Buenas,

¿Alguien que haya seleccionado el DRIP en ING? Yo aún no tengo las acciones.

Gracias

Yo lo tengo colocado por defecto y aun tampoco he recibido las acciones.

El dividendo se abona un dia despues de la fecha (que es hoy)

Se pagara el proximo lunes si no hay errores

Las acciones tardan bastante mas

Es curioso como dependiendo del broker unos pagan antes y otros después. En Heytrade y en un broker inglés que tenía hace años los divis ingleses se cobran el mismo día del pago.

+4%

Jeje venia a ponerlo, da gusto ver IMB sosteniendo la cartera XD

El imperio contraataca

Hay otros que lo ven peor: “Imperial Brands will cease to exist by the end of this decade”

https://twitter.com/tobaccoinsider/status/1577920716464349186

Imperial Brands declared a dividend of 141.17 pence a share for the financial year, up from 139.08 pence a year earlier.

Con este subidón del dividendo ya tenemos para el roscón de reyes

Capital Allocation | by Philip Gorham Updated Nov 21, 2022

We are upgrading our Morningstar Capital Allocation Rating for Imperial Brands to Standard from Poor as a result of the greatly improved distribution policies of the new managemernt team. However, this is a forward-looking rating and we acknowledge there have been some significant capital alloctation missteps in Imperial’s recent history.

As alternatives to cigarettes gained traction over the last few years, the multinational manufacturers have mitigated risk by diversifying their product portfolios. Imperial Brands adopted a very limited strategy, making a large bet on vaping by acquiring Blu during the break-up of Lorillard in 2014, while staying on the sidelines of heated tobacco. We always regarded that as a mistake because we expected heated tobacco to be the most likely new generation category to win consumer adoption. Nevertheless, Imperial’s error was not the acquisition of Blu; its error was its attempt to scale this commoditized category globally while ignoring the merits of heated tobacco. The $7.1 billion, or 7 times EBITDA, paid for the Lorillard assets afforded some optionality on Blu. Subsequent investments behind Blu have been significant, however, while Imperial remained a spectator as heated tobacco grew to 20% of the tobacco market in Japan, with Philip Morris International the primary beneficiary. Meanwhile, the vaping category contracted materially in 2020, particularly in the U.S. following a regulatory clampdown on nicotine liquid flavors, and Imperial’s net revenue from next generation products (primarily vaping) halved in fiscal 2020.

Having invested in emerging categories that were not delivering financial returns, and having lost ground to first movers in heated tobacco, Imperial has adjusted its strategy to that of a fast follower, implying lower levels of investment, and has withdrawn from NGP categories in several noncore markets. It manages its cigarette business for cash. The early signs of this strategy are positive. In fiscal 2022, Imperial’s growth algorithm normalized to what we expect will be similar to its medium-term profile, with price/mix more than offsetting the cigarette volume decline, and operating profit grew modestly.

Capital allocation has also improved. Having rebased the dividend in 2020, we see headroom to now grow the dividend faster than earnings for a few years. In addition, the firm commenced a GBP 1 billion 12-month share repurchase programme, and if the current financial performance can be maintained, we think Imperial can comfortably keep the buyback program going beyond this year as well as raise the dividend at a mid-single-digit clip.

Imperial’s historical acquisitions have brought mixed results. The 2007 acquisition of Altadis appeared rich, at 14 times EBITDA, a valuation at the high end of historical tobacco transactions. Although the logistics business Logista, that came to Imperial with Altadis, was retained following the recent strategic review, we would not be surprised if it is jettisoned eventually, as it is a drag on ROIC. Reemtsma, bought in 2002 for 12.7 times EBITDA, was also acquired at an above-historical valuation for the industry, but Tobaccor at 1.5 times sales was a value-enhancing deal.

Miedito me dan las compras XD

Se ve que está ahora con las prisas de engancharse mejor en la carrera actual hacia las nuevas formas de consumo.

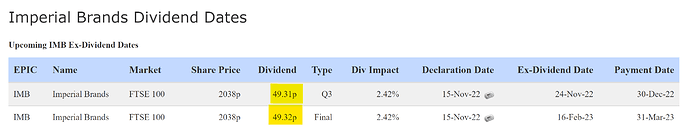

No se quien será el banco que paga el dividendo al resto de brokers. Pero en IBK siempre se retrasa este pago. Me llamo la atención que el otro día al revisar el apartado “modificación de los dividendos devengados” En los informes la fecha de pago ponía el día 5 de julio. Entré en la pagina de IMB y el día de pago era el 30 de junio como siempre. Además si se ha juntado con el festivo del 4 de julio… ![]()

![]()

![]()

![]()

Esperemos que mañana ya esté el pago.

Un saludo.

Pues estamos a día 6 y no aparece el pago, el de Enagás tampoco. Nunca le he prestado especial atención, pero observando en el PortfolioPerfomance cada vez se retrasan más en los pagos.

Enagás paga hoy.

Ayer en IBK ya aparecía el dinero en el saldo de libras. Ahora he abierto el informe de ayer y aparece el dividendo (con fecha del 30 de junio).

No se quien sera el banco que paga a IBK, pero ya les cuesta… ![]()

![]()

![]()

![]()