Narrow-Moat stocks that became newly rated as 5-star stocks between January 3 and May 18, 2022

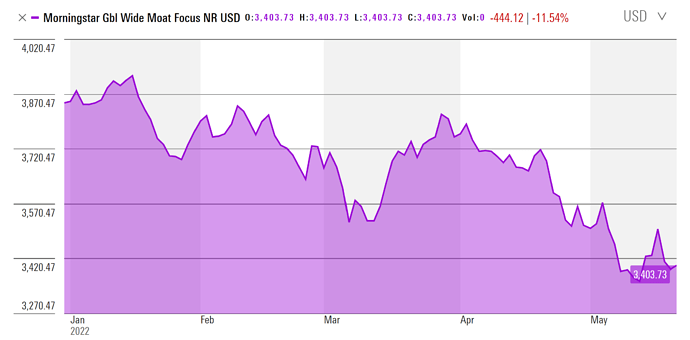

No sé si será representativo, pero este convulso comienzo de año el etf que sigue el índice m* wide moat global está ganando al MSCI World:

Así es.

El MSCI WORLD Index (NR USD) lleva un -17.23% YTD.

El Morningstar Global Wide Moat Focus Index (NR USD) un -11.54% YTD.

El ETF de Vaneck (GOAT) sigue este índice

Sí, los que he puesto yo son etfs ucits en euros.

Cuando voy a una tienda y tienen 10.000 referencias del producto que busco me agobio y al final no compro nada ![]()

Si quitas las que no pagan dividendo y las que lo han recortado en la última década se te queda algo bastante más manejable.

Alguno que siga la cartera con Morningstar?

Desde hace una semana o algo más, no me permite añadir ni acciones ni fondos.

¿Os pasa a alguien más? ¿Habéis encontrado alguna solución?

Yo hace tiempo que tengo problemas con la cartera de M* y creo que lo habia comentado en algun hilo.

Cuando daba de alta las compras, automaticamente me desaparecia algun otro movimiento anterior, un engorro porque me tenia que ir a comparar los desembolsos de cada empresa que me daba M* con los que tengo apuntados en mi Excel.

Una vez identificado, lo daba de nuevo de alta, pero hete aqui que me volvia a desaparecer otro movimiento.

Me puse en contacto con ellos y me dijeron, al menos es lo que entendi, que entrara en la cartera en ventana de incognito y que hiciera una limpieza de cache y cookies cada vez que entrara.

Ahora me pasa mucho menos y creo que es por la noche, cuando deben estar de mantenimiento.

Respecto a los movimientos, por si te sirve de ayuda, lo hice el dia 1 de junio

Muchas gracias, he entrado en modo incognito y no he tenido problemas en actualizar la cartera.

Me alegro ![]()

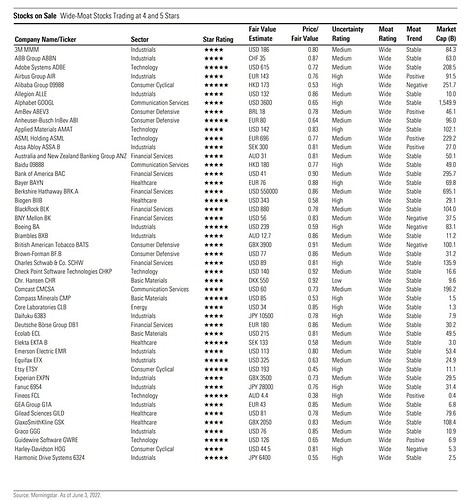

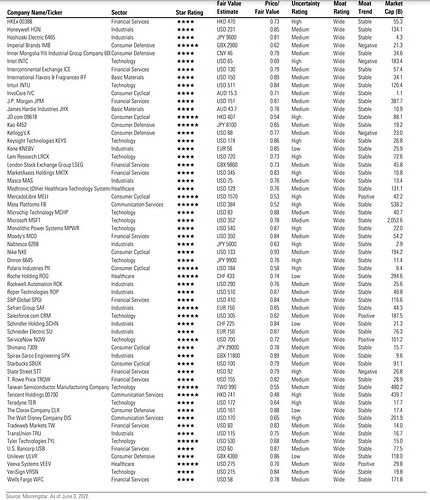

The best companies meet the following criteria:

- Wide Economic Moat

- Stable or Positive Moat Trend

- Standard or Exemplary Capital Allocation

- Low or Medium Fair Value Uncertainty

The 10 Best Stocks as of June 2022

The 10 most undervalued stocks from our Best Companies to Own list at the start of June are:

1. Salesforce.com CRM

2. Yum China YUMC

3. Taiwan Semiconductor Manufacturing TSM

4. Veeva Systems VEEV

5. Equifax EFX

6. Anheuser-Busch InBev SA/NV ADR BUD

7. Guidewire Software GWRE

8. ServiceNow NOW

9. Tyler Technologies TYL

10. Adobe ADBE

Here’s a little bit about why we like each of these companies at these prices, along with some key Morningstar metrics. All data is as of May 31, 2022.

Salesforce

- Price/fair value: 0.50

- Fair value uncertainty: Medium

- Moat Trend: Positive

- Capital Allocation Rating: Standard

- Industry: Software – Application

Salesforce hasn’t been immune to the drubbing the technology sector has experienced this year. While the enterprise cloud computing solution provider likely faces a dip in revenue growth below 20% at some point in the next few years, we think ongoing margin expansion will provide compound earnings growth of more than 20% for much longer. Salesforce has assembled a front-office empire it can build on for years to come, says Morningstar senior equity analyst Dan Romanoff. We expect the firm to continue to benefit from cross-selling and upselling, pricing actions, international growth, and continued acquisitions. “We believe Salesforce represents one of the best long-term growth stories in software,” he concludes. Salesforce stock is 50% undervalued by our measures.

Yum China

-

Price/fair value: 0.53

-

Fair value uncertainty: Medium

-

Moat Trend: Stable

-

Capital Allocation Rating: Standard

-

Industry: Restaurants

Although the resurgence in coronavirus cases has put pressure on the Chinese restaurant sector, we think Yum China, the largest restaurant chain in China, is being unduly punished: Yum China stock is 47% undervalued relative to our fair value estimate of $86.00. Morningstar senior analyst Ivan Su argues that there’s reason to be confident about restaurants such as Yum China (whose brands include KFC, Pizza Hut, and Taco Bell, among others) that have the scale to be aggressive on pricing in the near term; that provide customers greater access via robust digital ordering, delivery, and drive-through options; and that boast healthy balance sheets.

Taiwan Semiconductor Manufacturing

- Price/fair value: 0.56

- Fair value uncertainty: Medium

- Moat Trend: Stable

- Capital Allocation Rating: Exemplary

- Industry: Semiconductors

The stock of the world’s largest dedicated contract chip manufacturer, TSMC, has struggled this year, owing to macroeconomic uncertainty and a sluggish smartphone outlook. However, we think these headwinds have provided an enticing entry point for stock investors: TSMC’s stock trades 44% below our fair value estimate of $17. We foresee high-performance computing demand as the biggest growth driver in the next five years, says Morningstar analyst Phelix Lee—plus industrial and automotive demand remains strong despite a lukewarm consumer outlook. We don’t expect equipment deliveries to hurt our five-year revenue compound annual growth rate of 16.5%, he adds.

Veeva Systems

- Price/fair value: 0.62

- Fair value uncertainty: Medium

- Moat Trend: Positive

- Capital Allocation Rating: Standard

- Industry: Health Information Services

Veeva is the leading provider of cloud-based software solutions in the life sciences industry. Given its tech-leaning business, Veeva stock has gotten beaten down in 2022 and is about 38% undervalued relative to our $275 fair value estimate. We like the stock at this price, given the company’s strong retention rates, continued development of new applications, increasing penetration with existing customers, addition of new customers, and expansion opportunities outside of life sciences, says Morningstar analyst Dylan Finley. We think the company can extend its market leadership, and we therefore award the company a positive Morningstar Moat Trend Rating.

Equifax

- Price/fair value: 0.63

- Fair value uncertainty: Medium

- Moat Trend: Stable

- Capital Allocation Rating: Exemplary

- Industry: Consulting Services

One of the leading credit bureaus in the United States, Equifax faces strong headwinds today as mortgage market weakness—and a subsequent decline in mortgage credit inquires—takes a toll. We nevertheless think the market is being overly harsh: Equifax stock trades 37% below our $325 fair value estimate. In fact, we think Equifax’s Workforce Solutions segment is differentiated and growing at a healthy clip, says Morningstar analyst Rajiv Bhatia—and we think the segment’s fundamentals are strong. It’s now Equifax’s largest segment.

Anheuser-Busch InBev SA/NV

- Price/fair value: 0.63

- Fair value uncertainty: Medium

- Moat Trend: Stable

- Capital Allocation Rating: Exemplary

- Industry: Beverages – Brewers

Brewer Anheuser-Busch InBev has a vast global scale and regional density. The company has a history of buying brands with promising growth platforms and then expanding distribution while ruthlessly squeezing costs from the businesses, which contributes to the company’s exemplary Morningstar Capital Allocation Rating. “AB InBev has one of the strongest cost advantages in our consumer defensive coverage and is among the most efficient operators,” says Morningstar director Philip Gorham. We think the market has underappreciated AB InBev stock for a long while: The stock trades 37% below our fair value estimate of $90.

Guidewire Software

- Price/fair value: 0.63

- Fair value uncertainty: Medium

- Moat Trend: Positive

- Capital Allocation Rating: Standard

- Industry: Software - Application

Another victim of 2022′s tech-stock selloff, Guidewire stock is undervalued by about 37%. Guidewire provides software solutions for property and casualty insurers. Guidewire’s modern software platform has disrupted a sleepy industry that has been underserved by legacy software vendors, says Morningstar senior analyst Dan Romanoff. As the industry can no longer wait nor afford to maintain legacy systems, we see a long runway for additional growth, he adds. We’ve therefore awarded Guidewire a positive Morningstar Moat Trend Rating.

ServiceNow

- Price/fair value: 0.67

- Fair value uncertainty: Medium

- Moat Trend: Positive

- Capital Allocation Rating: Exemplary

- Industry: Software - Application

ServiceNow stock trades about 33% below our fair value estimate of $700 today. The company built a best-of-breed software as a service solution for IT service management, then branched out into IT operations management, and has since moved beyond the IT function to become an indispensable solution, explains Morningstar senior analyst Dan Romanoff. ServiceNow has earned a wide Morningstar Economic Moat Rating due to high switching costs—after all, switching software platforms involves time and money and bears operational risk, he adds. And we think ServiceNow’s moat is only growing: “Not only are customers renewing; they are also signing significantly larger deals,” he adds.

Tyler Technologies

- Price/fair value: 0.67

- Fair value uncertainty: Medium

- Moat Trend: Stable

- Capital Allocation Rating: Standard

- Industry: Software – Application

Like other software stocks on this list, Tyler Technologies stock has gotten knocked for a loop this year. The stock is undervalued, trading 33% below our $530 fair value estimate. The company, which is the leader in the nice government operational software market, posted strong first-quarter results, seeing momentum in its software subscriptions and transactional revenue. We think there’s a decade-long runway to growth at Tyler, as the push for local governments to modernize their legacy enterprise resource planning systems intensifies, argues Morningstar senior analyst Dan Romanoff.

Adobe

- Price/fair value: 0.68

- Fair value uncertainty: Medium

- Moat Trend: Stable

- Capital Allocation Rating: Exemplary

- Industry: Software – Infrastructure

Adobe stock is undervalued by about 32% after spending much of 2021 looking overvalued by our metrics. Adobe is a leader in content creation software thanks to its Photoshop and Illustrator solutions, both of which appear in the broader subscription-based Creative Cloud. Although some investors appear concerned about competition at the low end, we think Adobe’s dominance is unencumbered, says Morningstar senior analyst Dan Romanoff. Recent price increases make sense, we think, given the company’s expanding portfolio.

https://www.morningstar.com/articles/1079583/best-international-companies-to-own-2022-edition

Editor’s Note: This article is based on the 2022 edition of Morningstar’s Best Companies to Own.

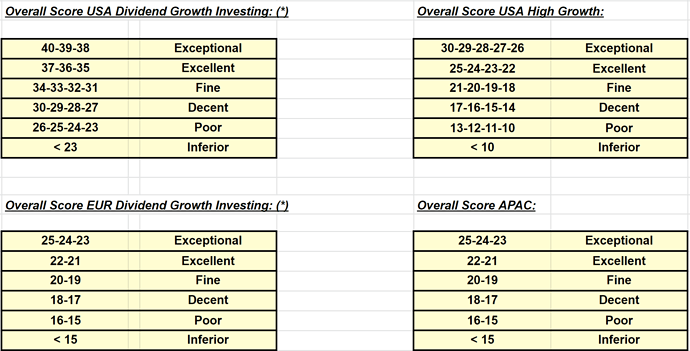

Reflexión en voz alta ¿Los frikis de las excels estamos cometiendo un error puntuando igual el moat, el stewardship y el uncertainty? Parece que el moat debería tener más puntuación (posiblemente el doble que los otros 2 factores)

Ahí lo dejo para que cambiéis toda la hoja CQSS ![]()

“Sí, por los cojones”.

En esta expresión se recurre a los testículos para negar de forma tajante sin necesidad de pronunciar la palabra “no”.

Cuando en 2015 el periódico La Rioja convocó un concurso para escoger el “Riojanismo más riojano”, esta fue la expresión ganadora. Se impuso por 1.036 votos contra 954 que obtuvo la palabra “pantaloneta”.

O su variante aragonesa: “Sí, maño, sí” ![]()

Que falta de empatía y habilidades sociales ![]()

Cuando reflexiones te darás cuenta de que algo hay que retocar:

Narrow - Low - Exemplary no puede ser mejor que Wide - Medium - Standard puesto que las primeras no cumplen los criterios de las Best Companies y en cambio las segundas si ![]()