Esta en pleno proceso de transformación a convertirse en un REIT para centro de datos etc. Para ello se ha endeudado y tiene en marcha un plan de reducción de costes. Puede que no este en el momento más tranquilo de su historia pero yo estoy dentro y seguiré estando. SDD acaba de cambiar la seguridad del dividendo a 40.

Pandemic Increases Pressure on Iron Mountain’s Dividend

May 4, 2020

The coronavirus pandemic creates several challenges for Iron Mountain (IRM). The business seems likely to remain a cash cow and has reasonable liquidity, but these emerging issues have potential to reduce the REIT’s financial flexibility.

This could be problematic given Iron Mountain’s ongoing investments to evolve its business model for the digital world, plus the firm’s already elevated leverage profile.

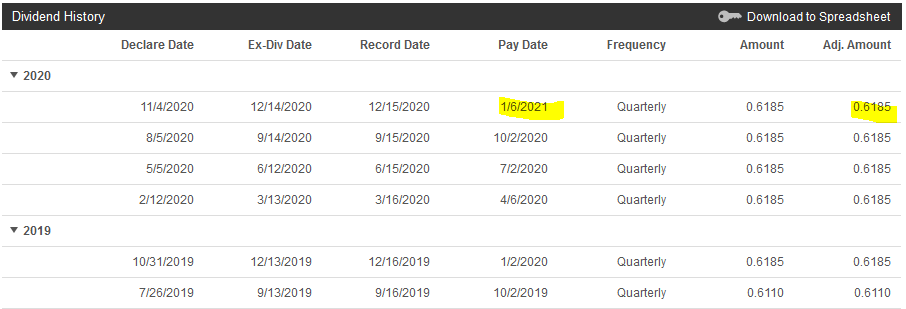

The dividend is central to Iron Mountain’s investment case. But depending on the severity and duration of COVID-19 headwinds that impact the business, it’s not out of the question that management could reduce the dividend to protect the firm’s balance sheet as it continues investing in its future.

Based on our analysis below, we are downgrading Iron Mountain’s Dividend Safety Score from Borderline Safe to Unsafe .

Iron Mountain reports earnings on May 7. It would be surprising if management adjusted the dividend at this stage, but it’s not out of the question.

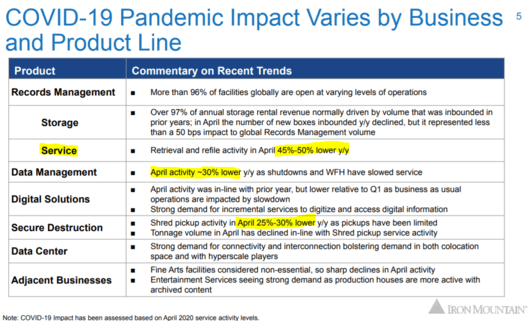

Iron Mountain’s services segment faces the most immediate pressure. This business generated 37% of the company’s revenue last year but only 19% of gross profit since it carries lower margins than document storage.

Source: Iron Mountain Q419 Earnings Supplement

About half of the service segment’s revenue (17% of IRM’s total revenue) is generated from Records Management. This includes adding or removing records from storage, and pickup and delivery of records upon customer request.

With many offices temporarily closed, demand for record management has likely plunged. On Iron Mountain’s website, the company has significantly reduced the frequency of its retrievals and pick-ups, too.

Source: Iron Mountain

Iron Mountain also provides digital solutions (5% of total revenue) and data management (4%). This includes scanning, imaging, and document conversion services of records, computer backups, and various other projects.

In its annual report, Iron Mountain notes that the more discretionary and event-driven nature of these services makes their revenue streams more sensitive to economic downturns.

With many parts of the economy closing, it wouldn’t be surprising if more customers than usual defer or cancel these types of services in order to reduce their short-term costs.

The same could be true with document shredding services (10% of IRM’s total revenue) since closed offices produce fewer documents that need to be shredded.

It’s also usually cheaper to leave records in storage a while longer rather than pay a higher fee to have them destroyed immediately.

Estimating how far services revenue could fall is difficult, but it doesn’t take much to put Iron Mountain in an increasingly uncomfortable financial position.

The company’s debt has covenants that restrict or limit its ability to incur additional indebtedness and pay dividends, among other things.

At the end of 2019, Iron Mountain’s lease adjusted leverage ratio was 5.7x, below the maximum allowable amount of 6.5x in the covenants. Management expected leverage to be flat or down slightly this year.

Source: Iron Mountain 2019 10-K

Revenue may not need to dip by much to pressure Iron Mountain’s headroom with its covenants.

That’s because the company’s cash flow is especially sensitive to changes in sales since many of its costs related to records are fixed.

For example, facilities (most are leased), transportation (truck fleet), and general and administration expenses exceeded 30% of revenue in 2019.

All else equal, we estimate that leverage rises about 0.25x for every 5% drop in EBITDA, which could happen with just a low single-digit revenue decline.

It’s unlikely Iron Mountain would breach its leverage ratio covenant thanks to continued stability in its record storage business, but management wants leverage to head much lower to provide the firm with more flexibility.

“Over time, we would like to get leverage between 4.5x and 5.5x. And ideally, that means that, over time, that target to get it below 5x … We’re at 5.7x or so right now versus 6.5x for our covenants. We would like to have 1.5x to 2x turns where our covenants kick in versus where our leverage is, purely for opportunistic reasons [such as share repurchases].” – CEO Bill Meaney

Iron Mountain realizes its paper storage business won’t last forever and relies on issuing debt to fund growth projects in other markets such as data centers.

Unlike other businesses that deleverage by paying down debt, Iron Mountain is borrowing more with hopes of improving its leverage ratio as EBITDA grows. This strategy has higher risk.

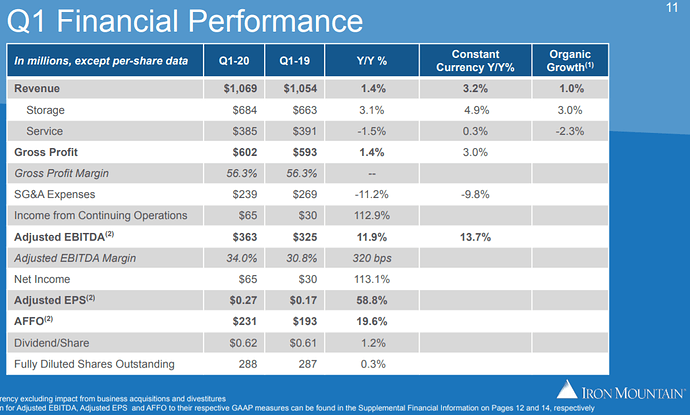

Prior to COVID-19, the midpoint of management’s 2020 guidance called for $945 million in adjusted funds from operations (AFFO).

After paying dividends of around $710 million (a 75% payout ratio), Iron Mountain would have approximately $235 million of retained cash flow available to reinvest in the business.

However, management had targeted upwards of $730 million in spending, including:

- $225 million for acquisitions

- $200 million for data center development projects

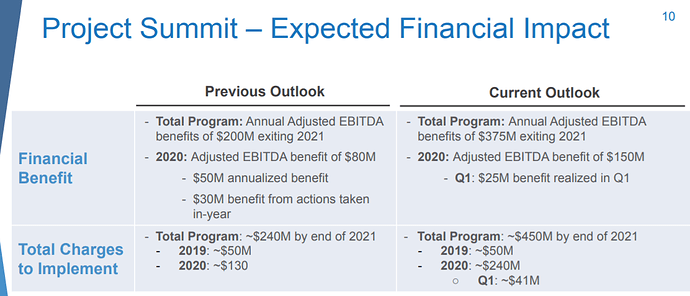

- $130 million for its Project Summit cost savings plan

- $150 million to $175 million for real estate growth investments

Selling non-core assets (i.e. capital recycling) was expected to generate $100 million of proceeds, but Iron Mountain would still need to borrow around $400 million to cover its investment plans (assuming they all need to move forward).

Despite its BB- junk credit rating from S&P, the firm’s balance sheet could handle this load without breaching its covenant.

Based on management’s 2020 EBITDA guidance, we estimate that Iron Mountain’s debt could increase around $2 billion before hitting 6.5x leverage.

Iron Mountain’s liquidity is also sufficient, with $194 million in cash on hand and $1.4 billion of available borrowing capacity under its credit revolver, which expires in June 2023. Less than $400 million of debt matures in 2020, too.

But if EBITDA fell 5% this year (rather than increasing 7.5% as management expected before the pandemic) and the REIT borrowed $500 million to execute its investment plans, then leverage could rise to around 6.2x.

The bottom line is that Iron Mountain’s ability to maintain its dividend and fund its investments hinges on the stability of its cash flow and management’s tolerance to continue running the business with elevated leverage, at least in the short term.

The coronavirus creates uncertainty on both of those fronts. Besides reducing services revenue, the pandemic has potential to accelerate the secular shift away from paper media as more businesses have been forced to conduct their operations digitally since March.

For example, in the healthcare vertical (16% of IRM’s revenue), telemedicine and virtual care could be here to stay. Financial (12%) and legal (8%) industries have already been transitioning more of their work to digital mediums, and energy (3%) companies are reeling from the crash in oil prices.

Source: Iron Mountain Q419 Earnings Supplement

An acceleration in these trends could pressure Iron Mountain’s high-margin storage business by reducing the amount of new boxes it receives from existing clients.

Here’s an example management provided at a recent conference regarding how the legal vertical’s digital transformation has impacted its business:

To provide further context, let’s say, a legal customer stores 100 boxes with us. 10 years ago, they would send us 6 new boxes a year and destroy or remove 2 boxes, so they would be net positive 4 boxes, or a 4% growth rate.

Today, a similar customer would send us 2 to 3 new boxes and still destroy 1 or 2 boxes, making them flat to net positive 1% growth rate, which is the new normal for this customer vertical, remaining stable at this lower growth rate given the age profile of their inventory has stabilized.

Iron Mountain’s organic records management volumes declined 0.1% in 2019. If volumes were to remain negative this year, investors may begin to lose faith in the durability of this critical source of cash flow.

And management could feel compelled to act with greater urgency on the balance sheet and the company’s investments. Iron Mountain’s data center business gets the most attention from investors, but this transition is happening gradually.

Management has said that data centers will hopefully get “into the high teens” as a percentage of Iron Mountain’s EBITDA in around five to seven years. That’s a long time to wait, even if these projects are a success.

In the meantime, management is pulling other levers to improve Iron Mountain’s financial positioning, including a major headcount reduction as part of its Project Summit restructuring plan. This alone is expected to add $200 million to EBITDA (about a 14% lift versus 2019) by the end of 2022.

Overall, it’s hard to gain conviction in Iron Mountain’s long-term outlook. The coronavirus could accelerate some of the secular headwinds facing the business and test Iron Mountain’s ability to grow its way back to a healthier balance sheet.

Management doesn’t have to cut the dividend, but they may choose to in this uncertain environment given desires to deleverage, lower the payout ratio, and maintain a full slate of investments to support Iron Mountain’s future.

As we stated in our July 2019 note, until Iron Mountain’s leverage and investment needs reach safer levels, conservative income investors may want to look elsewhere for yield. We will continue monitoring the situation.