothing. We are Games Workshop, and our mission is to make the best fantasy miniatures in the world, to engage and inspire our customers, and to sell our products globally for a profit. We intend to do this forever. Our ‘forever’ ethos is fundamental - we take decisions for the long term, not to make next week’s numbers look good. Our culture is unique - we are a vertically integrated business, and design, manufacture, distribute and sell our fantasy miniatures. We are an international business and proud of our roots in Nottingham, where it started: from our design studio to our factories, warehouses and stores all around the world, we love what we do. As the new chair, and a hobbyist myself, I will guard our culture and be its most vocal advocate.

Key to what makes us special is engaging with our very own community of hobbyists, now worldwide and buzzing. We don’t need a lot of marketing data to tell us when we get something right or wrong. We don’t need huge spreadsheets of customer data or complicated data algorithms. We know. And we know because we stay close to our fans and customers, whether they collect our miniatures simply because they look stunning on a shelf, whether they devour our amazing Black Library of books chronicling fantastic worlds millennia away, or whether they just enjoy a good old battle on an adrenaline-fuelled Saturday with their closest friends. But we are not complacent. Our biggest fans are also our harshest critics and tell us when we don’t get things just right. We will continue to care, to listen with humility, and to inspire our customers.

In the last year, we welcomed three new members to the board of directors and said goodbye to two. I would like especially to pay tribute to Rachel Tongue for her decades of deep commitment and command of our finances, and to my retired predecessor John Brewis for his stewardship, passion for the company, and dry English humour. I am delighted that Liz Harrison, Eric Maugein and Neil Tomlinson have joined the board, enriching our conversations. Also, after six years of committed service, Kate Marsh has informed me that she will stand for re-election at the 2025 AGM but not at the 2026 AGM, so that she can concentrate on her trustee and chair roles. This timetable allows for an orderly handover. A massive thank you to the Games Workshop team for delivering yet another exceptional year, and I look to our future as the new chair with pride and excitement.

Mark Lam

Non-executive chair

28 July 2025

Esas son las cosas que me gustan leer. Y especialmente estas:

Shareholder value

We believe shareholder value is created, primarily, by not destroying it. We have no intention to acquire other companies, nor to dispose of any of those we own.

We return our surplus cash to our owners and try to do so in ever increasing amounts. A cash buffer of three months’ worth of working capital requirement (now £85 million) alongside three months’ worth of tax payments and any large planned capital purchases or Group Profit Share payments/bonuses over £1 million, have been set aside before deciding how much cash is truly surplus for the purpose of declaring dividends.

te tendria que haber hecho caso y meterme en GAW, demasiado tarde ya

El loco debe estar dando palmas con las orejas. En todos los directos que escucho en los que interviene solo le oigo hablar de sus inversiones en Game Workshop, logística y iron mountain.

Entre intento de venta de un curso y de unas charlas.

Le sigo viendo un gran recorrido a medio y largo plazo.

Todo lo que hace fuera de los muñequitos lo hace con cabeza y a nada que meta cabeza en el sector del entretenimiento en series o cine y lo haga medio bien… Con las películas de Amazon Y Henry Cavill sigue todo OK

Estoy de acuerdo con lo que dices, falta todavía la serie de Henry Cavill. Además hay muchas personas enganchadas de la época de la pandemia, gente joven que en unos años van a poder incrementar su gasto medio porque empezarán a trabajar y tener más recursos. Es una pena no haber entrado cuando la vi a 12.000 GBX…

Al final me he decidido y entro con 10 acc. Creo que el precio aun tiene recorrido.