Novartis gana 1772 millones (+7%) en el tercer trimestre de 2017:

Proposed spin-off of the Alcon eye care division

Novartis shareholders approved the proposed 100% spin-off of the Alcon eye care division, as previously endorsed by the Novartis Board of Directors.

In addition to shareholder approval, completion of the spin-off remains subject to certain conditions precedent, such as no material adverse events, receipt of necessary authorizations . The spin-off is expected to be completed in the second quarter of 2019.

The spin-off will be implemented through the distribution of a dividend-in-kind of new Alcon shares to Novartis shareholders and ADR (American Depositary Receipt) holders. The distribution is expected to be tax neutral on a US and Swiss income tax basis. Shareholders will receive the following:

- For every 5 Novartis shares: 1 Alcon Share

- For every 5 Novartis ADRs: 1 Alcon Share

What will happen to the price of Novartis shares or ADRs following the Spin-off?

Novartis expects the trading prices of Novartis shares and Novartis ADRs immediately following the Ex Date to be lower than the trading

prices immediately prior to the Ex Date because the trading prices will no longer reflect the value of the Alcon business

NOVN@VIRTX (Name: NOVARTIS AG-REG) announced a spin-off effective 09/04/2019

The terms of the spin-off are 1 : 5. Please note that this action is a mandatory action.

Nada sé de mi broker sobre este spin-off de Novartis con Alcon. ¿Alguien me sabría decir cuando es la fecha tope para tener derecho a esas acciones de Alcon y a qué precio cotizarían?

ZURICH (Reuters) - Novartis’s spinoff of its eyecare division Alcon, set for Tuesday April 9, marks the largest Swiss stock deal in a decade and forces a reshuffle of the benchmark Swiss Market Index (SMI) as private bank Julius Baer gets booted out.

Novartis has estimated Alcon’s value at around 25 billion Swiss francs ($25 billion), while some analysts predict an initial market capitalisation of 21 billion francs ($21 billion) to 23 billion, implying shares worth from 43 to 47 francs.

By contrast Baer’s value has tumbled by a third in a year to 9.3 billion francs. It will instead be included in the SMIM index, replacing Aryzta, SIX Swiss Exchange said after Tuesday’s market close.

Dominated by Nestle, Novartis and Roche, the SMI is Switzerland’s most important index. Membership is based on market capitalisation, adjusted for the free float of readily tradable shares in its constituents.

Alcon is being spun off in a one-for-five share deal announced by Novartis last June as it focuses on new drugs rather than the surgical devices and contact lenses Alcon makes.

Joining the SMI may boost demand from funds focusing on the top Swiss companies. Yet Alcon’s inclusion means healthcare and medical technology will weigh even more heavily on the SMI.

Novartis’s weighting had been capped 18 percent, but with Alcon the two will account for up to 21.5 percent of the SMI, Zuercher Kantonalbank analysts estimated on Wednesday.

Novartis’s biggest owners - BlackRock, the Sandoz family, Capital Research Global Investors and Vanguard Group - will have similar holdings in Alcon, between 2.5 percent and 4.5 percent.

“We anticipate incremental buying of Alcon shares by some funds seeking to build a full-size position, offset by others not wanting to own a non-pharma eyecare company,” Jefferies analyst Peter Welford said.

Novartis bought Alcon’s eye surgery and contact lens portfolio in stages through 2010 for $52 billion from Nestle, only to see it lose ground to competitors as sales and profitability slipped.

In surgical equipment, Alcon competes against Johnson & Johnson, Germany’s Zeiss and Bausch in a $9 billion per year market. Rivals in vision care, worth $14 billion annually, include J&J, Cooper and Bausch.

In 2016, a new Alcon head, Mike Ball from Hospira, redoubled research and marketing spending to resurrect revenue, before Novartis chief Vas Narasimhan decided to shed the division.

The last comparable-sized Swiss listing was in 2010, when oil driller Transocean floated on the same day its Deepwater Horizon rig exploded in the Gulf of Mexico.

No me había fijado que OCU la tiene en recomendación de compra:

Básicamente explican que las ventas han repuntado un 7%, que han revisado al alza sus previsiones por nuevos tratamientos y que tiene una buen cartera de productos en desarrollo.

La parte negativa es la parte de genéricos (Sandoz) que sigue con la constante presión de precios en Estados Unidos. Para remediarlo está vendiendo productos y valorando la venta de Sandoz.

Todos los días me levanto pensando en aumentar mis posiciones en Novartis y Roche … y todos los días se escapan un poquito más. Lo achaco a la pereza que me da cambiar euros por francos suizos.

Esto que dices no es ninguna tontería, y creo que puede ser un buen factor a favor de los ADRs en el caso de divisas minoritarias en la cartera.

Yo, por ejemplo, las canadienses con listado dual las elegí en NY solo por eso. Quizá no tanto por la compra, pero sí porque me parecía un engorro andar siempre con pequeños dividendos en CAD que habría que ir cambiando.

Cuidado porque el ADR de Roche se negocia en el mercado OTC. No así el de Novartis, creo.

Ah, ni idea. Solo conozco el caso de las canadienses. Había contestado de manera genérica, en condiciones de ADRs cotizados, con gastos mínimos, etc.

Yo todos los días me levanto pensando en si Nestlé, Novartis y Roche pueden tener cabida en mi cartera. Luego recuerdo la retención en origen del 35% y recuerdo porqué no las llevo ![]()

![]()

Justo por eso solo me sé lo de las canadienses como cuarta divisa

Yo tambien, pero en este caso no son ADRs, son empresas cotizadas.

He vencido la pereza y he aumentado posición en Roche

Buena compra si atendemos a M*, 45 USD de valor intrínseco para el ADR que cotiza ahora a 34.XX

Mientras no la meta la OCU en su cartera modelo todo bajo control

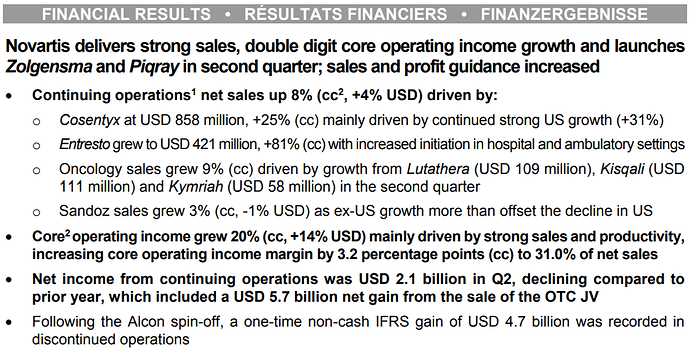

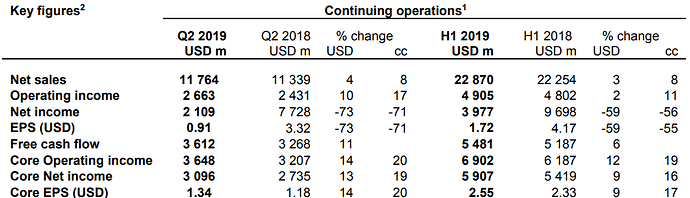

Novartis Financial Results – Q3 2019 (22/10/2019)

- Novartis delivered another strong quarter with double digit sales growth and core1

margin expansion; 2019 sales and profit guidance raised; Beovu launched in US - Continuing operations2 net sales up 13% (cc1, +10% USD) driven by:

- Core operating income grew 18% (cc, +15% USD) and Innovative Medicines core margin improved to 34.1% of sales, mainly driven by sales momentum and productivity, while funding growth investments

- Net income from continuing operations was USD 2.0 billion, up 12% (cc, +8% USD)

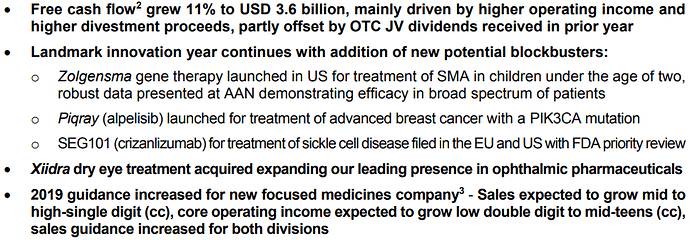

- Free cash flow1 grew 26% to USD 4.0 billion, mainly driven by higher cash flows from operating activities

- Significant innovation milestones:

- Beovu (brolucizumab) launched in the US in October for treatment of neovascular (wet) AMD, differentiated based on greater fluid reduction and potential for fewer injections

- Ofatumumab treatment for RMS showed compelling efficacy across all major clinical endpoints in two pivotal Phase III trials. Rolling regulatory submissions planned to start in Q4

- Cosentyx met primary endpoints in nr-axSpA at weeks 16 and 52 (PREVENT study); submitted to EMA, FDA submission planned for Q4

- Kisqali showed overall survival (OS) benefit in postmenopausal women (MONALEESA-3), and is now the only CDK4/6 to show an OS benefit in two trials and in pre and post-menopausal women

- Entresto PARAGON showed clinically important benefit in HFpEF subpopulations, planned to submit to FDA in Q4 for inclusion of data in the label

- 2019 guidance increased for new focused medicines company3 - sales expected to grow high single digit (cc), core operating income expected to grow mid to high teens (cc)

Novartis 2019 Financial Results (29/01/2020)

Novartis delivered strong sales growth, margin expansion and breakthrough innovation launching five NMEs in 2019

- Full year net sales for continuing operations1 up 9% (cc, +6% USD):

- Core operating income grew 17% (cc, +12% USD) and Innovative Medicines core margin improved

to 33.5% of sales, driven by sales momentum and productivity, while funding growth investments - Free cash flow grew 15% to USD 12.9 billion mainly driven by higher operating income

- Net income from continuing operations declined 44% due to the one-time net gain from the sale

of the OTC JV in prior year, excluding this item net income was broadly in line with prior year - Total Group net income was USD 11.7 billion, including the one-time effect from the Alcon spin-off

- Continued focusing Novartis as a leading medicines company:

- Alcon successfully spun-off, creating significant shareholder value. Following the spin-off, a onetime non-cash IFRS gain of USD 4.7 billion was recorded in discontinued operations

- The Medicines Company acquired, adding inclisiran a potentially transformative cholesterol-lowering therapy

- Xiidra acquired, strengthening ophthalmic pharmaceuticals portfolio

- Dividend of CHF 2.95 per share, an increase of 4%, proposed for 2019

- 2020 guidance - Focused medicines company - Net sales expected to grow mid to high-single

digit (cc); core operating income expected to grow high-single to low double digit (cc)