Buscando opciones para mi próxima compra llegó hasta esta empresa y veo que no hay hilo creado por lo que no parece muy popular. Alguien la lleva en cartera o la sigue?. Los números no parecen malos no?

Yo la llevo, y me parece una muy buena opción a estos precios. No he actualizado con los datos del último trimestre aún, pero lo último que tengo de ella es que a nivel de deuda, ratios de valoración y dividendo supera con creces lo que busco. Los payouts los mantiene sobre los 40-45% y tanto los márgenes como los retornos se mantienen estables. El único punto que me hace falta mirar más es el FCF que va disminuyendo poco a poco, lo cual en sí mismo no tiene por qué ser malo, pero es un dato a analizar.

Es que eso es lo que me ha parecido en una primera impresión, los números no son nada malos.

(Dividend Growth Investor) - Análisis Marzo 2019

Ingredion Incorporated (INGR), together with its subsidiaries, produces and sells starches and sweeteners for various industries. The company operates through four segments: North America, South America, Asia Pacific and Europe, and Middle East and Africa.

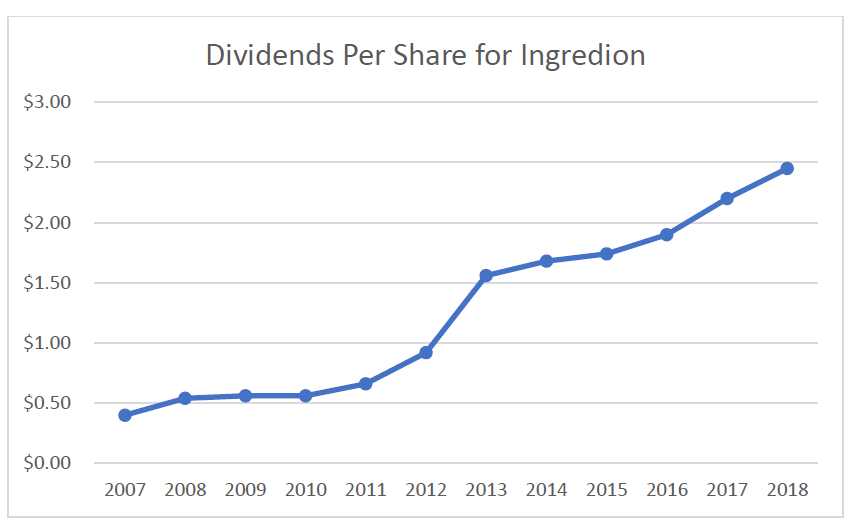

Ingredion is a dividend challenger, with an 8-year track record of annual dividend increases. The company is the type of dividend growth stocks that raises dividends for several years, but sometimes it also keeps them unchanged. For example, it raised dividends between 2004 and 2008, and resumed its dividend growth streak in 2011.

The last dividend increase in 2018 boosted the quarterly distribution by al little over 4.10% to 62.50 cents/share.

Over the past decade, the company has managed to grow annual dividends from $0.40 share in 2007 to $2.45/share in 2018.

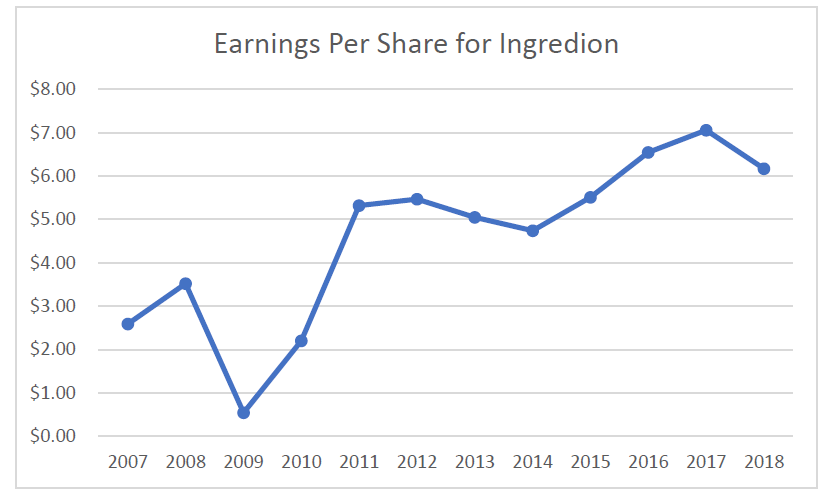

Over the past decade, the company has managed to grow earnings from $2.59/share in 2007 to $6.17/share in 2018. Analysts expect earnings per share to hit $7.06/share in 2019.

The company can grow through acquisitions, volume growth in emerging markets, cost savings initiatives and focus on higher margin specialty products.

North America accounts for 61% sales, followed by South America with 17% of revenues. Asia-Pacific accounts for 12% of sales, while the Europe, Middle East and Africa segment accounts for the remaining 10% of revenues. Ingredion believes to be well positioned to benefit from urbanization and growing middle class in emerging markets. Emerging markets are one area that can deliver higher demand than North American operations.

The company generates 28% of sales from specialty products that account for 50% of profits today. It plans to gradually boost specialty products to 32% - 35% of sales within 2022. In comparison, Specialty products accounted for a little over 20% five years ago. Specialty products usually are made for a specific end user, which makes the relationship stickier and less likely to be disrupted. They are value added premium proprietary products with higher margins and higher sales growth of mid to high single digits (versus growth closely approximating GDP growth for the rest of the products offered by Ingredion) Nevertheless, companies that use its specialty products value them enough to stay with the company, because they know that Ingredion can deliver good quality that won’t disrupt their own operations. There is switching cost risk for the end users.

For most of sales today, they are done by selling commodity type products, where the company is exposed to fluctuating prices such as corn. However, Ingredion manages to sell at a cost plus model, that mitigates the impact of fluctuating prices. Nevertheless, those are commodity type lower margin products that account for 72% of revenues but about half of profits. Ingredion’s customers may be unwilling to switch even for its commodity type products, since Ingredion has a lengthy record of quality and dependability.

Ingredion recently unveiled a $125 million cost restructuring program, that targets $75 million Cost of Sales savings, including global network optimization and $50 million in anticipated SG&A savings by year-end 2021. The Company expects restructuring costs to be incurred earlier in the program and expects savings to be realized beginning in 2018 and building momentum toward the targets through 2021.

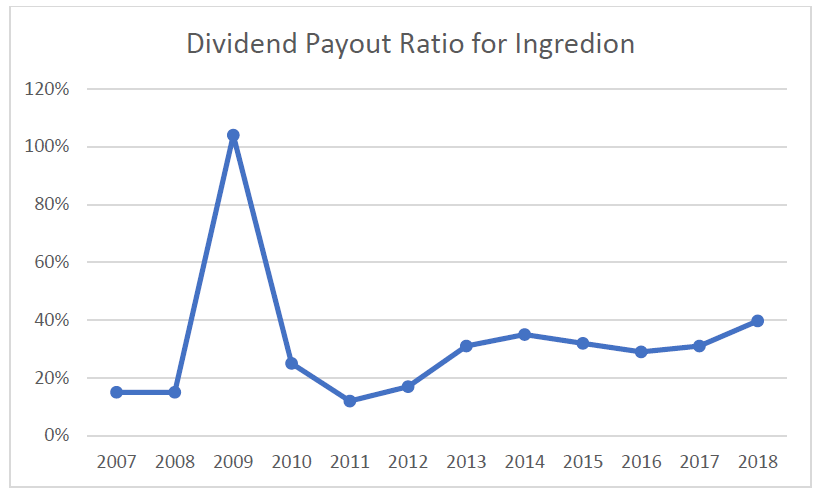

The dividend payout ratio has increased from 15% in 2007 to 40% in 2018. A lower payout provides a margin of safety against short-term earnings weakness. The high dividend growth over the past decade was aided by the growth in dividend payout ratio.

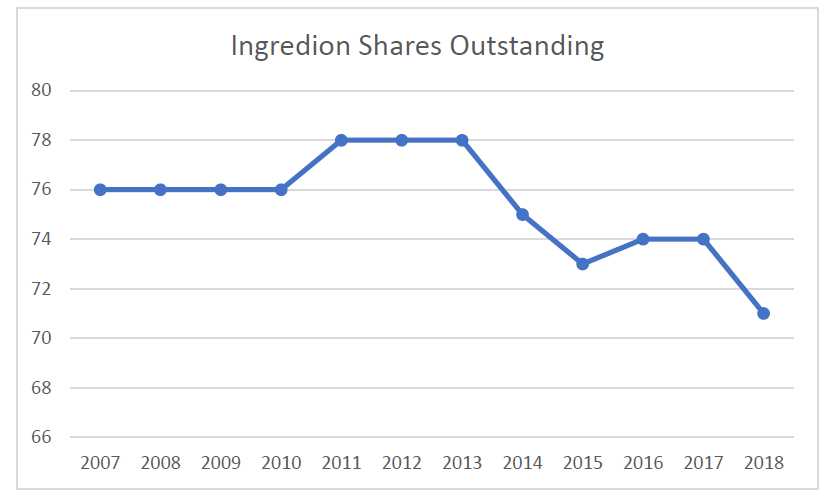

The number of shares outstanding has largely remained around 76 -78 million for most of the past decade. Over the past five years, the number of shares outstanding has reduced to 71 million through the end of 2018. Ingredion is targeting a 50% total payout, including dividends and share buybacks, and has recently been active on the repurchase front.

Yo querría añadirla antes de fin de año. Me gusta bastante más que ADM ya que comercia con productos con bastante más valor añadido por lo que debería obtener mayores márgenes. Por contra, tiene una baja capitalización.

Te pego enlace de análisis de Gorka (Eldividendo), es antiguo pero igual te ayuda.

Muchísimas gracias por el enlace, me ha servido de mucho. Esta empresa es una seria candidata a formar parte de mi cartera. Veremos.

Ingredion’s Specialty Ingredients Are Positioned for Long-Term Growth Despite Near-Term Volatility

Analyst Note 08/04/2020

Ingredion reported soft second-quarter results as adjusted operating income plunged 29% year on year due to the effects of operating leverage as volumes fell 12%. Much of the sales decline was a result of the COVID-19 restrictions that led to restaurant closures and sharply reduced dining-in. This weighed on the company’s sales volumes, particularly in April and May. Ingredion was also affected by the Mexican government’s decision to shut down breweries in April and May. This development weighed on volumes as Mexican brewery customers account for roughly 3% of total sales.

While we expect sequential improvement throughout the rest of the year, we have lowered our 2020 forecast to reflect continued pandemic-related headwinds. Our long-term outlook that profits will recover from an increasing proportion of specialty ingredients volumes, remains intact. After updating our model to reflect softer near-term results, our Ingredion fair value estimate falls to $120 per share from $125. Our narrow moat rating is unchanged.

The market reacted negatively to the company’s results, with the stock down 9% at the time of writing. We view Ingredion as materially undervalued, with shares trading in 5-star territory. While the market is expecting lower profits for longer, we think most of the bad news is priced in. The stock trades slightly below our bear-case fair value estimate of $80 per share. In our bear case, we assume slightly lower revenue over our five-year forecast period, with flat operating margins. This assumes little incremental profit from the company’s growing portfolio of specialty ingredients.

In our base case, we anticipate favorable growth rates for specialty ingredients like natural sweeteners stevia and allulose as well as plant-based proteins as demand for both categories rises. As such, we think shares offer attractive risk-adjusted upside.

Business Strategy and Outlook 05/05/2020

Ingredion manufactures starches and sweeteners by wet milling and processing corn and other starch-based raw materials. The company steeps these raw materials in a water-based solution before separating the starches from co-products (animal feed and corn oil). Starches are the largest category, generating around 45% of revenue, followed by sweeteners at roughly 35%, and co-products making up the remaining 20%. The starches are then further processed into starch and sweetener ingredients used primarily by the food and beverage industries, in addition to the paper, corrugating, brewing, and personal care industries.

The company classifies its products as either core or specialty ingredients, with core ingredients generating roughly 70% of companywide sales (as reported) and just below 50% of profits (based on our estimates). Core ingredients are typically commodity-grade, providing no pricing power for Ingredion. Ingredion sells roughly half of its core sales on a cost-plus basis. Specialty ingredients are value-added, requiring additional processing and, in many cases, proprietary formulations. They typically command twice the gross margins and enjoy twice the sales growth of core ingredients. Although we expect demand for Ingredion’s core ingredients to grow at a low-single-digit rate, specialty ingredients volumes should grow in the mid- to high single digits. Ingredion has been investing heavily in specialty ingredients, including plant-based proteins used in alternative meat products and specialty sweeteners such as stevia and allulose.

Ingredion has a multinational footprint, reporting via four geographic segments: North America (62% of 2019 sales); South America (15%); Asia-Pacific (13%); and Europe, the Middle East, and Africa (10%). Raw materials account for roughly half of the company’s unit costs. Corn, which is purchased around the world at market prices, represents the company’s single largest expense. Accordingly, Ingredion actively hedges against corn price fluctuations in North America, matching hedge volumes with its contracted corn-based ingredient volumes, which helps stabilize gross margins for the segment.

Economic Moat 05/05/2020

We assign a narrow moat rating to Ingredion. The most appropriate lens through which to analyze the company’s competitive advantage is our moat framework for commodity processors. Moaty businesses that operate in this space tend to benefit from switching costs, intangible assets, or cost advantage. For Ingredion, we see evidence of switching costs and intangible assets, but not cost advantage. Slightly more than 70% of companywide sales involve the processing of raw materials (corn, tapioca, potatoes, rice) purchased at market prices into commodity-grade starch and sweetener ingredients over which Ingredion commands no pricing power. We view this core ingredients business as no-moat, however, with roughly half of the core ingredients sales priced on a cost-plus basis, it should generally deliver ROICs in line with the company’s weighted average cost of capital. However, we contend that Ingredion’s specialty ingredients business operates with a narrow moat and earns excess ROICs. As a result, it has served as the key driver of the positive economic profit spread witnessed on a companywide basis each year over the past decade.

The evidence for both switching costs and intangible assets stems predominantly from Ingredion’s specialty ingredients business, which accounts for roughly 30% of companywide sales and around 50% of profits (by our estimates). These solutions include an array of proprietary offerings that align with growing market and consumer trends. Switching costs stem from the fact that, when these proprietary formulations are used by consumer packaged goods customers for food and beverages, buyers are often unwilling to jeopardize the brand equity of their products by switching to alternative solutions that consumers might reject. Often, specialty solutions are formulated with specific customer needs in mind, as Ingredion partners with its customers to develop new formulations and applications for their products. With the consumables space subject to a high degree of regulatory oversight, we see traces of switching costs for even the company’s commodity-grade ingredients. Customers are often hesitant to switch away from suppliers like Ingredion that have established a lengthy record of quality and reliability with regard to food safety compliance.

Intangible assets stem from the research and development spending required for these specialty ingredients, which establishes intellectual property that protects them from replication. The company has more than 850 product-related patents and patents pending, in addition to a number of established trademarks. Although no individual patent or trademark is material to its business, we believe they are valuable in aggregate as they make the company’s offerings more difficult to replicate. Ingredion expects that demand for its specialty ingredients will continue to grow more than twice the rate of its commodity ingredients. Specialty margins are also more than twice as high as commodity margins, as Ingredion commands more favorable pricing power for its specialty products. Accordingly, the proportion of companywide sales from specialty ingredients has been rising slowly but steadily, reaching 30% in 2019 from only 21% as recently as 2013.

For wide-moat flavor and fragrance companies, R&D spending as a percentage of sales typically exceeds 8%. For Ingredion’s specialty ingredients business, R&D accounts for 3% of specialty ingredients sales, indicating that, although intangible assets are present, they are not as strong as those of moatier operators. For Ingredion’s commodity-grade operations, the wet milling process by which raw materials are processed into starches and sweeteners provides few inroads for differentiation, preventing the company from establishing a cost advantage over peers. Although commodity ingredient processing has historically served as the company’s core function, this will continue to change over the foreseeable future as the company makes incremental investments in growing its specialty volumes (both organically and via acquisition).

Admittedly, given the scale of Ingredion’s commodity operations, the qualitative evidence for a companywide moat is arguable. However, the quantitative evidence is strong. Ingredion’s ROICs have consistently exceeded the company’s weighted average cost of capital in recent years. Based on our calculations, ROICs have averaged over 11% over the trailing 10-year period, safely above our assumed 8.3% WACC. Due primarily to an improving product mix driving very modest margin expansion, our midcycle ROIC forecast sits just shy of 13%. We feel confident that economic profits will persist at least 10 years into the future. Although corn prices, Ingredion’s key input cost, can fluctuate significantly, half of Ingredion’s core sales are priced on a cost-plus basis, which essentially locks in returns roughly in line with the company’s cost of capital. For the remaining half of core sales, the company’s active hedging strategy should help minimize ROIC volatility in the years to come. As evidence of the stability of its business, Ingredion generated positive economic profits during both the financial crisis and the North American corn drought of 2012.

Fair Value and Profit Drivers 08/04/2020

Our fair value estimate is $120 per share. Ingredion reported an average adjusted operating margin just below 11% over the previous decade, and we forecast a roughly 15% margin in a midcycle environment. This assumes a more favorable product mix as specialty ingredients volume will continue to proportionately displace core volume. Additionally, we expect South America margins to expand as economic growth stabilizes and higher capacity utilization drives the benefits of operating leverage. However, we expect these tailwinds to be largely offset by the negative impact of rising corn prices. Therefore, we anticipate relatively flat margins over the next five years. Our long-term forecast assumes roughly 2% annual top-line growth through 2024. We forecast Ingredion to see some impact by COVID-19-related mandatory shutdowns resulting in lower sales to brewing in North America, as well as lower high fructose corn syrups sales used in soft drinks in restaurants. However, these impacts should be relatively small and short-lived, allowing Ingredion to return to growth in 2021. Since 2010, none of Ingredion’s reporting segments has delivered even a single quarter of operating losses, even though the company has faced geopolitical disruptions in some of its key markets outside the U.S. Further, the North American business maintained double-digit margins after the North American corn drought in 2012. These achievements represent the company’s impressive earnings stability as well as the impact of Ingredion’s North American corn input cost hedging strategy. Our weighted average cost of capital is 8.3%. Our stage II EBI growth rate is 4%, which reflect’s the pricing power of Ingredion’s growing proportion of specialty ingredients.

Risk and Uncertainty 05/05/2020

We assign a medium uncertainty rating to Ingredion. The company’s cash flows are generally quite stable, revenue cyclicality is low, and financial leverage is manageable. Ingredion’s consistent free cash flow generation should allow the company to sustain its strong financial condition and capitalize on value-accretive, tuck-in merger and acquisition opportunities when they arise.

Corn input costs represent a significant source of uncertainty for Ingredion, as the company’s hedging efforts are focused largely on its North American corn purchases and corn prices have been highly volatile in recent years. For example, a significant drought in North America could prove highly problematic. Although corn could be sourced abroad, the associated incremental transportation costs would likely weigh on profitability. Further, Ingredion’s profits can be affected by the spread between corn meal and soymeal prices as the two can be used interchangably in many products such as animal nutrition. Should soymeal prices fall, pressuring cornmeal prices, Ingredion’s net corn costs would rise, reducing profits.

Cash flows could also be heavily affected by geopolitical instability, particularly given Ingredion’s market leadership in Pakistan, as well as its exposure to Korea and various South American economies. Although its significant exposure to developing economies should, more often than not, drive attractive volume growth, GDP growth in these regions can fluctuate meaningfully from year to year. In total, the company has plants in more than 40 countries.

Regardless, sales and profits have been relatively steady in recent years, and the company’s raw material hedging strategy and cost-plus contracts for its non-specialty core products help to reduce earnings volatility. These dynamics improve our conviction in forecasting future cash flows. Even in the wake of the financial crisis and the North American corn drought in 2012, operating margins remained in the high single digits.

Stewardship 05/05/2020

We assign a Standard stewardship rating to Ingredion. The company has exhibited prudent capital-allocation practices and wise decisions regarding M&A, avoiding value destruction and favoring strong value creation. Management has been friendly to shareholders in recent years thanks to a careful balance of both dividend growth and share buybacks. The company targets a dividend payout ratio between 25% and 30% and should have no problem maintaining this.

In October 2010, Ingredion acquired competitor National Starch in a transformational deal. This increased Ingredion’s exposure to starch-based ingredients, as opposed to sweeteners, and gave it a foothold in Europe for the first time, helping to diversify its geographical exposure. The transaction was both earnings-enhancing and value-accretive, given the overlap with Ingredion’s existing starch-based business and given National Starch’s high profitability. Earnings per share moved off a $3 level toward a $5 level immediately after the acquisition. This acquisition was by far Ingredion’s largest at a cost of $1.3 billion, accounting for one third of its sales at the time. All of National Starch’s top 10 members of the management team stayed with the company after the acquisition, a testament to the success of the integration with Ingredion.

The National Starch acquisition was masterminded by Ilene Gordon, who served as CEO from 2009 through 2017. Jim Zallie took over as CEO in 2018, bringing 30-plus years of industry experience. Zallie was president and CEO of National Starch when it was acquired by Ingredion. Subsequent to the acquisition, he ran Ingredion’s operations in the Asia-Pacific, Europe, Middle East, and Africa regions in addition to spearheading the company’s global innovation and operational excellence initiatives. We expect Zallie to maintain the company’s broader strategy, which includes a shift toward specialty ingredients and continued international expansion.

In addition to National Starch, management has pursued a tuck-in acquisition strategy to gain exposure to new types of specialty ingredients. The Kerr acquisition in 2015 gave Ingredion exposure to natural fruit and vegetable ingredients, while the TIC Gums acquisition in 2016 provided organic gum and texture ingredients. The Western Polymer acquisition in 2019 expands the company’s starch portfolio. Ingredion’s 2019 investment in Clara Foods adds a sustainable protein product made from yeast found naturally in eggs. The announced acquisition of a 75% controlling stake in PureCircle adds increased Stevia production, which should have a favorable growth rate and expand the natural sweeteners portfolio. Further, we are in favor of recent investments in plant-based proteins and specialty sweeteners, such as allulose, which we think position Ingredion to capture growth from changing consumer preferences. We expect the company to continue to look for smaller acquisitions in order to continue expanding its specialty portfolio.

Corporate governance appears satisfactory. The CEO and chairman of the board roles are separate now that Zallie has taken over as CEO; this represents a positive shift from the prior setup in which Gordon held both positions. All 10 board members are independent. They are elected for a term of only one year, making it easy to replace them if need be. There are no term limits on board members, but the company does impose a mandatory retirement age of 65 on its executive officers.

None of the executive officers has an employment agreement with the company, but there are severance agreements in place with each of them. Annual incentive plan awards for executives are determined by goals relating to EBITDA, operating working capital, and personal objectives. Historically, the company has done a nice job ensuring that pay is closely aligned with performance. Executive compensation doesn’t look excessive. Long-term incentives are based on return on invested capital and total shareholder return. We appreciate that Ingredion cites ROIC as a key performance metric rather than absolute sales or profit targets, as this target should encourage management to invest in the growth of the company’s specialty ingredients business, which forms the basis of our narrow moat rating.

Mirando opciones para mi próxima compra me fijo en Ingredion, me parecen buenos números, per 14 dividendo cercano al 4%, pay out contenido , sobre el 50%, pero viendo su grafica veo una caida impresionante desde los máximos de hace 2 o 3 años mas o menos. Se me escapa el tema de la deuda, no se como anda en este aspecto. Que os parece esta opción?,es una empresa de la que se habla muy poco. Sabeis como anda de deuda?.

Puedes mirar en

https://app.topdividendos.com/buscador/INGR

Gracias Zerep, me gusta esta página, no la conocia. Por lo poco que he visto no tiene problemas de deuda. Tengo que leer mas pero para mi próxima compra , para enero, Ingredion a estos precios es un claro candidato. Veremos como evoluciona el precio. Saludos.

Es una empresa que me gusta, la estoy estudiando para una pròxima compra. Creo que este año que viene, las materias primas van a romper al alza. Tambien puedes ver una sinopsis de està empresa en -eldividedo de Gorka-

http://www.eldividendo.com/?s=Ingredion

Sin saber mucho del sector, yo en sectores con poco diferenciamiento, siempre me iria por las empresas lideres en cuanto a tamaño y mercado, en este caso creo que que ADM y Bunge son superiores.

¿Que ventaja competititva le veis a Ingredion?

Tienes razon con respecto a ADM y BUNGE, però como las tengo, quiero cerrar el circulo de materias primas con INGR. Creo que Ingredion complementa las otras dos, y asi cierro el abanico de productos primarios, basicos para industria alimentaria humana o animal.

Vaya, es increible este foro, todos los dias aprendo algo o descubro algo nuevo. No conocía Bunge, pero echándole un vistazo así por encima tiene peores números que Ingredion y ademas hace mas de dos años que no sube el dividendo. Parece mejor Ingredion no?, y ADM parece más cara. En principio me llama mas la atención INRG.

Considero que las tres son buenas compras, para formar una cartera diversificada dentro de este sector. Yo por mi parte, compro unas cuantas siempre que las veo bajar un poco. Es un sector aburrido, pero basico para el dia a dia. Tenemos sus productos en casi todas las fases de la alimentacion.

Un apunte, fijaros en las tiendas de mascotas, en casi todos los productos alimentarios, van incluidos productos basicos generados por estas industrias. Observad la calle y vereis la proliferación de mascotas (sobretodo perros), sin contar las que tenemos en casa.

Como siempre, esto no es una recomendacion de compra

Algunas consideraciones sobre INGR:

Yo abrí posición hace un par de meses, me gusta más que ADM. Más margen neto, menos deuda y más calidad en sus productos elaborados.

ADM ademas ahora está cara a mi parecer…INGREDION la tengo en el radar para abrir posicion el prox mes…veremos la cotización, pero de momento esta en precio.

Yo la tendría en muy buena consideración si no fuera por su, para mí, baja capitalización.