alguien lo entiende? Presenta resultados, malos en teoría, de hecho la acción caía mas del 2% en premarket, y tras la alertura sube casi el 10%. ?

alguien lo entiende? Presenta resultados, malos en teoría, de hecho la acción caía mas del 2% en premarket, y tras la alertura sube casi el 10%. ?

“Guidance was maintained… optimism is supposedly over the incoming CEO who had double digit years of experience working at HD before wasting his time at JCP”

Ackman makes roughly $1 billion bet on Lowe’s

Me huele que ese tipo de noticias anteceden a caídas en el valor…

Vídeo interesante: https://www.youtube.com/watch?v=67bdaAWCrWU

Análisis Fundamental Lowe’s

Analisis Fundamental Home Depot (HD)

Eterno dilema, cual de las dos empresas es mejor, HD-LOW, PG-UNA, KO-PEP, etc.

Yo no me lo pregunto, por que no las dos?

yo igual, si en un sector hay dos empresas que destacan sobre las demas, no me complico las compro en cuando esten a tiro!!

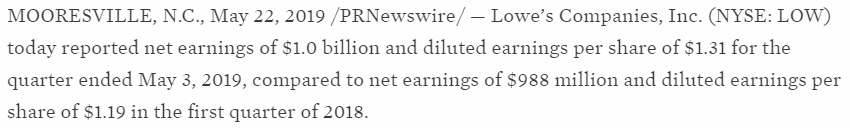

Lowe’s +7 en premarket por batir previsiones

A tomar por #@€¬ la posibilidad de ampliar

Y ayer ya había pegado un estirón tras los resultados de Home Depot…

Siguen intratables HD y LOW.

Yo añadí un poco a 94 porque no suele bajar de ahí últimamente. Qué bien haberlo hecho y qué pena no haber metido más. La sensación agridulce habitual.

Second Quarter Sales And Earnings Results (21/08/2019)

- Excluding $14 million of pre-tax operating losses associated with the wind-down of the Company’s Mexico retail operations, adjusted diluted earnings per share1 increased 3.9 percent to $2.15 from adjusted diluted earnings per share1 of $2.07 in the second quarter of 2018.

- Sales for the second quarter increased 0.5 percent to $21.0 billion from $20.9 billion in the second quarter of 2018, and comparable sales increased 2.3 percent. Comparable sales for the U.S. home improvement business increased 3.2 percent.

- The company repurchased $1.96 billion of stock under its share repurchase program and paid $382 million in dividends in the second quarter.

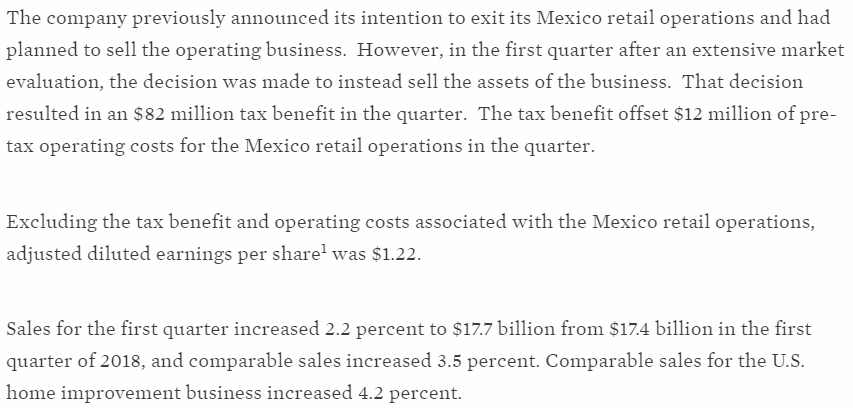

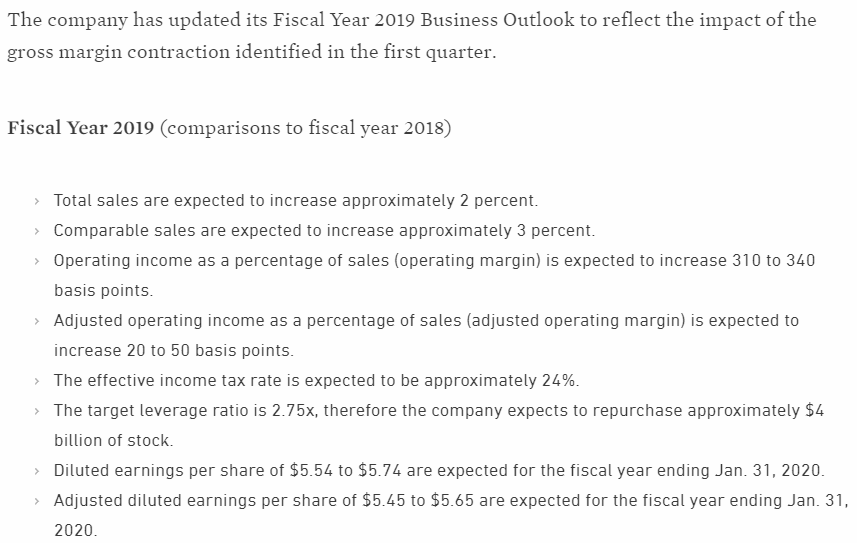

Outlook

- Total sales are expected to increase approximately 2 percent.

- Comparable sales are expected to increase approximately 3 percent.

- Operating income as a percentage of sales (operating margin) is expected to increase 310 to 340 basis points.

- Adjusted operating income as a percentage of sales (adjusted operating margin) is expected to increase 20 to 50 basis points.

- The effective income tax rate is expected to be approximately 24%.

- The target leverage ratio is 2.75x, therefore the company expects to repurchase approximately $4 billion of stock.

- Diluted earnings per share of $5.54 to $5.74 are expected for the fiscal year ending Jan. 31, 2020.

- Adjusted diluted earnings per share1 of $5.45 to $5.65 are expected for the fiscal year ending Jan. 31, 2020.

Third quarter 2019 results (20/11/2019)

- Sales for the third quarter were $17.4 billion and consolidated comparable sales increased 2.2 percent. Comparable sales for the U.S. home improvement business increased 3.0 percent.

- Diluted Earnings Per Share of $1.36

- Adjusted Diluted Earnings Per Share of $1.41

Fiscal Year 2019

- Total sales are expected to increase approximately 2 percent.

- Comparable sales are expected to increase approximately 3 percent.

- Operating income as a percentage of sales (operating margin) is expected to increase 290 to 320 basis points.

- Adjusted operating income as a percentage of sales is expected to increase 40 to 60 basis points.

- Diluted earnings per share of $5.35 to $5.47 are expected for the fiscal year ending Jan. 31, 2020.

- Adjusted diluted earnings per share of $5.63 to $5.70 are expected for the fiscal year ending Jan. 31, 2020.

Fourth Quarter Sales And Earnings Results (26/02/2020)

- Net earnings of $509 million and diluted earnings per share of $0.66 for the quarter ended Jan. 31, 2020, compared to a net loss of $824 million and diluted loss per share of ($1.03) in the fourth quarter of 2018.

- Sales for the fourth quarter were $16.0 billion compared to $15.6 billion in the fourth quarter of 2018, and comparable sales increased 2.5 percent.

Lowe’s Business Outlook - Fiscal Year 2020 (comparisons to fiscal year 2019)

- Total sales growth of approximately 2.5 to 3.0 percent.

- Comparable sales growth of approximately 3.0 to 3.5 percent.

- Operating income growth of approximately 12 to 16 percent.

- Adjusted operating income1 growth of approximately 8 to 12 percent.

- Operating income as a percentage of sales (operating margin) increase of approximately 80 to 100 basis points.

- Adjusted operating income as a percentage of sales (adjusted operating margin1) increase of approximately 50 to 70 basis points.

- Effective income tax rate and adjusted effective income tax rate of approximately 24.5%.

- Target leverage ratio of 2.75x, therefore the company expects to repurchase approximately $5 billion of stock.

- Diluted earnings per share of $6.38 to $6.58.

- Adjusted diluted earnings per share1 of $6.45 to $6.65.