Va a estar complicado…

Palantir decided to go with a direct listing instead of an IPO, following other mature startups such as Slack Technologies Inc. [WORK], Spotify Inc. [SPOT] and Asana Inc., which is expected to begin trading this week.

The most prominent way a direct listing differs from an IPO is that the company does not create nor sell any new shares. For Palantir, though, years of venture-capital investments have created more than enough shares to launch public trading: roughly 1.64 billion, though that grows to 2.17 billion in a fully diluted formula that includes vesting options.

Palantir said in a news release Friday that it expects a total of 461.2 million shares will be permitted to be sold on the first day of trading, though there are no guarantees that all of those shares will hit the market.

The rest of the Palantir shares will largely become available to sell on the third trading day after Palantir publicly announces its 2020 earnings, which would be expected early next year. In the meantime, strong demand for the limited number of shares could drive prices higher, as they have for recent hot software IPOs like Snowflake Inc. [SNOW] and Unity Software Inc. [U]

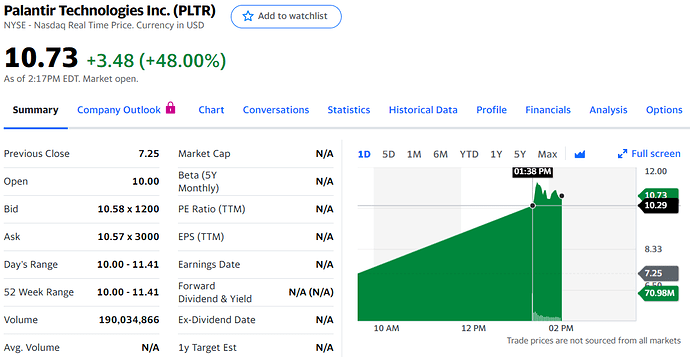

) a 10,07 con comisiones. Lo de vender es coña a no ser que tuviera una revalorización estratosférica.

) a 10,07 con comisiones. Lo de vender es coña a no ser que tuviera una revalorización estratosférica.